The scale of the activist group’s funding is round “several tens of billions of yen,” the particular person mentioned, asking to not be recognized as a result of the transaction hasn’t been publicly disclosed. Each ¥10 billion ($64 million) funding is equal to a 0.2% stake in Sumitomo, based mostly on Friday’s closing share value of ¥3,909. Japanese markets have been closed for a public vacation Monday.

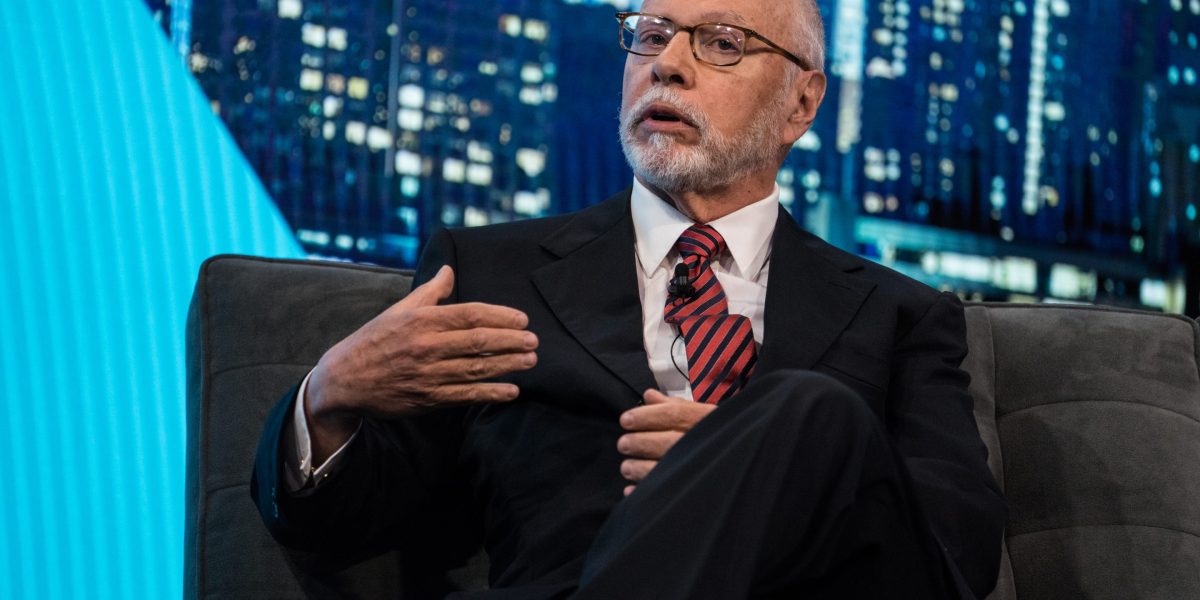

Japan is without doubt one of the hottest markets for activist investing, with the federal government and establishments such because the Tokyo Inventory Trade asking firms to raised handle stability sheets and retool enterprise methods to spice up shareholder returns. Elliott — founded by billionaire Paul Singer — not too long ago targeted on developer Mitsui Fudosan Co., after beforehand focusing on Toshiba Corp., SoftBank Group Corp. and Dai Nippon Printing Co.

Elliott has engaged with Sumitomo and shared its views on methods to create shareholder worth, the particular person acquainted informed Bloomberg. It’s unclear when the fund collected its stake in Sumitomo, or when the discussions occurred.

A consultant for Elliott declined to remark, whereas Sumitomo mentioned it doesn’t touch upon shareholders.

Given activist strain, “lagging trading companies should need to not just take care of their own large project risks, but are also subject to pressure to pay out more,” mentioned Kelvin Leung, a portfolio supervisor at Robeco Hong Kong Ltd. “The question remains if management can deliver bolder shareholder-friendly measures and further divestment of non-core and non-performing assets,” he mentioned.

Japanese buying and selling homes’ shares have surged to data since Buffett mentioned a 12 months in the past that he could be elevating his holdings in them. In February, he mentioned in his letter to buyers that the businesses observe shareholder-friendly insurance policies which can be “superior” to these practiced within the US. Sumitomo shares reached their highest ever final week, and have climbed 27% this 12 months.

Sumitomo’s friends additionally noticed their inventory costs rally on shareholder returns. In February, Mitsubishi introduced a buyback of as much as 10% of its shares for ¥500 billion, whereas Itochu mentioned in April it plans to repurchase about ¥150 billion of inventory.

Berkshire Hathaway Inc. holds about 8.3% of Sumitomo, in response to information compiled by Bloomberg. It additionally invests in different buying and selling companies together with Mitsubishi Corp., Mitsui & Co., Itochu Corp. and Marubeni Corp., and has mentioned it hopes to ultimately personal 9.9% of every.

Sumitomo is Japan’s fourth-largest buying and selling agency with a market capitalization of ¥4.8 trillion, information compiled by Bloomberg present. It has a price-to-book ratio of 1.1 and a ahead 12-month price-to-earnings ratio of 9.5, each the bottom amongst its friends. Sumitomo’s fiscal 2023 earnings are due Thursday, when the corporate can be scheduled to reveal its medium-term marketing strategy.

Activism from shareholders has been boosting the broader Japanese fairness market, contributing to a rally to document highs.

Mitsui Fudosan launched a plan in April to promote belongings and enhance buybacks, two months after information of Elliott’s stake within the agency, whereas Dai Nippon Printing introduced its largest-ever inventory buyback in March 2023 following strain from the activist fund.