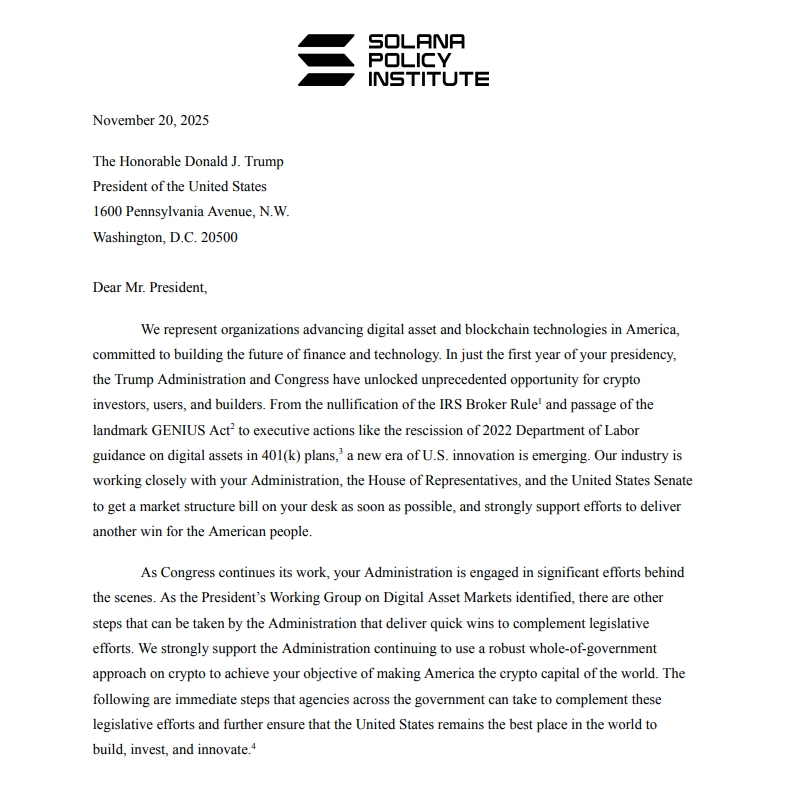

According to reports, more than 65 crypto firms and advocacy groups have sent a joint letter to US President Donald Trump urging immediate action to clarify tax and regulatory rules for digital assets.

The groups said agencies can move now to protect US innovation without waiting for Congress, and they laid out a set of specific fixes they want applied quickly.

The letter was signed by some of the biggest names in the blockchain and crypto industry, including Coinbase, Uniswap Labs, Exodus, Pantera, the Blockchain Association, the Solana Foundation, and the Solana Policy Institute, which helped lead the effort.

Reports also say other groups such as Block, Paradigm, Multicoin Capital, and the Crypto Council for Innovation joined the call for immediate action.

1/ Today, 65+ crypto organizations, from major trade associations to builders, investors, and advocates, spoke together with one voice: it’s time for federal agencies to act.

Our letter to @POTUS outlines immediate steps @SECGov, @CFTC, @USTreasury, and @TheJusticeDept can take.… pic.twitter.com/44zY97eeXe

— Solana Policy Institute (@SolanaInstitute) November 20, 2025

Tax Rules And Developer Protections

The letter asks for clearer tax treatment for everyday crypto activity, including a call to treat staking and mining rewards as self-created property that would be taxed only when sold or converted, not when received.

The groups also proposed a “de minimis” carve-out — an example figure mentioned in coverage was $600 — to avoid taxing tiny transfers that users don’t think of as taxable events.

The signers want rules that say routine operations like bridges, forks, airdrops, collateral moves, and liquidations should not automatically trigger tax events.

Regulators Urged To Move First

Industry leaders told the White House that agencies such as the SEC, CFTC, Treasury and DOJ can grant interim guidance, “no-action” letters, or exemptive relief to give builders room to work.

Reports say the groups pressed for targeted safe harbors and regulatory sandboxes to protect developers who publish open source code and to support self-custody options for everyday users. The push is framed as a short-term administrative fix while longer rulemaking proceeds.

BTCUSD trading at $85,298 on the 24-hour chart: TradingView

A Call Over A High-Profile Case

The coalition also asked the administration to urge the Department of Justice to drop or reconsider charges against Roman Storm, the developer tied to Tornado Cash, arguing that his work should be treated as publishing software rather than a criminal act.

That request reflects broader industry concern about cases that, they say, blur the line between building code and committing a crime.

Where This Fits In The White House Agenda

The letter lands in the context of an executive push on crypto that began with an order signed on January 23, 2025, which set up a Presidential Working Group on Digital Asset Markets to coordinate a whole-of-government approach.

The industry frames the new letter as a practical follow-up: these are steps agencies could take now to make the rules clearer while the working group’s longer reports and proposals move forward.

Featured image from CP Image/Policy Options, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.