Justin Sullivan

A Nice Paradox

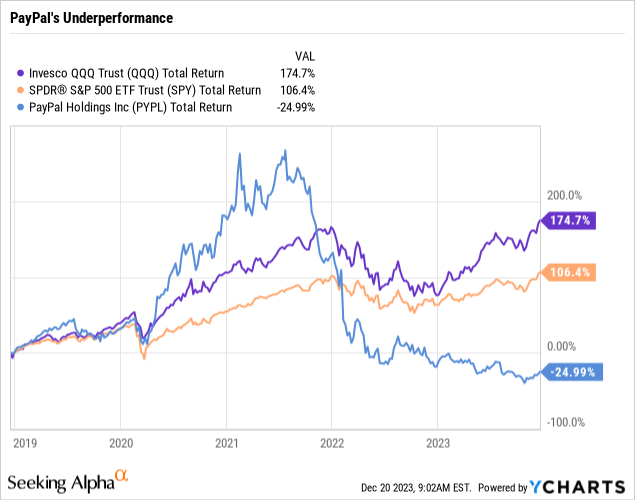

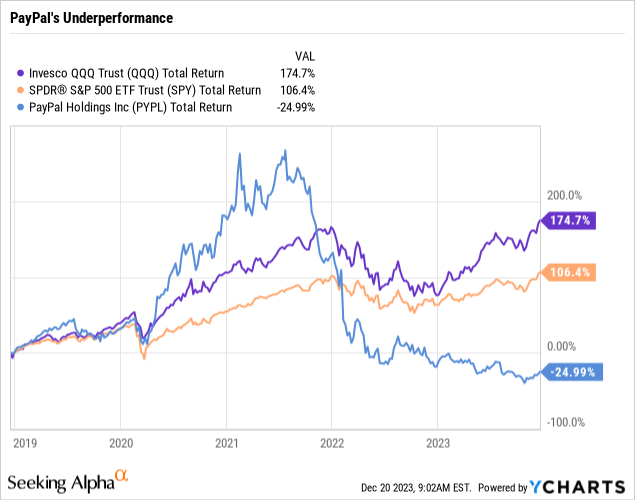

What would you suppose if I advised you a significant American tech enterprise that’s rising its core operations whereas having fun with quite a few tailwinds has dramatically underperformed the market previously 5 years? Whereas the market is nice at allocating capital to good companies over time, typically Wall Road will be far too pessimistic about shares primarily based on projections of future progress.

PayPal (NASDAQ:PYPL), a darling inventory throughout COVID, has been trampled over the previous two years. Whereas whole fee quantity, month-to-month lively customers, and transactions per lively account have all elevated sequentially, there has additionally been a rise in competitors with Apple Pay, a spotty observe report of acquisitions, and in my opinion, a lack of administration focus.

Regardless of dangers, I consider PayPal inventory is extraordinarily engaging at present ranges and will likely be a really worthwhile funding for long-term traders.

There’s a lot to debate, let’s dive proper in.

