Magical dawn over the snow-covered summit of Mt Taranaki in New Zealand”s North Island Qui Reitzig/iStock via Getty Images

We have written about Virtus InfraCap U.S. Preferred Stock ETF (NYSEARCA:PFFA) a number of instances now. Our rankings on this have been starting from “Buys” to “Holds.”

While this may sound negative, in our Universe, this is fairly middling. We have a lot of funds and stocks that have vacillated between “Sells” and “Sturdy Sells.” We won’t bother to reintroduce the fund here, as the background is all there in the past articles. You can also get the same from other authors who have described this preferred share ETF when they wrote about it for the first time. Instead, we will dive into some performance metrics and get into the facets of the fund that make it a Sell today.

The Performance

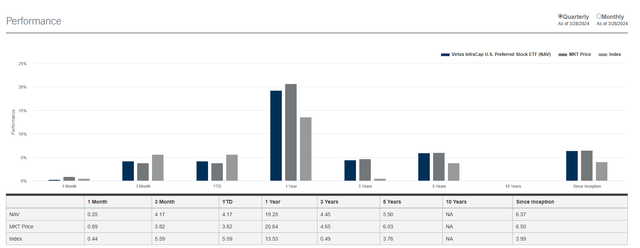

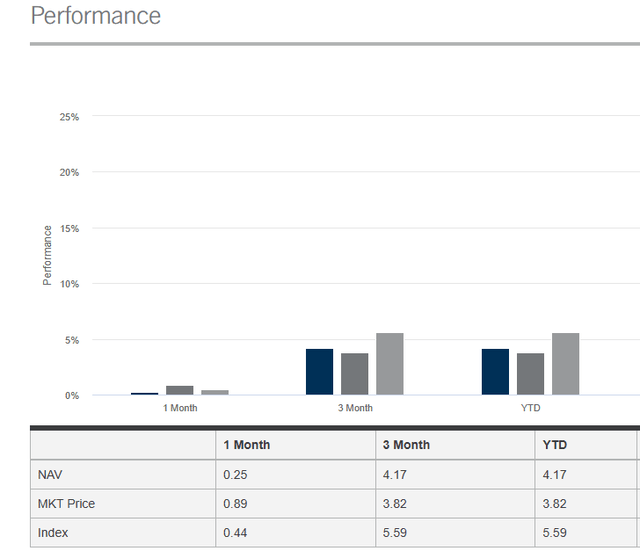

If you just judged by the performance here, there won’t be much to complain about. You can right-click and open this in a new tab in case you are not blessed with falcon vision.

PFFA has generally beaten the index across all timeframes that count. Things have been a little spotty recently, but we really cannot evaluate a fund on just one quarter’s worth of results.

What matters is the performance since inception, and that has been fantastic. Kudos to those that bought and held. All that said, we will go into our reasons why we would do a hard sell and not look back until things change.

1) Performance Always Looks Perfect At The Top Of A Cycle

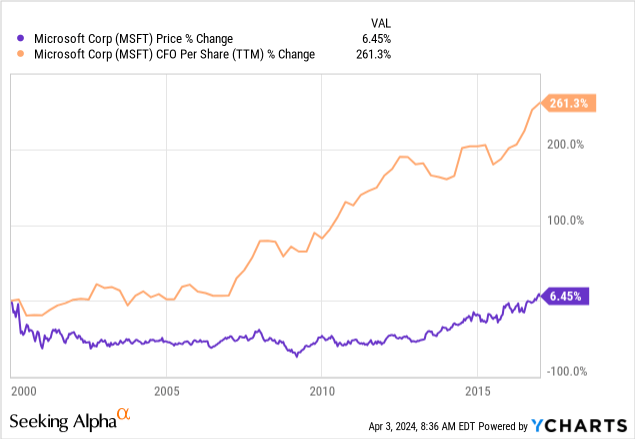

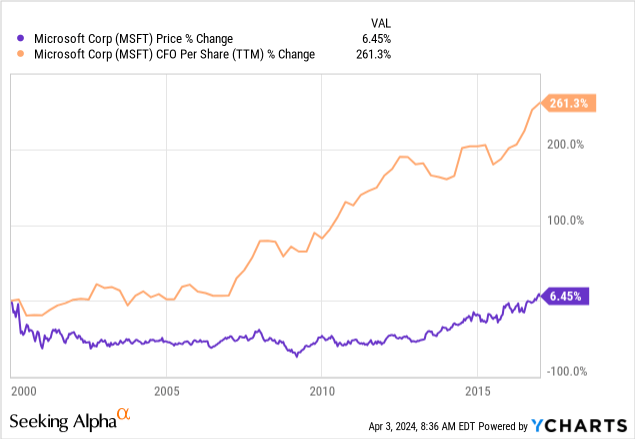

This is true of any asset class. Investors tend to look at the rearview mirror and assume that is what represents the forward returns. Imagine if you extrapolated that Microsoft Corporation (MSFT) would deliver 15% annualized returns right at the NASDAQ 2000 top. MSFT’s cash flow per share exploded from even those lofty levels in 2000, but the stock took 16 years to break even.

