The world is full of companies that attempt to assist streamline the method of establishing an organization. Doola is one such startup, and it has raised a cool $12 million so far since its inception in 2020. The corporate simply closed a $1 million “strategic investment round” from HubSpot Ventures, lower than a yr after its $8 million Sequence A, and in the present day we get to take a very good take a look at the pitch deck it used to boost that spherical.

Often, when a startup raises a small sum of money following a decent-sized spherical, there’s one thing unusual happening — it’s a symptom of one thing not fairly going to plan. In Doola’s case, nonetheless, HubSpot’s involvement is smart: The advertising and marketing software program firm reaches a number of clients, so Doola’s toolset could possibly be a very good match with HubSpot’s enterprise mannequin.

We’re on the lookout for extra distinctive pitch decks to tear down, so if you wish to submit your personal, here’s how you can do that.

Slides on this deck

My AI deck-review instrument estimates there’s solely a 15% probability of Doola efficiently elevating capital with this deck alone.

Doola shared its 14-slide deck with none redactions.

- Cowl slide

- Funding timeline slide

- Drawback slide

- Resolution slide

- Product slide

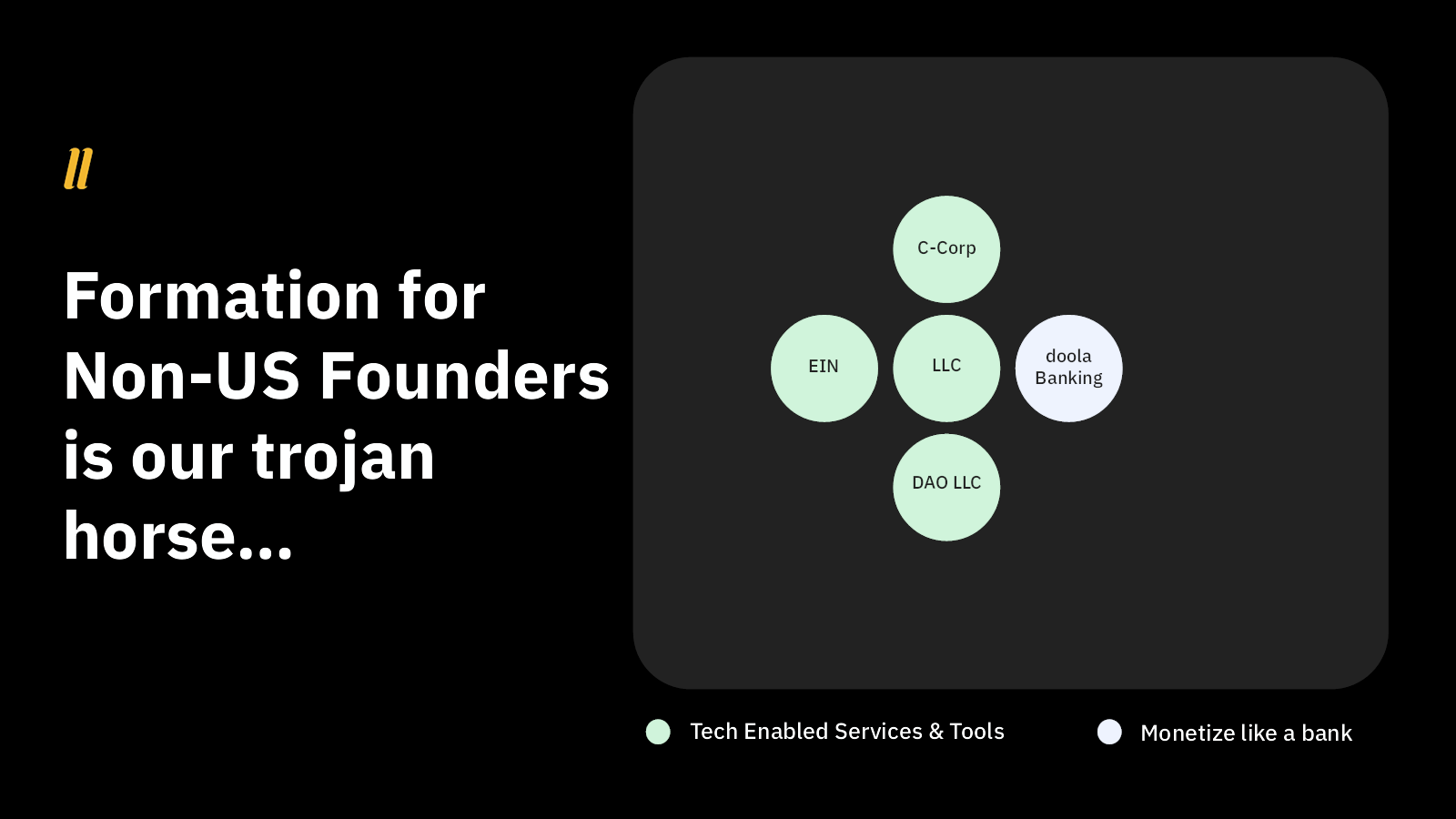

- Technique slide

- Product portfolio slide

- Market measurement slide

- The way it works slide

- U.S. market alternative slide

- International market alternative slide

- Imaginative and prescient slide

- Group slide (?)

- Contact slide

Three issues to like

To be frank, I can inform from simply wanting on the checklist above that there’s rather a lot of data lacking from the deck. In reality, my AI deck-review instrument estimates there’s only a 15% chance of Doola successfully raising capital with this deck alone. We’ll get to that later, however let’s first concentrate on what Doola bought proper, as a result of it does do some issues extremely nicely:

Nice use of a mix slide

I like utilizing two slides that work collectively to inform a compelling story. Doola makes use of slides 6 and seven to nice impact:

[Slide 6] The setup . . . Picture Credit: Doola

[Slide 7] . . . and what a payoff! Picture Credit: Doola

That is fairly the efficient solution to construct towards explaining the enterprise mannequin not directly. It additionally units the stage for explaining the enterprise mannequin and monetization plans over time.

