MichaelRLopez

If you like to find companies selling well below their accounting cost, depreciated, net hard-asset value (after subtracting all liabilities), PBF Energy, Inc. Class A Common (NYSE:PBF) should be near the top of your research list. [Class A shares represented 99.3% of voting power at the end of December, Class B the remaining 0.7%. Page 8 of the 2023 10-K] The business operates mostly petroleum refineries across the United States, based in New Jersey.

And, with a rough 50% haircut in price since April, the stock appears to be discounting a recession soon, on the assumption far lower crack spreads for turning crude oil into gasoline will become the new reality.

It’s not the first recession experienced by the company. However, this time around the company is basically net debt-free in the high capital spending, usually high debt-load refinery category. Extraordinary profits during the post-pandemic era of 2021-23 allowed the company to intelligently repay debts. So, when you buy shares today, you are essentially getting refinery assets, cash, receivables, inventory, etc. well in excess of long-term IOUs and debts ($6+ billion in current assets plus $8 billion in long-term assets vs. $7.6 billion in total liabilities). The end result is future earnings and dividends will be the gravy for shareholders, as the stock is already backed by real-world assets (a rarity on Wall Street in 2024).

The question is how low below the replacement value of its net asset/liability setup can the stock trade, with both equity market capitalization and enterprise value already available at an enormous discount to net accounting assets?

I have been adding to my PBF Energy position for months, as the upside arguments have become quite compelling. In my view, either crude oil spikes soon from Federal Reserve easing and/or more trouble in the Middle East, lifting nominal sales at this business, or an economic recovery in 2025 (after a minor recession or soft landing is finished playing out) boosts demand for gasoline and crack spreads.

Plus, if you believe very few new refineries will be built in America because of environmental outcry, while the transition to electric vehicles appears to be slowing, crack spreads could remain elevated (vs. decades ago) for quite some time, similar to 2021-23’s outcome.

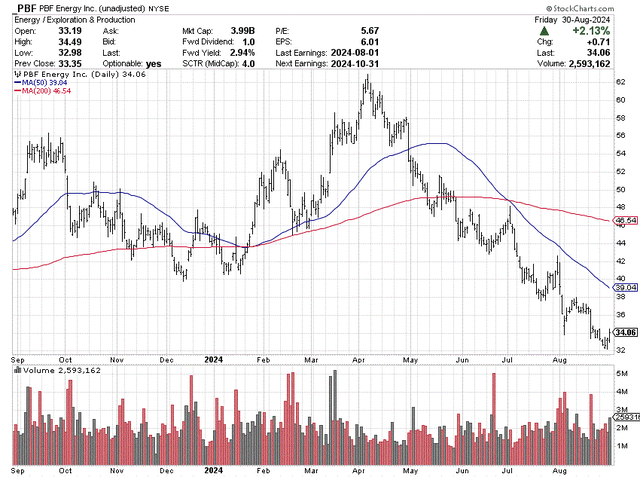

I did write a bullish article on the company in November here at $46 a share. Without doubt today’s $34 price has dramatically better long-term value for new investors. Let me explain why I am upgrading my PBF view to Strong Buy.

