samxmeg

Every other day, Paramount Global (NASDAQ:PARA, NASDAQ:PARAA) gets another rumor or confirmed report on a new deal. The problem for shareholders is that Shari Redstone, controlling shareholder, appears to have no real interest in a deal in the best interest of common shareholders. My investment thesis is Bullish on Paramount due to valuation, but doubts regarding a merger are elevated.

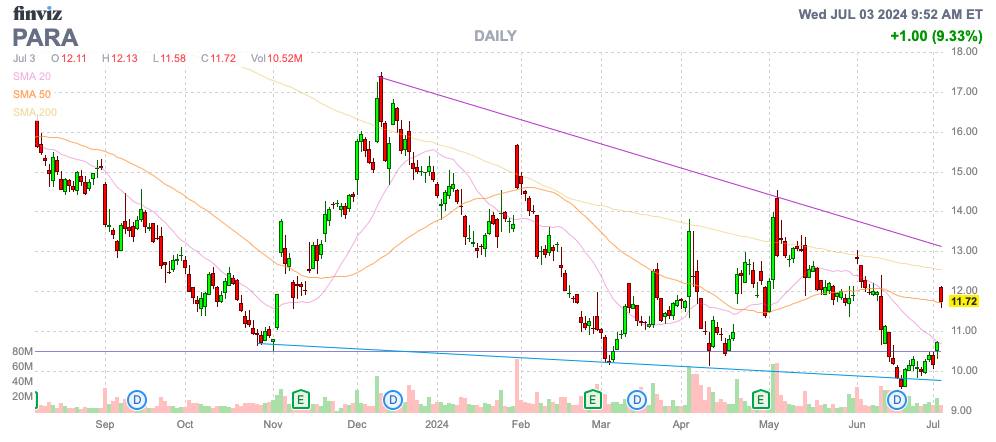

Source: Finviz

More Deals

Only a few weeks ago, Paramount appeared to cancel any of numerous rumored deals with Shari Redstone, apparently not comfortable with the final offering from Skydance Media. Now, Paramount is in talks with Skydance to acquire National Amusements (NAI), plans to sell BET and media mogul Barry Tiller is kicking the tires.

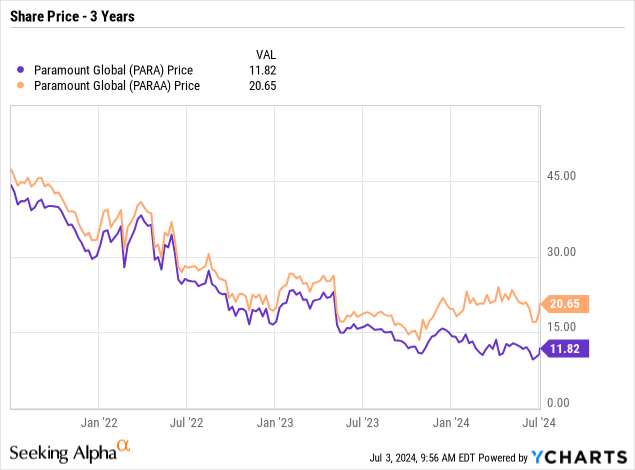

Despite all the deal rumors, Paramount has only rallied back above $11. The Class B shares recently traded at the lows for the year due to reduced signs the non-controlling shareholders would obtain premium valuations for their stock similar to the controlling shareholders. PARAA now trades at nearly double the price of PARA.

The problem is that the WSJ is reporting Skydance Media working on a deal to acquire NAI (National Amusements) from Shari Redstone for $1.75 billion to obtain the 77% voting control. This deal makes no sense, going back down the path of a special deal for the voting shares of NAI over the broader shareholder class.

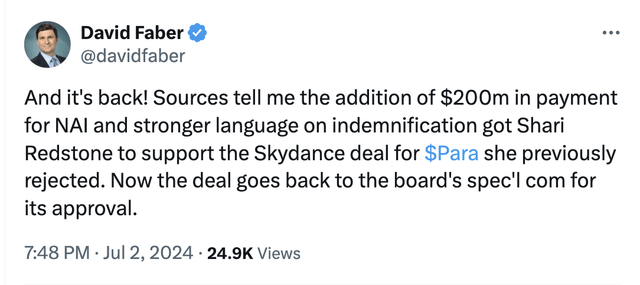

David Faber, CNBC deal expert, is reporting the NAI deal has stronger language to indemnify Shari Redstone. Nonetheless, the deal has apparently been sent to the special committee to review.

