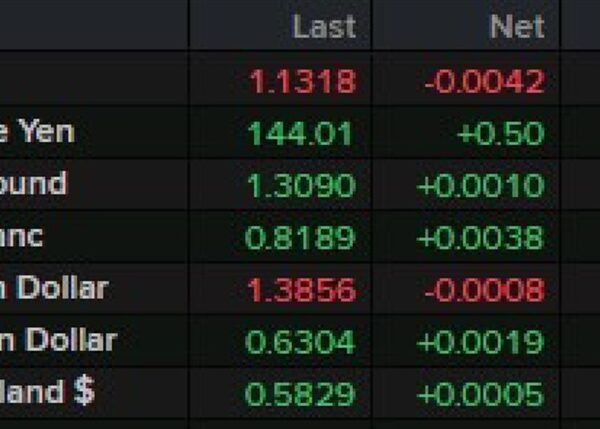

- Prior was +23.2

Details:

-

Employment: 4.6 vs 5.6 last month

-

Prices paid: 49.2 vs 46.8 last month

-

New orders: +18.2 vs +12.4 last month

If there’s good news here it’s that new orders were in positive territory for the second month in a row.

-

Shipments: 6.0 vs 26.1 last month

-

Unfilled orders: -2.2 vs -6.6 last month

-

Inventories: 5.4 vs 15.0 last month

-

Average workweek: 12.8 vs 14.9 last month

Six-months from now indicators:

-

6 month index: 36.2 vs 31.5 last month

-

Capex index 6-month forward: 25.2 vs 12.5 last month

Another notable thing when you look at the survey is that no firms are expecting any price decreases, despite falling oil prices. In the survey, 49.2% expect price increases while 50.8 see no change. That’s not the kind of thing a central banker wants to see in terms of anchoring prices.

The special question highlights that software is ruling the world:

This article was written by Adam Button at investinglive.com.