LordRunar

Otis (NYSE:OTIS) has made significant progress since I started coverage in early August 2023 with a ‘Buy’ rating. Its share price increased 11.11%, and total returns are up 12.89% at the time of writing.

As a brief refresher since my previous article, Otis engages in the design, manufacture, installation and servicing of elevators and escalators globally. It covers a wide range of uses including in commercial / office buildings, freight, and residential solutions.

In this article, I present an updated view on Otis post-Q2 earnings. I also assess Otis’s 1H operating performance and present an outlook for 2H 2024 and beyond.

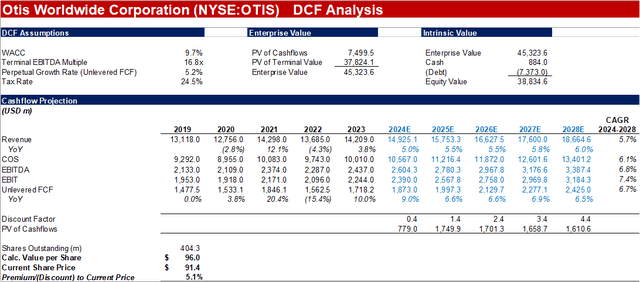

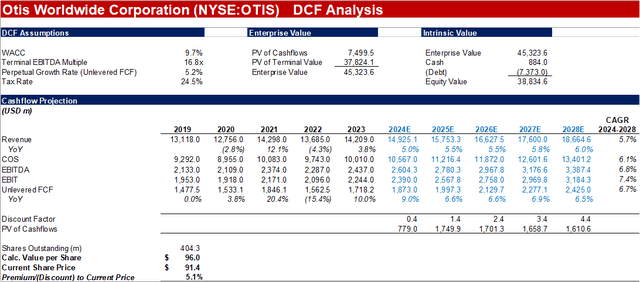

In preview, I believe Otis is trading at a discount of c.5.1% to fair value today, with potential upside of 10.3% in the next 12-18 months. The unwarranted dip after its Q2 earnings release is a clear ‘Buy’ opportunity for investors to scoop up a 1.6% yield that is likely to grow at c. 20% CAGR going forward.

2024 Q2/H1 Interim Results

When looking at the Q2 Interim results, Otis had a solid first half despite some macro challenges.

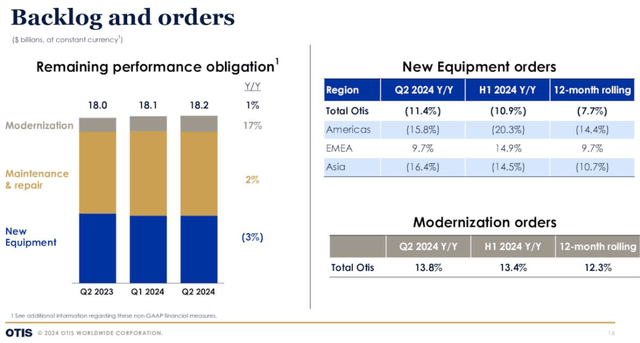

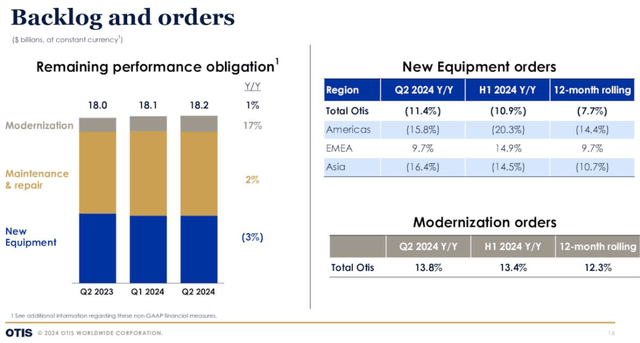

New Equipment Orders (the future growth driver, as new units sold and installed are mostly converted into recurring maintenance portfolio units), were down 11.4% YoY in Q2, and down 10.9% YoY in H1. This is not ideal and can be explained by headwinds, specifically in the US as well as China. Modernization orders (the replacement or upgrading of existing products in established buildings) were a bright spot, growing double digits in Q2 YoY and H1 YoY.

