PayPal is engaged on a brand new client app for its cell clients, and recommended that will probably be “ready” to make the most of the brand new EU regulation, the Digital Markets Act (DMA), when it goes into impact subsequent month for tech “gatekeepers,” like Apple. For PayPal, one of many important modifications coming within the DMA is the power for third-party apps to entry the NFC expertise that at the moment powers Apple Pay in their very own cell pockets purposes. iPhone customers will even have the ability to swap to a different cell pockets as their default, below the brand new pointers.

On its This autumn earnings name, PayPal didn’t share a lot about its plans regarding Apple’s compliance with the DMA or how it might influence PayPal particularly. Partially, that’s as a result of Apple is an organization PayPal works intently with in the present day, providing checkout and fee providers on Apple units, from Macs to iPhones, in addition to integrations with Apple Wallet, together with help for “Tap to Pay” contactless payments which leverage Apple Pockets.

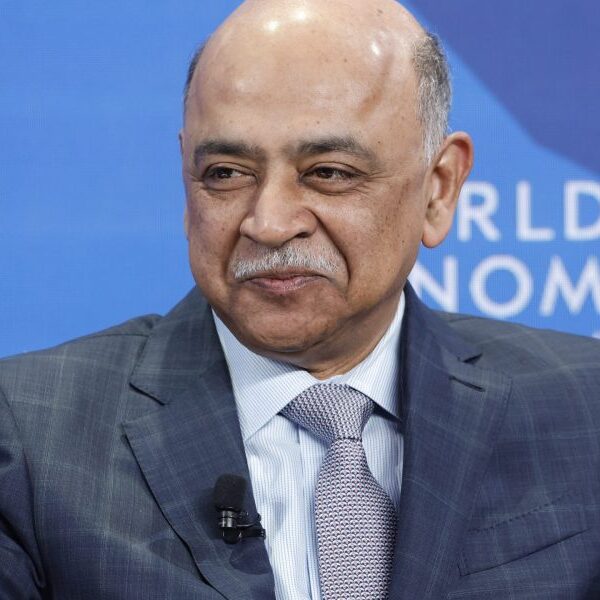

Famous PayPal CEO Alex Chriss, a former Intuit exec who started his new role at PayPal in September, “We are tracking this closely,” in response to an investor query about how PayPal could be profiting from the brand new entry to the NFC expertise the DMA permits for. “Apple is a great partner of ours,” he added.

Nonetheless, Chriss additionally recommended that PayPal clients have been in search of a method to make use of PayPal exterior the world of on-line funds and that the corporate was engaged on delivering this.

“…our customers that love PayPal on the online e-commerce side are demanding being able to have an omnichannel and offline solution, as well. So, we’ll be working closely on this. And when it is available, we will be ready to be able to deliver for our customers, both online and offline,” he responded,

It’s not a transparent reply, however one which definitely suggests the funds big is engaged on one thing within the space of NFC cell wallets, notably given the “offline solution” remark.

Offline funds, that means these going down in bodily retail shops, is an space PayPal has unsuccessfully tried to broaden into for years. Over the previous decade, PayPal has tried a spread of initiatives on this entrance, including partnerships with national retailers in the U.S., deals with Point-of-Sale software and terminal makers, features to pay local shops via its app, acquisitions of mobile wallet technology, the use of QR codes for retailer payments, partnerships with credit cards on offline payments, tools for merchants selling offline, and extra.

However though the Covid-19 pandemic drove quicker adoption of contactless funds, Apple Pay remained the top mobile payment player, a minimum of within the U.S.

As for the EU, Europe has a excessive cell pockets penetration, with one 2023 study noting {that a} majority (72%) actively have interaction with the expertise. Another analysis says Europe’s cell funds market measurement is estimated to achieve $108.35 billion in 2024, then $373.29 billion by 2029. Whereas Apple and Google have gained floor right here, 90% of Europeans have used PayPal providers, the examine mentioned.

Merely put, PayPal has a large alternative to capitalize on Apple’s loosened guidelines within the days forward, if it chooses.

Apple’s DMA-driven modifications will include new APIs that permit app builders use NFC expertise of their banking and cell pockets apps all through the EU. Plus, Apple is including new controls that might permit shoppers to pick a third-party contactless fee app as their new default. In different phrases, PayPal may very well be swapped in for Apple Pay, if it adopts this performance.

Chriss didn’t share when PayPal would implement the “offline” answer the DMA would allow, solely saying that the corporate could be “ready” to take action, in some unspecified time in the future after the brand new performance grew to become obtainable.

Probably associated to this, PayPal additionally provided hints of a brand new client app in improvement on the firm.

“This year, we’re launching and evolving a new PayPal app to create habituation,” famous Chriss.

Later, he additionally admitted that PayPal’s “mobile experience for our consumers, has been underwhelming. And it’s something that with the new innovations we just rolled out, I expect for us to be able to continue to see improvement there,” he added.

Just lately, PayPal introduced a series of AI-powered features, together with customized cashback presents within the app and good receipts that supply recommendations of what to purchase subsequent from the identical model, for instance. These options and others had been introduced as a part of a “first look” experience in January, which Chriss mentioned was completed in 60 days, as an alternative of the “months or years” they may have taken.

Buyers didn’t dig in to ask extra DMA or cell wallet-related questions, however the firm already announced when choose new options would launch, like CashPass (customized cashback) due out in March, with Sensible Receipts mentioned to be coming quickly.

PayPal in This autumn beat on earnings with EPS of $1.48, above the $1.36 anticipated, and income of $8.03 billion, forward of the $7.87 anticipated. The stock dropped after the earnings announcement, nevertheless, due to weaker-than-expected first-quarter steerage.