The terms of the deal haven’t been released, but the believed terms are similar to the prior deal, with Paramount Class B shareholders having the option to accept $15 for 50% of the outstanding shares. Considering the 45-day “go-shop” period, Barry Diller has time to come in with a deal, but again the interest and focus appears geared towards taking over NAI for the voting control and leaving the non-controlling shareholders in the dust.

Streaming Pain

Paramount doesn’t need a deal as much as the company needs to find a profitable solution for the streaming service. Paramount+ is hiking streaming prices to help wipe out ongoing losses, with the new plan costing $12.99/month for the ad-free service with Showtime and the Paramount+ Essentials costing $7.99/month, up $2 from the prior level.

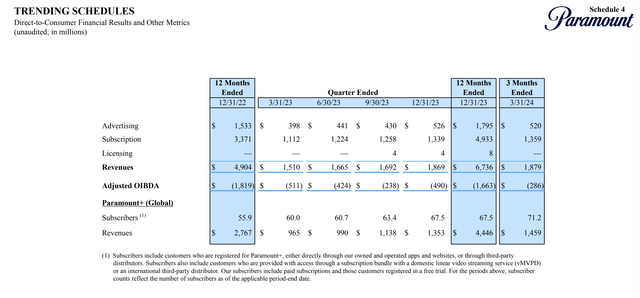

During Q1, Paramount+ reported an adjusted OIBDA loss of $286 million. The DTC business reported an adjusted OIBDA loss of $1.7 billion in 2023 to offset a business with total adjusted OIBDA of $2.4 billion.

Source: Paramount Q’14 trending schedule

Paramount has over 71 million subscribers now. The streaming service will have an average cost of $10 a month plus advertising sales, providing a business that should top $8 billion in annual sales going forward.

The other major rumor was Paramount working on a deal to find a streaming partner for Paramount+. A joint-venture model could include a match with Max from Warner Bros. Discovery (WBD) and Peacock from Comcast (CMCSA).

Media experts appear to suggest Paramount+ and Peacock need additional scale to compete with Netflix (NFLX) and the Disney (DIS) bundle of Disney+/Hulu/ESPN+. The likely key is some type of bundling of these streaming services while Paramount+ maintaining independence and standalone sales, though bundles tend to lead to reduced revenues.

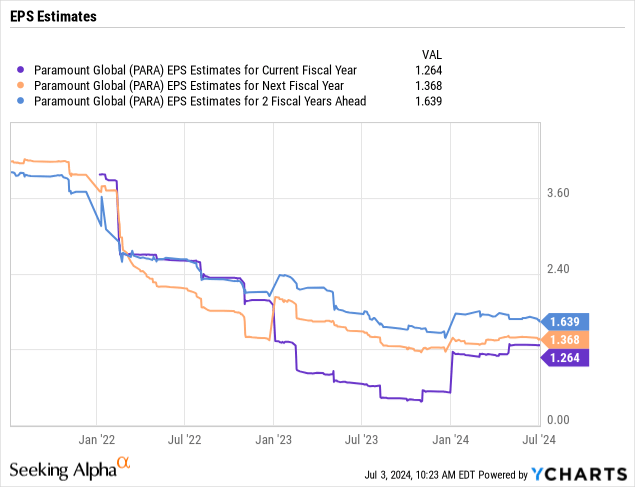

Paramount is already forecast to produce a 2024 EPS of $1.27 leading to much higher earnings per share in 2026 to 2027. A big key to this story is stripping out the DTC losses that currently contribute to an EPS headwind in the $2+ range just from the OBIDA losses on 654 million shares and not factoring in any ability for the streaming business to eventually reach the 25% OBIDA margins similar to the TV Media unit.

The media company reported a large jump in EPS during Q1 ’24 with the DTC business cutting OIBDA losses in half. Paramount reported an adjusted quarterly EPS of $0.62 while only reporting a profit of $0.52 for all of 2023 in a sign of the profit potential from cutting the losses from the streaming business.

Takeaway

The key investor takeaway is that the Paramount Global is appealing when the stock trades at $10 due to the valuation. Any shareholders that can cash out on the Skydance Media deal at $15 can make a few bucks, but the real value in the business is vastly beyond this price when the company can eliminate the losses from the DTC business. The biggest problem is that the powers in control aren’t really concerned about the non-controlling shareholders and the real value of the business may not materialize whether via the control of NAI or Skydance Media in the future.

Investors should scoop up shares on weakness, but the deal merry-go-round isn’t favorable for non-controlling shareholders actually obtaining a premium valuation for shares. At $15, Paramount would only trade for ~10x forward EPS targets that appear conservative.