Q1 / H1 Results Presentation

I expect the new installation market to remain soft in the US and China into Q3 and Q4, while I expect the Modernization business to see continued tailwinds, as the stock of global building supplies ages, and more and more lifts need replacement / upgrading.

Q1 / H1 Results Presentation

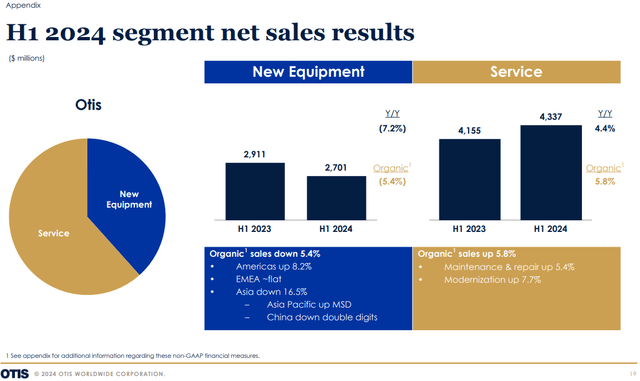

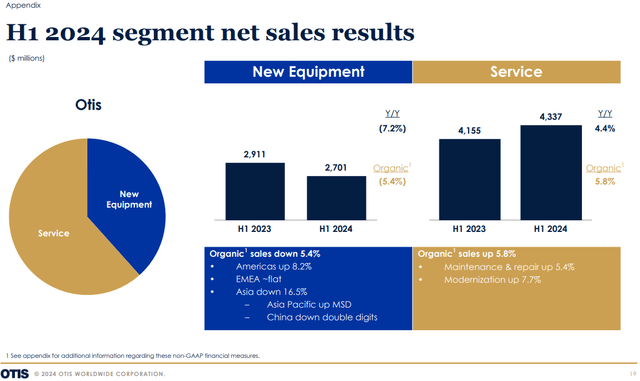

The maintenance part of the business (Service) continues to go from strength to strength, with 4.4% YoY growth. Growing the portfolio of units under maintenance is one of the top priorities for Otis, since it accounts for most of the revenue (62% in H1 2024) and operating profit (85%). As such, growing 4.4% YoY is healthy as it is coming off a higher base. Since New Equipment orders are the main driver of growing the maintenance portfolio (the other is acquiring more units to maintain through M&A), it is important for the long-term health of the business to continue to sell new units. This is a key point to watch. I would expect to see Otis continue to outperform the overall market in terms of New Equipment orders (i.e. grow its market share) and continue to increase its maintenance unit base going forward. Should Otis start losing market share or grow below the market average, this will be a cause for concern.

For 2024, management revised their EPS outlook upwards by ~15% from Q1 estimates, with adjusted EPS expected to increase from $3.83 – $3.9 to $3.85 – $3.9, increasing the lower range of their estimate somewhat. Their share repurchase plan for 2024 remains unchanged at ~$1bn, an increase from ~$800m in 2023. Similar to last year, I believe management will try to outperform their downside scenario and is signaling that if things continue as they are, they will be in the mid to upper range of their EPS estimate for 2024.

