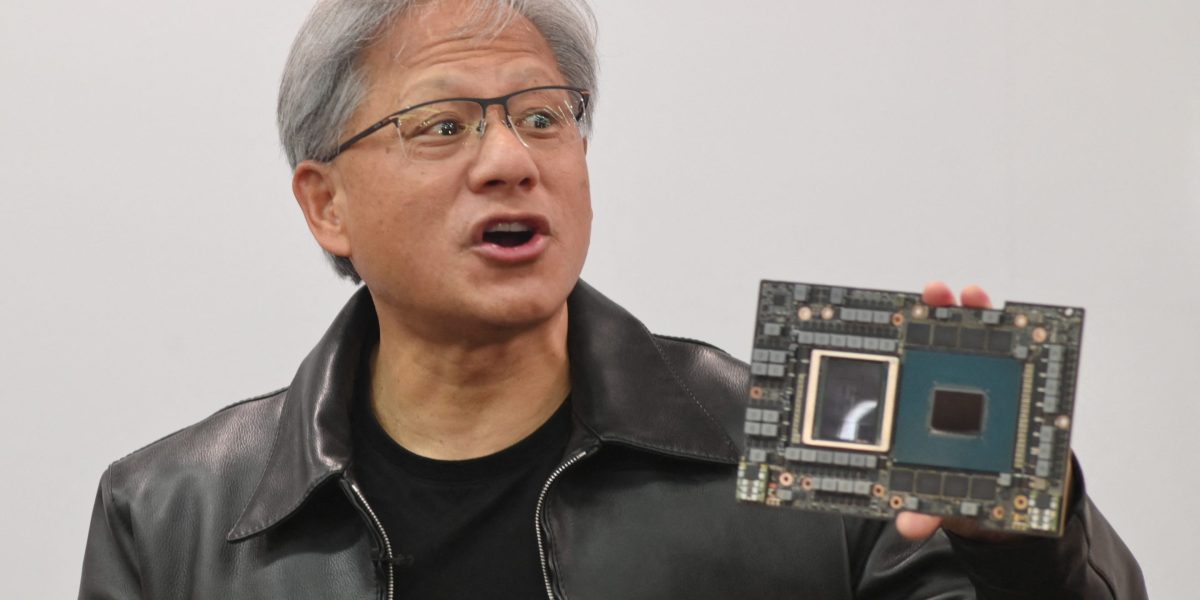

Nvidia Corp.’s red-hot rally to begin 2024 has Wall Avenue speeding to maintain up, with a minimum of 5 corporations climbing worth targets on the substitute intelligence-darling this month.

The chip large’s shares have surged 46% this yr and added about $560 billion in market worth. The power, together with the insatiable demand for its accelerators that energy AI duties, led UBS Group AG and Mizuho Securities to comply with counterparts at Morgan Stanley, Bank of America Corp. and Goldman Sachs Group Inc. in boosting worth targets forward of the corporate’s earnings outcomes due Feb. 21.

This week, UBS lifted its goal to $850 from $580, and likewise elevated its estimates for earnings per share. In the meantime, Mizuho raised its goal to $825 from $625. Demand for Nvidia’s H100 AI accelerators continues to outstrip provide, Mizuho’s Vijay Rakesh wrote in a consumer notice, calling the inventory the most effective AI play.

Nvidia dipped 0.2% on Tuesday, closing at about $721. However it outperformed its big-tech counterparts, which got here below stress after a report showed US client costs rose final month by greater than forecast. The Nasdaq 100 Index fell 1.6%.

The inventory of the Santa Clara, California-based firm, the highest performer on each the S&P 500 and Nasdaq 100 indexes this yr, has grow to be one of many most-loved on Wall Avenue. It has 58 buys, 5 holds and solely a single promote ranking amongst analysts tracked by Bloomberg.

Analysts on common have boosted 2024 income estimates by greater than 100% during the last 12 months, in accordance with information compiled by Bloomberg.

And but, they’re struggling to maintain tempo with the inventory’s advance, which has pushed its market cap above that of Amazon.com Inc. Wall Avenue’s common 12-month worth goal of about $690 is a few 4.4% under Tuesday’s shut.