bjdlzx

(Note: Peyto is a Canadian company that reports using Canadian Dollars unless otherwise noted.)

Peyto (OTCPK:PEYUF) is a natural gas producer that manages to report a profit in this environment. At least part of that is due to a robust hedging program noted in the last article. In the latest earnings press release, management noted the rather substantial net amount that the hedging program has contributed to revenues. This company is unique in that the hedging program generally makes money for the company over time, and that the company is making money at a time when many natural gas producers are losing money. When natural gas prices recover, this is going to be a very profitable proposition.

Acquisition Progress

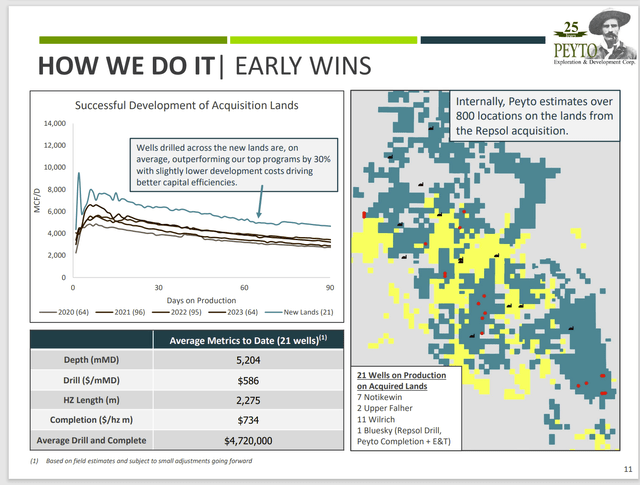

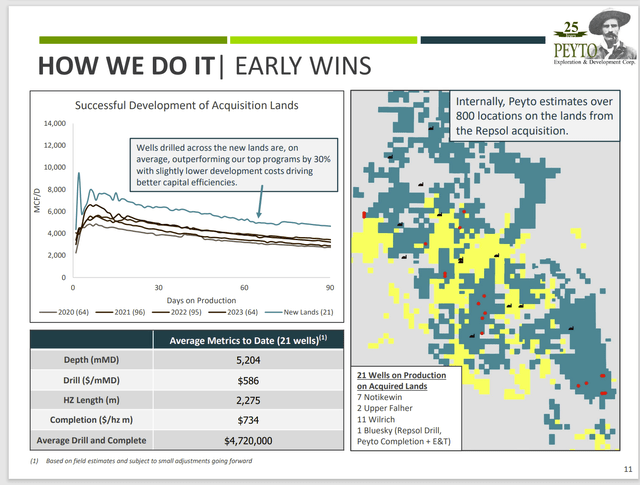

Management had expected after the acquisition to lower costs 10%. The earnings announcement noted that they were already halfway there. Not only does the acquired acreage compete for capital. But it has better results than the legacy company acreage on average.

Peyto Drilling Results On Acquisition Land (Peyto Corporate Presentation July 2024)

Not only are these wells doing as well or better for drilling and completion, but they also outproduce the legacy acreage. The interesting thing is that management really has no time to optimize results on this acreage (because that usually takes a while). So, there could be still better comparisons in the future as management becomes more familiar with the acquisition.

During the earnings conference call the acquired acreage was described as premier acreage. It usually takes a while for enough new wells to be drilled on the acquired acreage for those wells to be significant. But as shown above, management is very much determined to decrease average costs overall and that new acreage “is the ticket” to accomplishing that goal.

One of the more interesting things mentioned was that the company was really not covering the costs incurred for pulling ethane out of the natural gas stream. Therefore, management has largely abandoned the idea of selling ethane and instead sells it as natural gas (for about the same money but less processing costs).

Earnings

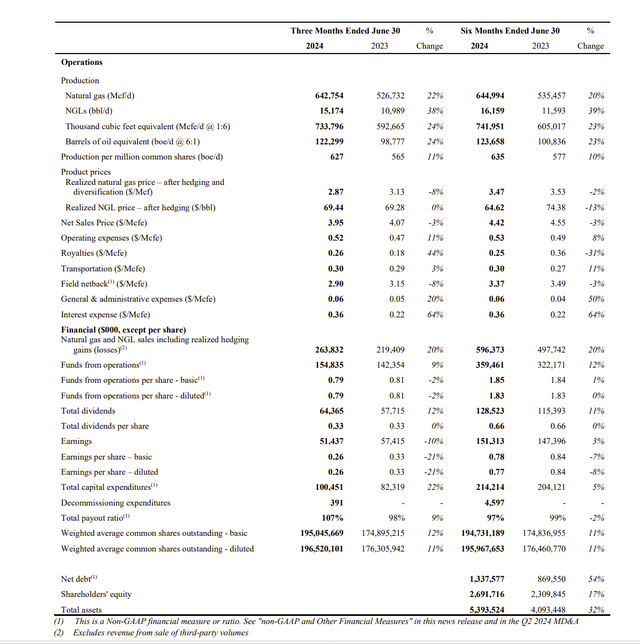

The best part of this report is that this company is actually making money despite weak natural gas prices.

