Conservative Supreme Court justices on Wednesday appeared open to a problem to how the Securities and Change Fee fights fraud, in a case that might have far-reaching results on different regulatory businesses.

A majority of the nine-member courtroom prompt that folks accused of fraud by the SEC ought to have the suitable to have their instances determined by a jury in federal courtroom, as a substitute of by the SEC’s in-house administrative legislation judges.

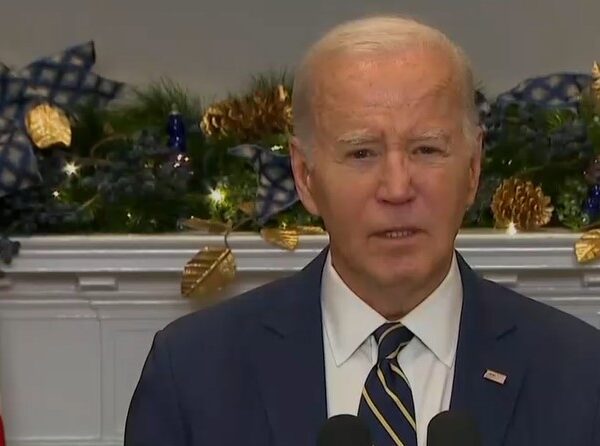

The justices heard greater than two hours of arguments within the Biden administration’s enchantment of a lower-court ruling that threw out stiff financial penalties imposed on hedge fund supervisor George R. Jarkesy by the SEC, which regulates securities markets.

“That seems problematic to say that the government can deprive you of your property, your money, substantial sums in a tribunal that is at least perceived as not being impartial,” Justice Brett Kavanaugh mentioned.

Justice Division lawyer Brian Fletcher warned the justices that their determination may have results reaching far past the SEC, noting that roughly two dozen businesses have related enforcement schemes.

“I don’t want you to think it’s just about the SEC,” Fletcher mentioned.

The case is only one of several this term during which conservative and enterprise pursuits are urging the courtroom to constrict federal regulators. The courtroom’s six conservatives have already got reined them in, together with in May’s decision sharply limiting their means to police water air pollution in wetlands.

Within the Jarkesy case, the Democratic administration is counting on a 50-year-old determination during which the courtroom dominated that in-house proceedings didn’t violate the Structure’s proper to a jury trial in civil lawsuits.

However Chief Justice John Roberts, signaling his issues with the ability of federal regulators, famous that “the impact of governmental agencies on daily life today is enormously more significant than it was 50 years ago.”

Who enforces the legislation?

The courtroom’s three liberal justices appeared sympathetic to the Biden administration’s arguments. Justice Elena Kagan, responding to Roberts, mentioned “our problems have only gotten more complicated and difficult.”

Later, Kagan mentioned in-house enforcement actions have been near routine for the previous half-century. “Nobody has had the, you know, chutzpah, to quote my people,” mentioned Kagan, who’s Jewish.

Final yr, a divided panel of the New Orleans-based fifth U.S. Circuit Courtroom of Appeals dominated in favor of Jarkesy and his Patriot28 funding adviser group on three points.

It discovered that the SEC’s case in opposition to him, leading to a $300,000 civil high quality and the reimbursement of $680,000 in allegedly ill-gotten positive factors, ought to have been heard in a federal courtroom as a substitute of earlier than one of many SEC’s administrative legislation judges.

Though the Supreme Courtroom principally dealt solely with the federal courtroom difficulty, the appellate panel additionally mentioned Congress unconstitutionally granted the SEC “unfettered authority” to determine whether or not the case must be tried in a courtroom of legislation or dealt with inside the govt department company. And it mentioned legal guidelines shielding the fee’s administrative legislation judges from being fired by the president are unconstitutional.

Choose Jennifer Walker Elrod wrote the appellate opinion, joined by Choose Andrew Oldham. Elrod was appointed by President George W. Bush, and Oldham by President Donald Trump. Bush and Trump are Republicans.

Choose Eugene Davis, a nominee of President Ronald Reagan, additionally a Republican, dissented.

Jarkesy’s legal professionals famous that the SEC wins nearly all of the instances it brings in entrance of the executive legislation judges however solely about 60% of instances tried in federal courtroom.

The SEC was awarded greater than $5 billion in civil penalties within the 2023 authorities spending yr that ended Sept. 30, the company mentioned in a information launch. It was unclear how a lot of that cash got here by means of in-house proceedings or lawsuits in federal courtroom.

A choice in SEC v. Jarkesy, 22-859, is predicted by early summer season.