Homeownership is likely to be the American Dream, however a lot can — and infrequently do — go flawed if you personal a house.

A tree falls by way of the roof throughout a heavy storm, your neighbor’s teen drives their household automobile by way of your fence, a burglar steals the whole lot however the kitchen sink whilst you’re on trip—what now?

That’s the place owners insurance coverage is available in. It may be the distinction between providing you with peace of thoughts in an emergency or having to cough up your whole wet day fund. Right here’s what a typical coverage covers, what it doesn’t, and the way a lot it prices.

What’s owners insurance coverage?

Owners insurance coverage protects you financially in case your property or belongings are broken by sure perils. Insurance coverage insurance policies outline “perils” as an occasion that causes injury to your property or belongings. It’s thought-about a “covered event” if it’s listed in your coverage.

After a hearth, leak, or different surprising catastrophe, submitting a declare along with your insurance coverage firm will help you pay for repairs or to switch your stuff. A owners coverage will even pay for residing bills if your own home turns into quickly unlivable.

However what qualifies for reimbursement is determined by the kind of protection you get and the way a lot you’ve gotten. Normally, there are two sorts of owners insurance coverage insurance policies—named perils protection (HO-2) and open perils protection (HO-5)—after which there’s a 3rd: a hybrid coverage (HO-3).

A broad coverage (HO-2) covers losses to your property or belongings attributable to an inventory of named perils, together with:

- Hearth

- Lightning

- Windstorms

- Hail

- Riots

- Plane

- Vehicles

- Smoke

- Vandalism

- Explosion

- Theft

- Volcanic eruption

- Falling objects

- Weight of snow, ice, or sleet

- Water overflow or discharge from air con, home equipment, or plumping

- Injury from a sudden energy surge

A particular coverage (HO-3) covers injury to your private belongings attributable to the named perils. But it surely broadens the scope for construction injury so that each one perils, besides any which can be particularly excluded in your coverage, are lined (extra on exclusions later).

A complete coverage (HO-5) makes use of open perils protection for all buildings and belongings in your property. That is probably the most beneficiant type of protection—and the priciest—nevertheless it nonetheless has some exclusions.

There are completely different insurance policies for houses which can be at the least 40 years previous or deemed a historic landmark (HO-8), and insurance policies for renters (HO-4) and rental homeowners (HO-6).

What does owners insurance coverage cowl?

Most individuals who reside in single-family houses have an HO-3 coverage. It covers injury to the next:

- The house’s inside and exterior

- Indifferent buildings on the property, similar to a storage or shed

- Private belongings like electronics and home equipment

An HO-3 additionally gives loss-of-use protection, which pays for added residing bills if you must transfer out of your own home whereas repairs are being made on account of injury from a lined peril. It offers private legal responsibility and medical funds for accidents sustained by a customer, too. As an example, in case your canine bites a good friend at your ceremonial dinner, the insurance coverage firm might assist pay for his or her physician invoice.

Like most different sorts of insurance coverage, you must pay your share of the loss for bodily and private property injury earlier than the insurance coverage firm steps in. Most deductibles on owners insurance policies are comparatively low, starting from $500 to $2,000.

The house itself is usually insured on the substitute value worth. That is typically greater than your buy value and can doubtless hold going up over time, says Angi Orbann, a vice chairman at insurance coverage firm Vacationers. “You could have purchased a home for $300,000, but to rebuild it, it could cost $500,000.”

She suggests working with an insurance coverage agent yearly to assessment and replace your dwelling protection, which informs different protection limits in your coverage. Private property protection is usually 50% of dwelling protection. For instance, if your property is insured for $500,000, your belongings can be lined for $250,000 (limits reset yearly).

You possibly can elevate the protection quantity if that’s not sufficient, however it is best to count on the next month-to-month premium fee. Lack of use and indifferent buildings are normally every lined at 10% to twenty% of dwelling protection.

Private legal responsibility protection has separate limits not associated to property protection, normally between $100,000 and $500,000. Medical funds protection will be as excessive as $5,000.

What doesn’t owners insurance coverage cowl?

A owners insurance coverage coverage isn’t a catch-all for calamity. “Let’s say your roof starts letting in water, but there was no wind or hail event around—that could be excluded, depending on the situation,” Orbann says. “Or if your refrigerator stops keeping things cold, that’s wear and tear.” Pest infestations, similar to termites and mice, are generally excluded perils, as is injury that was deliberately inflicted on the property by the house owner or their speedy household.

And regardless of a lot of the U.S. more and more affected by seasonal storms and hurricanes, flooding from weather-related occasions isn’t a lined peril—and neither are earthquakes.

“If that’s a concern in an area, there are separate policies that can be either endorsed onto the homeowner’s policy or a total separate policy that homeowners should secure for those types of risks,” Orbann says.

Some sorts of private property are excluded from owners insurance policies or have particular limitations, even when injury is attributable to a lined peril. For instance, jewellery is roofed as much as your coverage restrict for perils similar to hearth or weather-related injury, however theft has decrease limits.

Most insurers pays solely as much as $1,500 for stolen jewellery. Equally, theft of a firearm is normally lined as much as $2,500. To get full protection for these, specialists suggest getting a separate private articles insurance coverage coverage. In some instances, it’s possible you’ll wish to add supplemental insurance coverage for high-value jewelry gadgets like an engagement ring or luxury watch.

In case you use your property as your enterprise, your owners insurance coverage will not be sufficient to guard your enterprise belongings. On this occasion it is likely to be finest to contemplate including a business insurance policy.

