Joe Smith didn’t image elevating his granddaughter at age 66, however when his daughter’s substance use disorder meant she couldn’t look after her youngster, that’s the place Smith and his spouse discovered themselves nineteen years in the past.

That introduced all the prices that include a brand new child in the home, like garments, a crib, a 3rd mouth to feed — and generally a fourth, when Smith’s daughter lived with them on and off. His granddaughter’s father supplied no youngster help. When Smith and his spouse lastly gained authorized custody of their granddaughter, Olivia, Smith had missed numerous hours of labor as a building electrician to attend courtroom hearings and lawyer conferences.

“You don’t receives a commission sick days… They anticipate you to be there daily. They don’t care what goes on in your private life. I imply, a minimum of the businesses I used to be working for,” mentioned Smith, who runs a weekly peer help group for folks of these fighting habit in Columbus, Ohio.

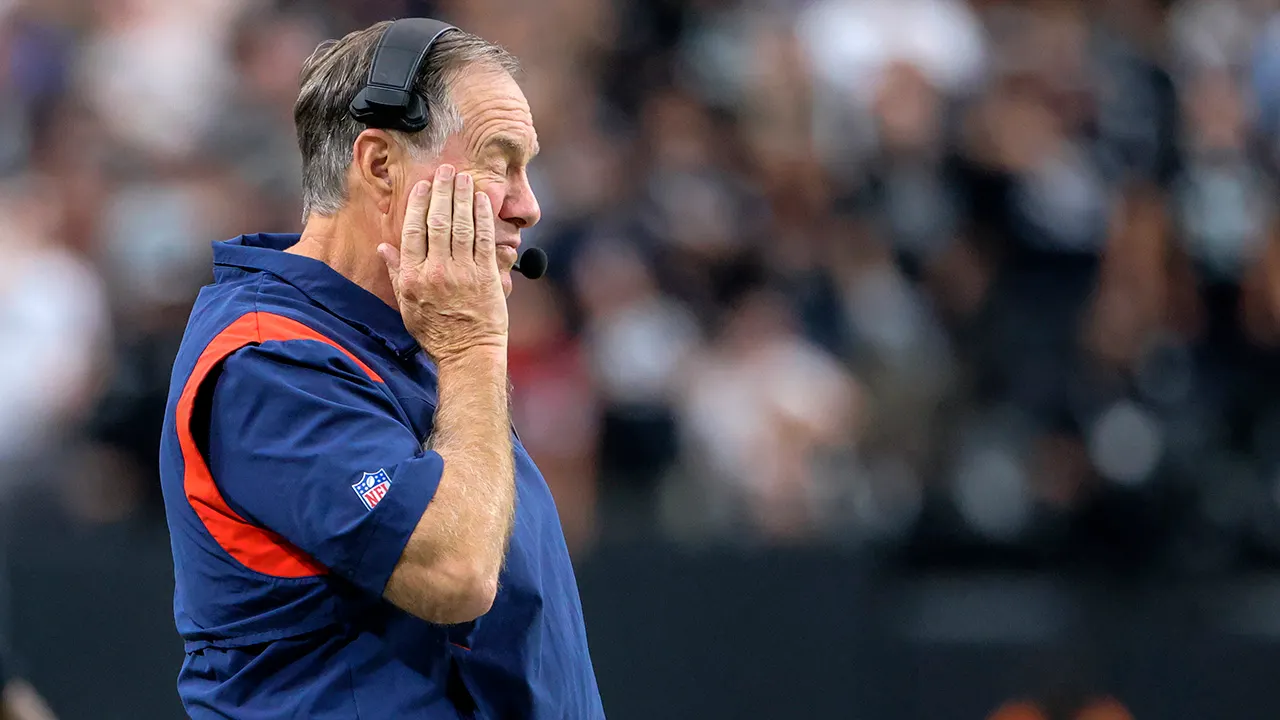

This picture reveals Olivia strolling by means of the yard of her house in Columbus, Ohio, on Oct. 24, 2023, the place she lives together with her grandfather Joe Smith. Smith didn’t image elevating Olivia, however when his daughter’s substance use dysfunction meant she could not look after her youngster, that is the place he and his late spouse discovered themselves 19 years in the past. (AP Photograph/Carolyn Kaster)

DRUG OVERDOSE DEATHS AMONG ADOLESCENTS ON THE RISE

Smith’s story isn’t distinctive. Relations throughout the nation are going through new monetary burdens as youngsters, mother and father or different family wrestle with the illness of habit, whether or not it’s lacking work, blowing by means of their financial savings or changing into mother and father once more properly into their 60s and 70s. The prices can add as much as lots of of hundreds of {dollars} in medical payments, remedy stays, broken property and numerous different unexpected bills.

The opioid disaster alone price the U.S. economy $631 billion from 2015 by means of 2018, in accordance with a research from the Society of Actuaries. That quantity has virtually actually elevated as there was little aid within the opioid disaster over the past 5 years. Overdose deaths elevated in 2022, although solely barely, after an enormous spike throughout the first years of the pandemic.

The research additionally discovered that simply one-third of these billions is borne by the federal government, with the rest falling on the shoulders of people and the personal sector.

In Ohio, an epicenter of the opioid crisis, the state’s Division of Commerce is taking a one-of-its-kind strategy to aiding households financially impacted by habit, by ensuring the individuals dealing with their cash are educated about it.

This summer season, the division launched the primary trainings in its “Restoration Inside Attain” program for monetary advisers, instructing them how you can spot the indicators of habit of their purchasers’ households and direct them to state and personal assets that may assist relieve the heavy financial burden.