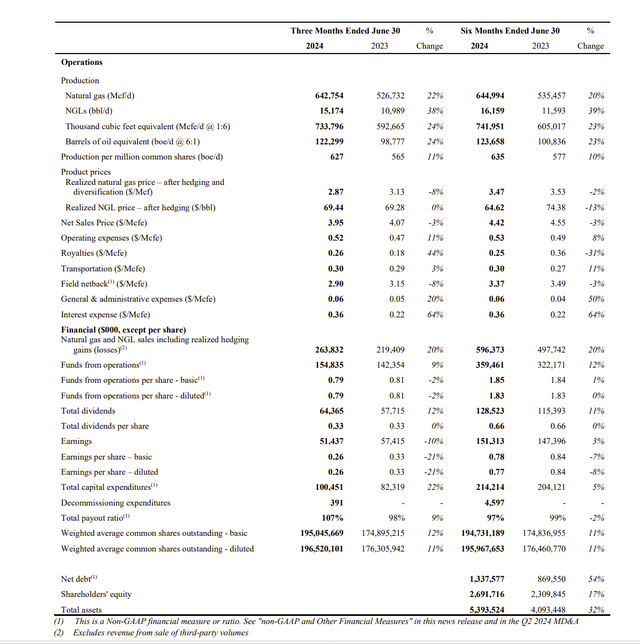

Peyto Second Quarter 2024, Earnings Summary (Peyto Second Quarter 2024, Earnings Press Release)

The second quarter is Spring Breakup, which usually slows down outside activity until that is over with. The other consideration is that there is some gas production that has been shut-in because currently weak prices have made it unfeasible to produce.

It was mentioned that sour gas, for example, is just not worth producing in this current environment. So, that was shut down to improve cash flow and profits.

The last part is that this company will try to bring on new production in the fall. As the fall campaign gets underway, there will be an emphasis on completions in time for the heating system. Production could take a sizable jump (unless the weather intervenes).

Now the acquired acreage does produce some valuable liquids. The above quarterly comparison shows a decent jump in liquids production. That will have an outsized effect on sales price averages and profitability in the future.

Despite the relatively small amount of liquids produced, the average sales price is up quite a bit from the natural gas price. Therefore, it does not take a particularly high percentage of liquids in the production mix to improve profitability quite a bit.

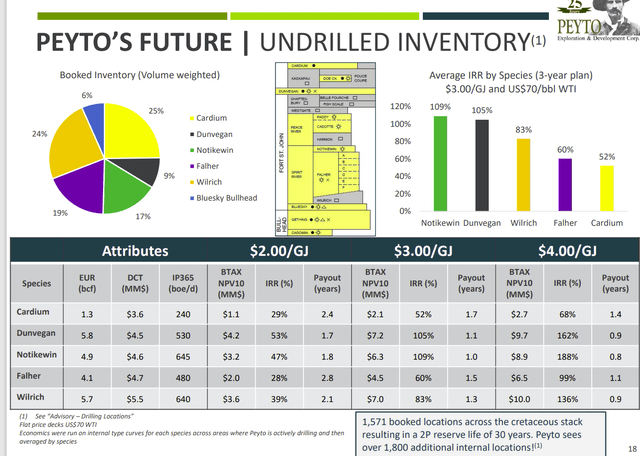

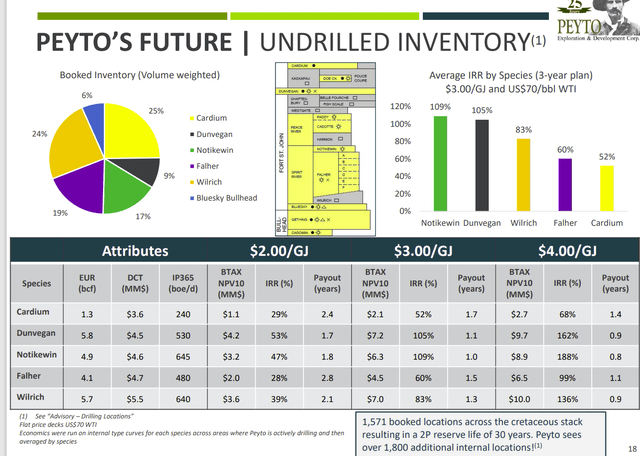

Inventory

Amazingly, the company has years of this very profitable inventory.

