Michael Burrell/iStock through Getty Photographs

Funding thesis:

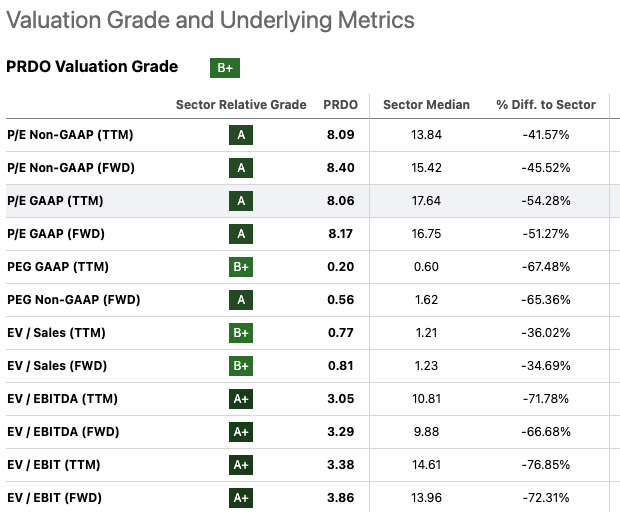

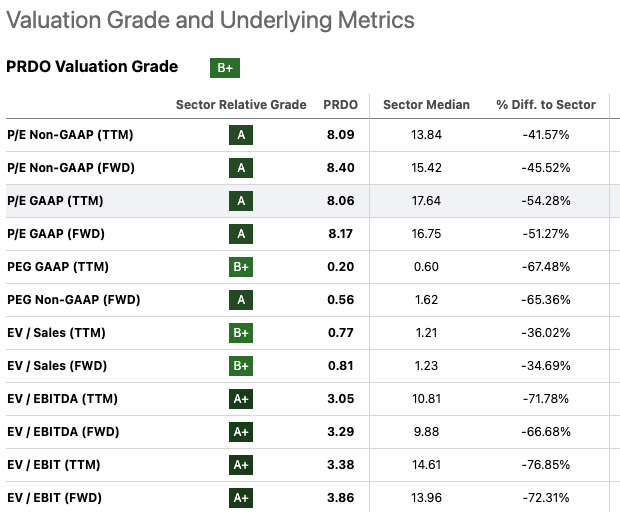

Perdoceo Schooling (NASDAQ:PRDO) sports activities a horny valuation at simply 8.4x ahead P/E versus the sector median of 15.4x and has posted stable monetary efficiency together with increasing working margins and a wholesome steadiness sheet. Nonetheless, the for-profit training business faces intensifying scrutiny beneath the Biden administration over points like gainful employment and 90/10 rule adjustments, and Perdoceo itself is beneath investigation by the Departments of Schooling and Justice. Current insider inventory gross sales by executives together with the shock resignation of the corporate’s CEO in lower than two years additionally elevate some warning flags. I imagine the inventory deserves a maintain ranking attributable to mounting regulatory headwinds, no less than till there’s additional readability.

Firm Overview

Perdoceo operates three primarily on-line for-profit universities – Colorado Technical College and American InterContinental College. Perdoceo operates completely on-line, with over 97% of its ~39,000 college students enrolled in on-line diploma packages throughout enterprise, IT, healthcare, and different fields as of the final 10k filing. Enrollments as of the most recent quarterly release are at 36,400, declining constantly year-over-year. The coed physique can also be largely non-traditional, with 76% enrolled in enterprise packages and 68% aged over 30. TTM income is $730 million.

Regulatory Troubles Mounting

The for-profit training business has confronted rising scrutiny in recent times from regulators and policymakers. Efforts by the Division of Schooling to restrict eligibility and federal help for poor-performing packages or colleges may considerably affect gamers like Perdoceo.

Particular areas of focus embody the 90/10 rule, which caps the share of income that for-profit schools can obtain from federal pupil help sources. An even more restrictive version has taken impact in 2023 which has made compliance more difficult. Breaching the 90/10 restrict for 2 straight years would threaten accreditation and federal help eligibility.

There’s additionally a push to convey again “gainful employment” rules that had been rescinded in 2019. These guidelines can revoke federal help eligibility for packages whose graduates have extreme debt burdens in comparison with earnings. The Division has signaled plans to introduce new gainful employment guidelines in 2023.

Perdoceo faces not solely stricter laws however greater enforcement as nicely. Each the Department of Education and the Department of Justice have despatched data requests concerning the corporate’s pupil recruiting, advertising and marketing, and monetary help practices. This has affected pupil enrollments over the previous few years, that are down from 42,700 in 2020 to 36,400 as of the final reported quarter.

CEO Departure & Insider Gross sales

In November 2023, Perdoceo announced the shock resignation of CEO Andrew Hurst after lower than two years on the job. The corporate reinstalled former chairman and CEO Todd Nelson to the highest submit.

Whereas the explanations for Hurst’s exit are unclear, the abrupt change raises questions concerning the firm’s management stability and strategic course. Nelson himself brings controversy – he’s being sued over the alleged wrongful dying of his daughter-in-law, though he has vehemently denied the allegations by his lawyer.

