Gary Yeowell/DigitalVision via Getty Images

Odyssey Marine Exploration (NASDAQ:OMEX) is a marine mining exploration company involved in a lawsuit against Mexico that could generate more than $10 in cash per share.

The company’s operations outside this litigation are unimportant, and it has debatable and risky exploration concessions in the Pacific Ocean. Therefore, this article concentrates on the potential of the litigation against Mexico.

Although I do not believe the stock is a Buy, given the enormous uncertainty and clear risk of it going to zero, it could be a potential speculative play on the judgment, depending on how the reader assigns odds to different scenarios.

Company Overview

Pirate treasure hunters: In the late 2000s and early 2010s, the company was engaged in finding shipwrecks. It made headlines when it found a Spanish ship from the XIX century with nearly $500 million in gold and silver coins. Unfortunately, the company lost a lawsuit with Spain for the ownership of that treasure chest.

Ocean mining: After that, the company transitioned to a mining exploration model in the novel seabed mining industry. Currently, the company has exploration concessions or equity participation in several projects in the Pacific Ocean, near The Cook Islands and Papua New Guinea.

Like most mining explorers, Odyssey’s business is extremely risky, with binary outcomes. If land mining exploration is hard, ocean exploration is even harder, given the activity is nascent and not clearly regulated.

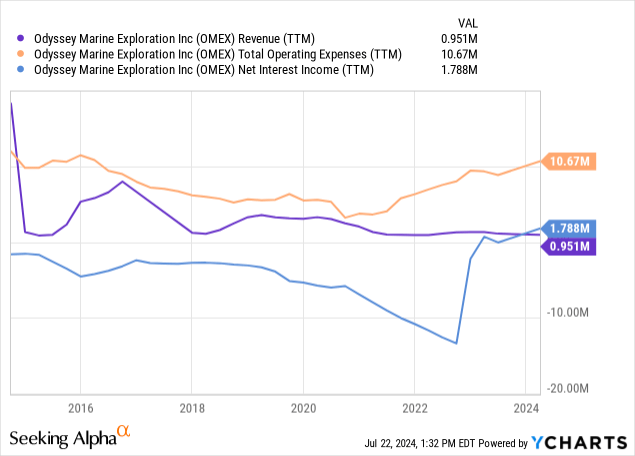

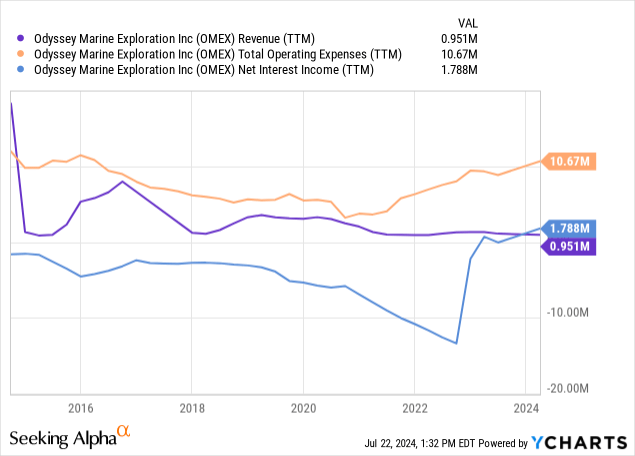

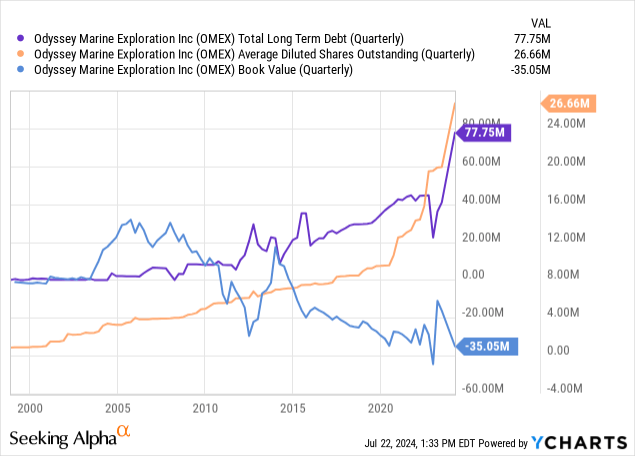

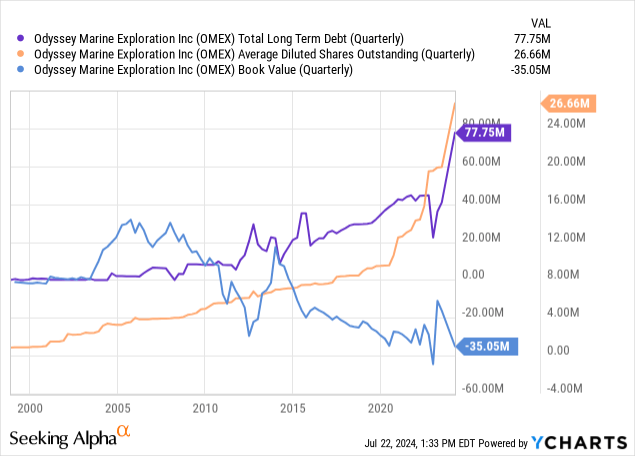

Terrible business situation: Odyssey has not generated meaningful revenues in years, and its operational and financial losses have widened. Today, the company’s equity deficit is close to $300 million, financed via debt and consistent share dilution.

