Nvidia: Too Much, Too High Kwarkot/iStock via Getty Images Nvidia

If you are like just about every single person I talk to, you own shares of Nvidia (NASDAQ:NVDA). And you probably love to tell your story of how you got in early, or how you should have bought more. But what about Nvidia’s valuation? And what about your “position sizing” of Nvidia within your aggregate investment portfolio? After reviewing Nvidia’s business, megatrend growth trajectory and risks, we discuss its current valuation and prudent position sizing within your personal investment portfolio. We conclude with our strong opinion about owning Nvidia shares ahead of the upcoming earnings announcement.

About

Nvidia makes semiconductors or “chips.” Specifically, the company makes graphics processing units (“GPUs”) which have proven superior to traditional computer processing units (“CPUs”) in a wide variety of applications ranging from video games, to cloud computing (data centers), cryptocurrency mining and now artificial intelligence.

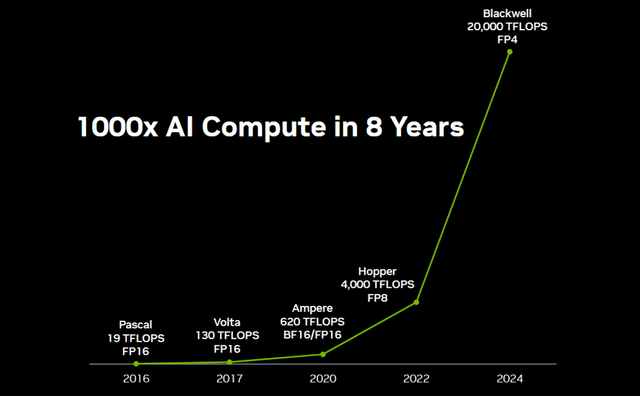

And as the company continues to innovate and grow, it has evolved into an accelerated computing platform with a full stack approach encompassing silicon (chips), systems and software. Nvidia has dramatically advanced “compute” power in a relatively short period of years (see graphic above), thereby opening a dramatic new world of accelerated computing possibilities.

And more immediately, Nvidia’s ramping Blackwell chips (see image above), combined with liquid cooling, will be a next step in accelerated computing for GPUs. More specifically, the liquid cooled A100 will be readily available in Q3 and a liquid cooled H100 should be available in early 2025.

A Massive Market Opportunity

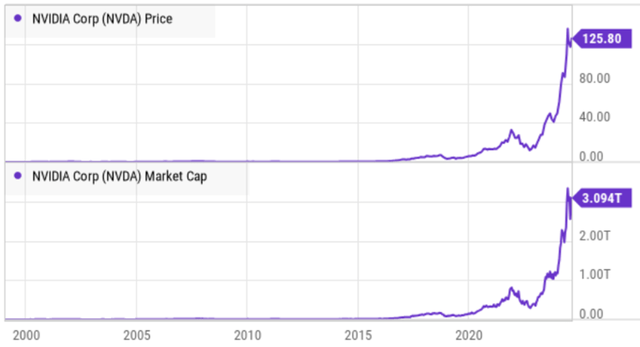

It would be naive to suggest that it’s time to sell Nvidia simply because its share price and market capitalization have risen so dramatically.

Because what was simply a $5 billion market cap company (on the verge of bankruptcy) just 15 years ago is now one of the largest companies on the planet, and it has truly massive market opportunities ahead.

The Cloud

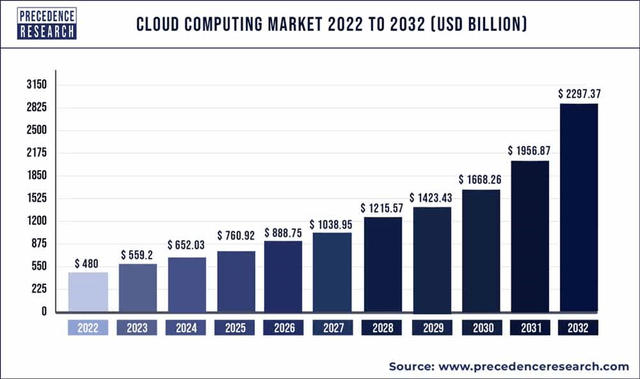

To some people, “the cloud” is this mysterious place where all your personal computer data and email messages are magically stored in thin air (instead of on your personal computer hard drive like they were years ago). In reality, the cloud is really just massive computer data centers where everyone’s data (people, businesses, governments) is now stored, and this is a megatrend that is still just getting started.