Lastly, gadgets which can be insured by one other coverage, similar to vehicles, boats, or bikes aren’t lined by a owners coverage.

Is owners insurance coverage required?

Owners insurance coverage isn’t a state mandate in the identical manner that auto insurance coverage is, nevertheless it’s typically required by a lender you probably have a mortgage, Orbann says. “That’s basically to make sure that their interests are looked out for in the case of a loss,” she says.

It’s a wise manner for owners to guard their funds, too. In accordance with the Insurance Information Institute (III), the common owners insurance coverage declare is almost $14,000. The most typical claims are for wind and hail injury, averaging about $11,700 per incident. Hearth and lightning are the most costly property injury claims, averaging greater than $77,000.

How a lot does a owners coverage value?

Owners insurance coverage premiums have elevated sharply within the final decade. Extreme climate occasions, costlier constructing supplies, and labor shortages are largely to blame. In 2019, the common U.S. house owner paid $1,272 a yr for property insurance coverage, in keeping with the newest knowledge from the Nationwide Affiliation of Insurance coverage Commissioners. That’s an almost 40% enhance from 2010. In some states like Texas, the price of owners insurance coverage can attain above $4,000 yearly.

How a lot you pay for a coverage is determined by the traits of your own home and your owners insurance coverage historical past, says Orbann. “We always say in homeowners insurance, there’s no VIN number like auto insurance, where you have a number and you know almost everything about the house,” she says. Insurers rely on owners to disclose their previous claims after which fill in any gaps utilizing third-party knowledge sources.

As with the whole lot actual property, the situation of your property is paramount. Property insurance coverage corporations use a by-peril ranking system, which helps them value insurance coverage insurance policies primarily based on geographic publicity to sure dangers, particularly climate.

“If you’re in California, you’re going to have higher rates for wildfires,” Orbann provides. “If you’re on the East Coast, you’ll probably have higher rates for hurricanes. In the Midwest, it’s wind, hail, tornadoes.”

Listed here are the primary elements for pricing owners insurance coverage premiums:

- Location: Your house’s ZIP code can inform insurers rather a lot concerning the threat degree in your space, such because the frequency of theft or climate disasters. Location additionally helps insurers think about native labor and constructing materials prices to estimate what it will value to rebuild the house after a complete loss.

- House worth: Pricier houses are usually costlier to insure.

- Traits of the home: The distinctive options of the home, from bed room and toilet rely to roofing materials as to if you’ve gotten a swimming pool, are thought-about. The age of your property can be essential, as newer houses are inclined to have fewer hazards.

- Insurance coverage claims historical past: The character and frequency of your previous insurance coverage claims as a house owner assist the insurer assess your threat degree.

- House owner marital standing: Married {couples} are inclined to file fewer claims than non-married folks, an element that insurance coverage corporations understand as much less dangerous.

- Protection quantity: Most HO-3 insurance policies have substitute value protection on dwellings and precise money worth protection on private property. In order for you your coverage to switch your misplaced belongings, relatively than pay an quantity that’s been diminished for depreciation, it’ll value extra.

- Deductible: A better deductible can result in a decrease premium.

Contemplating all the person elements that go into pricing a owners insurance coverage coverage, right here’s the place it’s most and least costly, in keeping with 2019 knowledge from the Nationwide Affiliation of Insurance coverage Commissioners.

Listed here are probably the most and least costly states for owners insurance coverage:

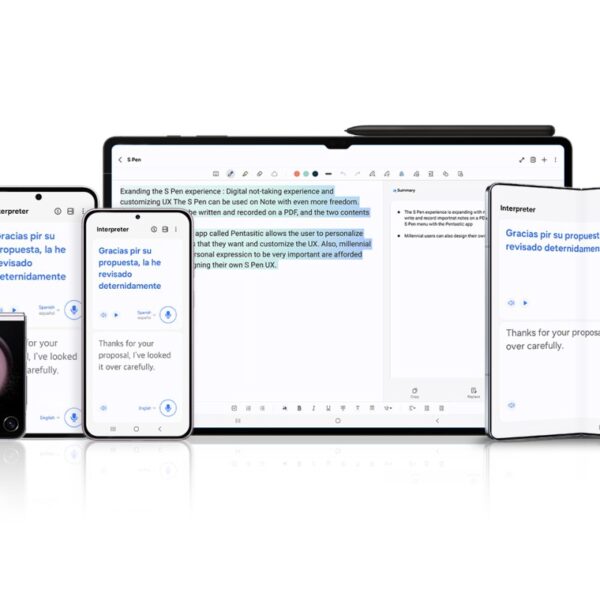

A lot of the elements used to set premiums are out of your fingers. Nevertheless, you’ll be able to take steps to qualify for reductions. Including sensible programs to your property, similar to a safety digital camera or smoke detector that alerts your telephone if you happen to’re away, can result in a decrease premium. Putting in a brand new roof could make an enormous distinction, too.

Normally, shopping for two or extra insurance coverage insurance policies from the identical firm, generally known as bundling, can lead to a less expensive month-to-month fee.

Homeownership is dynamic, and the insurance coverage you purchase to guard what’s doubtless your largest asset isn’t a set-it-and-forget-it exercise, particularly in an period of excessive inflation. “The cost of everything is going up,” Orbann says. Checking in along with your insurance coverage supplier yearly to regulate your property’s substitute value and account for brand new reductions, she says, is “especially important right now.”