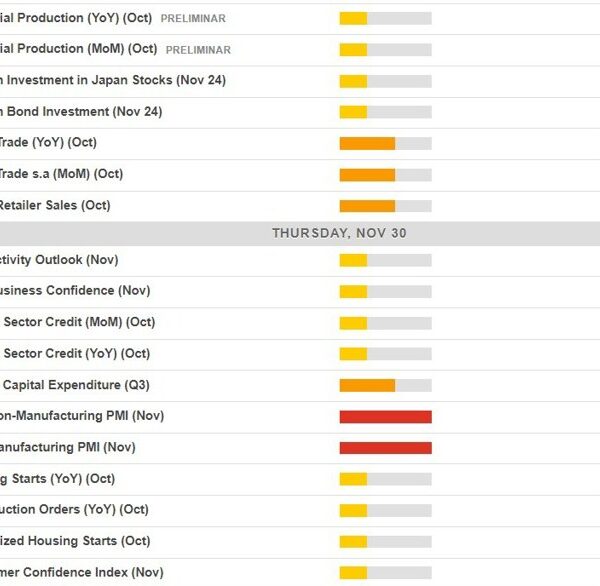

WTI crude oil has been flirting with $80 for the previous two weeks and a selloff earlier this week instructed it may not get there. However tighter US stock numbers this week lastly did the trick and oil has damaged out to the best ranges since early November.

WTI crude is up $1.64 to $81.35 in the present day within the second day of massive positive factors. It is the best since OPEC prolonged manufacturing curbs in November. These curbs have been reaffirmed final week and can final a minimum of by June.

Stronger international progress can be a tailwind for oil with the EIA revising its US demand forecasts barely larger this week. That might in the end be a doubled-edged sword if the economic system stumbles however for now the market is optimistic heading into US driving season. Significantly notable was the big attract US gasoline inventories on this week’s information. That means that Americas proceed to drive regardless of higher engine effectivity and a rising variety of EVs on the street.

Maybe extra importantly, the market is eyeing a flip within the Chinese language economic system in 2024 or 2025. Copper broke out to a seven month excessive yesterday in a telltale signal of progress optimism.

For WTI, the shut in the present day is vital. It it could end above $80, it is a good signal. If it holds above the March intraday excessive of $80.85, that is significantly good.

The $81.37 stage can be the 50% retracement of the autumn since September. The 61.8% stage coincides properly with $85, which is the following goal.

This text was written by Adam Button at www.forexlive.com.