Peyto Portfolio Profitability By Interval (Peyto Corporate Presentation July 2024)

The company clearly has possibilities that are profitable under some very stressful circumstances, (like when natural gas prices are at C$2).

Despite this company being smaller and maybe having slightly higher debt levels than one might be comfortable with, the unusual profitability of the company makes up for many of those perceived deficits. When a company is profitable at a time like this, then it will be unusually profitable when natural gas prices recover.

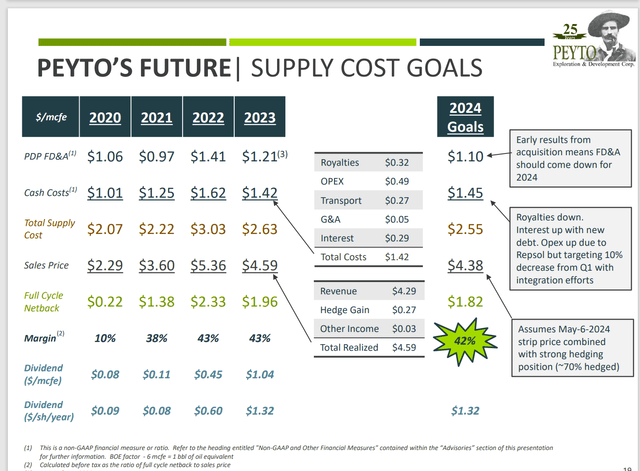

Goals

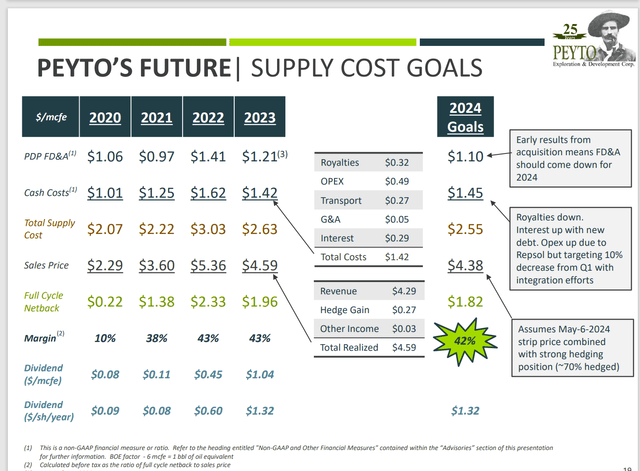

There has long been a strategy of producing the product for less than it costs to sell it. The definition of “less than it costs to sell it” also included a reasonable profit as part of that cost.

Peyto Cost And Margin Goal for Fiscal Year 2024Peyto Cost And Margin Goal for Fiscal Year 2024Peyto Cost And Margin Goal for Fiscal Year 2024 (Peyto Corporate Presentation July 2024)

The biggest difference here is a knowledge of what prices may well look like during the next cyclical downturn. Therefore, this company is forever searching for ways to reduce costs so that when that cyclical downturn arrives, this company is poised to make money during that downturn.

Only once, in all the years I have followed this company, has there ever been an announcement of an impairment charge. Yet for much of the industry, that is a bottom cycle regular event. This is an example of setting (what many in the industry would say) impossibly high goals and then meeting those goals. It is one of those things that many try to do, but few succeed.

Note that Opex is up due to the assimilation related optimization charges, which past articles went into some detail about. However, management has a goal to reduce the ongoing charges by 10%. That means those Opex charges shown above could take a big drop as the one-time charges end.

Summary

Peyto is probably one of the most profitable upstream natural gas producers in all of North America. The company is making money at a time when many competitors are losing money and considering shutting in a significant amount of production.

Peyto remains a strong buy as the acquisition appears very much to remain on track to meet management expectations. As technology improvements continue to sweep the industry, management clearly uses those improvements to maintain its cost leadership position.

There are definitely issues like a slightly elevated debt level and the fact that the company is midsized. However, the profitability of the company adds to the safety of the investment more so than any deficit would take away (at least at the present time). Nothing adds to investment safety like above-average profitability.

The company is well positioned to take advantage of any recovery in natural gas prices. In fact, this stock could well be a recovery leader as there is no wait to turn profitable from the recovery.

Risks

Clearly, Don Gray has built an exceptional company. The loss of his services or of any of the people he deems key people could adversely affect the future of this company.

Any upstream company is subject to the volatility and low visibility of future commodity prices. A severe and sustained downturn can cause a material change in the company outlook.

This company has a strong hedging program that has made a few hundred million for the company over the years. This has the effect of avoiding short-term volatility. As a result, this company” can ride out storms” better than many in the industry.

Similarly, the very low-cost structure of the company means a lot of competitors will suffer far more than this one during any cyclical downturn. It also means that this company can profitably grow production while others wait for still better prices.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.