And for more perspective:

Worldwide spending on public cloud services is forecast to reach $805 billion in 2024 and double in size by 2028, according to the latest update to the International Data Corporation (IDC) Worldwide Software and Public Cloud Services Spending Guide. Although annual spending growth is expected to slow slightly over the 2024-2028 forecast period, the market is forecast to achieve a five-year compound annual growth rate (CAGR) of 19.4%.

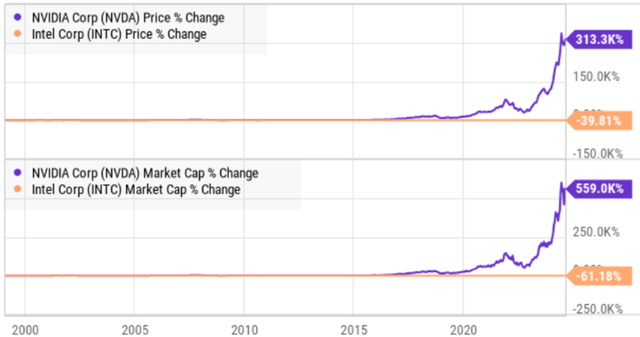

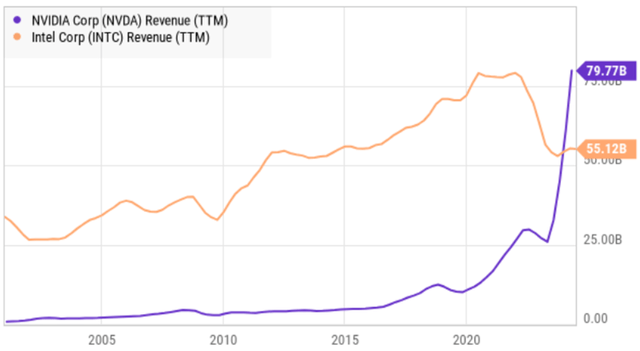

And what is so impressive about this megatrend is that Nvidia chips are the prime beneficiary as they have largely displaced almost everyone else (for example Intel (INTC)) and now reign superior in this ongoing long-term megatrend (i.e. “the great cloud migration”).