The Bear Case

Declining Take Charge and Person Base

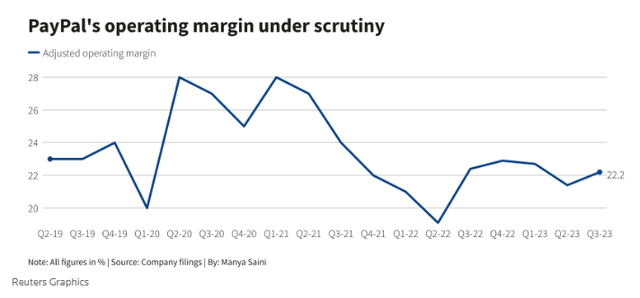

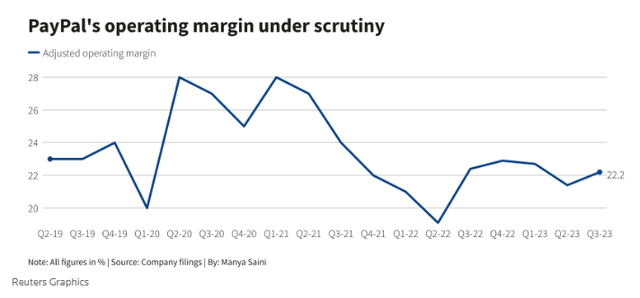

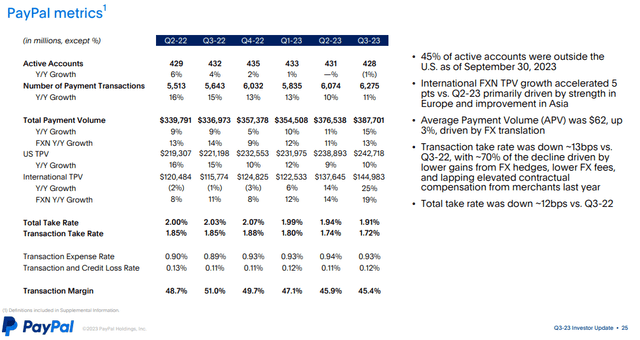

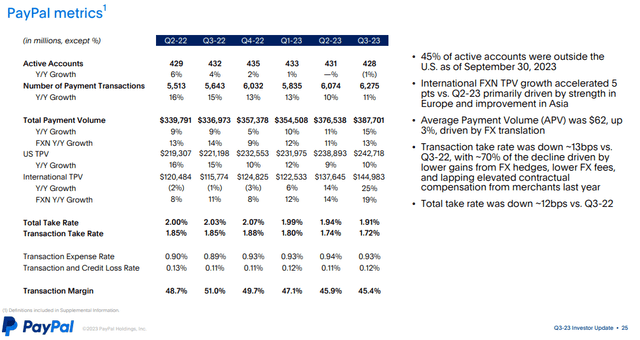

The main trigger for concern in PayPal inventory is a protracted decline in general take fee whereas the consumer base has been shrinking. This has led to working margins shrinking from roughly 23% in Q2 2019 to 22.2% in Q3 2023, after leaping towards the roof throughout COVID:

Reuters

Analysts weren’t enthused with the dearth of an inflection following a couple of quarters of falling margins. An analyst at Jefferies said, “New quarter, same story as gross profit headwinds persist on continued take rate pressure, offsetting better TPV growth”.

PayPal’s take fee is the colloquial time period for his or her transaction margins. That is how a lot PayPal makes on funds between the number of its companies. The latest decline in general take fee is because of PayPal’s unbranded progress outpacing branded funds progress. Branded refers to testing with the PayPal button, whereas unbranded doesn’t have a PayPal button. Unbranded is generally known as Braintree.

Braintree’s pricing is decrease than PayPal branded at a base of two.59% + $0.49 per transaction, with negotiable charges for giant enterprise clients ($80,000+ gross sales month-to-month). In response to Alex Chriss, Intuit veteran and PayPal’s new CEO, Braintree has roughly 10% market share globally within the enterprise fee service supplier market. Braintree touts clients like Adobe (ADBE), reserving.com (BKNG), Ticketmaster, DoorDash (DASH), and Uber (UBER). It is not essentially dangerous for the take fee to lower given the basis trigger is robust progress. Take into account that PayPal branded continues to be rising.

Braintree’s progress has outpaced PayPal branded’s progress in latest quarters, which has been making use of constant downward stress on general transaction margins. The trigger is two-fold: Growing competitors within the branded area and the rising pie within the enterprise PSP (fee service supplier) market. Braintree has two main opponents in Stripe and Adyen (OTCPK:ADYEY), and it is positioned fairly nicely within the e-commerce area. It is not as competitive for retailers in search of bodily point-of-sale options however has a robust digital providing.

