da-kuk

Last week, I wrote about a small ETF called the WisdomTree Artificial Intelligence and Innovation Fund ETF (WTAI) which needs to populate half of its portfolio with companies that make at least 50% of their revenues from AI. The problem is, not many large companies are doing that at the moment. WTAI therefore has a 35% exposure to the only companies making significant revenues from the AI megatrend: semiconductors. The likes of NVIDIA Corporation (NASDAQ:NVDA) are swimming in revenues as mega-cap tech companies race to build infrastructure.

The $3T question is: What will happen when this infrastructure is built? This article looks at why small revenues and huge energy costs could limit further CAPEX by NVDA’s main customers.

All About Data Centers

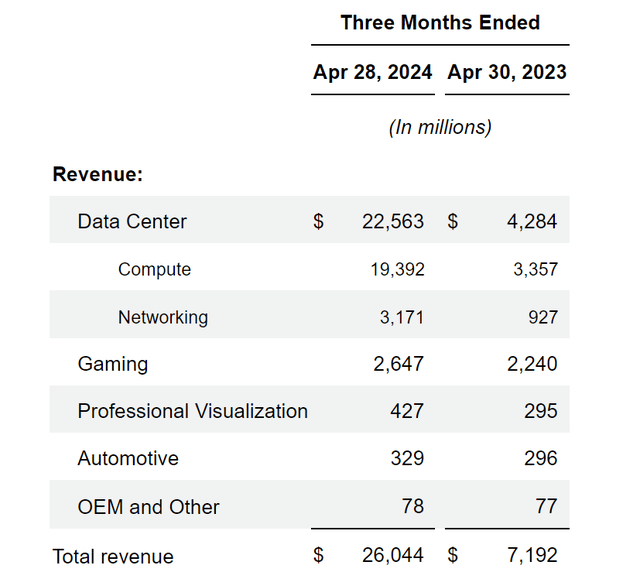

Nvidia Corporation earnings continue to astound, but this is almost entirely due to Data Centers, which account for 86% of revenues. Other markets are growing at a healthy 19.7%, but quarterly revenues growing from $2.9B to $3.48B will never justify NVDA’s $3T market cap; it’s all about Data Centers.

The Big Spenders

The huge growth in Data Center revenues has been mostly driven by mega-tech companies. NVDA’s Q4 conference call revealed just how much –

“In the fourth quarter, large cloud providers represented more than half of our data center revenue, supporting both internal workloads and external public cloud customers.”

This probably doesn’t include Meta Platforms, Inc. (META) which doesn’t have a cloud, but is busily building AI infrastructure. International Business Machines Corporation (IBM), Oracle Corporation (ORCL), and others will bump the figures higher. It’s clear NVDA is heavily reliant on the CAPEX of a handful of huge customers. Amazingly, Microsoft may have been responsible for 19% of NVIDIA’s revenue in FY24 and 22% in the fourth quarter. A second unnamed customer is responsible for 13% of revenue in Q3 and 10% of revenue for the first three quarters of the year.

These huge investments are only part of the spending. As well as NDVA’s GPUs, companies have to invest about the same amount in buildings, energy, backup generators, software developments, and staffing. This is currently seen as a necessary investment in the future, but it cannot continue indefinitely.

The Potential for Problems

MSFT spent almost $5B on NVDA GPUs in Q4 and around $11B in FY24. It’s not clear how many GPUs will stockpile, but at some point, they must surely slow the buying and focus on end products. The same goes for the other companies in the AI race. Shareholders will eventually demand results, and we are already seeing some backlash against the spending, as META dropped -16% after its last earnings report as it was revealed they will spend heavily on AI.

The major problem is the lack of revenues. OpenAI has impressed with an annualized revenue of $3.4B and significant growth, but they stand alone. Furthermore, the numbers are less impressive when the energy costs associated with consuming half a million kilowatts a day are considered; AI is expensive to run.