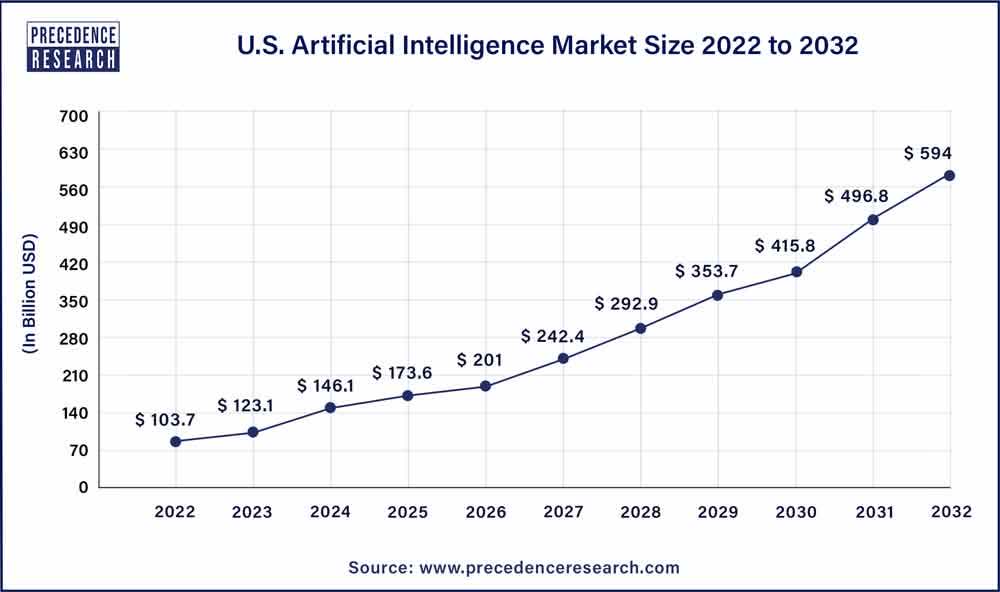

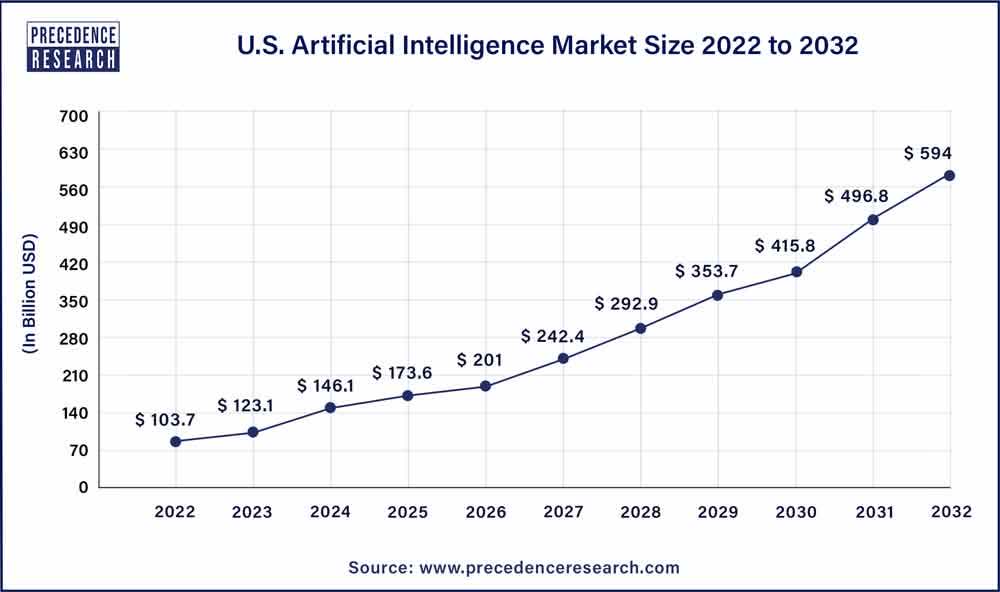

Artificial Intelligence

And as if the cloud migration wasn’t already big enough, the release and growth of new artificial intelligence models have now accelerated the need for cloud data storage (and the need for Nvidia chips in particular).

Precedence Research

For example, according to this Nvidia blog post:

Features in chips, systems and software make NVIDIA GPUs ideal for machine learning with performance and efficiency enjoyed by millions.

and

ChatGPT provided a powerful example of how GPUs are great for AI. The large language model (LLM), trained and run on thousands of NVIDIA GPUs, runs generative AI services used by more than 100 million people.

So considering the dominance of Nvidia chips (and the incredible demand growth), it’s easy to see how so many people have gotten so excited about investing in Nvidia. However, there are risks that need to be considered too.

Risks

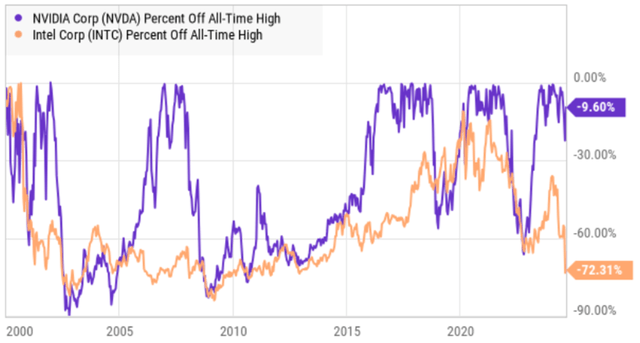

The two most common negative things (“risks”) I hear about Nvidia are (1) it’s just the tech bubble all over again, and (2) you do realize chip stocks are notoriously cyclical and Nvidia is obviously overdue for a massive pullback.

Tech Bubble 2.0

And regarding the first, I’m sure you’ve likely heard the objection (which I agree with) that the tech bubble was based on wild hysteria over the amazing new internet (whereby companies with zero earnings and very little revenues were trading at inappropriately high nosebleed stocks prices) as compared to Nvidia today (a company with massive revenue, massive growth and truly incredible bottom line net profits). The tech bubble was a “bubble;” Nvidia is a profitable revenue-growth juggernaut.