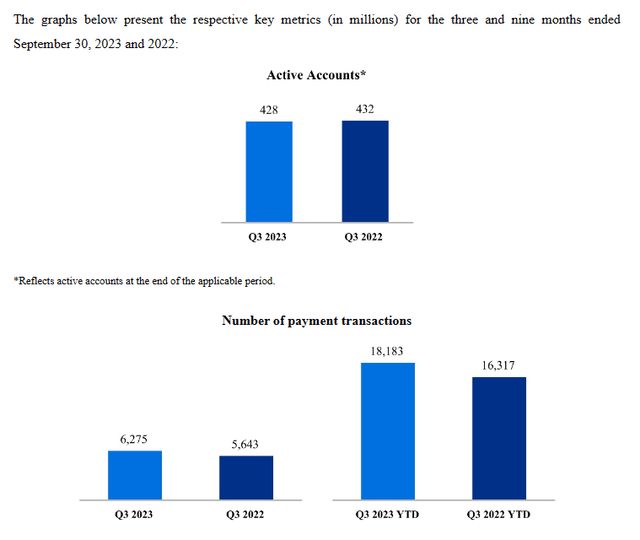

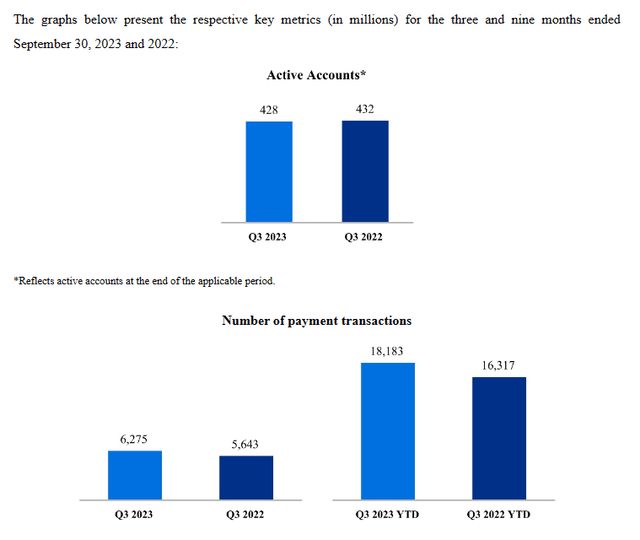

PayPal’s lively consumer base in the meantime has shrunk YoY from 432 million to 428 million. The whole variety of transactions has nonetheless elevated although, with 13% progress YoY in transactions per lively account (TPAA). Whereas a shrinking consumer base is rarely good for a network-effect-based enterprise, it is clear that administration has shifted focus to rising consumer base at any value to robust engagement with higher-value customers.

PayPal November 10-Q

What we have seen time and time once more with digital wallets / monetary companies apps is that customers grow to be considerably stickier and generate larger income once they use a number of services or products inside the app. PayPal principally depends upon peer-to-peer (P2P) funds because the top-of-funnel buyer acquisition channel. From there, they attempt to additional have interaction clients and deepen relationships with extra product presents. Administration has shifted towards deepening relationships with current engaged customers reasonably than buying as many new customers as doable. This mannequin will work over time because the flywheel impact of PayPal’s in depth and trusted community additional locks clients into the community.

More and more Disruptive Competitors

Braintree’s spectacular progress has harm working margins. Whereas Braintree has been exhibiting constant double-digit progress, PayPal branded has been rising within the single digits for a couple of consecutive quarters. A part of this lagging progress is rising competitors within the funds area.

PayPal bears are fast to say Apple and its Apple Pay providing as a severe aggressive headwind for PayPal Branded. Apple Pay is consuming share in bodily transactions given its ease and security.