StockCharts.com – PBF Energy, 12 Months of Daily Price & Volume Changes

Crack Spreads

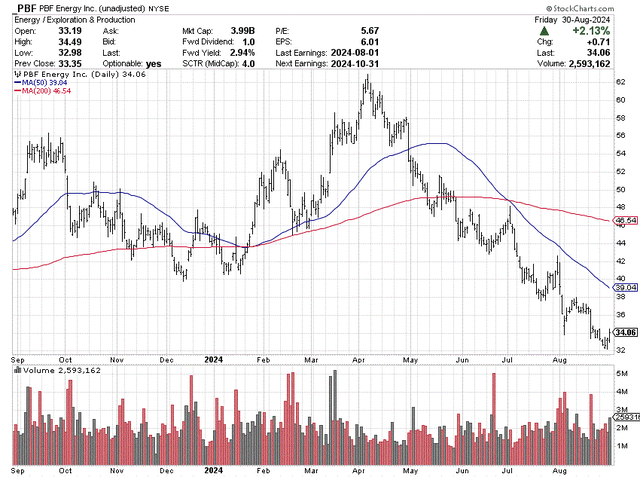

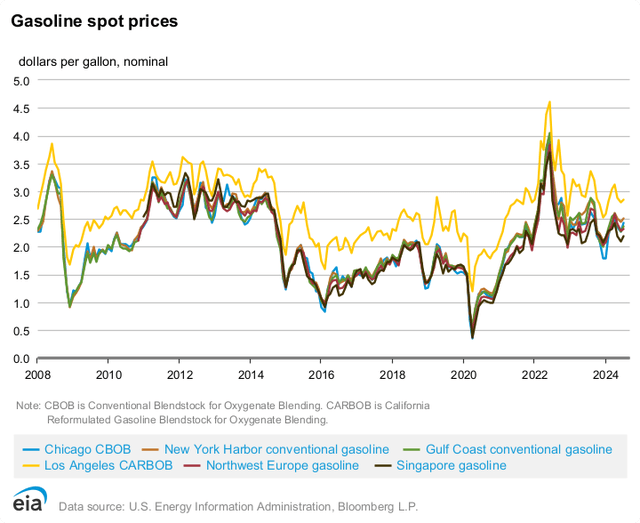

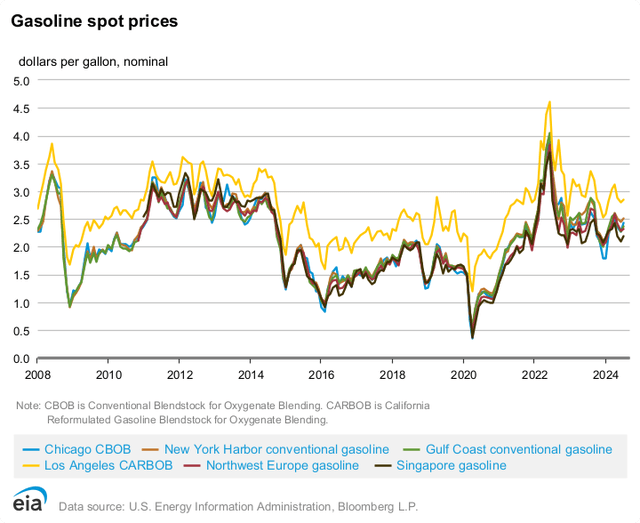

After the 2020 pandemic shutdowns on the planet caused a bust in petroleum demand, the whole energy sector came roaring back into a top outlined on the Russian invasion of Ukraine in 2022. Wholesale gasoline prices fell as low as $0.50 per gallon during March-April 2020, then spiked to roughly $4.00 into June 2022. PBF Energy moved from a share price of $6 to $40 over the same span (before rising to its all-time peak of $62 earlier this year), as refinery profits exploded to the upside.

U.S. EIA – Wholesale Gasoline Prices, Since 2008

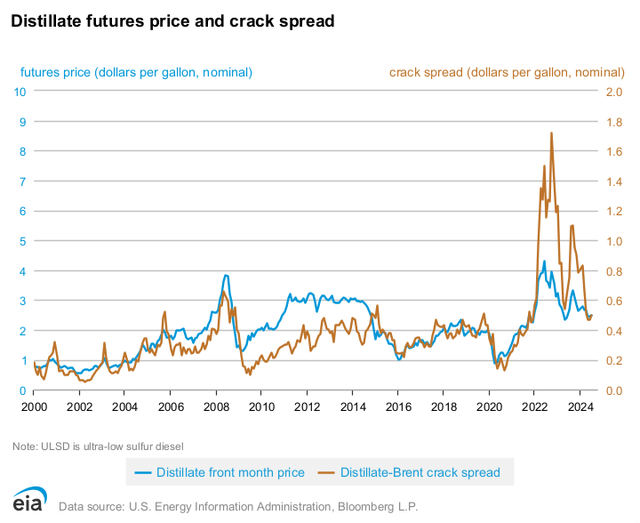

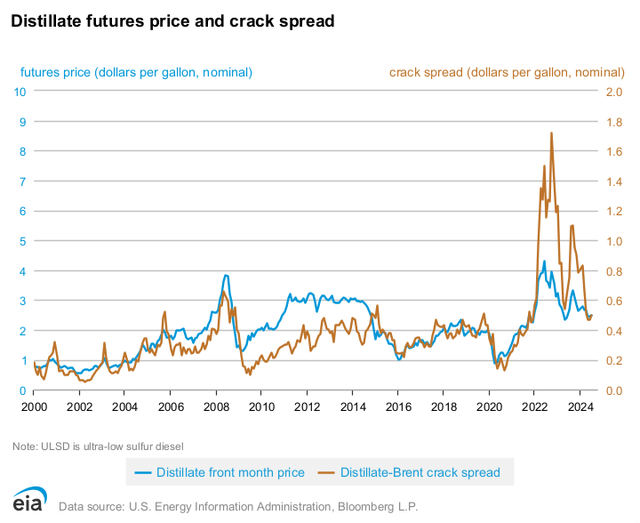

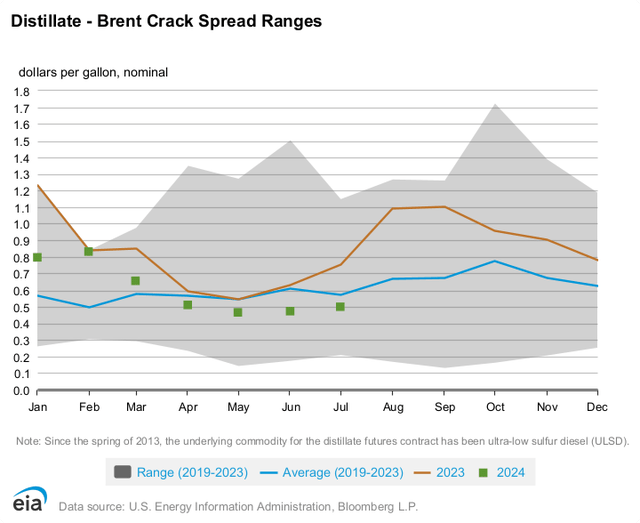

You can review the record distillate crack spread (price to refine crude oil into gasoline, diesel, jet fuel, etc.) reached in late 2022 and early 2023 below. Today, spreads have dropped closer to 10-year averages.

