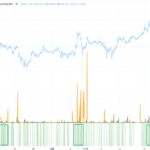

The news is here from earlier:

The Wall Street Journal (gated) recaps the move from the Bank, pointing out:

- In recent months, Chinese authorities have been recasting the PBOC’s seven-day reverse repo rate as the main policy rate while letting the shorter-term operation play a bigger role in managing liquidity, a practice more in line with those of Western central banks.

- Draining cash via the MLF tool helps facilitate the shift, economists say.

Further easing is expected from the PBoC ahead.

This article was written by Eamonn Sheridan at www.forexlive.com.