Chip Stocks are Notoriously Cyclical

Regarding the second point, yes chips stocks are cyclical (see chart below), but they are also the direct beneficiaries of the two long-term megatrends described above (i.e. the cloud and AI) and any company that can stay ahead of the competition (like Nvidia has so far) is positioned to reap truly massive rewards over the long-term.

But to at least acknowledge the cyclicality risk a bit more, yes, supply and demand are dynamic and there is the risk for market cycle pullbacks (as Nvidia and other chips stocks have experienced repeatedly throughout history). But again, what makes Nvidia special is its leading position as a beneficiary from the two megatrends which continue to create massive long-term upside potential.

Worth mentioning (from a supply and demand standpoint), there have been delays in the release/availability of Nvidia’s next-generation Blackwell chips, but arguably this has helped spread-out future revenues a little better, and the company has not been significantly hurt so far because of it.

Competition:

Obviously, competition is a risk too (after all, 25 years ago Intel was the semiconductor leader believed by many to be unstoppable) and current day competitors like AMD and other mega cap companies’ continued attempts to develop homegrown chip alternatives present a threat. But as long as Nvidia remains a leader (like it is positioned to be with its upcoming 2026 platform called “Rubin”) it will continue to benefit from AI and the great cloud migration, as noted in this article:

Dominating roughly 80% of the market for AI chips, Nvidia stands in a unique position as both the largest enabler as well as beneficiary of surging AI development.

Aside from competition and cyclicality (and comparison’s to the “tech bubble”), geopolitics and tough comps also present risks, as we noted in our previous Nvidia article: “Despite Red Flags, It’s Going Much Higher.”

Valuation

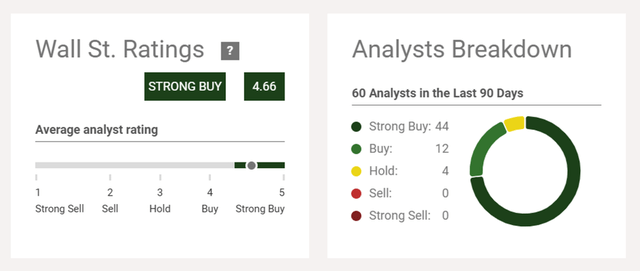

It’s always worth a good laugh when some “super smart” analyst attempts to use old school valuation models and metrics to value a disruptive growth company like Nvidia because the rates of growth and innovation are so fluid that even the slightest over or under projection assumption can make the entire valuation exercise nearly worthless. Nonetheless, here are the current ratings and price targets of the 60 Wall Street analysts following Nvidia over the last 90 days.

As you can see, these guys and gals rate Nvidia a “Strong Buy” with more than 10% upside (versus the current share price). But you can also see (below) how quickly their price targets and ratings have changed (i.e. they basically follow the actual stock price) in the relatively recent past.

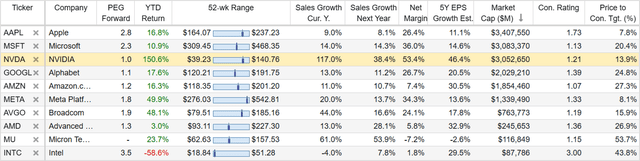

However, for a little comparative analysis, here is a look at how Nvidia rates on a forward PEG ratio (price/earnings to growth) basis as compared to other mega caps and to other leading chip stocks.

And if this data (above) is at least as accurate as the broad side of a barn, it seems Nvidia’s valuation is relatively quite attractive.

Of course there are certain critical assumptions (such as future growth rates) baked into these data, and if they’re off by even a small amount then the price targets would be significantly different.

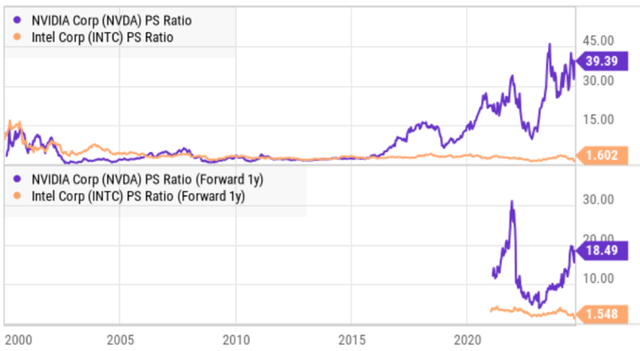

And for one more data point, here is a look at current and forward price-to-sales ratios for Nvidia versus Intel (below). As you can see, the two are being valued quite differently.