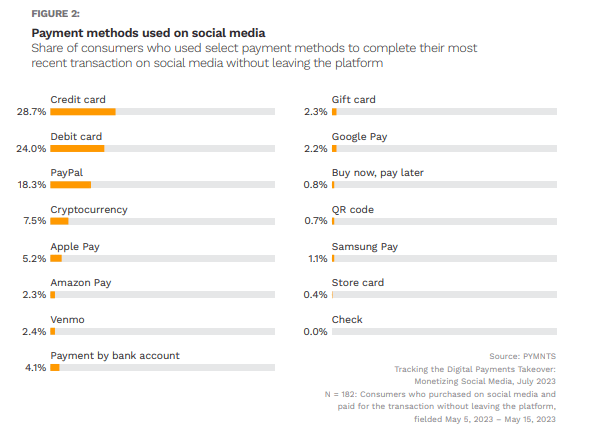

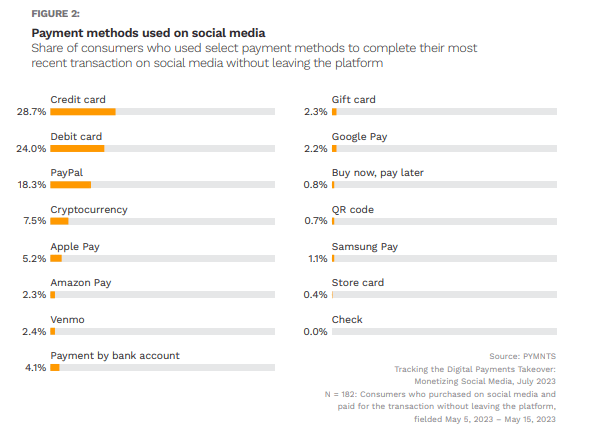

I consider the market is overestimating the affect of Apple Pay on PayPal’s core enterprise. PayPal has all the time been within the enterprise of on-line funds. Apple Pay just isn’t taking share within the on-line funds area, solely bodily funds. PayPal continues to be the main on-line fee processor and can proceed as such regardless of Apple Pay’s progress. PayPal is a frontrunner in each social media and web-based funds, whereas Apple Pay nonetheless trails Crypto as a way for social media funds, based on pymnts.com report “Tracking the Digital Payments Takeover“.

pymtns.com

PayPal itself (be aware that almost all social media funds will likely be by means of PayPal Branded) has almost 1 of each 5 transactions. Social media commerce has main potential however is stymied by an absence of shopper belief, based on pymnts.com:

Regardless of the potential of social media as a retail platform, many customers nonetheless have issues in regards to the authenticity of retailers. The survey revealed that 37% of customers who don’t transact on social media are skeptical about sharing their private information safely, and 31% doubt the legitimacy of sellers on social media platforms.

One of many main worth propositions for PayPal is that it is some of the trusted names globally. Shoppers really feel snug with PayPal and their retailers and PayPal has a historical past of defending each customers and retailers. They’ve a compelling worth proposition in social media commerce.

Apple has additionally made forays into the bank card and buy-now-pay-later segments. Apple’s lending merchandise are backed up by its fortress steadiness sheet, with almost $200b in money. Presumably, Apple will get pleasure from considerably decrease prices of capital to finance these credit score merchandise and will exhibit “race to the bottom” pricing conduct to gobble up market share. Whereas smaller opponents like Affirm (AFRM) and Klarna may very well be materially harm by this, I consider PayPal can climate these aggressive pressures. This will likely result in {industry} consolidation over time, however PayPal advantages from fewer selections at checkout.

PayPal is within the ‘A’ credit standing vary from each Fitch and Moody’s (MCO). Their wealth of shopper information permits them to offer safer loans. They’ve grown money and short-term investments from $5.6b in 2017 to $11.5b in the newest quarter. Growing competitors just isn’t an imminent menace.

In the meantime, PayPal advantages from the explosion in BNPL utilization, however this exposes them to elevated credit score threat. PayPal has an ideal technique to restrict credit score threat with their BNPL loans: selling some. On this mannequin, PayPal earns cash on the preliminary BNPL transaction, earns cash on the sale of the ebook, and has safety from default threat whereas servicing the loans. Any compensation threat is shifted to the customer (on this case, KKR (KKR)), who presumably earns a bit of cash on curiosity for late loans.

Some vital particulars of this deal weren’t publicly disclosed although. PayPal’s “Pay Later” product presents two kinds of loans: “Pay in 4” and “Pay Monthly”. Pay in 4 is the well-advertised BNPL providing: purchase an merchandise now and pay it off in 4 interest-free installments. Pay Month-to-month is the extra secretive BNPL product in that it does carry an rate of interest wherever from 9.99% to 35.99% (the utmost rate of interest allowable by US legislation is 36%). That is geared towards bigger transactions, round $10,000 and up. Most BNPL distributors supply an analogous construction. The cut up between Pay in 4 and Pay Month-to-month ought to be of nice concern to KKR as it would tremendously affect the anticipated curiosity receivables from the loans. These Pay Month-to-month loans face a a lot larger threat of non-repayment, so PayPal is offloading credit score threat regardless.

PayPal talked about that the proceeds of this sale will fund some share buybacks. I view this as an overwhelmingly optimistic transaction for PayPal as they’re offloading threat and shopping for again their considerably undervalued inventory.

The bear case that PayPal’s core enterprise is being disrupted by competitors doesn’t maintain its weight. Now let’s focus on the main threat of a PayPal funding – recession.