Outlook – 2H 2024 and beyond

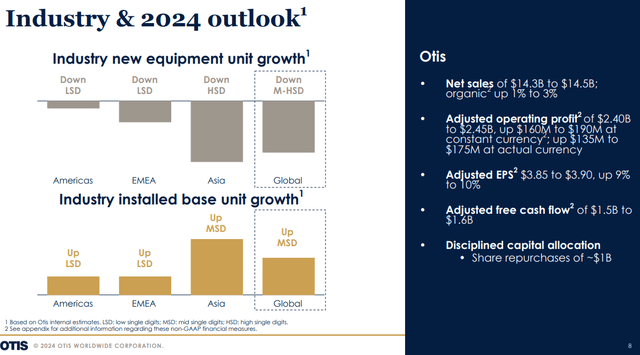

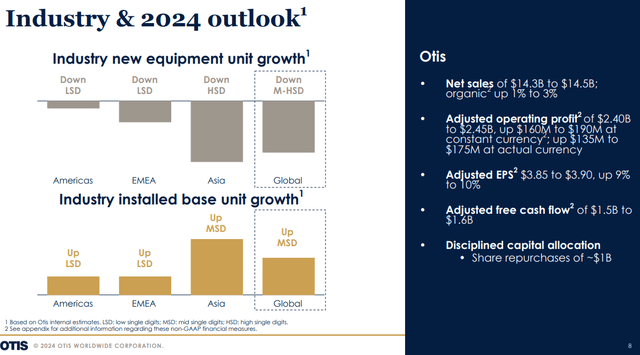

Focusing on the rest of the year and the longer-term outlook, Otis is in a good spot. The entire industry is facing new equipment headwinds (mid-to-high single digit declines for 2024), as such Otis’s YTD results are in-line with that I expect some recovery in H2 as there is a slight element of seasonality where H2 tends to be stronger than H1 for elevator and escalator manufacturers. Management has given similar guidance in their 2024 organic sales outlook, indicating they expect a mid-single digit decline in new equipment sales.

Q1 / H1 Results Presentation

Many of the same headwinds (and tailwinds) of H1 are likely to continue for the rest of the year, New Equipment orders will continue to face challenges while Modernization orders will increase. Labor cost inflation is a persistent challenge (which I noted in my previous coverage) but through strong operations and digitalization Otis can offset these cost headwinds through productivity enhancements and cost reduction initiatives (Uplift program).

February 2024 Investor Day Presentation

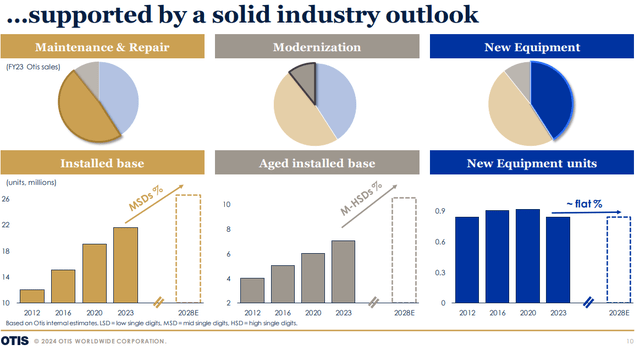

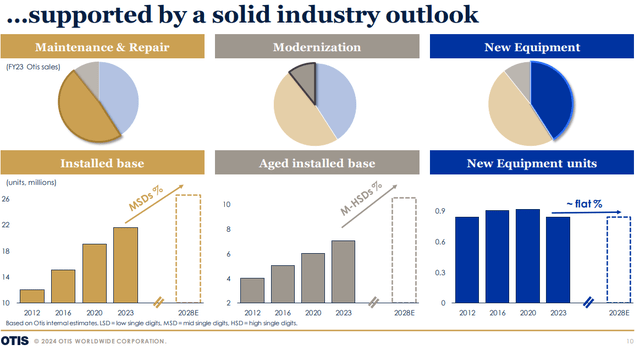

Looking beyond 2024, during the Otis Investor Day held in February this year, Otis provided some guidance on their views of the market through 2028. Focusing first on the New Equipment section, they expect growth to be roughly flat through 2028, with unit growth around 0.8% annually. While Otis can see some upside here in terms of pricing power and installation efficiency uplift (i.e. lower installation costs which translates into higher margins), overall New Equipment growth is likely to be somewhat muted for the next few years due to a changing phase of the global economic cycle. As they mentioned in their Investor Day, however, there are bright spots such as APAC and India, which will help offset continued weakness in China. Management is aware of these opportunities and is actively looking to capture them.

The outlook for the maintenance portfolio remains positive, with management expecting mid-single-digit unit growth of their maintenance portfolio through 2028. As the maintenance business accounts for over 80% of profits, this is key.