U.S. EIA – Distillate Futures Price vs. Crack Spread, Since 2000

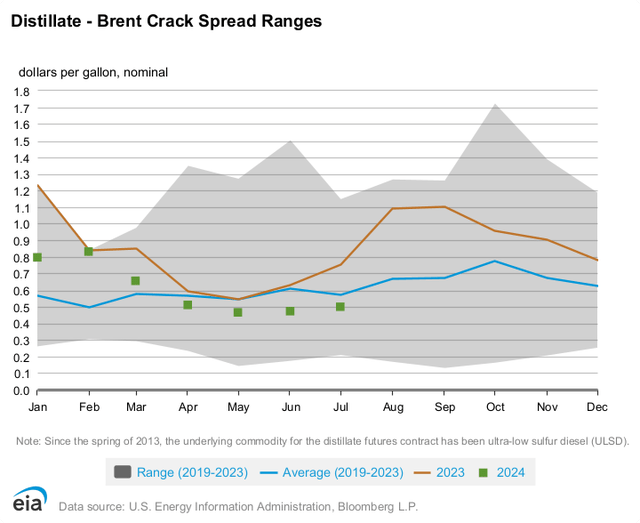

The issue for refiners since March-April of this year is seasonal spreads have fallen from rates above 5-year averages in January-February to below normal readings since April.

U.S. EIA – Distillate Seasonal Crack Spread, Current vs. 5-Year Average

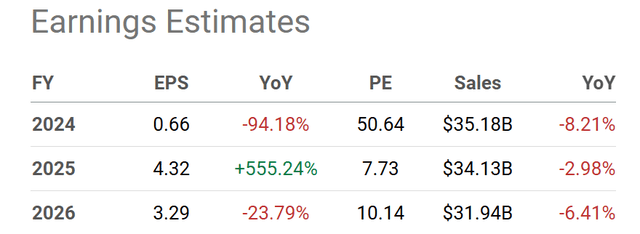

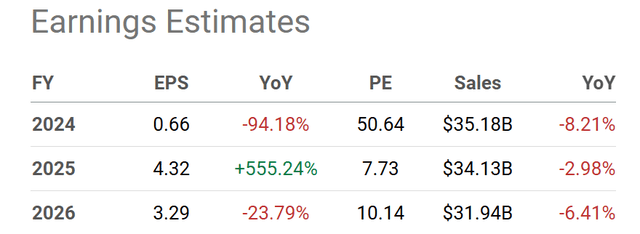

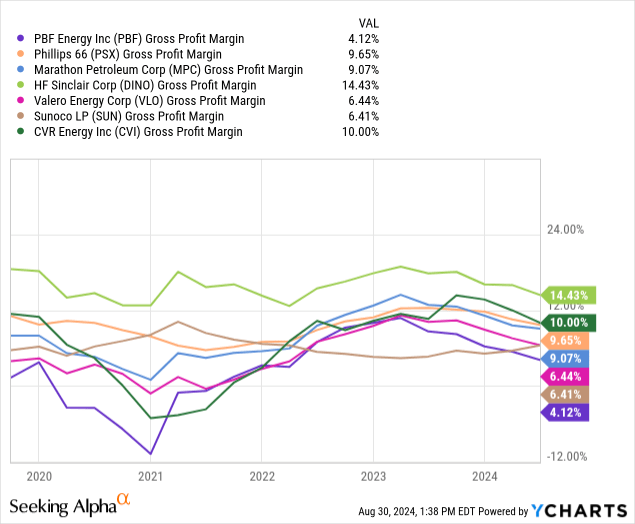

Since PBF is one of the lower-margin refiners on gross margins, it has taken one of the bigger hits to its income level and stock quote. Nevertheless, crack spreads even slightly above current rates should help EPS recover nicely next year.

Seeking Alpha Table – PBF Energy, Analyst Estimates for 2024-26, Made August 29th, 2024

