Antonio Bordunovi

My Thesis Update

I last wrote about NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA) here on Seeking Alpha in early May 2024, ahead of its fiscal Q1 2025 report. At the time, I argued that despite its recent growth rates and solid profit margins, Nvidia may “face challenges from increasing overall competition in the future, a potential near-term slowdown in demand, and increased competition in the accelerator market.”

This risk hasn’t materialized as the time showed. The stock has continued its wild rally, which looks even stronger after the recent dip. We’re just over a week away from the release of the Q2 2025 report on August 28th, but I conclude from some signs that Nvidia is highly likely to beat consensus estimates again. In addition, I don’t think management’s guidance will be weak. I believe all this should lead to a further rise in the stock price in the medium term — hence my rating upgrade today.

My Reasoning

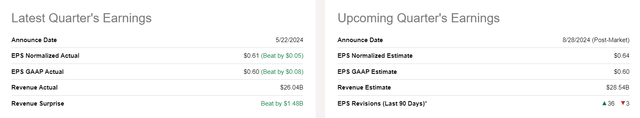

First off, I should like to dedicate a few words to what everyone probably knows already — the Q1 results. In fiscal Q1 2025 (ending April 30, 2024), Nvidia reported revenue of ~$26 billion, marking a 262% YoY increase and an 18% QoQ rise, exceeding the high end of Nvidia’s own guidance by ~$1.5 billion and also Wall Street’s expectations by $1.48 billion, according to Seeking Alpha. Non-GAAP earnings were $6.12 per share, up 462% from the same quarter last year and $0.96 higher than the previous quarter — these figures also beat the consensus estimate of $5.59 per share (that’s unadjusted for the 10-to-1 stock split the firm had completed):

Nvidia’s data center segment — the key pillar to its phenomenal growth — achieved sales of $22.6 billion, an increase of 427% over the previous year and accounting for 87% of total revenue. Within this segment, sales of AI computers increased by 478%, driven by increased demand for Nvidia’s HGX platform, which powers large-scale language models and other AI applications. Despite supply constraints for its Hopper GPU platform, Nvidia is ramping up production. This is thanks to its partnerships with manufacturers such as Taiwan Semiconductor (TSM). It looks like the company will have more opportunities to meet the considerable demand that has accumulated in the few months since the market realized the importance of LLMs (large language models).

The gaming segment was also robust with sales of $2.65 billion, which corresponds to an increase of 18% compared to the previous year. Nvidia’s GeForce RTX 40 series graphics processors, which are based on the Ada Lovelace architecture, are also enjoying strong demand. Professional visualization revenue of $427 million rose 45% annually, reflecting a higher sell-in to partners following the normalization of channel inventories. On the other hand, the automotive revenue of $303 million increased just by 3% YoY (8% QoQ), driven by self-driving platforms (while the sequential gain reflected “rising demand for sales of AI cockpit solutions”).

Based on what I saw in Q1 numbers, Nvidia continues to be a leader in the field of AI; as this technology becomes more widespread, I believe Nvidia’s extensive involvement in this fast-growing industry sets it up for further success. However, what is surprising is that the market still has not fully priced this in — allow me to explain.

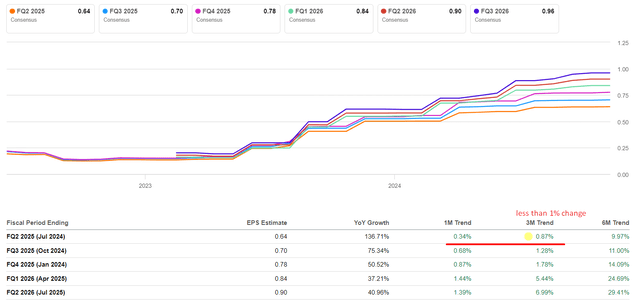

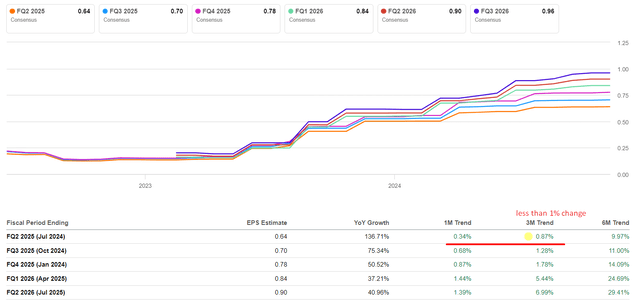

What I find strange is that while Wall Street analysts raised their forecasts for the next periods after such strong Q1 figures — we saw that in the screenshots above — the extent of these upward revisions seemed too small:

Seeking Alpha, NVDA’s Earnings Revisions, Oakoff’s notes

Normally, such massive earnings beats as we saw in Q1 lead to massive strong upward revisions, but in Nvidia’s case, we don’t see enough strength. The less than 1% increase in EPS expectations after the Q1 release makes the final Q2 consensus estimate even more pessimistic than before the Q1 release. The thing is, Nvidia’s strong Q1 should theoretically have reduced the level of uncertainty, but for some reason, the market has chosen to ignore this.

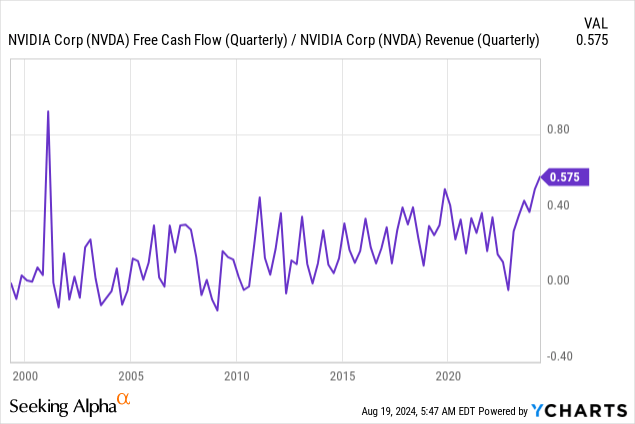

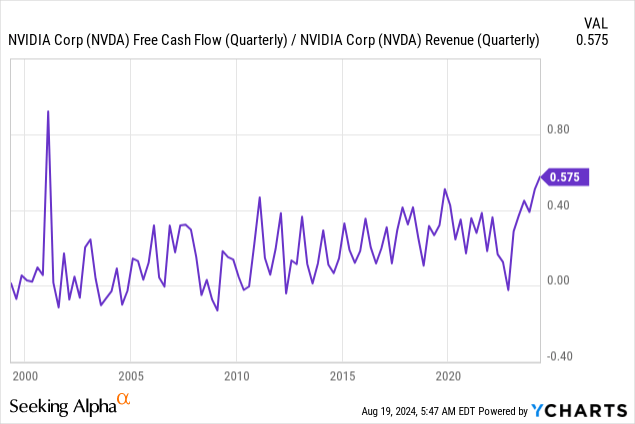

The management guided for ~$28 billion in revenue for Q2 2025, expecting all of their market segments to show growth. Aiming for about 75% in gross margin (~3% lower QoQ) and with OPEX projected to be $4 billion on a GAAP basis and $2.8 billion on a non-GAAP basis, Nvidia should maintain its superior FCF margin, in my opinion. This should give investors more reason to expect more buybacks.

Since fiscal Q1 2023 (6 quarters have already passed), Nvidia’s revenue has grown 4.3 times, while the gross profit margin has increased 5.3 times thanks to operating leverage. In other words, CAGR growth rates amounted to 27.5% and 32.1%, respectively. Now the market is forecasting non-GAAP EPS growth of only 4.9% on a QoQ basis — no matter how we try to explain this with seasonality, I don’t think growth will be that modest, especially in light of management’s (and Nvidia’s major customers’) comments that AI is just at the dawn of massive adaptation.