What’s more, analyst valuations typically only forecast revenue and growth a few quarters and years into the future, when in reality the great cloud migration megatrend has many more years to run (even beyond analyst projections). So there is a lot of uncertainty baked into these Wall Street analyst ratings, to say the least.

How Much Nvidia Should You Own?

If you are going to invest in Nvidia (or any individual stock for that matter) it’s critical to consider your absolute and benchmark relative allocation strategy.

Benchmark-Relative Weight

If you think you are going to outperform an S&P500 index fund, you should at least know that Nvidia is currently around 6.5% of the S&P500. So if you hold less than 6.5% of Nvidia in your personal portfolio (say you have a 5% position size, which means you are “underweight” Nvidia) then you are basically making an active bet that you think Nvidia will underperform the market (after all, every passive S&P500 index fund investor owns more Nvidia than you).

Obviously, every investor has their own unique goals and asset allocation (for example, perhaps you own mostly US treasury bonds for the safe income) thereby making a comparison of your holdings to the S&P500 apples-to-oranges. But it’s worth giving some thought to how big of a bet you want to make on Nvidia (by being either over or under weight versus a passive index fund like the S&P 500).

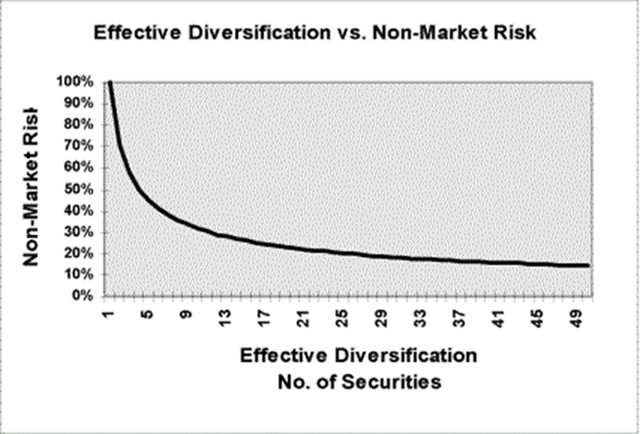

Absolute Weight

And for a little more perspective, if you are focused more on the absolute volatility of your portfolio (in terms of standard deviation) instead of the performance (or tracking error) of your portfolio versus an index fund (like the S&P 500) then this old school 1970’s study from Fisher and Lorie suggests holding at least 25-30 individual stocks is the “magic number” to diversify away the lion’s share of idiosyncratic stock-specific risks (which you may or may not want to do, depending on your personal goals and tolerance for certain types of risks).

Upcoming Earnings Announcement

Nvidia is set to announce earnings after the market close on Wednesday August 28th, and the latest concerns surround the extent to which recent Nvidia Blackwell delays will push out revenue. Specifically, a Reuters report back in May noted, according to an Nvidia spokesperson:

“As we’ve stated before, Hopper demand is very strong, broad Blackwell sampling has started, and production is on track to ramp in the second half.”

Jefferies analyst Blayne Curtis expects another:

“strong beat in [for] July and strong guidance into October” from Nvidia, with beats of about $1B for both results and guide.”

Such an outcome would likely add support to the current share price. However, more importantly, for simple risk management purposes, investors may want to consider whether their current allocation to Nvidia (whether over or underweight) is still prudent ahead of potential earnings price volatility and in light of their own individual situation.

The Bottom Line:

Nvidia’s long-term potential remains compelling. However, if you are losing sleep over near-term volatility (especially ahead of earnings) that could be an indication that you need to “rightsize” your allocation (both absolute and benchmark relative) and perhaps even consider Nvidia as part of a partially-indexed core-satellite strategy (as we recently wrote about here).

Most importantly, you need to do what is right for you, based on your own personal situation. Disciplined, goal-focused, long-term investing continues to be a winning strategy.