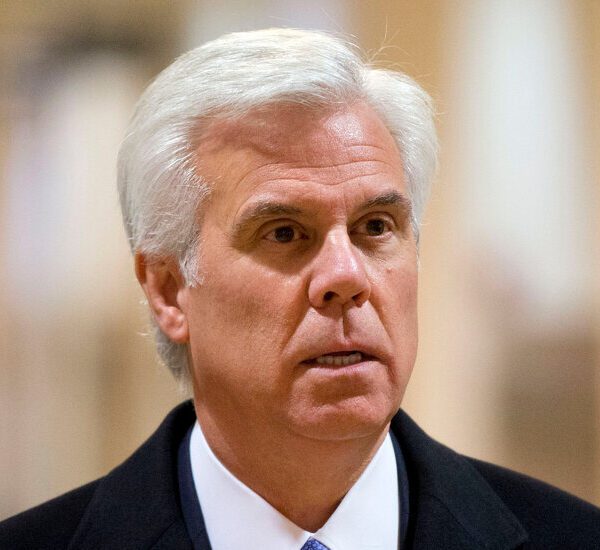

Carson Block, the founding father of the famed short-selling funding agency Muddy Waters, revealed he’s betting towards Blackstone Mortgage Belief on Wednesday, in an indication that he expects business actual property’s woes to tug on into subsequent 12 months. In a report titled “Here Comes the Cliff!,” Block prompt that the publicly traded actual property funding belief (REIT), which gives loans for the ailing business actual property sector, faces a “perfect macro storm” of rising rates of interest and workplace vacancies.

Regardless of many CEOs’ pleas and threats for his or her staff to return to the workplace, workplace vacancies hit a record excessive of 13.3% in August, based on the Nationwide Affiliation of Realtors. And overdue business actual property loans additionally hit a 10-year high final month as property values within the sector proceed to sink amid larger rates of interest.

Muddy Waters fears that this implies “a large number” of Blackstone Mortgage Belief’s debtors might be unable to refinance or repay their loans in 2024. The funding agency estimates that between 70% and 75% of Blackstone Mortgage Belief’s U.S. debtors are at the moment “unable to cover interest expense from property cash flows.” That would, per Muddy Waters’ estimates, result in losses of between $2.5 billion and $4.5 billion for the REIT.

In different phrases, Blackstone Mortgage Belief’s $4 billion market cap is “at risk of being completely wiped out by these losses,” the short-seller’s report warns. Whereas the REIT hasn’t confronted points but as a result of it has been in a position to lengthen and modify loans for shoppers, that may’t final perpetually, based on Block.

“There’s been a lot of extending and pretending when things have been backed by paper profits,” he told Bloomberg on the Sohn funding convention in London on Wednesday. “It’ll be the second half of next year that we’ll really start to see losses.”

As soon as losses start to pile up within the second half of 2024, Muddy Waters expects Blackstone Mortgage Belief might be pressured to chop its dividend, which has soared to almost 12%. Even the growing prospect of rate of interest cuts from the Fed that would present aid for the business actual property sector within the type of cheaper loans could be “too little, too late,” based on the short-seller.

Blackstone Mortgage Belief didn’t instantly reply to Fortune’s request for remark, however a spokesperson instructed Bloomberg in a statement that the REIT is “well positioned to navigate this environment,” including that they consider ”Muddy Waters’ report was “self-interested,” “misleading,” and “designed solely…for the short seller’s own benefit.”

Blackstone Mortgage Belief’s inventory sank 8% on Wednesday after the discharge of Muddy Waters’ report.

Block’s Muddy Waters is one of some famous short-sellers who’ve risen to fame over the previous decade for making massive, and infrequently fairly worthwhile, bets towards a myriad of corporations, overseas and home.

Based in 2010, the funding agency burst onto the scene in its first 12 months of operation by shorting shares of China’s Rino Worldwide, a previously Nasdaq-listed maker of desulfurization gear for metal vegetation. Block warned on the time that the corporate was misstating its income and making deceptive claims about its standing as an trade chief in key metal markets.

Rino Worldwide was finally delisted from the Nasdaq, and the CEO and his spouse, the corporate chairman, confronted U.S. Securities and Exchange Commission expenses of overstating revenues and diverting cash for private use.

Since then, Block has made large bets towards a lot of companies, together with the medical supplier St. Jude and the European actual property firm Corestate Capital Holding SA. Nonetheless, in an interview with Bloomberg earlier this 12 months, Block stated that his short-selling days could also be ending within the subsequent few years, noting that the toll of company lawsuits towards his agency for its unfavourable stories is taking its toll.

Of short-selling, he stated, “It is a decent living, but per unit of brain damage, it’s definitely one of the worst businesses in the asset management industry.”