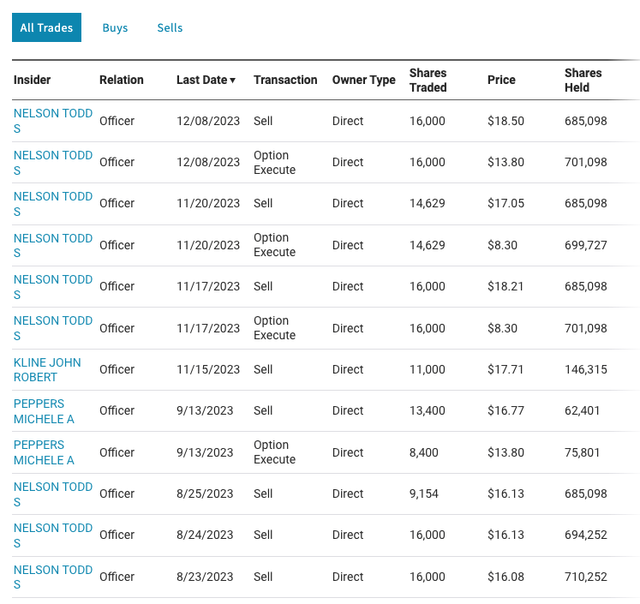

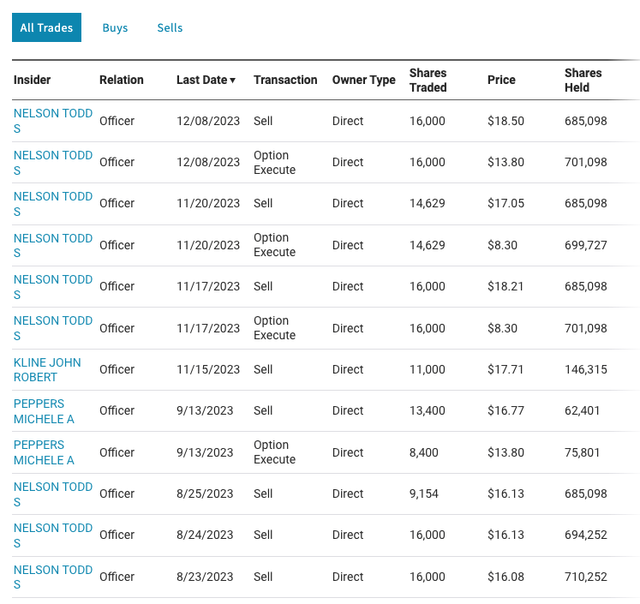

Moreover, Nelson has executed vital gross sales of Perdoceo inventory over the past couple of months. Different executives additionally offloaded shares final fall. The insider promoting hints that management may even see additional draw back forward.

Insider Exercise (Nasdaq)

Monetary Efficiency Stable, Valuation Reductions Regulatory Danger

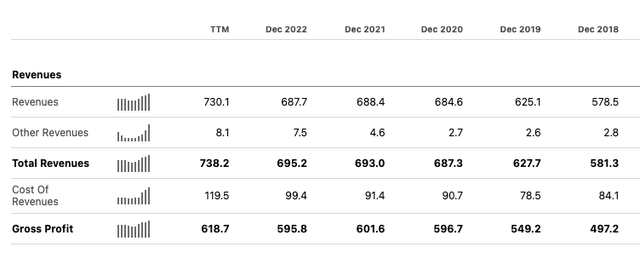

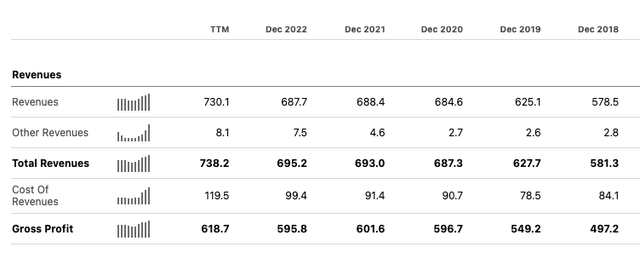

Perdoceo has posted spectacular monetary outcomes all through. Regardless of some hiccups, revenues grew healthily over the past 5 years, up from $578m to $730m within the final twelve months. Outcomes have been aided by increased pupil retention and decrease common & administrative prices as a proportion of income.

Searching for Alpha

The corporate additionally carries a stable steadiness sheet, with ~$600 million in money in opposition to negligible debt. This offers flexibility for natural investments and acquisitions – Perdoceo not too long ago made purchases to develop its choices in healthcare, IT, and cybersecurity coaching.

The inventory trades at simply 8.4x ahead P/E in comparison with over 15x for its closest publicly traded for-profit training friends. Numerous the regulatory threat has already been discounted within the value.

Valuation Scores (Searching for Alpha)

Bulls will level to the potential for continued margin growth, natural development alternatives in areas like healthcare coaching, and upside from latest acquisitions. Execution of the corporate’s technique may additionally make it a horny takeover candidate.

However in the end, the regulatory storm clouds make it tough to get too constructive, particularly given the departure of the CEO and insider gross sales. Whereas the danger/reward calculus appears favorable for worth and contrarian traders, I desire to stay on the sidelines for now.

Upside Catalysts

- Margin growth if retention stays excessive and enrollment traits enhance

- Accretive acquisitions that develop presence in rising areas like healthcare coaching

- Regulatory reversals following an administration change

- Settlement of Division of Schooling investigation with out penalties

- Profitable integration of latest Coding Dojo and CalSouthern acquisitions

- Inventory repurchases supported by massive money steadiness

Draw back Catalysts

- Stricter “gainful employment” guidelines result in lack of federal help eligibility for sure packages

- Failure to adjust to new 90/10 rule caps and required audit processes

- Penalties, fines or operational restrictions ensuing from DoE investigation

- Reputational harm from controversies hurting enrollment and retention

- Insider gross sales and CEO change indicative of concern over coming outcomes

- Recession reduces demand for discretionary training spending

- Acquisitions fail to drive development and require vital funding

Conclusion

Perdoceo Schooling presents an intriguing threat/reward profile, with stable monetary traits and a reduced valuation which will supply a big margin of security. Nonetheless, the elevated regulatory uncertainties, latest senior management adjustments, and insider promoting preserve me impartial on the inventory till there’s extra readability. Worth traders can keep opportunistic if any sudden optimistic catalysts emerge.