1001Love/iStock through Getty Photographs

The Worst Of The Bunch

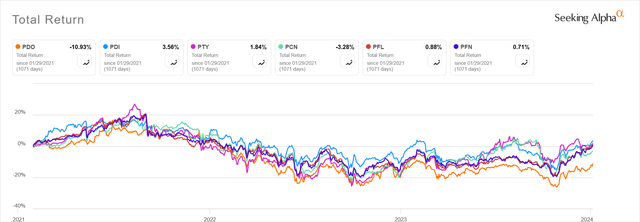

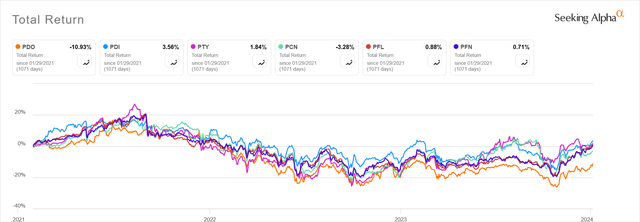

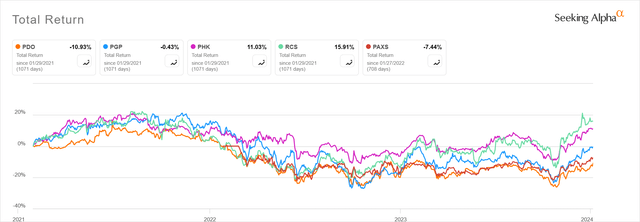

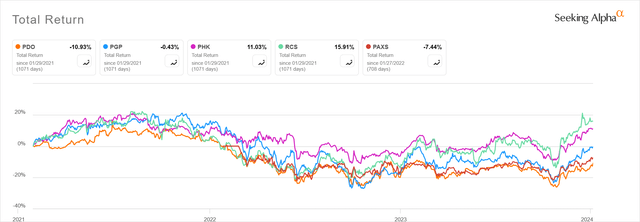

The PIMCO Dynamic Revenue Alternatives Fund (NYSE:PDO) debuted on 1/29/2021 and is now the second latest of PIMCO’s 11 taxable mounted earnings closed end funds. This was an unlucky time to come back public, on the finish of a benign rate of interest surroundings simply earlier than the steepest price climbing cycle for the reason that 1970’s.

One would have anticipated leveraged closed finish bond funds to battle on this surroundings, however PDO managed to carry out useless final of the 11. (PAXS is proven from its inception date on 1/31/22. PDX will not be proven on the chart because it drastically outperformed the others attributable to its power trade focus for many of its existence.)

Looking for Alpha Looking for Alpha

As you’ll be able to see, PDO’s underperformance was important and endured for many of the lifetime of the fund. Regardless of its quick life, the fund is the third largest of the PIMCO taxable CEF household and has been heavily covered right here on Looking for Alpha. Most analysts bought it unsuitable with 2/3 of the articles by February 2023 rated Purchase or higher (together with mine from April 2022.) Since then, sentiment has soured with lower than 1/3 of the articles rated Purchase.

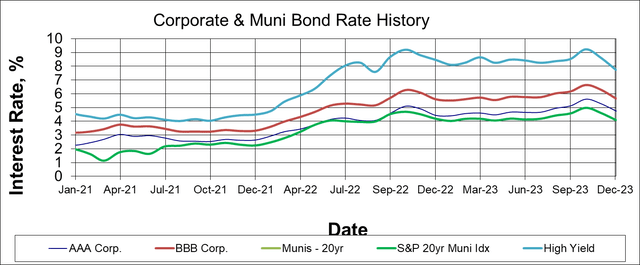

In fact, what actually issues to traders will not be the place the fund has been, however the place it’s going. It is attainable that the rate of interest surroundings has turned since late October 2023 when the 10-year Treasury yield (US10Y) touched 5% on an intraday foundation. A few of the components that damage PDO since its inception could now be useful. Sadly, there are some misconceptions about which components are necessary that usually get repeated in these articles and within the remark part. It’s obligatory to check out the information to clear up a few of these.