OpenAI’s ChatGPT is one of the most useful applications found for AI thus far. Other companies are developing their own versions, but this is not a large enough area for mega-cap companies to expect huge revenues from. Other uses for AI tend to focus on efficiency and assistance with tasks, but again, revenues are currently small. AI clearly has huge potential, but this has not yet translated into profits, which could be a problem for NVDA as the likes of MSFT could be pressured to rein in expenditures.

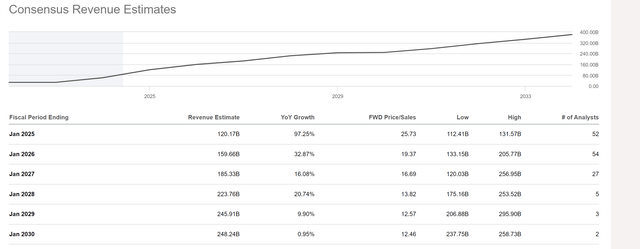

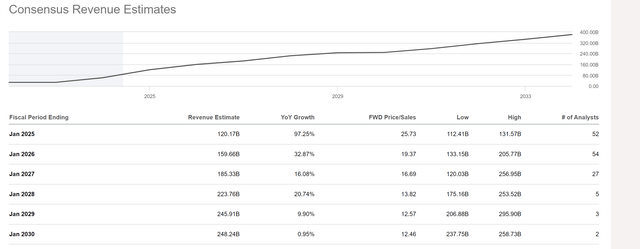

NVDA earnings estimates reflect slowing growth, but revenues are still expected to show double-digit growth until 2029. This would likely require the big four companies (Microsoft, Meta, Alphabet Inc. (GOOG), (GOOGL) and Amazon.com, Inc. (AMZN)) to continue spending astronomical sums on infrastructure. This begs the question: how many Data Centers do they actually need?

Earnings Estimates (Seeking Alpha)

Headwinds may also come in the form of regulation, both on the applications of AI, but also because of the huge energy demands. Headlines such as, “Google’s carbon emissions surge nearly 50% due to AI energy demand” are increasing the backlash against AI use. If MSFT were to continue spending like they have in recent quarters and keep building Data Centers into 2029, they would require an incredible amount of energy to run.

NVDA Outlook

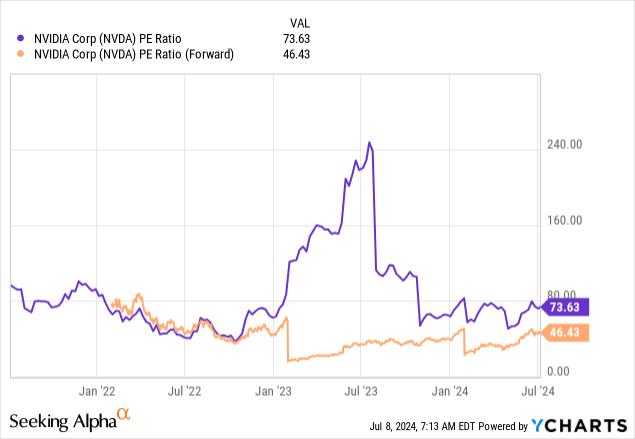

NVDA’s P/E ratio is 73.63 and its forward P/E ratio is 46.43. This seems high when around 50% of revenues come from a handful of large customers that may decide they have enough “infrastructure” and stop buying.

I doubt that happens this year, and will likely happen slowly, but I do think NVDA has limited potential for further huge growth. Multiple expansion is therefore unlikely, and the stock could drop into a large consolidation, or at least a slower ascent. Earnings in August are still likely to impress, so I would not call it a top – yet.

2025 and beyond could be rocky as revenue growth will inevitably slow and more questions will surface about AI revenues, energy consumption, and other regulations, all of which could get technology companies to curb spending.

Conclusions

86% of Nvidia Corporation revenues come from Data Centers. In turn, over 50% of the Data Center revenue comes from a handful of mega-cap technology companies racing to develop AI infrastructure. This presents a large risk. These companies may stop buying “infrastructure” for various reasons, and NVDA cannot expect indefinite recurring revenues. I rate Nvidia Corporation stock a “hold” or a buy under $100.