The Main Danger: World Recession

No matter value, all funding carries threat. Though I’m making the case that PayPal presents an especially compelling threat/reward at present ranges, there are nonetheless dangers to this thesis. The main threat is a world recession inflicting a slowdown in TPV, or Complete Cost Quantity. Since PayPal makes cash principally by means of a share of TPV + a flat price per transaction, any slowdown in general transactions and fee quantity will naturally erode PayPal’s profitability. With the mixture of decrease take charges, a recession might instantly re-ignite the worst of Wall Road pessimism and ship PayPal again down towards a 5-year low.

On the onset of 2023, I used to be satisfied we had been marching face-first right into a recession this 12 months. Regardless of my conviction, I did not touch upon this in any articles. How fallacious everybody was who predicted doom and gloom, because the market and economic system have drastically outperformed even the rosiest of predictions from the start of the 12 months.

I can not let you know the probability of a recession in 2024. I can let you know {that a} international recession is a severe threat to PayPal. I may let you know {that a} international recession is a severe threat to most different equities and would doubtless trigger a fabric drawdown in fairness markets. It’s as much as every investor’s threat tolerance and outlook on the worldwide economic system to measure this threat. For me, I don’t really feel the specter of a recession poses a severe concern to an funding in PayPal at present ranges. It’s nonetheless drastically undervalued, even appreciable macro headwinds can have a tough time slowing this inventory down in 2024.

With that mentioned, let’s focus on tailwinds for PayPal and why I consider that is the highest inventory to choose for 2024.

Tailwinds

Quick-term

New Administration – Alex Chriss

Essentially the most notable amongst many adjustments to PayPal’s management workforce is the addition of Alex Chriss as CEO. After Dan Schulmann, whose tenure on the board will finish on the flip of 2024, PayPal was stymied by an absence of focus and a doubtful acquisition historical past.

Chriss, an {industry} veteran who grew Intuit’s (INTU) SMB enterprise immensely, brings a renewed focus to the workforce. In his first earnings name as CEO, Chriss posed a few vital questions:

Are we executing with excellence behind an important work to offer clients with a compelling and differentiated worth proposition? Are we partnering with clients in a manner that brings them deep worth, but in addition rewards the PayPal shareholder? These are questions I’m maniacally targeted on answering with the workforce and doing a greater job of executing throughout the board. However let me be clear, however these realities, it is a progress firm with nice prospects.

A maniacal concentrate on driving worth for patrons and shareholders is a welcome message. PayPal has been rewarding shareholders with buybacks and continues to construct on its world-class attain and trusted model. Buyers additionally ought to think about the probability of extra asset gross sales in 2024. Former CFO Gabrielle Rabinovitch famous that the workforce will look to dump property that are not serving their core objective:

As you heard from Alex, we’re evaluating our progress priorities and aligning our assets to speed up our velocity… In September, we entered into an settlement to promote Comfortable Returns to UPS for $465 million in money, meaningfully larger than our acquisition value… This sale, which is predicted to shut within the present quarter, will allow us to place much more concentrate on our core enterprise and priorities.

Intense administration concentrate on productive property whereas slicing some chaff is a internet profit for shareholders.

Explosive Development of BNPL

As mentioned earlier, PayPal’s BNPL proposition “Pay Later” is having fun with secular progress. Your complete BNPL sector is exploding in recognition as American customers search to scale back their publicity to high-interest bank card debt. In response to Adobe Analytics, BNPL grew 17% YoY for November, contributing $8.3B to e-commerce gross sales. On Cyber Monday alone, BNPL attributed to $940m of on-line spending, up over 40% YoY. Adobe has additionally famous outright deflation of their Digital Worth Index, one thing that can drive extra customers to spend on-line the place PayPal is dominant. All this mixed with PayPal’s willingness to dump threat by promoting BNPL mortgage books paints a really rosy image for shareholders. The main threat with BNPL is that it is booming amidst a backdrop of rocketing shopper debt which exacerbates credit score threat. PayPal protects itself in opposition to this elevated threat by promoting the loans.