The Database

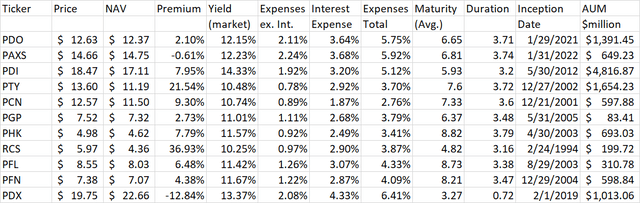

It is uncommon in these CEF articles to have a look at knowledge for a complete fund household. Even PIMCO itself makes you take a look at every fund web page individually to gather this knowledge. I’ve compiled this knowledge to be used on this article and I’m presenting it right here for reference. First, listed below are some fundamental fund information. Pricing and yield knowledge is from 1/5/2024. Different knowledge is from 11/30/2023 which is the newest out there from PIMCO.

Creator Spreadsheet (Knowledge Supply: PIMCO)

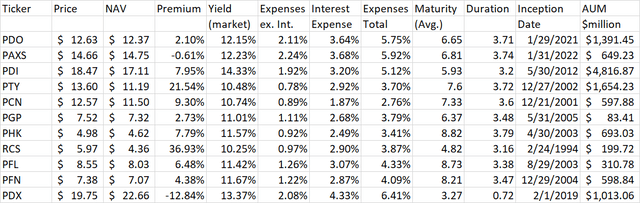

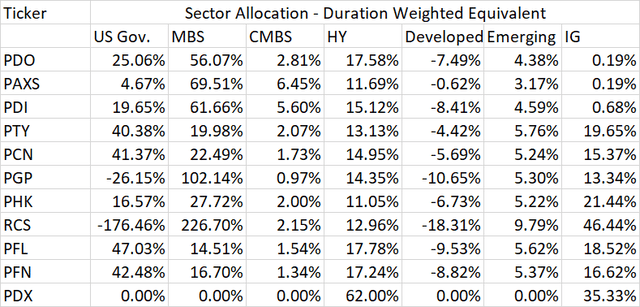

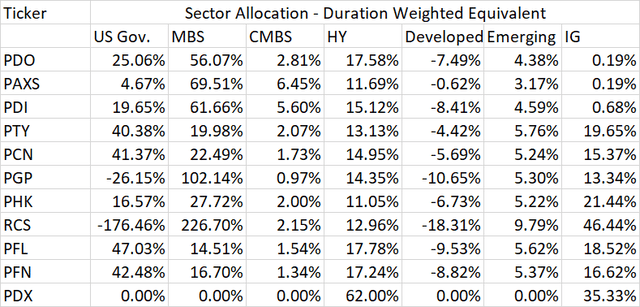

Subsequent up are the fund holdings. All knowledge are as of 11/30/23. Somewhat than present the precise holdings by market worth, I’m exhibiting the period weighted equal concentrations as calculated by PIMCO, which bear in mind the affect of swaps, repos, and derivatives used for hedging and leverage. For simplicity, I left off just a few smaller classes which embrace largely munis, quick period investments, and others.

Creator Spreadsheet (Knowledge Supply: PIMCO)

