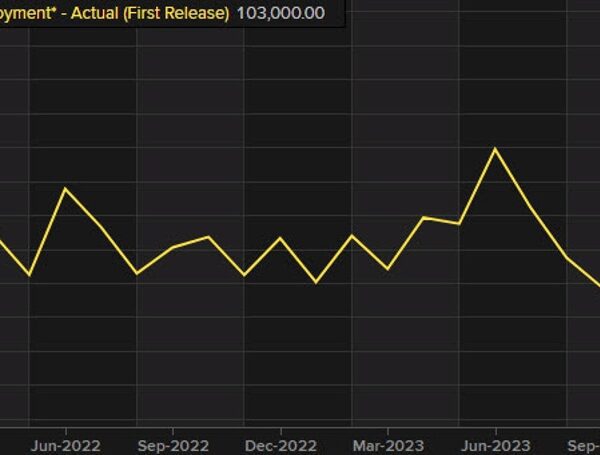

S&P failing on break above all-time excessive shut

The all-time excessive shut for the S&P index is at 4796.57. Again on December 28, the excessive value reached 4793.19 and backed off. Yesterday the excessive value prolonged above the all-time excessive shut reaching 4798.50, however backed off. At present’s excessive value prolonged to 4802.40 and with the present value buying and selling at 4776.91 has backed off as soon as once more.

Merchants proceed to be apprehensive to take the S&P above the all-time excessive closing degree for lengthy. By the way in which the all-time excessive intraday excessive reached 4818.62 again in January 2022.

What subsequent?

Sellers searching for extra draw back would now focus as soon as once more on the 100-hour transferring common 4749.44 as the subsequent goal to get to and thru and keep under to extend the bearish bias. The value yesterday did fall under that transferring common after failing at highs, however that break was shortly reversed with the value rebounded into the shut.

However, it stays a degree that if damaged would tilt the technical bias extra to the draw back not less than within the quick time period. The rising 200-hour transferring common at 4697.57 could be the subsequent goal.

Patrons nonetheless want a break of the all-time excessive shut and a detailed above that degree to really feel extra comfy concerning the break. There’s nonetheless numerous hours left within the day (Monday is a vacation by the way in which), and the consumers could also be nonetheless lurky within the weeds to take the value to and thru that degree (and thru the all-time excessive intraday degree too).

A basic concern for the bulls? Elevated pressure within the center east after the US/UK strikes on Houthi rebels in Yemen.