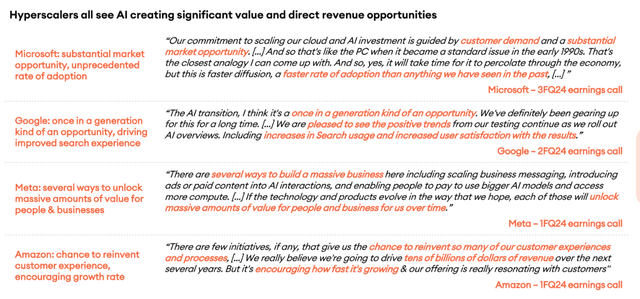

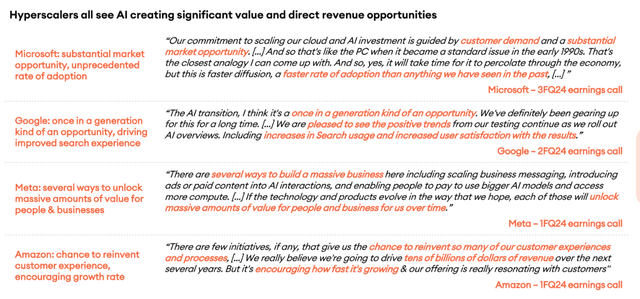

New Street Research, August 2024 (proprietary source)

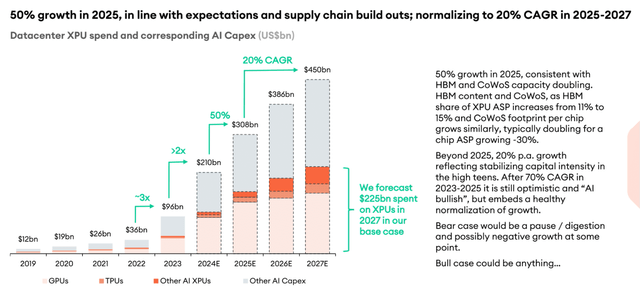

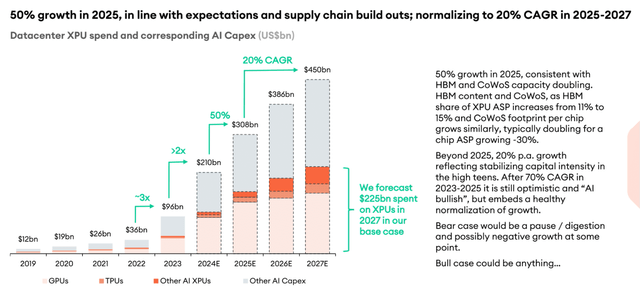

According to calculations by New Street Research (proprietary source), CAPEX for AI (expenditure on XPUs in data centers) is expected to increase by 50% in 2025 and by 20% annually between 2025 and 2027.

New Street Research, August 2024 (proprietary source)

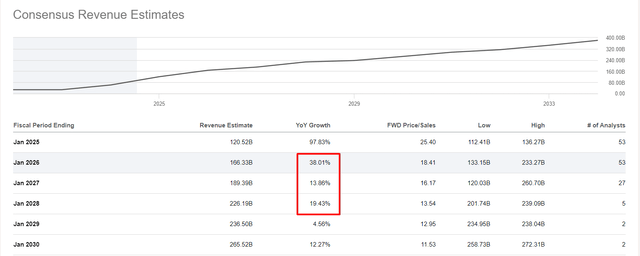

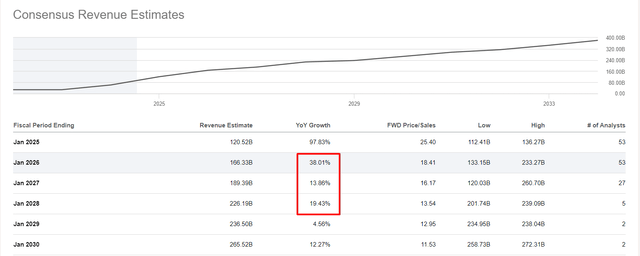

Given the recent problems of potential competitors such as Intel (INTC), I now believe that Nvidia will maintain its leading position in the market for much longer than I previously thought. More specifically, the risk to its supremacy has now become less. So Nvidia will be able to translate the projected growth into its future revenue. But apparently the market is still underestimating this, as the current revenue estimates seem too low to be true.