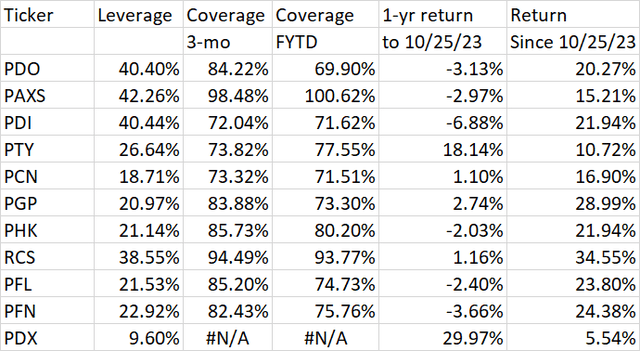

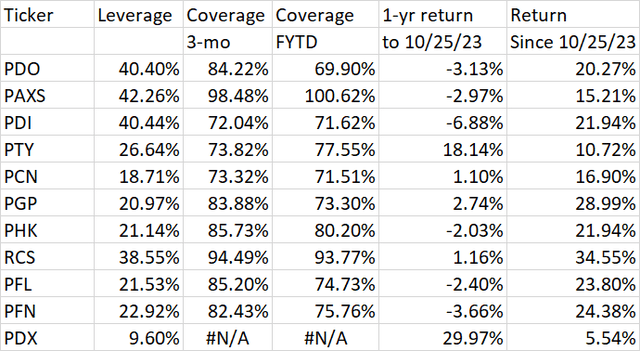

Lastly, listed below are some knowledge on leverage, distribution protection (each by 11/30/23), and efficiency (final column by 1/5/24).

Creator Spreadsheet (Knowledge Sources: PIMCO, Looking for Alpha)

Let’s dig a bit deeper and see which of those metrics matter and which do not.

Ignore The Premium

I point out this primary as a result of it is typically talked about by each authors and commenters as a motive to purchase a fund or choose it over one other. In actuality, the rating of every fund’s premium in comparison with the others doesn’t appear to alter a lot over time. Absolutely the ranges do change. Premiums are often greater when the funds are performing effectively and decrease when they’re doing poorly. However, there are some funds, like PTY and RCS, that all the time appear to have a better premium than the others. The attainable exception to that is after a dividend reduce, however inside a 12 months or so, the excessive premiums come proper again. Alternatively, a fund like PDO has maintained one of many lowest premiums within the group since inception. Some individuals attribute this to the truth that this fund has a delegated termination date (2033), however I do not grant a lot credence to that concept. Quite a bit can occur within the mounted earnings markets over a decade, and there are way more speedy components impacting the fund’s premium than its eventual attainable liquidation. The liquidation could not even occur as a voting course of exists to increase the termination date and even make the fund perpetual if desired.

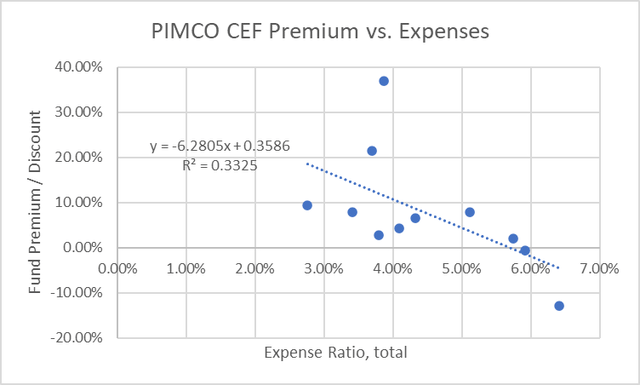

Trying on the above knowledge, there does seem like a weak correlation between a fund’s expense ratio and its premium. This can be a damaging for PDO, which has one of many greater expense ratios.

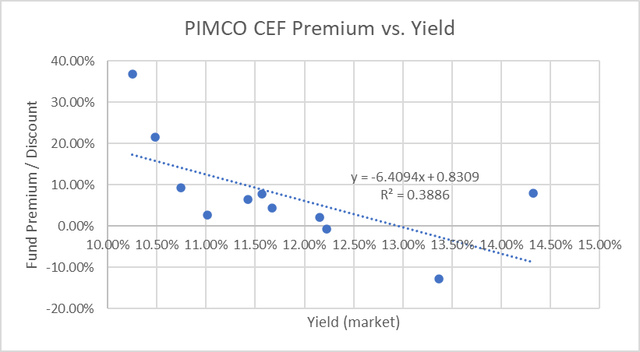

Prior to now, I’ve instructed {that a} fund’s premium can also be influenced by its yield relative to related funds. This was based mostly on a robust constructive correlation I noticed within the Nuveen municipal CEF space. Throughout the PIMCO taxable household nevertheless, the correlation is weaker and runs in the other way with greater yielding funds having decrease premiums.