Management is doing all the right things, focusing on the things they can control (costs) and ensuring they are well positioned to capture some areas of higher growth, which will allow them to keep outperforming the overall industry. As such, I remain bullish on Otis’s long-term potential.

Risks

Many of the same risks mentioned in my previous article continue, and as such, I will mention only what changed.

New Equipment Sales:

The key risk remains sales, should Otis start falling behind global new equipment growth and lose market share, this will be a major red flag.

Recovery of China’s property sector:

China used to be a major growth market for Otis’s New Installation business, and thus was also a large contributor to the Maintenance business. What is clearer now than it was 12 months ago, is that the China property sector will not recover in the short-to-medium term (next 3-5 years). As such, China will likely no longer be a growth driver for the business. While this is a negative for Otis, all its competitors face the same challenge. Rather, they will need to shift to other markets such as APAC and India for growth going forward.

Wage inflation:

This remains a major headwind globally and continues to be a negative force weighing on margins. Any reduction in wage inflation will be welcome to Otis, however more important will be their other cost control and efficiency enhancement initiatives (Uplift). YTD Uplift has delivered ~$100m run-rate savings, and this is expected to increase to $175m in 2025, ahead of previous management estimates. This is encouraging and indicates management is on top of cost control.

Another effort to help improve productivity is their ‘Otis One’ connected units (Internet of Things) program. Having units fitted with IoT sensors can enhance maintenance efficiency and reduce costs by allowing Otis to do cheaper and faster routine maintenance, rather than the more expensive fixing of ‘breakdowns’.

In addition, Otis is designing and developing more modular elevator units that are easier, faster and safer to install. Otis also has several robotic solutions for installation of certain lifts. All of these can be efficiency drivers going forward, helping to increase operating profit margins.

Valuation and Shareholder Value

Despite increasing their EPS guidance by 15%, Otis share price was down 7.06% after the release of their Q2 numbers. Overall, Otis shares are up c.104.2% since the spin-off in May 2020, and shares are currently trading 9.3% down from the all-time high of US$100.84 (June 2024).

Seeking Alpha

I remain bullish on Otis and believe this is a good opportunity to buy the dip. Revenues and net profit continue to grow and based on a slightly more conservative view of managements growth guidance through 2028, I am again calling it, a return to all-time high is likely in the next 12 months (c. 10.3% upside from current prices), but with a near-term valuation range of US$96, indicating a c. 5.1% upside from current prices. While my near-term price target is below the all-time high, I believe continued share buybacks are a likely catalyst to send the share price higher.

Author’s Calculations

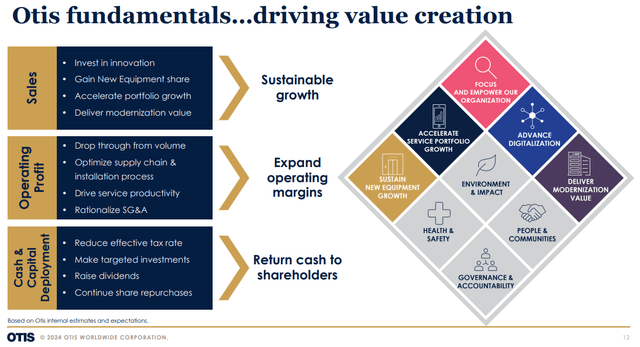

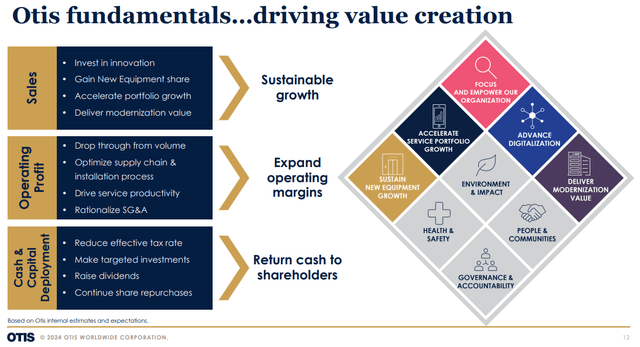

One of the reasons why I’m so bullish on Otis despite the new installation market headwinds, is management’s strong track record of delivering results, and their shareholder friendly capital allocation strategy.

