The People’s Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.

- USD/CNY is the onshore yuan. Its permitted to trade plus or minus 2% from this daily reference rate.

- CNH is the offshore yuan. USD /CNH has no restrictions on its trading range.

- A significantly stronger or weaker rate than expected is typically considered a signal from the PBOC.

The previous close was 7.1150

In open market operations (OMOs):

- PBOC injects 328bn yuan via 7-day RR, sets rate at 1.5%

- 799bn yuan mature today

- net drain is 471bn yuan

—

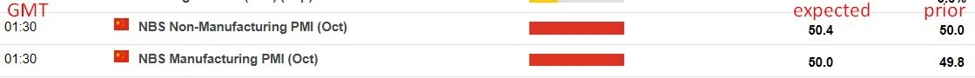

Still ahead, PMIs from China:

China has two primary Purchasing Managers’ Index (PMI) surveys – the official PMI released by the National Bureau of Statistics (NBS) and the Caixin China PMI published by the media company Caixin and research firm Markit / S&P Global.

- The official PMI survey covers large and state-owned companies, while the Caixin PMI survey covers small and medium-sized enterprises. As a result, the Caixin PMI is considered to be a more reliable indicator of the performance of China’s private sector.

- Another difference between the two surveys is their methodology. The Caixin PMI survey uses a broader sample of companies than the official survey.

- Despite these differences, the two surveys often provide similar readings on China’s manufacturing sector.

-*//*-