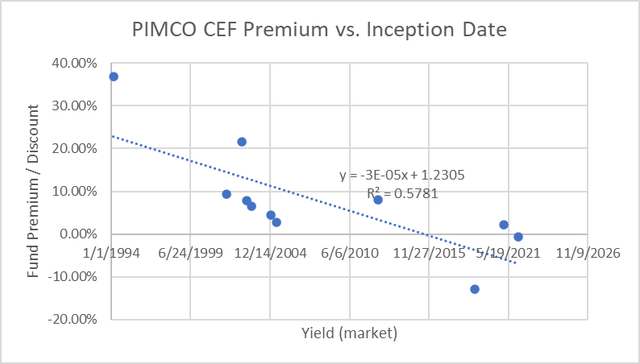

In reality, one of the best correlation I discovered with fund premiums was one thing utterly sudden – the age of the fund, with the older ones having the upper premiums. This may very well be attributable to traders preferring the extra established funds, or it may very well be only a coincidence with no causation in any respect.

Both means, the low premium will not be a superb motive to personal PDO, regardless of the intuitive enchantment of a cut price to worth traders.

Leverage – A Uninteresting Double-Edged Sword

I’m responsible of utilizing the cliche of leveraged being a double-edged sword in different articles, although I’m not the primary or final to take action. Intuitively, it is smart. In a flat or inverted yield curve surroundings, the price of leverage is excessive relative to the earnings earned by the fund’s holdings. This ought to be a damaging for high-leverage funds like PDO. (additionally PDI, PAXS, and RCS) If the yield curve is steepening and the price of leverage is dropping relative to the earnings from the fund holdings, these funds ought to profit.

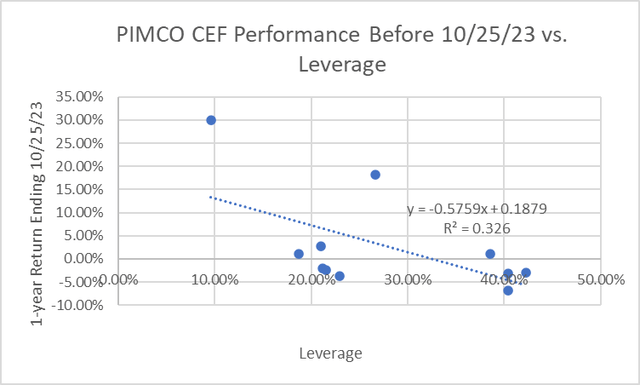

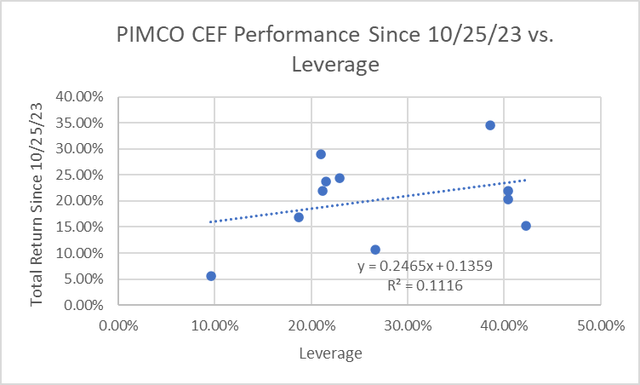

Within the 12 months main as much as the October 2023 rate of interest peak, we did see a damaging correlation between leverage and efficiency, however it was weak.

For the reason that rate of interest peak, we should always have seen leverage begin to change into a profit. It has, however the correlation is even weaker.

To be truthful, lengthy charges have fallen greater than quick charges since October, so the price of leverage could not but have come down a lot. The constructive fund efficiency might simply be from higher mark to market of the lengthy maturity holdings. We could must see precise Fed Funds price cuts and the yield curve turning constructive earlier than the higher-levered funds like PDO see a big profit.