February 2024 Investor Day Presentation

Otis’s priority is reinvesting in their business (driving sales and gaining market share, investing in innovation, growing maintenance portfolio and modernization), followed by improving profitability through productivity enhancement and stringent cost management. As mentioned previously, I generally consider buybacks in the same breath as buybacks are a way to signal to shareholders (and the market) that management believes the core business is undervalued.

Following investing in the core business, Otis does selective bolt-on M&A and focuses on increasing the dividend (a key priority for me as a long-term dividend investor). Otis’s most recent dividend increase was 14.7% in April. Otis has increased its dividend by 95% since its spin-off in May 2020, or 18% CAGR. After the Q2 results release, Otis has a dividend yield of c. 1.6%. This combined with a nearly 20% dividend growth CAGR makes it a solid holding for any dividend (growth) investor’s portfolio. As management has indicated they expect to maintain a c. 40% payout ratio and with profitability set to increase, I expect more dividend increases next year in April and am not worried about any cuts.

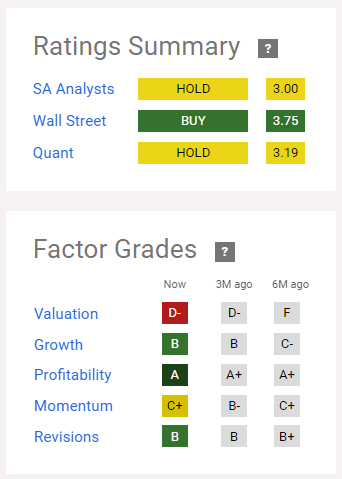

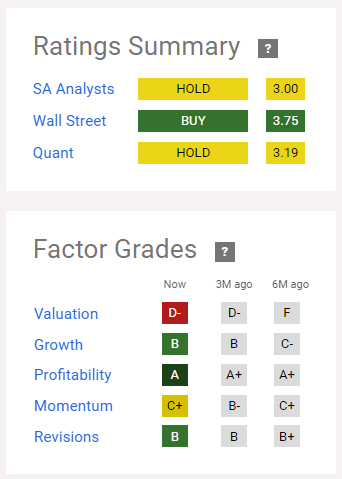

Looking at the Ratings Summary and Factor grades, Otis has a Quant rating of 3.19 ‘Hold’, shared by SA Analysts. That said, I’m with Wall Street on this one and rate Otis a buy. I think the factor grades are largely in-line with my views, with the exception of getting a ‘D-‘ for Valuation. Rather, I would give Otis a C or C+, as I do believe there is some more value there.

Seeking Alpha

Takeaway

Despite a strong 1H and an upwards revision of its EPS guidance by ~15%, Otis saw a significant correction of just over 7% after its results announcement. It is trading 9.3% below its all-time high, and its yield is roughly constant versus last year at 1.6%.

Despite macro headwinds for new installations, I believe the profit generating machine of its service business is healthy, and the high growth of its modernization book that has many tailwinds will support Otis in growing moderately going forward. Management is doing all the right things in controlling costs, improving margins. It keeps innovating its products and is focusing on strategic growth markets in APAC and India to ensure it captures growth where possible. The long-term outlook I believe is positive, and Otis has positioned itself well to outperform the market and its peers.

While the China market will no longer be a growth driver, management has shifted its focus accordingly, and it is making good strides in enhancing productivity and efficiency to limit and offset the impacts of wage inflation.

Otis is trading at a c. 5.1% discount to fair value, but with continued buybacks and high double-digit annual dividend increases on the horizon, I believe a return to all-time highs is likely in the next 12-18 months. I believe this is a good opportunity to buy the dip, and thus give Otis a rating of ‘Buy’.