When surveyed by the division, 45% of Ohio’s monetary advisers mentioned they had been conscious of a consumer of theirs, or a consumer’s member of the family, that was fighting habit.

However that quantity is probably going a lot larger, in accordance with Ohio Securities Commissioner Andrea Seidt, as one in 13 Ohioans have a substance use dysfunction. The stigma of habit, particularly coupled with a dialog about cash, might be holding individuals from disclosing their struggles, even to somebody they belief.

“The extra we speak about it and each trade begins speaking about it, the extra profitable we might be in combating the stigma and the extra snug individuals might be reaching out and getting the remedy they want,” Seidt mentioned.

In this system, monetary advisers are taught to search for sure indicators. These embody massive, sudden withdrawals from their purchasers’ accounts, late or lacking funds on essential payments, recurring accidents or accidents, skyrocketing insurance rates or sudden custody of a minor member of the family.

Restoration Inside Attain additionally has an info hub on its web site. These in search of assist can enter their insurance coverage standing and remedy must be related packages they’ll extra simply afford or obtain monetary assist with.

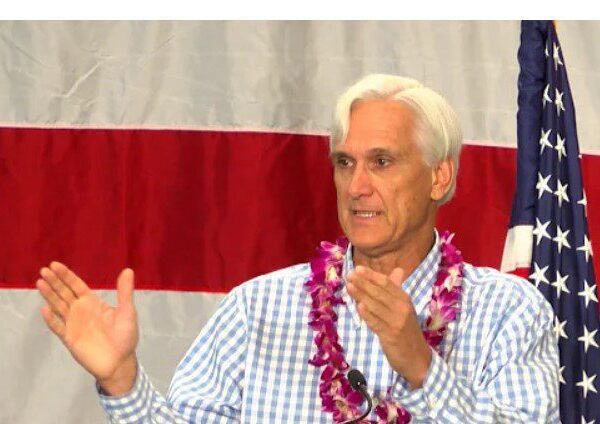

Carl Hollister, president of the Cincinnati-based funding advisory agency L.M. Kohn since 1994, took the coaching earlier this summer season. In September, he introduced in workers from his firm’s branches across the nation to take it, too.

Monetary advisers have needed to provide you with methods to fight a large number of monetary crises, like rising cybersecurity breaches or funding fraud focusing on the aged. Hollister mentioned he sees habit as the subsequent disaster the nation might want to set protocol for within the monetary world, and he believes Ohio is a number one instance for what different states ought to undertake.

WHITE HOUSE ANNOUNCES FUNDING FOR YOUTH SUBSTANCE ABUSE PROGRAMS TO TACKLE ‘OVERDOSE EPIDEMIC’

Ohio’s program additionally encourages monetary professionals to interrupt by means of the stigma and begin the dialog themselves, making certain confidentiality and approaching purchasers with empathy.

Lori Eisel, a monetary adviser and proprietor of Arcadia Monetary Companions, is aware of each side of the wrestle. However for a very long time, she hid that her son has been out and in of remedy a minimum of six instances for substance use dysfunction since he was a highschool freshman.

“It was kind of like a health care provider attempting to deal with themselves,” Eisel mentioned, noting that whilst a monetary planner, she didn’t make the very best monetary selections all through her son’s ordeal. “You’re taking a look at this primary as a mom, and that is what my youngster wants.”

His first spherical of remedy price $10,000 out of pocket, even partially coated by personal insurance coverage. The second spherical was in a remedy facility in one other state. Journey prices added up — aircraft tickets, resort stays and meals. Later, an intensive outpatient remedy price one other $5,000. When he was 18, she transferred him to Medicaid after a suggestion from one other remedy facility, which helped ease among the monetary burden.

However remedy was not the one price. Her son totaled a car whereas driving below the affect. He needed to have particular medical look after signs and accidents associated to his illness. Eisel at instances was pressured to overlook work.

Trying again, what Eisel wanted most was somebody to be compassionate. However she additionally wanted somebody to look objectively at assets and packages that might assist her son with out jeopardizing her or her different youngsters’s monetary stability.

“This can be a journey that takes years and years to get by means of,” Eisel mentioned, and that journey typically turns right into a cycle of enabling the addicted cherished one reasonably than serving to them.

Eisel, like Joe Smith, helps run a bunch for members of the family affected by habit in Ohio, and tries to offer others the assistance she might have used. “We’ve got those that’ll by no means be capable of retire as a result of they spent all of their retirement funds on remedy,” she mentioned. “It doesn’t need to be that approach.”

OVERDOSE PREVENTION CAMPAIGN CRITICIZED FOR ADVOCATING FURTHER DRUG USE: ‘DO IT WITH FRIENDS’

Smith is practiced in navigating the courts, Medicare and different state assets after having to take action for Olivia, her mom and his three different daughters, who additionally undergo from substance use dysfunction, for many years.

However that apply, like a lot of his state of affairs, has come at a value: time, cash and stress. If the assets he needed to discover on his personal had been frequent information to extra individuals, financial advisers or in any other case, Smith sees that as “the best factor” for these financially burdened by habit.

Nineteen years after first taking Olivia in, Smith is lastly contemplating retirement subsequent 12 months, although it seemingly received’t be what he imagined. His beloved spouse handed away final December. He’s in search of impartial housing for his granddaughter, who nonetheless lives with him. He’s managed to stow away some cash however needed to dip into his financial savings to repair the roof on his home.

“For 19 years, our life was on maintain,” Smith mentioned. “Now my spouse’s gone. I don’t have that a few years left. I simply wish to attempt to take pleasure in life.”