Seasonality

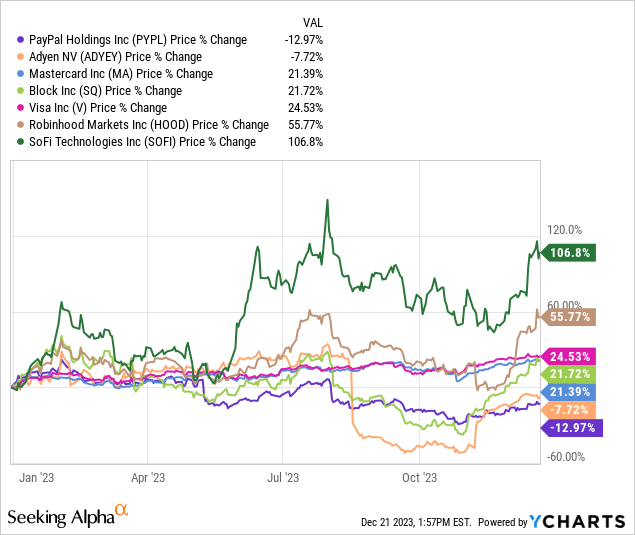

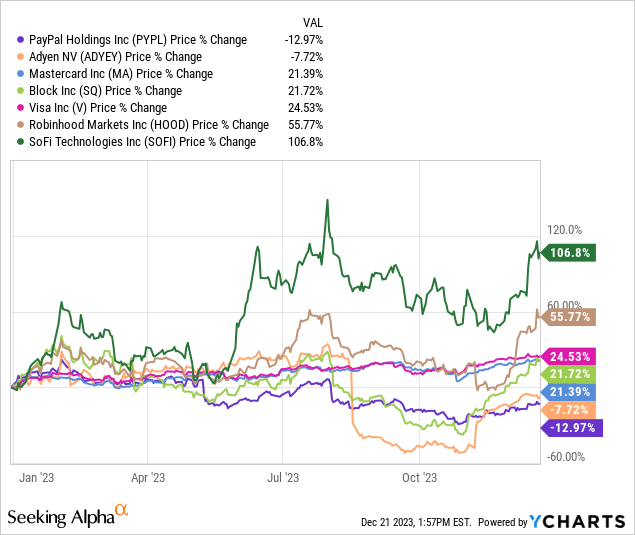

The ultimate short-term tailwind is seasonality. This autumn is a seasonally robust 12 months for companies that profit from shopper spending. As famous earlier, shopper spending is surprisingly robust this 12 months and breaking data. Though many traders consider seasonality is all the time priced in, I consider PayPal’s first earnings launch of 2024 will likely be exceptionally robust on the again of vacation spending, which is able to drive a larger-than-expected beat and lift of 2024 steerage. This beat and lift will reprice the inventory at a better a number of. Additional to the thesis that seasonality just isn’t priced into PayPal but is that PayPal has underperformed its Fintech opponents:

PayPal has carried out the worst YTD. In the meantime, PayPal is a frontrunner within the BNPL area, rising its core enterprise metrics TPV and TPAA, accelerating share repurchases, reducing OpEx, and can doubtless report a margin inflection in 2024. These are important short-term catalysts for PayPal.

Medium-term

Buybacks

Share buybacks present natural EPS progress with out underlying earnings progress. YTD by means of September 2023 PayPal repurchased roughly 64 million shares for $4.4 billion at a median value of $69.06. Additionally they have a complete of $11.5 billion remaining obtainable for future repurchases as of September 30, 2023. Share repurchases have been accelerating in recent times and with a lot capital remaining for additional repurchases, there may very well be important upward motion in EPS.

I contemplate PayPal one of many largest bargains being provided by the market presently. Administration has roughly 1/sixth of the present market cap of PayPal obtainable to repurchase shares at these cut price costs, which I consider will enable present shareholders to get pleasure from robust EPS progress within the coming years.

Margin Inflection

The opposite medium-term tailwind for PayPal inventory is an inflection within the take fee. I anticipate this as early as Q1 2024. When margins do lastly inflect, the market will reward PayPal closely for it in my opinion. Though they’ve been declining sequentially, the speed of decline is slowing in latest quarters (since This autumn-22, QoQ change has been -8 bps, -6 bps, -2 bps), hinting on the impending inflection:

Q3 Shareholder presentation

Chriss famous on the latest earnings name that the workforce is concentrated on increasing Braintree margins and accelerating their proper to win within the PSP sector. With 10% market share, PayPal is solidified as one in all three main enterprise PSPs, one thing that can function an ongoing topline progress engine. Nonetheless, the sequential decline in transaction take charges must inflect earlier than Wall Road begins to reward PayPal. Contemplating administration focus, the expansion of the higher-margin BNPL product, and the slowing fee of sequential declines, I anticipate this inflection someday in 2024.