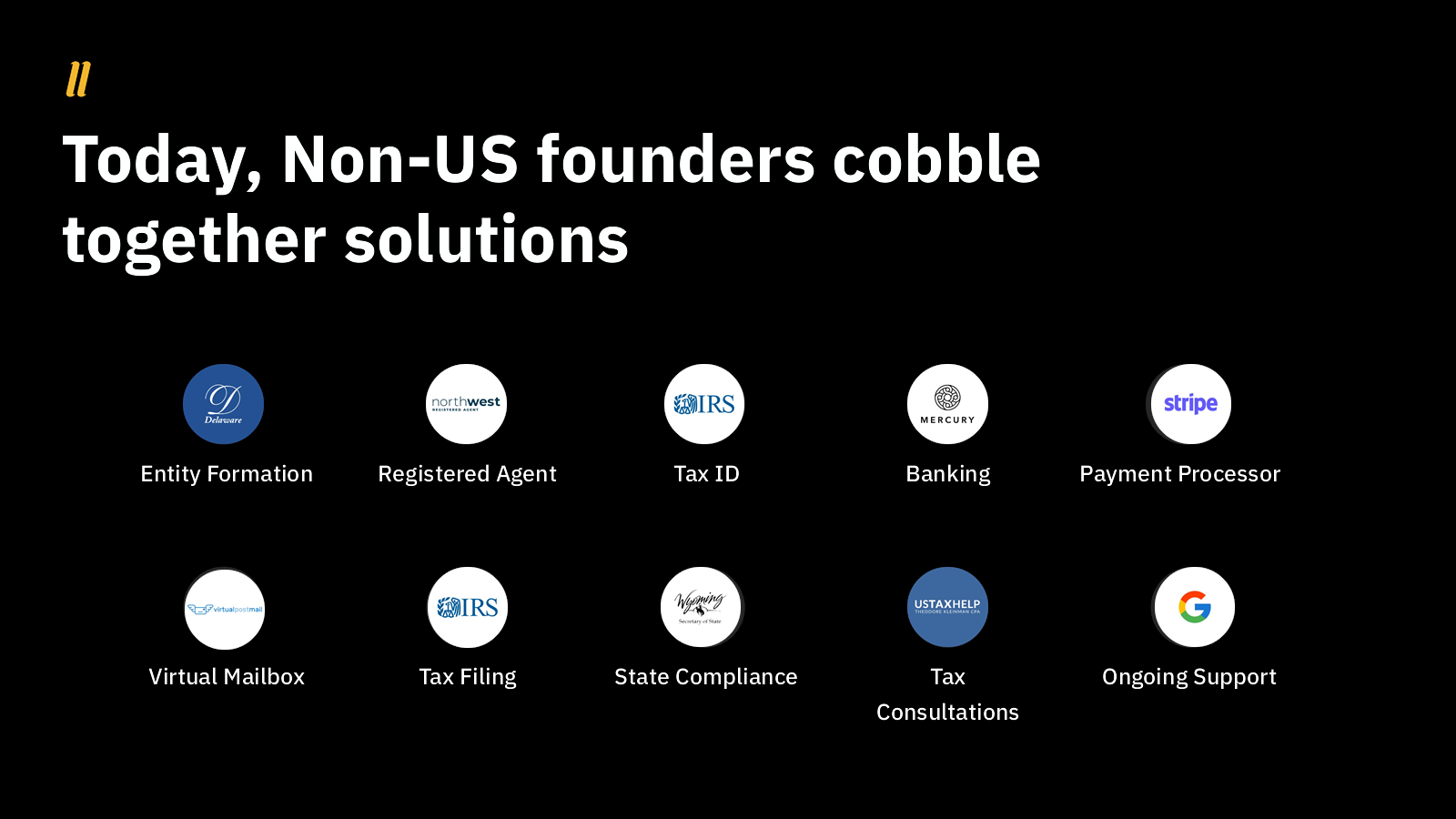

A refined and stylish drawback assertion

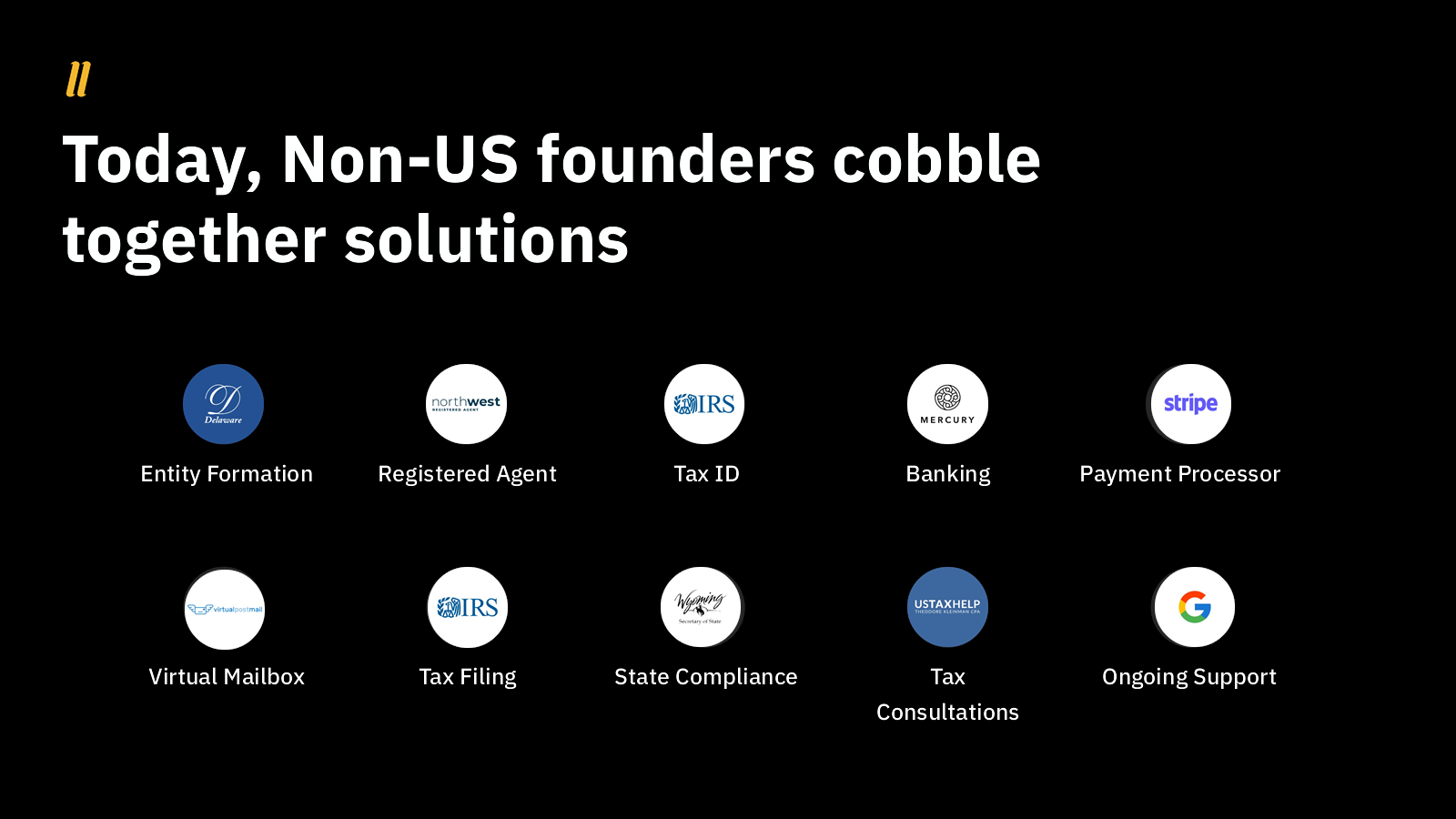

This can be a excellent instance of an organization that is aware of its viewers. The slide lays out a bunch of issues, however Doola is aware of it’s speaking to traders, and so it resists the temptation to clarify every drawback. Buyers are painfully conscious of many of those points and the way they present up for startups.

[Slide 3] Understated drawback assertion — it’s a little bit of a chance, however it works right here. Picture Credit: Doola

Simplifying issues is all the time a chance, however on this case, I imagine Doola gained the wager. Sure, these are advanced, irritating and costly issues, which makes them positively value fixing!

Fascinating bottom-up method to measurement up the market

[Slide 10] It’s fascinating, however is it a good suggestion? Picture Credit: Doola

Most startups have an honest quantity of success with the top-down method for estimating their market’s measurement (utilizing the TAM/SAM/SOM mannequin). But it surely’s fascinating to see Doola take a unique tack to reach at a possible market measurement of $4.5 billion per yr. As I’ve written earlier than, great founders often have to turn to a bottom-up approach to market sizing, as a result of there’s nothing else like what they’re constructing on the market.

I’m unsure if that’s the appropriate method right here on condition that this area does have a number of rivals, however I do benefit from the readability of this slide.

As I discussed earlier, there’s an unlimited quantity of data lacking from this pitch deck. A lot, the truth is, that it’s basically ineffective as a conventional pitch deck. I believe that Doola was already speaking to HubSpot Ventures as a part of its authentic spherical and that one thing inspired HubSpot to write down a examine anyway — perhaps the investor had already made up their thoughts earlier than they noticed this deck.

In the remainder of this teardown, we’ll take a look at three issues Doola might have improved or completed in a different way, together with its full pitch deck!