Rare Discount to Net Assets

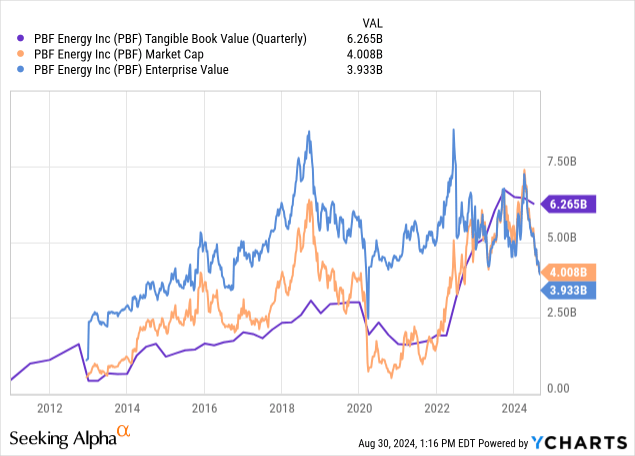

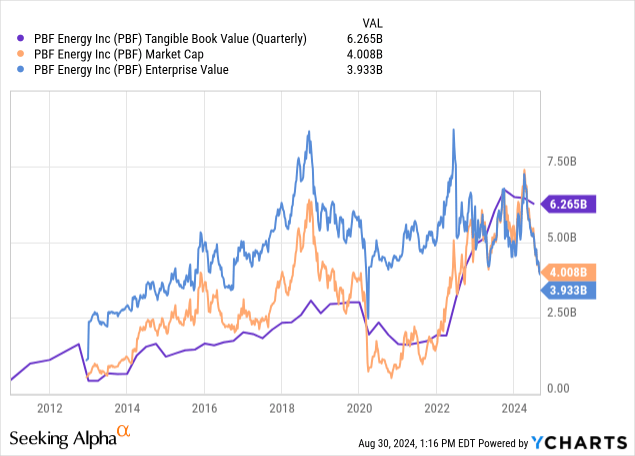

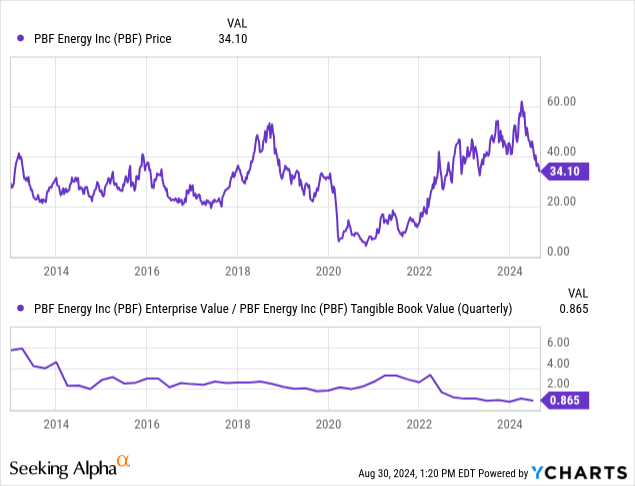

Since the 2012 IPO, tangible book value has usually supported both the stock price (market cap) and whole business valuation on enterprise value (equity + debt – cash). Yet, today the equity market cap and enterprise value are both sitting well BELOW tangible accounting book value.

YCharts – PBF Energy, Tangible BV vs. Equity Market Cap vs. Enterprise Value, Since 2012 IPO

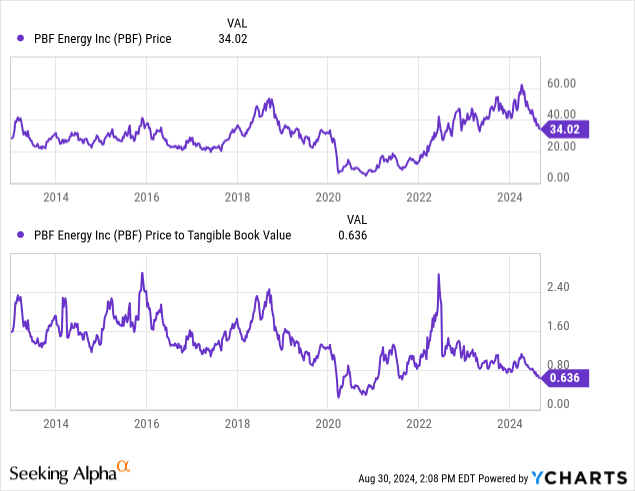

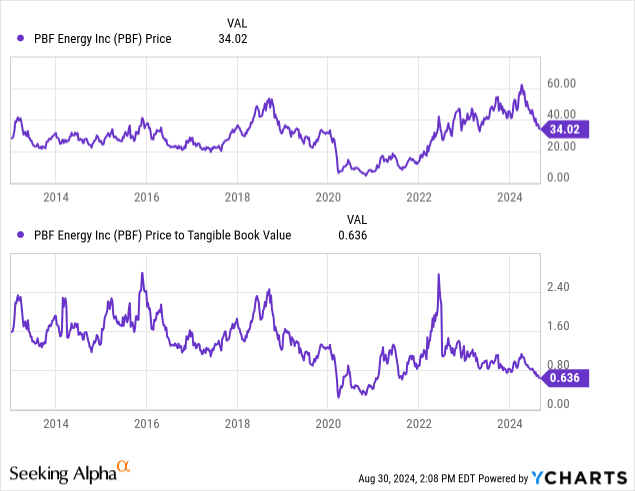

Price to tangible BV is getting close to the once-in-a-lifetime lows of the 2020 pandemic. Despite crack spreads and income levels still relatively positive at the present moment, Wall Street is saying PBF’s valuation should be stuck near a depression-era level?

YCharts – PBF Energy, Price Changes vs. Price/Tangible BV Ratio, 10 Years

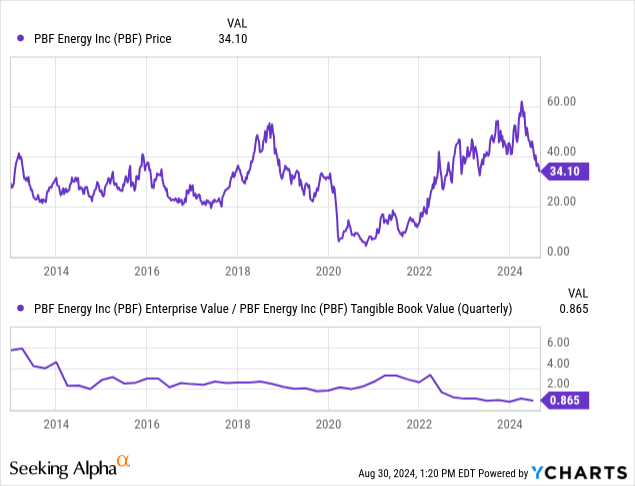

More importantly, the main investment attraction for me is the hard-asset worth of the entire business in a merger, takeover or take private situation, which includes changing debt and cash levels, has reached a record low in August 2024.