We should have a similar return profile set up today for MSFT. But the broader point is that it always looks awesome at the top. No exceptions. So PFFA’s performance, while impressive relative to the benchmark, will likely look very different in the coming years than it did in the past. That is, of course, if we are correct about this being a top of sorts for the sector.

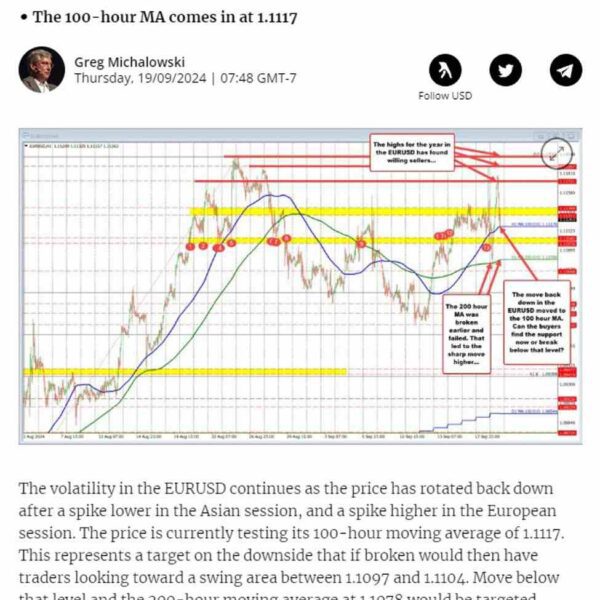

2) Why This May Prove To Be A Big Top For The Sector

The idea here has been the Federal Reserve will cut and cut hard. Everyone will rejoice in the rate cuts and losses on a fixed income like instruments will be a thing talked about only in folklore. We have pushed back against that notion on two fronts. The first being that rate cuts will come as quickly as the consensus believes. We think this will drag on and election season will be upon us soon, restricting the Fed’s antics. Our thoughts have so far played out perfectly as the rate cuts have been delayed relative to what markets expected 6 months back. The chart below shows the probability of a rate cut in the different Fed meetings for 2024. You can see that May 2024 was a lock for a rate cut at the end of last year. Today, almost no chance of that happening.

