EschCollection/DigitalVision via Getty Images

The Global X U.S. Infrastructure Development ETF (BATS:PAVE) is one of the more intriguing thematic ETFs I’ve come across recently.

PAVE seeks to profit from opportunities in the infrastructure. It’s become increasingly evident that the United States has a good deal of outdated, substandard, or run-down infrastructure in areas such as bridges and highways, ports, water systems, etc. There are reasons to think that federal, state, and municipal governments may put more tax dollars to work in infrastructure spending in coming years to help address these deficiencies while also helping promote job employment and provide a boost to local economies.

Specifically, PAVE invests in a variety of industrial, technology, materials, and utility companies that should prosper from increased infrastructure projects. The portfolio is widely diversified, with 100 different holdings in total, and no one position accounting for more than 3.81% of the whole portfolio. Holdings span companies in construction and engineering, raw materials, transportation, construction equipment, and so on.

While many thematic ETFs struggle to gain much market attention or trading activity, PAVE has built a nice shareholder base for itself. As of this writing, it has assets under management of more than $7.8 billion. The performance has certainly backed that up, with the ETF rising 25% over the past 12 months and 134% over the past five years.

Positive Tailwinds Are Now Set to Fade

And that’s where my less favorable intermediate-term outlook starts to form. Industrial stocks in general and infrastructure plays in particular have enjoyed several favorable macroeconomic factors in recent years which have led to outperformance. I expect these to reverse in coming months, which will likely lead PAVE to give back some of its recent gains.

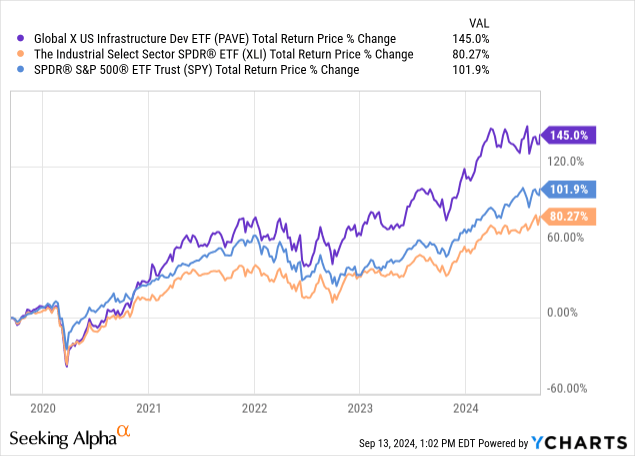

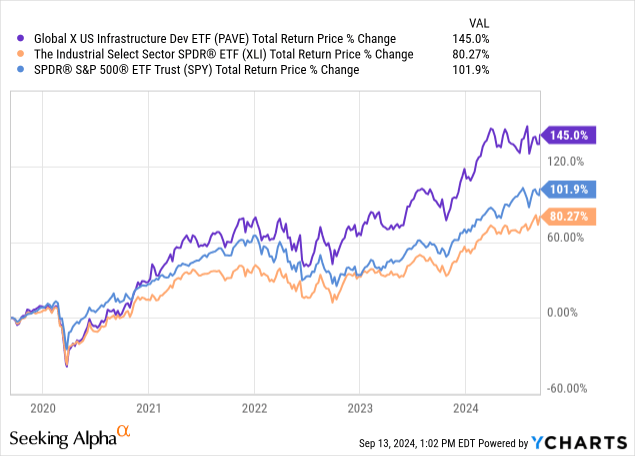

When thinking about performance, PAVE has two distinct periods. Since 2017, when the fund launched, PAVE has generated approximately the same total return as the overall S&P 500 index — and it significantly underperformed the market from 2017 through to the onset of the pandemic. However, since early 2020, PAVE has outperformed both The Industrial Select Sector SPDR Fund ETF (XLI) and the S&P 500 quite dramatically:

It’s interesting to note that the Industrials ETF has quite a different portfolio mix than the PAVE ETF. As of this writing, XLI and PAVE share just one stock in common among their top 10 holdings, which means there is real differentiation here. That has allowed PAVE to outperform considerably as investors have locked in on the infrastructure theme over the past four years.

You can also reasonably argue that some of the industrial ETF’s top 10 holdings as of this writing, including Automatic Data Processing (ADP) and Uber Technologies (UBER), are not overly industrial in nature. Perhaps PAVE’s mix of holdings will sustainably generate more alpha over time than the broader industrial sector ETF. That could be especially true if the broader theme around the revitalization of the nation’s infrastructure keeps up.

However, my view is that industrials in general are coming into a rough stretch, macroeconomically speaking, and that PAVE’s holdings in particular are not well set up for a falling interest rate/slowing economy backdrop.

Risks On The Horizon

Infrastructure investments most clearly benefit from government spending in the sector. The Biden Administration was quite helpful to infrastructure companies. Policies such as the Infrastructure Investment and Jobs Act and the Inflation Reduction Act authorized large amounts of spending on transportation projects, clean water and broadband internet access, and renewable energy production among other priorities. Meanwhile, the CHIPS and Science Act provided considerable funding support for semiconductor companies who build new foundries and manufacturing facilities in the United States.

With President Biden set to finish his term soon, it’s unclear whether the next administration will continue with such spending on infrastructure projects. As mentioned above, infrastructure stocks generally underperformed the S&P 500 during the prior Trump Administration.

Meanwhile, Deutsche Bank recently cautioned that Vice President Harris’ proposals, such as increasing the tax on corporate buyback programs and regulating energy producers more heavily, could impact industrial companies. That note specifically highlighted that companies which generate more of their revenues within the United States would potentially face a bigger taxation burden if Harris’ plans were to be enacted. That could be particularly impactful to companies which generate a large portion of their sales constructing and maintaining infrastructure and logistics assets within the United States. Deutsche Bank’s analyst noted that companies like Trane Technologies (TT), Parker-Hannifin (PH), and Emerson Electric (EMR) — all top PAVE holdings — could face downside from these assorted proposals.