The Mexico Case

In the mid-2010s, the company explored and developed a project in the Pacific seabed of Mexico to extract phosphate sands, which could be used as fertilizers. The operational company is called Exploraciones Oceanicas SAdCV, and Odyssey owns 56% of it.

The project’s environmental permit was denied by the Mexican authorities in 2018. Odyssey appealed the decision, arguing that the treatment had been unfairly compared to similar ocean mining projects in more environmentally sensitive areas. A Mexican court agreed with the company’s point, but the Mexican government once again rejected the environmental plan.

After that, Odyssey decided to fight the Mexican state in an International Investment Court, ICSID. The company reclaims its exploration costs, the potential gains it could have generated from that project, and compensation for the damages. In total, Odyssey claims more than $2.3 billion.

The judgment for this case was expected for 1Q24, but it was then delayed to 2Q24 and again delayed for an unknown period in June 2024.

Financing

Without operations or profits, the company could not have self-financed the lawsuit until this point (or its existence). That’s why Odyssey has been issuing shares and different types of debts and derivatives.

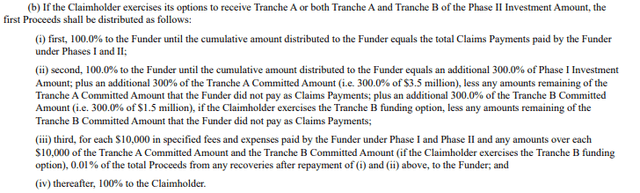

As of the FY23 10-K report, the company owed $27 million in loans. In addition, it classified $52 million as litigation liabilities from specific litigation funding. This funding is valued using probabilities of winning the lawsuit, but in case it was actually won, it would represent $100 million (300% margin on $25 million borrowed), plus 25% of all proceeds (1% for each $1 million borrowed). The terms are explained below.

Terms of litigation financing (OMEX’s 10-K FY23)

Valuation

Considering negative equity of $91 million in 1Q24, the company’s survival depends on the Mexican judgment. If the courts decide that Mexico is right, then Odyssey’s stock is probably worth zero. If the courts decide that Mexico’s actions were faulty, then Odyssey’s winnings depend on how much is recognized in favor of Exploraciones Oceanicas (ExO)

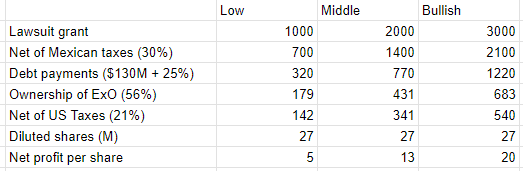

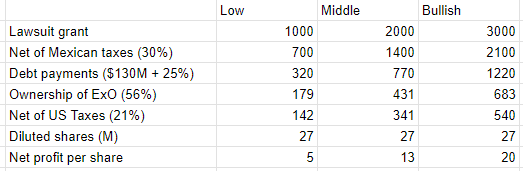

The table below establishes three potential scenarios for a judgment favoring ExO. One aspect missing from the scenarios below is whether the original project can proceed with exploitation, providing ExO with the option to sell the project’s rights.

Potential profit scenarios under a positive judgment for Exploraciones Oceanicas (Author)

Probabilities

Then, what are the odds that each scenario will materialize?

Assuming that the above positive scenarios each had a 33% chance of occurrence (implying a positive expected value of $12.6) and that Odyssey’s stock is priced at $5, the market considers Odyssey to have a 40% chance of winning. If we assume that the $2.3 billion claim is a positive scenario($15 net per share), then the market gives Odyssey a 33% chance.

Another approximation is Odyssey’s valuation of its own financial liabilities. The litigation payments are currently carried in the books at $52 million. Considering the company’s original claim of $2.3 billion, it would owe $675 million in the case of winning. If it carries the debt at $52 million, it implies that it assigns itself a 7.7% chance of winning.

Conclusions

Odyssey is not worth much as a business. Its risk of going to zero is substantial. Therefore, the company’s stock would never qualify as a Buy, as it cannot provide minimum guarantees of capital safety.

However, the stock is more interesting as a speculation vehicle. The company can potentially make significant profits out of one court decision, and the market assigns low chances to a victory, even though the company’s arguments were already upheld by a Mexican court.

For those reasons, I consider Odyssey a Hold, with the potential to become a speculative Buy for some risk-prone readers.