It has been a somewhat difficult yr for oil. From talks of tighter market circumstances to slowing economies throughout the globe, there have been arguments to each side of the story. And that’s additionally mirrored considerably in worth motion, with the excessive for WTI crude being at $95 on the finish of September earlier than sinking again decrease previously two months as markets step up fee cuts pricing.

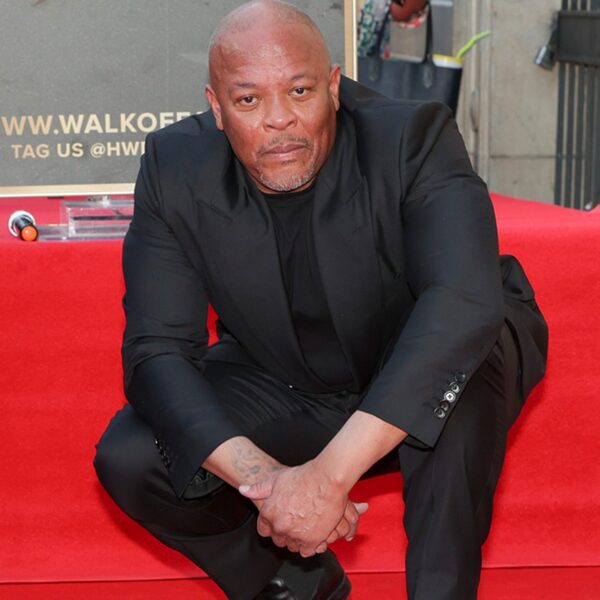

WTI crude oil weekly chart

The lucky factor for oil costs is that consumers have stepped up when it mattered most. At every level throughout the course of the yr the 200-week shifting common (inexperienced line) was examined, they managed to maintain a protection of that. And even when issues have been trying somewhat gloomy final week, they managed to barely flip it round in the direction of the top.

And so for this yr, oil continues to be down over 7% but when not for the protection on the 200-week shifting common seen above, it actually may’ve been a lot worse.

So, what’s subsequent as we transfer in the direction of 2024?

The outlook is usually leaning in the direction of bearish facet amid financial and energy-transition headwinds. As such, OPEC+ may have an necessary function in making an attempt to no less than maintain a ground on costs with deeper manufacturing cuts. That being stated, if financial circumstances aren’t as dangerous as feared, that might nonetheless stimulate greater demand and maintain the market tight. That’s one consideration to be aware about, particularly since decrease costs will even assist to carry demand circumstances typically.