Lengthy-term

Crypto: PYUSD

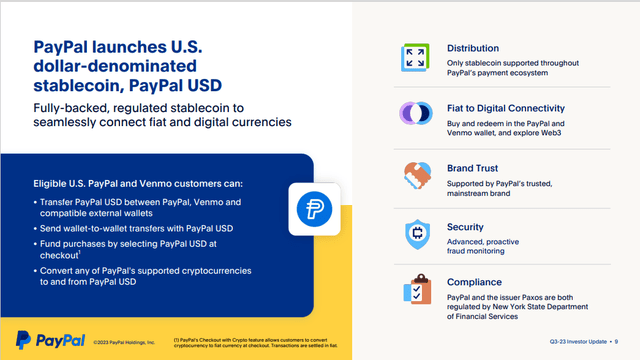

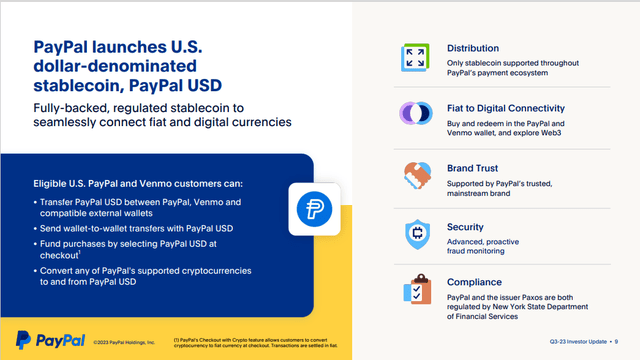

The strongest long-term tailwind for PayPal (apart from secular {industry} progress and elevated regulatory scrutiny of opponents like Visa (V) and Mastercard (MA)) is PYUSD. PYUSD is an Ethereum-based Stablecoin backed by Paxos. That is the one stablecoin that’s accessible all through your complete PayPal community and can make it considerably simpler for PayPal to course of worldwide funds.

The main early use of Stablecoins is as a retailer of worth and change between worldwide currencies. For instance, I can convert my USD to PYUSD after which the PYUSD to GBP. That is considerably cheaper than exchanging USD to GBP or in any other case sending cash abroad utilizing legacy fee rails. Worldwide funds are already one in all PayPal’s main margin merchandise, and PYUSD ought to enhance worldwide transaction margins whereas making worldwide transactions cheaper, safer, and sooner for patrons.

PayPal shareholder slides

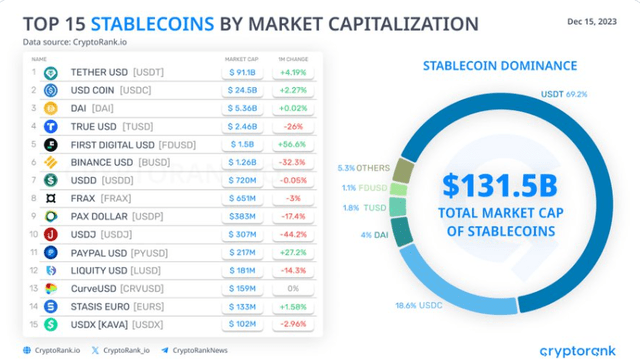

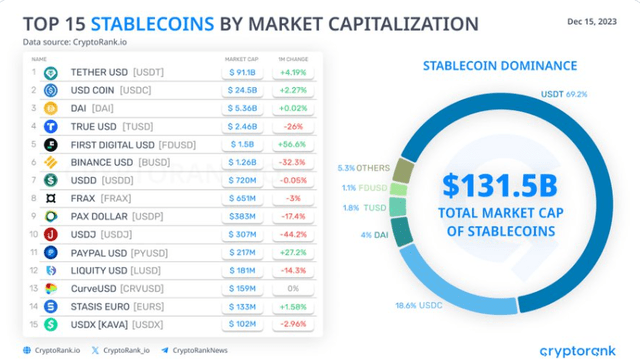

PYUSD is likely one of the quickest-growing Stablecoins by market cap and is about to interrupt by means of the highest 10 quickly:

Cryptorank

Because the crypto ecosystem continues its international enlargement and widespread adoption, PayPal will likely be on the frontlines of early use circumstances. This may kind a first-mover benefit over time, as PayPal’s model recognition will assist alleviate buyer distrust in crypto. I anticipate PYUSD to grow to be a significant progress engine for PayPal that can assist compound shareholder worth over time.