Distribution Protection – Examine Again Subsequent Month

It is smart that we should always choose funds that may cowl their distributions with funding earnings fairly than returned capital. Return of capital lowers the asset base on which the fund can earn extra earnings. Funds can increase capital by promoting new shares, however that is much less dilutive for funds that promote at a excessive premium to NAV, not like PDO.

PDO had good distribution protection throughout its first two years, even paying a big particular distribution on the finish of 2022. PAXS, simply wrapping up its second 12 months of existence, additionally has close to 100% distribution protection. For the reason that particular dividend, PDO protection has deteriorated. The fund now has the bottom protection within the group for the fiscal 12 months thus far (7/1/23-11/30/23). The excellent news is that protection appears to be bettering, at the very least within the quick time period. PDO moved again to the center of the pack on a 3-month foundation. Even higher, PDO didn’t concern a Section 19a notice in December which it will have carried out if the distribution was not lined by funding earnings. A number of different funds did nonetheless concern a 19a discover final month.

Distribution protection can range significantly from month to month relying on maturities and asset gross sales, particularly at PIMCO, the place swaps and forex hedges can even have an effect on outcomes. Once we see the UNII report for December, I count on to see an enchancment for PDO, offering some reassurance {that a} dividend reduce will not be imminent.

Pay Consideration To Holdings

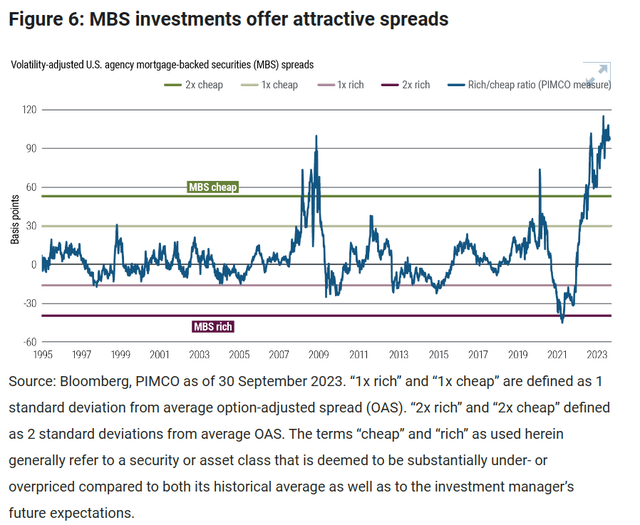

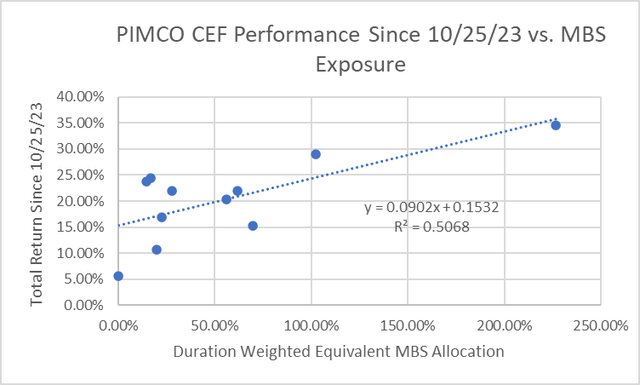

After seeing so many weak correlations, it’s good to seek out one thing elementary that drives fund efficiency, particularly the fund’s holdings classes. PIMCO occurs to be bullish on mortgage-backed securities, noting of their 2024 outlook that MBS spreads have widened even past the place they had been within the housing disaster.

If the comfortable touchdown state of affairs holds, MBS ought to carry out effectively. Rates of interest ought to come down sufficient to permit some value appreciation, however not a lot to create prepayment danger. Avoiding a severe recession additionally minimizes default danger. PIMCO has excessive publicity to MBS in a number of of its funds, together with PDO, PDI, PAXS, PGP, and RCS. Since October, there’s a constructive correlation between MBS publicity and fund efficiency.