The $4 billion EV number is an amazing discount vs. $6.2 billion in tangible book value. To me, it’s a truly uncommon mispricing situation. The late August 0.65x multiple is an all-time low for PBF (with the chart below ending with June’s 0.86x ratio). For reference, the 12-year average since the stock’s IPO is closer to 2.3x. So, new investors purchasing a position under $34 are getting a 70% discount to long-term averages of enterprise value vs. net hard assets!

YCharts – PBF Energy, Price Changes vs. EV/Tangible BV Ratio, 10 Years

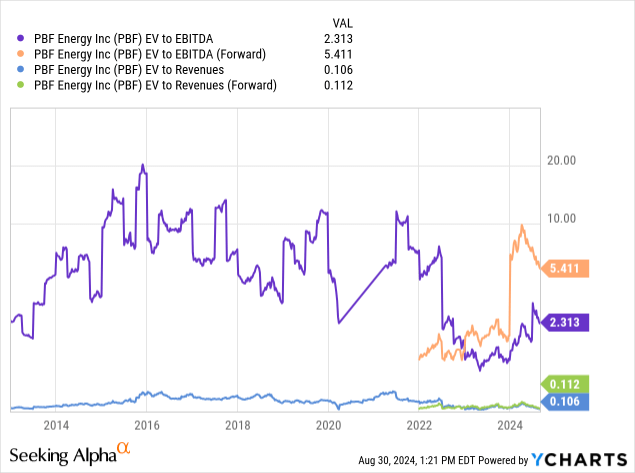

EV ratios on EBITDA and Revenue also remain in a positive setup for investment. The valuation on sales is nearing the record lows of early 2020, while EBITDA numbers (either trailing or forward estimated) remain well below average, measured from 2012.