Valuation

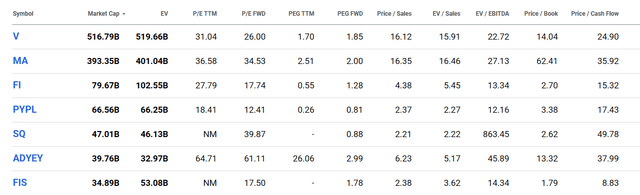

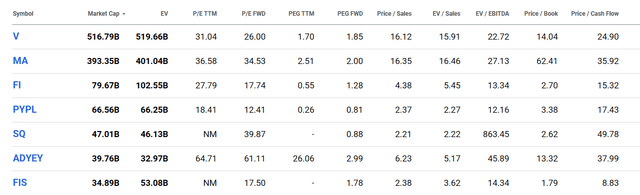

PayPal is presently graded as a ‘D’ valuation by Looking for Alpha’s Quant mannequin, however it’s because the valuation is relative to the Financials sector as an entire. This consists of companies that commerce at far decrease multiples like insurance coverage firms and banks. When refined all the way down to an industry-specific view, we see PayPal is considerably undervalued relative to all main Fintechs:

Looking for Alpha

PayPal touts each TTM and FWD P/E ratios which might be materially decrease than opponents. Its PEG is predicted to extend materially in 2024 from its drastically undervalued present stage. Additional, solely Block beats out PayPal from a Worth/Gross sales perspective. From a relative standpoint, PayPal is significantly undervalued.

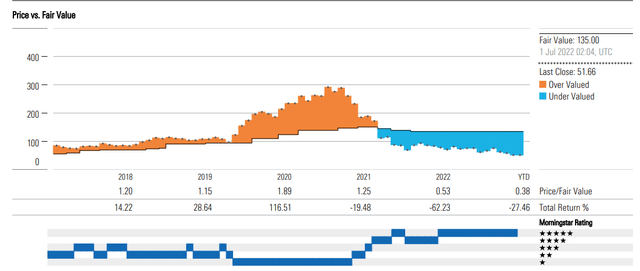

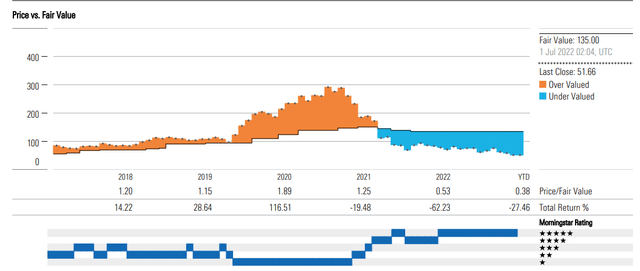

That is supported by Morningstar’s valuation of Paypal as nicely. Morningstar estimates PayPal’s truthful worth to be $135 and ranks it 5 out of 5 stars:

Morningstar

Morningstar’s estimate of PayPal’s intrinsic worth is barely above my very own. I used to be fairly conservative in my valuation of PayPal, assuming lower than 5% earnings CAGR by means of 2033 with a 15% low cost fee and an earnings a number of of 15. That is fairly a conservative estimate for earnings progress of a Fintech agency with a brand new growth-minded CEO, and but nonetheless yields an estimated worth of $110-$130. As shares excellent proceed to lower in parallel, I consider PayPal’s share value will leap again out of its tough 2023 buying and selling vary.

Throughout actually any measurable valuation estimate, PayPal is significantly undervalued inside the $60-$80 value vary.

Conclusion

All this goes to say that I believe PayPal presents some of the compelling threat/reward profiles of any inventory immediately. Affected person, long-term traders ought to be tremendously rewarded over time, nevertheless at its present ranges I even anticipate important short-term upside. For these causes, PayPal is my high choose for 2024.

Editor’s Observe: This text was submitted as a part of Looking for Alpha’s Top 2024 Long/Short Pick investment competition, which runs by means of December 31. With money prizes, this competitors — open to all contributors — is one you do not wish to miss. In case you are concerned about turning into a contributor and participating within the competitors, click here to search out out extra and submit your article immediately!