I’m also concerned about the impact of interest rates on the infrastructure stocks. For one thing, higher interest rates tend to have a meaningful lag before really making an impact on real-world economic results. That’s because it takes a while for projects to go from the design and scoping phase through to getting approvals, funding, and actually putting the shovels in the ground.

U.S. industrial activity has remained strong in recent quarters despite higher interest rates. However, I suspect we’ll really start to see the effects of higher rates in terms of curtailing capital spending projects over the next year or two as companies have throttled back new discretionary spending. Given the significant slowdown in housing, autos, home appliances, and so on, it’s not hard to foresee a significant deceleration in industrial spending tied to these industries in due time.

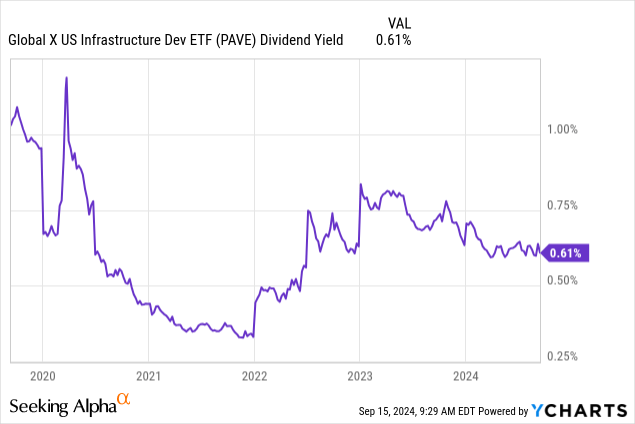

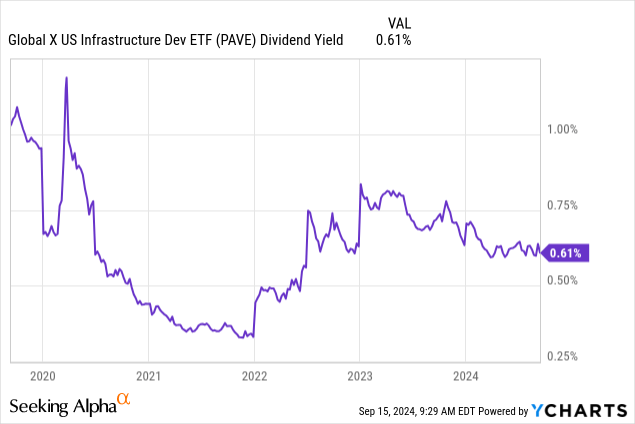

There’s a flip side to the interest rate coin as well. Arguably, investors have paid less attention to dividend yields on many equities recently, given the abundance of higher-yielding fixed income options over the past couple of years. Until recently, sectors such as telecom, utilities, and consumer staples had underperformed, likely in part because investors did not need their dividend streams for income generation.

That was, in turn, a favorable development for more growth-focused funds such as PAVE, which pays a low dividend yield:

In a potentially recessionary macroeconomic environment with plunging interest rates on certificates of deposit and government bonds; however, I suspect investors will be less keen toward holding ETFs that yield just 0.6%.

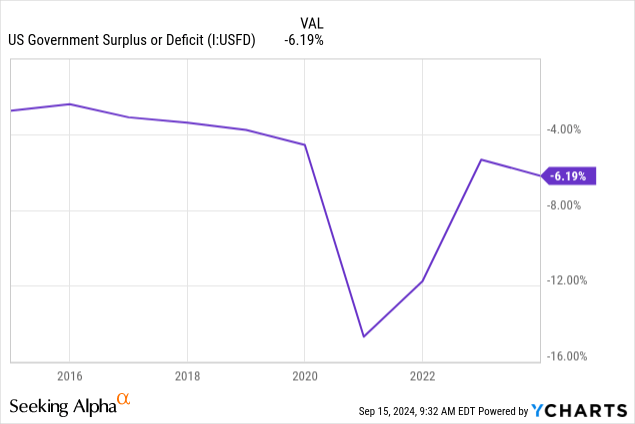

The final point I’d raise is that I suspect federal government spending may have to be trimmed due to the U.S.’ more challenged fiscal position:

Prior to the pandemic, the federal government was running a 3% to 4% of GDP deficit annually. This moved to a double-digit GDP deficit in 2021 and 2022 as economic activity was disrupted, meanwhile the government authorized massive stimulus programs (including infrastructure spending) to reactivate the economy.

However, the deficit never really returned to prior levels. Despite a roaring economy, it wasn’t enough to close the fiscal gap. With the deficit now exceeding 6% annually, spending capacity is significantly more constrained. To the extent that the bullish infrastructure thesis relies on the government borrowing money to build stuff, this will be significantly harder to finance going forward as compared to a few years ago.

PAVE’s Bottom Line

Infrastructure spending was an excellent investment theme over the past few years. There was understandable reason for stimulus spending to help the economy bounce back from the pandemic, and infrastructure companies enjoyed a substantial piece of that pie. Meanwhile, developments in the semiconductor and AI space helped fuel heavy investments in technology manufacturing in the United States, giving further momentum to the sector.

However, I expect that the combination of political and tax policy impacts, waning government funding for infrastructure, and the interest rate environment are likely to cap upside for the sector, and thus PAVE shares, over the next few years. While PAVE has outperformed dramatically in recent years, it has performed roughly in line with the S&P 500 Index over the longer term. Thus, some reversion to the mean can be expected in the coming months.