YCharts – PBF Energy, Enterprise Valuations, 10 Years

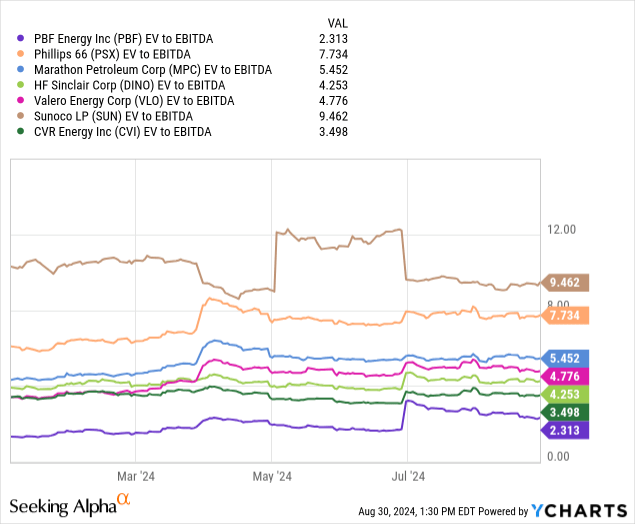

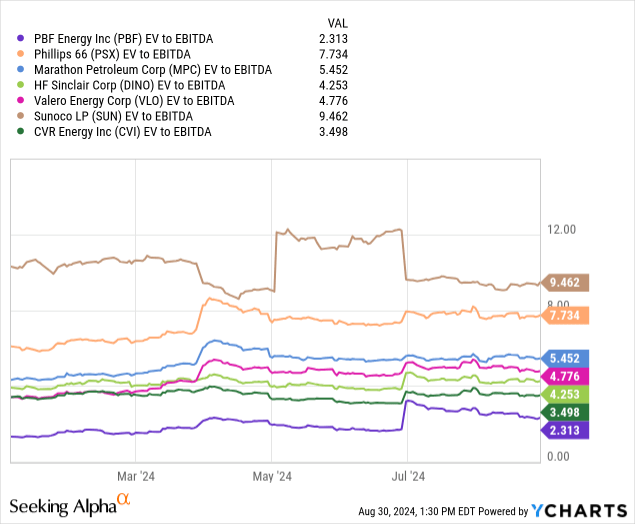

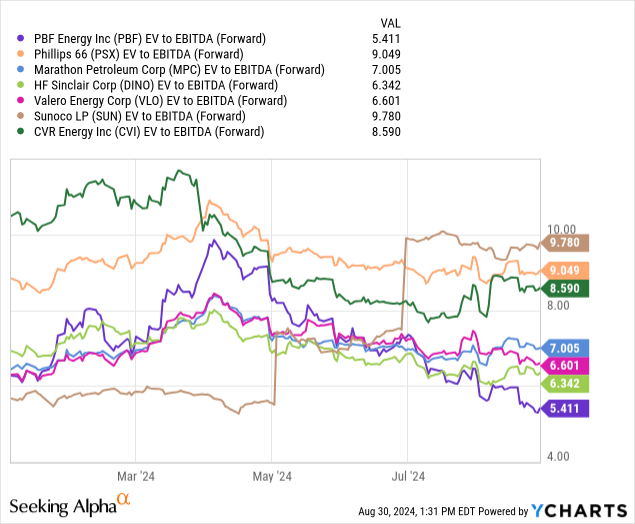

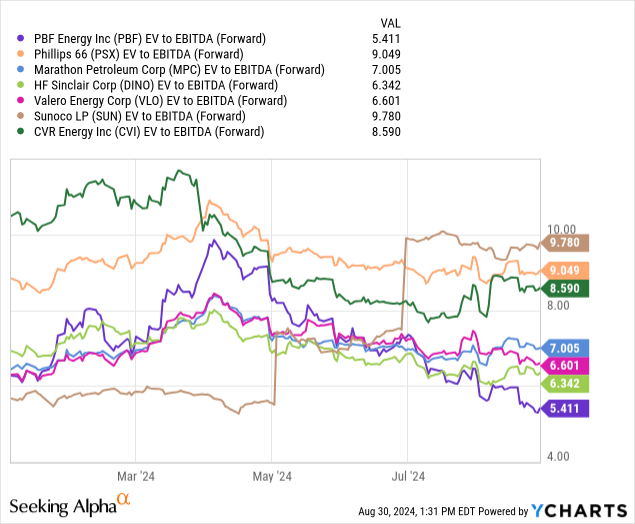

Versus competitors and peers in the refining industry, each holding extra debt on their books, PBF really stands out today. Whether we’re looking at trailing (2.3x) or forward EBITDA (5.4x), this stock is far cheaper than the alternatives. My peer sort group includes independent oil refiners (some also marketers/retailers) Phillips 66 (PSX), Marathon Petroleum (MPC), HF Sinclair (DINO), Valero Energy (VLO), Sunoco LP (SUN) and CVR Energy (CVI).

YCharts – PBF Energy vs. Major Refinery Peers, EV to Trailing EBITDA, Since Jan 2024 YCharts – PBF Energy vs. Major Refinery Peers, EV to Forward 2024 EBITDA, Since Jan 2024

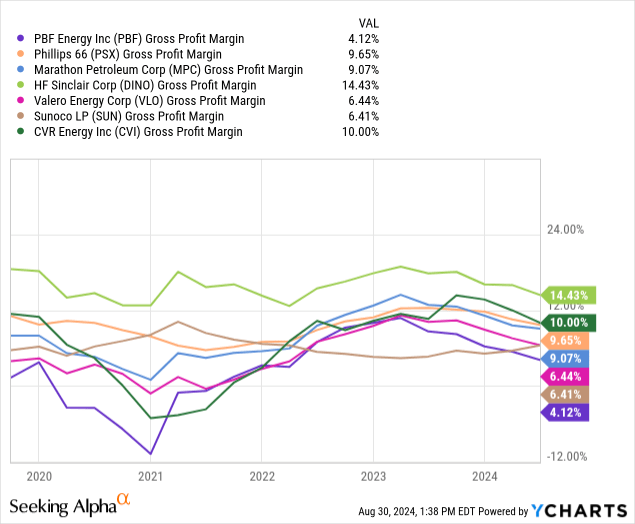

A credible reason for a somewhat lower share valuation is PBF typically runs a subpar gross refining margin (lacking a retail business). Lower margins can equate to a lower valuation vs. peers. The pertinent question going into September is how much cheaper is acceptable before a clear bargain valuation can be argued?

YCharts – PBF Energy vs. Major Refinery Peers, Gross Profit Margins, 5 Years

For example, the next strongest balance sheets, in my opinion, are part of the Valero and Sinclair business stories currently. Slightly higher gross margins for the two, alongside balance sheets not quite as conservative, have translated into share valuations 25% to 30% greater than PBF (using EV numbers).

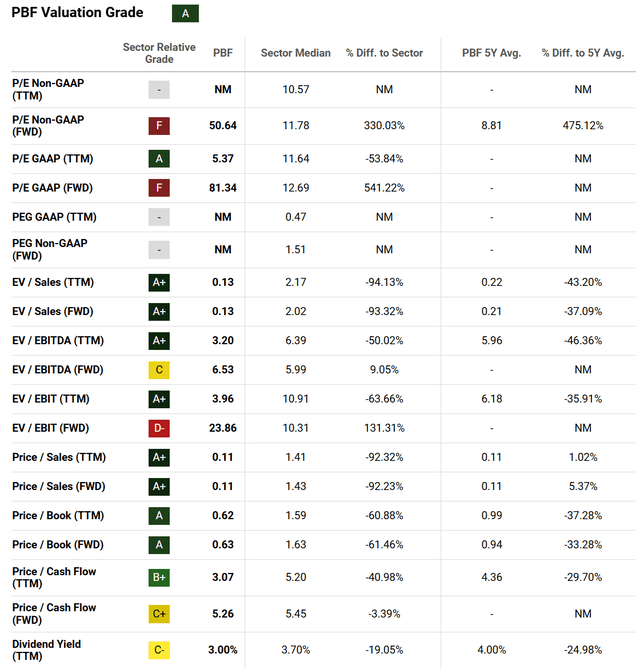

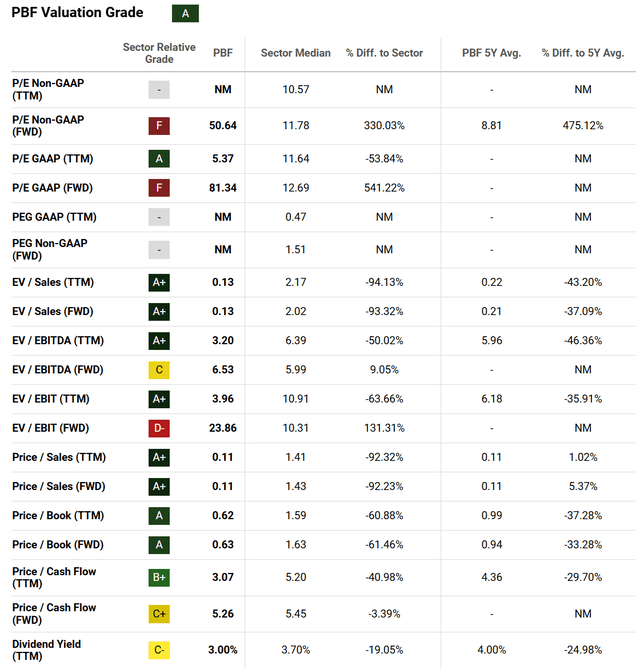

Seeking Alpha’s computer-sorting system seems to agree with my overall view that PBF has become quite inexpensive. Using a variety of measuring metrics on fundamental performance, PBF is sitting at an “A” Quant Valuation Grade. Valero is at “B+” and Sinclair at “A-” currently, in comparison.

