In enterprise software-as-a-service (SaaS), usage-based pricing — a pricing mannequin by which prospects are charged solely after they use a services or products — is gaining floor. According to a report from VC agency OpenView, roughly 60% of SaaS companies provide some type of usage-based pricing right now. Just lately, Apigee, Google Cloud’s API administration platform, made the shift, as did vertical software program large Autodesk.

However whereas usage-based pricing has its benefits, it may be more durable to maintain tabs on from a billing perspective. Typically, firms paying for usage-based-pricing merchandise battle to determine what to invoice their very own prospects for stated merchandise.

“This is a new challenge for engineers, as they need to build a real-time infrastructure to put cost control in place and integrate usage data with product and revenue teams,” Peter Marton, co-founder and CEO of OpenMeter, advised TechCrunch in an interview. “Real-time data is a challenge from the consumer side, too. A tight feedback loop between customers interacting with usage-based products and the consumption reflected on their billing and usage dashboards is essential for controlling spending.”

Marton skilled points with “metering,” as he calls it, firsthand whereas working at Stripe as a employees software program engineer. There, he bumped into blockers accumulating usage-based pricing knowledge from completely different suppliers and infrastructure and aggregating and analyzing this utilization collectively.

In quest of an answer, Marton teamed up with András Tóth, an ex-Cisco software program engineer and Marton’s former colleague at RisingStack, a software program dev agency, to launch OpenMeter, which meters buyer utilization of apps.

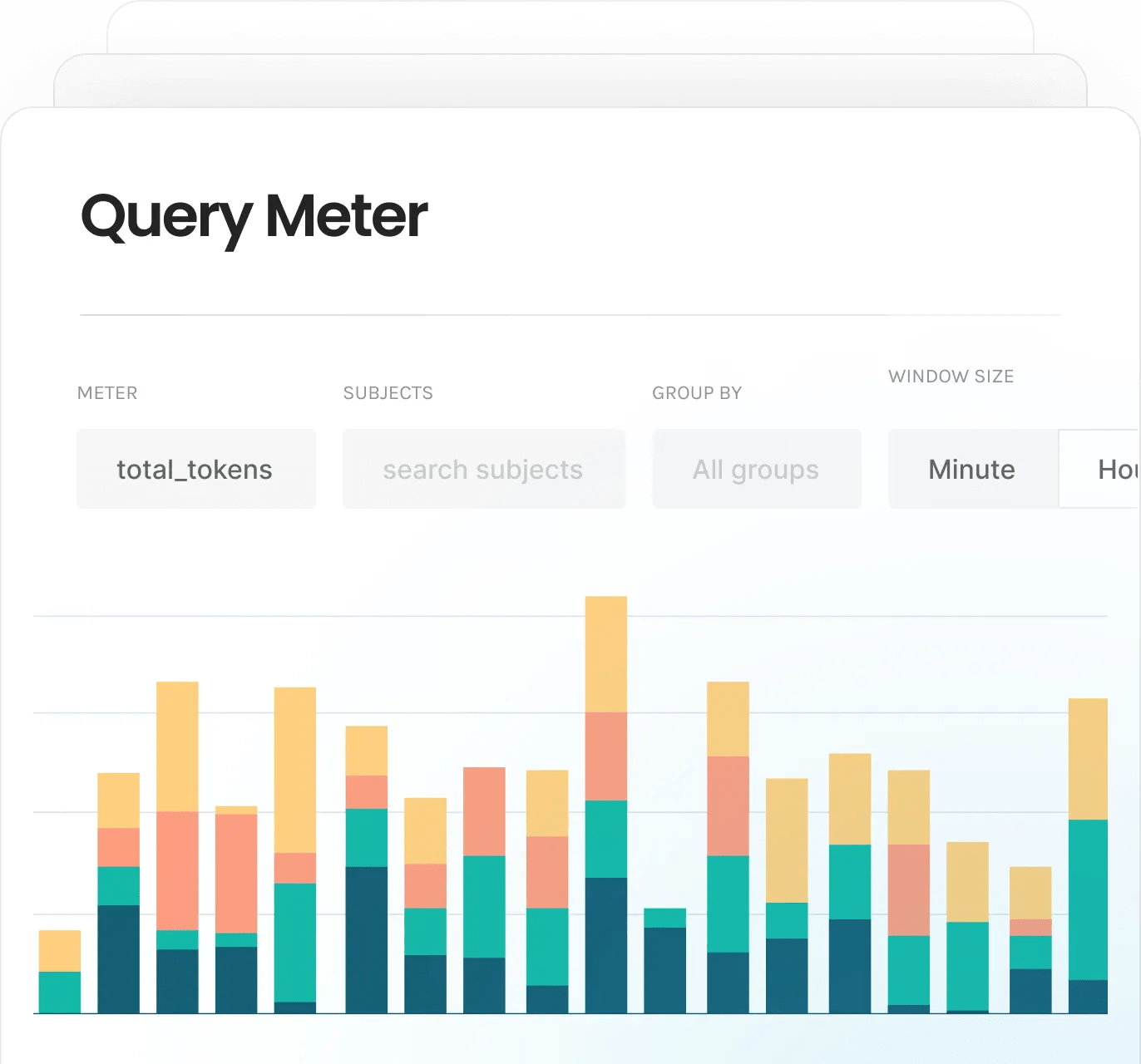

As Marton explains, OpenMeter — constructed on Apache Kafka, an open supply toolkit for dealing with real-time knowledge feeds — processes “usage events” throughout an organization’s tech stack. It then turns the occasions into human-readable consumption metrics, which it funnels to billing and finance dashboards in addition to buyer relationship administration databases for product and income groups to evaluate.

OpenMeter may also implement utilization and fee limits. And it might probably execute usage-based or hybrid pricing, permitting firms to extra transparently invoice (not less than in concept) their prospects.

“OpenMeter is … built for engineers, and offers a composable architecture to process real-time usage data and control cost,” Marton stated. “Enterprise companies choose OpenMeter for its composability. It’s hard to replace decades of monetization infrastructure at once, so we built a solution that engineering teams can incrementally adopt.”

One among OpenMeter’s monitoring dashboards. Picture Credit: OpenMeter

Now, OpenMeter isn’t the one recreation on the town on the subject of distributors addressing metering dilemmas.

There’s Metronome, which not too long ago raised $43 million for its software program that helps firms provide usage-based billing, and Amberflo, which is constructing instrument units to rework SaaS pricing with metered utilization. Elsewhere, M3ter furnishes SaaS companies with usage-based pricing options.

So what units OpenMeter aside? Properly, for one, it’s open supply. OpenMeter’s software program is freely out there to make use of, with paid choices for enterprises that want managed plans.

Marton implies that it’s additionally cheaper than the competitors — although he acknowledges that precise pricing continues to be being labored out.

“Competitors in the usage-based space only cater to the revenue teams with a closed source, billing-first approach,” he stated. “OpenMeter focuses on the new generation of AI companies.”

In any case, OpenMeter has managed to realize a measure of early success, raking in $3 million from Y Combinator (which incubated it), Haystack and Sunflower Capital. Marton says that the corporate, which has 4 staff at current based mostly out of its San Francisco workplace, has “multiple” market-leader AI firms as prospects — however wasn’t prepared to share their names.

“The economic downturn prompted companies to have tighter control around spending, necessitating understanding per-user cost and enforcing usage quotas, while revenue teams need to find actionable insights in usage data to find new revenue streams,” Marton stated. “It’s a tailwind for OpenMeter.”