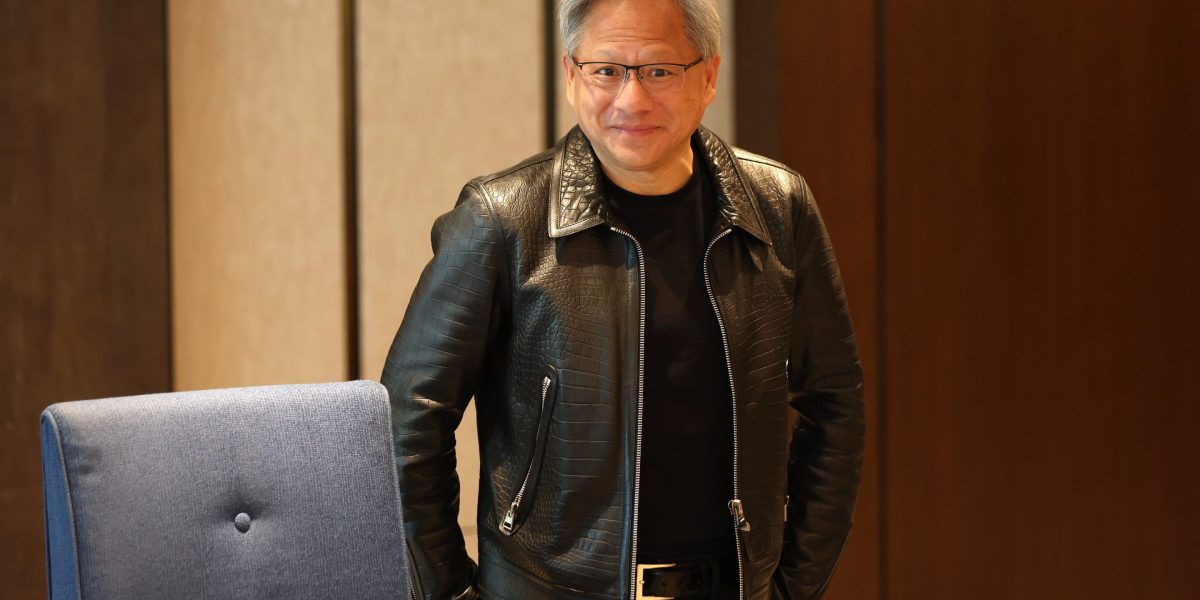

Jensen Huang, the founder and CEO of Nvidia, is strolling on cloud 9. After handing over one other stellar earnings report that had Wall Road celebrating on Wednesday, Huang’s semiconductor large was capable of retake its place because the world’s third most precious firm from Google’s mum or dad firm Alphabet.

Nvidia shares surged over 15% in early buying and selling on Thursday, with the chip maker’s blowout quarter convincing traders that the AI revolution will proceed to spice up the corporate for years to come back. Huang talked up the rise of AI and his firm’s position in what some have referred to as the trendy gold rush on the Wednesday post-earnings convention name. “Accelerated computing and generative AI have hit the tipping point,” he instructed traders. “Demand is surging worldwide across companies, industries and nations.”

Huang, whose internet price is now over $60 billion, highlighted the continuing shift from general-purpose computing to “accelerated computing” at knowledge facilities as one of many keys to Nvidia’s success, arguing it’s “a whole new way of doing computing”—and even “a whole new industry.”

The entire suggestion and personalization options in fashionable purposes are pushed by what Huang calls “tokens” for AI firms. From biotech startups which can be producing new proteins and chemical compounds to OpenAI’s new generative AI text-to-video system referred to as Sora, Nvidia’s AI tokens are indispensable for the trendy tech world. Simply take a look at the numbers: Income exceeded estimates by a whopping $2 billion as firms wolfed up all of the tokens on supply.

“For the very first time, a data center is not just about computing data and storing data and serving the employees of a company,” Huang mentioned on the decision. “We now have a new type of data center that is about AI generation, an AI generation factory.”

AI-generation factories

Huang defined that these AI era factories are all about taking in knowledge and producing what he calls tokens for AI firms. “These tokens are what people experience on the amazing ChatGPT or Midjourney or search [engines],” he mentioned.

Nvidia’s tokens are additionally in accordance with Huang, driving the corporate’s progress. To his level, the start of AI-generation factories has led to intense demand for Nvidia’s chips. So intense that the corporate needed to tackle the way it decides who can purchase its merchandise on its earnings name, promising that the method is finished “fairly.”

After Nvidia’s robust earnings report, Huang wasn’t afraid to make some daring claims in regards to the significance of his firm’s merchandise both. “My guess is that every enterprise in the world, every software enterprise company…will run on NVIDIA AI Enterprise,” he mentioned. “So this is going to likely be a very significant business over time. We’re off to a great start.”

Lofty expectations

To say Wall Road has excessive expectations for Nvidia over the subsequent yr can be understating it. The median analyst forecast for the chipmaker is $832 (and rising, as analysts proceed to change their worth targets put up earnings), in accordance with data from the Wall Road Journal. That represents a 24% bounce from Nvidia’s pre-earnings inventory worth.

“While the stock has doubled since its 2021 high, the world has changed since then, and there is significant demand for artificial intelligence, and thus, Nvidia has plenty more room to run,” James Demmert, chief funding officer, Major Road Analysis, instructed Fortune, including that he expects Nvidia shares to succeed in $1,000 within the subsequent 12 months.

There are some Nvidia doubters nonetheless on the market. Dr. Gil Luria, a senior software program analyst at D.A. Davidson, argued that even when Nvidia continues to “dominate” the AI chip market over the subsequent yr, ultimately, they’re more likely to see a decline in demand for his or her merchandise. Luria famous that a few of Nvidia’s greatest clients, together with its fellow huge tech giants, have mentioned that they’re accelerating their AI spending this yr in an preliminary push to meet up with demand for AI companies, however which means a spending slowdown might be coming in 2025.

“We believe that customers like Microsoft are not interested in indefinitely sustaining this level of Capex dedicated solely to AI compute, yet alone NVIDIA,” she wrote. “Consequently, we believe our FY26 and FY27 estimates reflect a Street low, as we see potential for a sequential decline in NVIDIA’s data center business starting sometime over the next 4-6 quarters.”

Luria has a “neutral” ranking and a $620 12-month worth goal for Nvidia inventory, and he or she isn’t the one analyst preaching warning relating to AI chipmakers’ long-term progress prospects. On Wednesday, BCA Analysis chief strategist Dhaval Joshi told Fortune’s Paolo Confino that we’re in “an AI bubble” and traders’ expectation for steady, monumental earnings progress could also be unreasonable.

“The market is saying: ‘Hey the baton is going to be passed on now to generative AI and that will continue the trend for the next five to 10 years.’ I’m very cynical about that,” he mentioned.