Seeking Alpha Table – PBF Energy, Quant Valuation Grade, August 29th, 2024

Final Thoughts

The good news is management has levers to achieve a rapid reversal in the share price and valuation. PBF could sell one or two of its lowest margin refineries and use the proceeds to directly buy back shares. Better margins and lower share counts would nicely support the stock quote in my opinion.

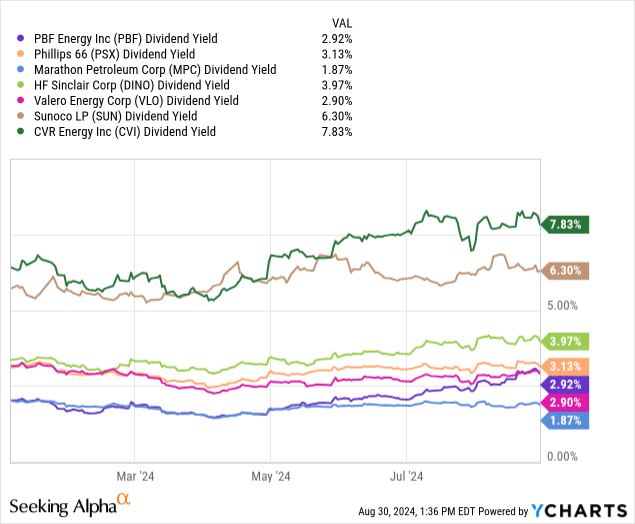

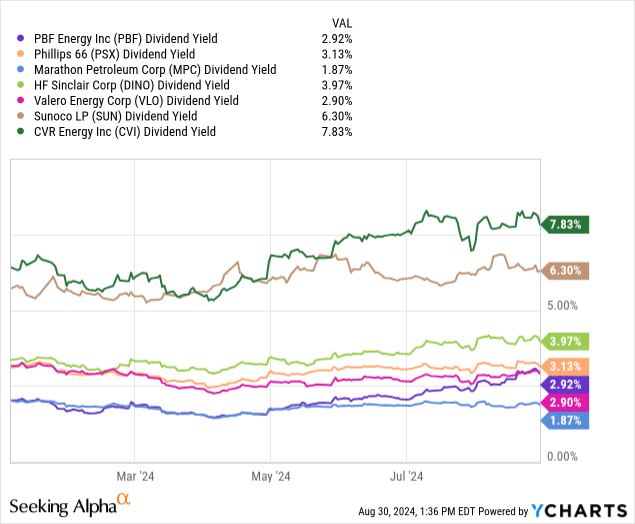

Plus, there exists plenty of room to increase the dividend payout. Before the 2020 pandemic, PBF Energy was a top dividend idea in the sector. I am thinking Wall Street might reward the share price with a faster advance in 2025, if the dividend payout was raised 50% or 100%, creating a 4.5% to 6% annual yield. With $1.27 billion in trailing operating cash flow, the $113 million in common dividends paid is simply too low over the latest 12 months. (A net $470 million in common shares were retired through buybacks between July 2023 and June 2024.)

YCharts – PBF Energy vs. Major Refinery Peers, Trailing Dividend Yield, Since Jan 2024