Seeking Alpha, NVDA’s Earnings Estimates, Oakoff’s notes

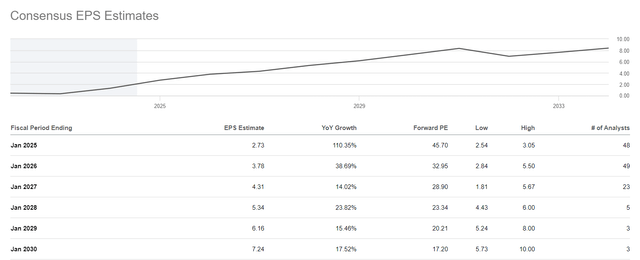

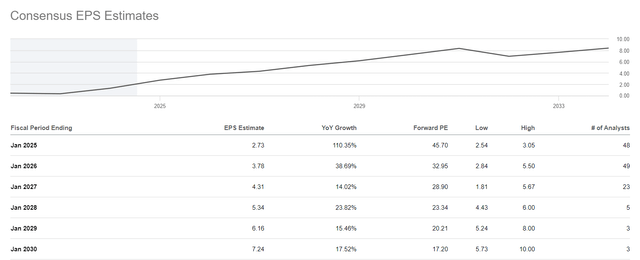

Take a look at the EPS forecasts for the next few years: The market is pricing in virtually no operating leverage and apparently assumes that the company has already peaked on this issue.

Seeking Alpha, NVDA’s Earnings Estimates

Logically, however, I think Nvidia should have opportunities to expand its margins even further as it expands its chip production capacity.

Therefore, I expect Nvidia stock to trade at a valuation premium to for some time. If we assume that the current FY2026 consensus forecast for EPS of $3.78 is 4% below what is likely (which is roughly the average EPS beat over the past decade), then at a P/E of 40x, I see a “fair value” of $157.3/sh. (12-month target), which is about 26% above the current stock price.

So I’ll conclude that NVDA deserves a “Buy” rating right before its Q2 release and should be bought on any major dip.

Risks To My Thesis

There are, of course, plenty of risks to my rating upgrade.

First off, I think there is a real chance that we are in an AI bubble. The fact that AI could change our world forever doesn’t mean this area is a no-brainer investment field. The rapidly increasing investments and valuations from VCs and others could be due to hype rather than sustainable, long-term changes in demand. If this is the case, there could be a steep market correction, leading to massive losses for Nvidia and its shareholders.

Additionally, the ongoing investment cycle in AI and data centers is very supportive of Nvidia, but as I noted in my very first article on NVDA stock, such investment cycles can turn quickly. For example, a recession that results in businesses and governments cutting back on their AI spending — due to economic pressures, new technological trends, or geopolitical developments — could imperil Nvidia’s future growth prospects. Further, a sudden decline in capital spending from the largest cloud providers and enterprises would result in Nvidia’s products facing lower demand, which could also hurt its top-line as well as bottom-line growth.

And of course, I can’t escape the topic of valuation. The Nvidia stock has already rallied strongly, as high hopes for future growth have driven its price up. So the stock is perhaps already fully priced and there is no margin for error — any slowdown in growth, a fall in profits or even a slight change in positive market sentiment could have a significant impact on the stock.

Your Takeaway

Despite the possibility of an AI bubble looming, I believe Nvidia’s continued leadership in AI and strong financials suggest a positive trajectory in the medium term. I believe Nvidia should beat earnings again (for Q2 2025) because a) the management clearly guided for stronger growth across all segments and b) the current estimates weren’t adjusted properly, in my view, after the company released its strong Q1 2025. The stock could be undervalued by around 26% if my premise of maintaining the valuation premium is upheld.

So that’s why I think that any major dip in the stock should be viewed as a buying opportunity. I thus have upgraded Nvidia Corporation stock to “Buy” about 1 week before its Q2 release.

Thank you for reading!