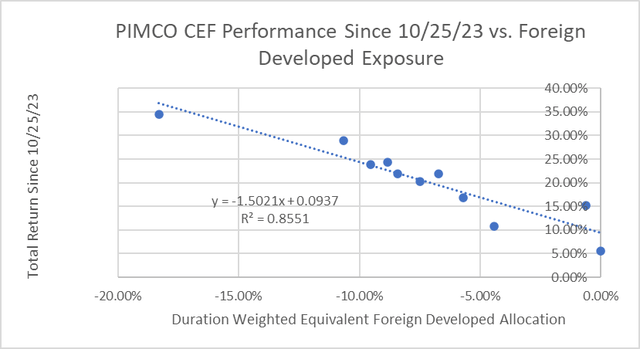

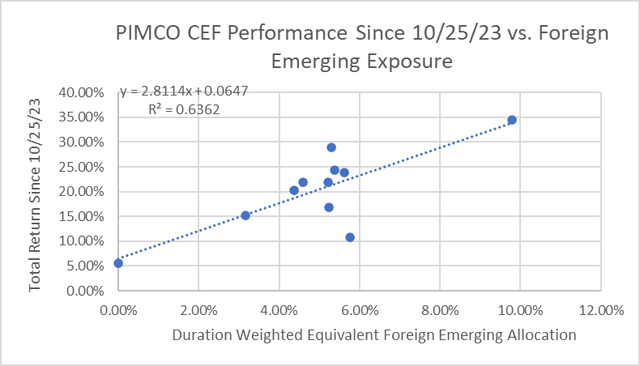

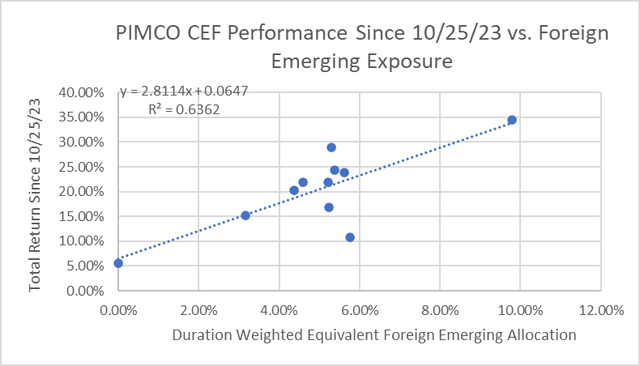

PIMCO additionally seems to be making a name on international bonds, differentiating between developed and creating markets. Every fund is successfully quick developed market bonds and barely lengthy rising market bonds. PDO has about a median quick place in creating, however its rising market lengthy place is a bit beneath common. Fund efficiency since October has correlated fairly effectively with publicity to those classes.

Creator Spreadsheet Creator Spreadsheet

On the company credit score aspect, the funds (aside from PDX) all have excessive yield publicity between 11% and 18%, with PDO on the excessive finish. Publicity to funding grade is extra variable, with PDO (together with PDI and PAXS) having virtually none, whereas others have as a lot or greater than they’ve in excessive yield. This positioning most likely damage PDO from inception by 2022 when excessive yield spreads widened, however they’ve been narrowing for the previous 12 months. PDO can profit in a comfortable touchdown state of affairs the place excessive yield spreads keep slender, however efficiency can be negatively impacted in the event that they widen.

Conclusion

Many individuals, together with myself, had been too optimistic about PDO after its inception in 2021. Its low premium and good distribution protection sounded nice in concept however didn’t assist the fund outperform its friends. Since rates of interest hit a peak in October 2023, PDO has returned 20.3%, however that is proper round common for the group. In a comfortable touchdown state of affairs, the fund’s leverage and publicity to MBS and excessive yield credit score ought to enable it to at the very least proceed to maintain tempo with the group. If rates of interest return up or a recession occurs, PDO will go proper again to being an underperformer. Sadly, the excessive expense ratio, even earlier than curiosity expense, is a everlasting headwind. I am hanging on to PDO, in line with my financial outlook, however would strongly contemplate swapping it for a decrease danger fund when an financial downturn appears imminent.