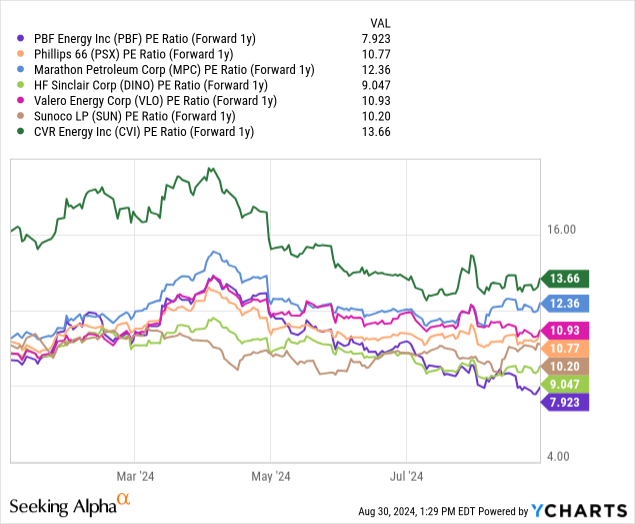

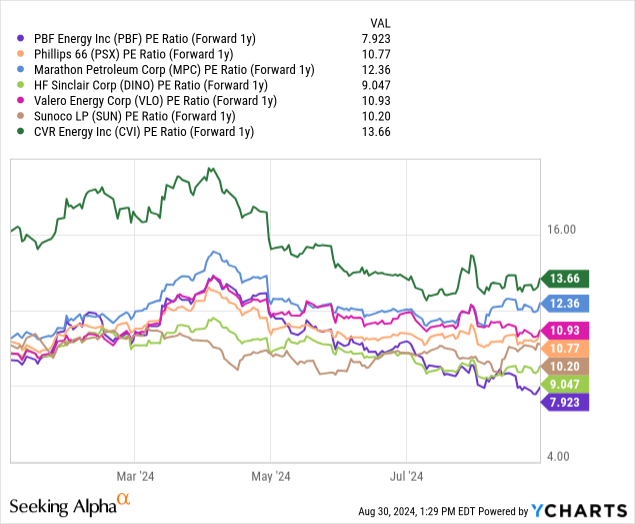

Looking forward to 2025 operating estimates, the oversized decline in the share quote this year may translate into the best forward 1-year P/E ratio in the industry at 7.9x. In summary, the 2024 price drop may have opened a rare and temporary chance to accumulate a position.

YCharts – PBF Energy vs. Major Refinery Peers, Price to Forward Estimated 2025 Earnings, Since Jan 2024

Again, the main risk owning PBF Energy would be a severe recession shock to petroleum demand. Fear of this negative outcome with far weaker crack spreads is the excuse for selling since April. Yet, at this stage of the downturn, with such a huge disconnect developing between market pricing and the value of its plant & equipment, lower share quotes may only open a smarter opportunity to compound your money 2-3 years down the road.

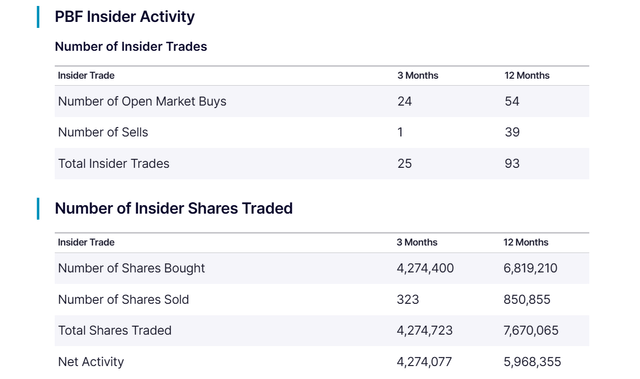

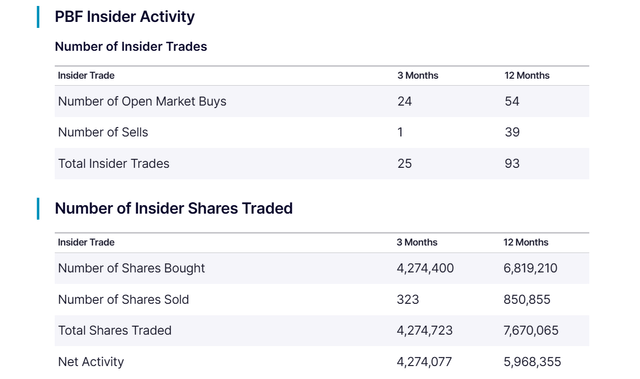

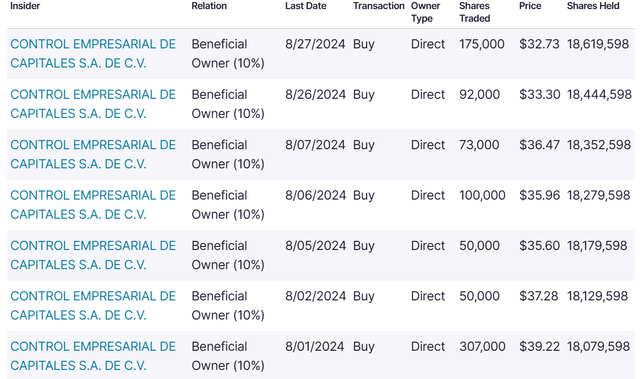

What about insider transactions? Carlos Slim, Mexico’s wealthiest billionaire, has been a PBF investor since 2017. He has been aggressively buying shares in August under $40. Mr. Slim now owns a 16% stake in the company, far above the 2% held by management. I have a screenshot below of the August purchases by Mr. Slim, via Nasdaq.com.

Nasdaq.com – PBF Energy, Insider Trading Activity Nasdaq.com – PBF Energy, Carlos Slim Buying in August 2024

His timing in buying and selling shares has been quite impressive over the years. He greatly expanded holdings during the 2020 pandemic oil/gas bust, and sold a large percentage of his PBF stake in 2022. So, if he is aggressively increasing shares owned in 2024, investors might want to take note.

I am thinking PBF will double in price back to $60 over the next 12-18 months, if a significant unexpected rise in crude oil is next (as the company should continue to earn its margin on stable volumes with increasing base pricing) or the U.S. economy continues to prove resilient.

I know it’s difficult to imagine right now, but if crude oil doubles in price to US$150 a barrel, PBF could be generating $5 to $10 for EPS in a year or two with relative ease. $60 would put the stock quote back to April’s level, still supported by a lower-than-average enterprise value vs. net assets owned.

Where else can you find a tangible asset-backed, margin of safety idea for your upfront investment capital, with the potential for sizable total returns near +100% in quick order? If your goal is to buy a stock approaching a cyclical low (with lots of pent-up underlying value), then sell high later, why not investigate this company further?

I now rate PBF Energy shares a Strong Buy and own a steadily growing position size over the last month.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.