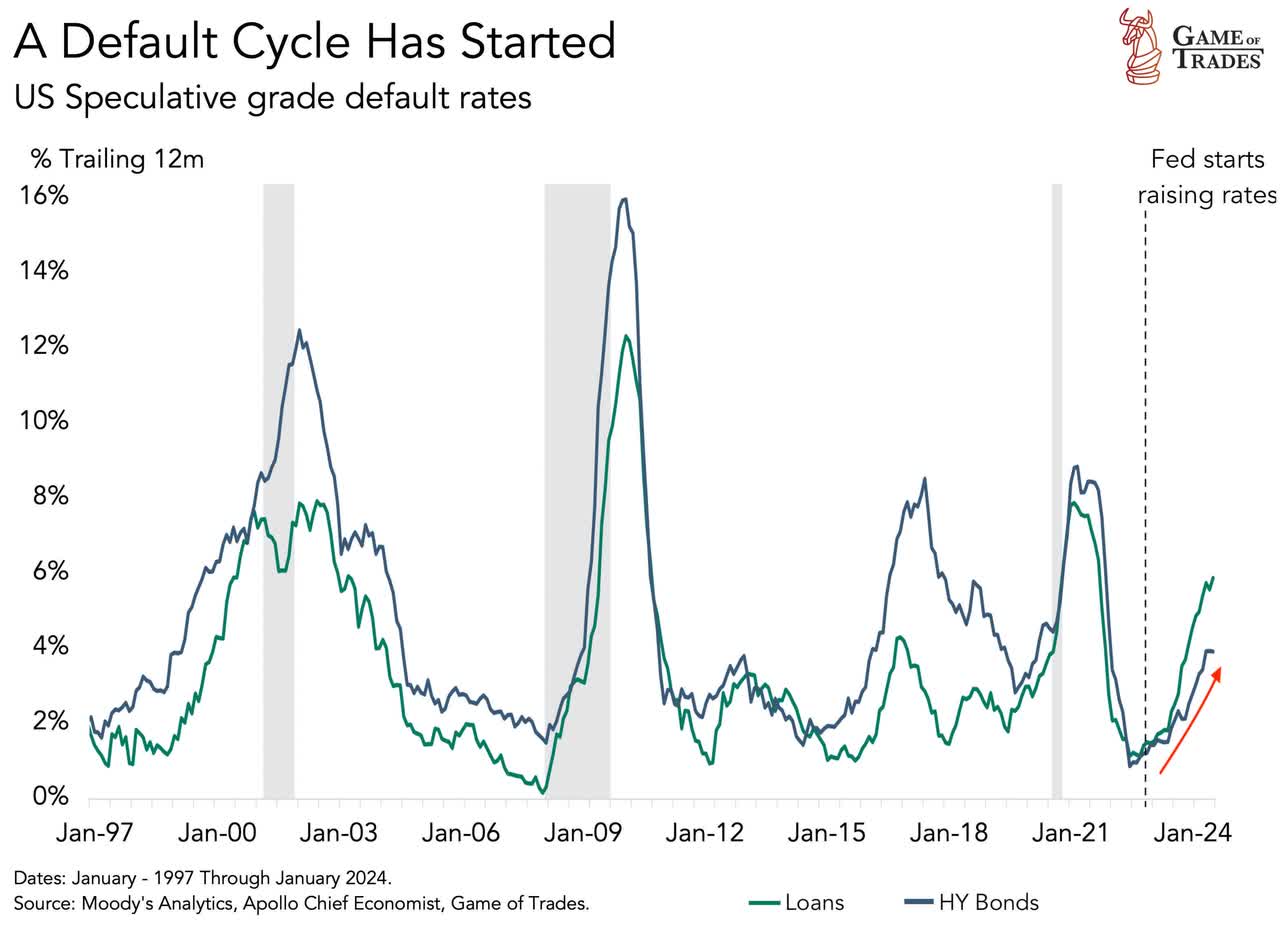

The second area where we have pushed back is that if rate cuts do come eventually, it will be great for the sector. Yes, there are signs that we may eventually hit an ultra-hard landing.

That could overwhelm the sticky inflation we are seeing. If we cut rates into that, you won’t enjoy holding PFFA.

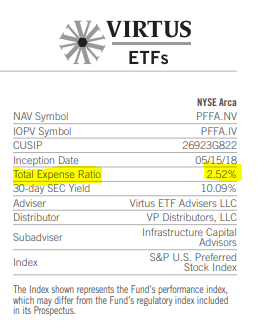

3) The Leverage And Expense Ratios Are Unacceptable

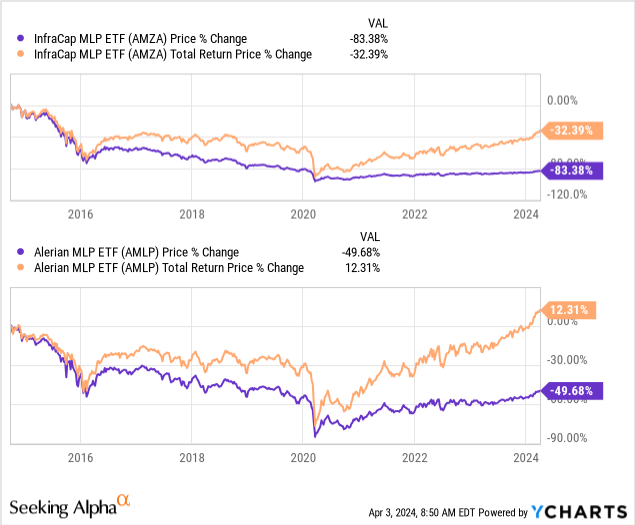

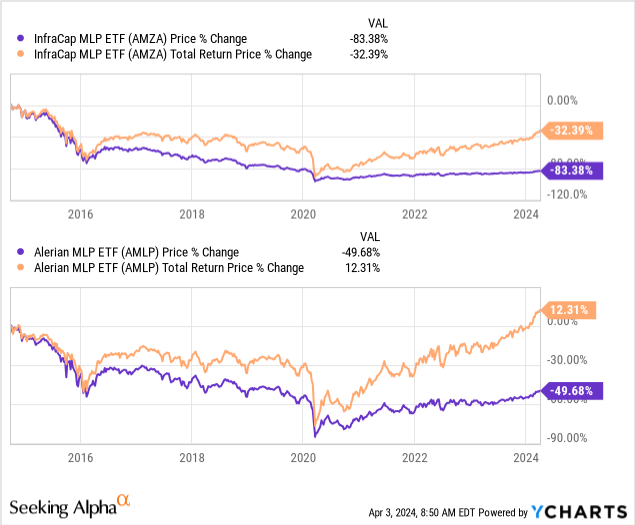

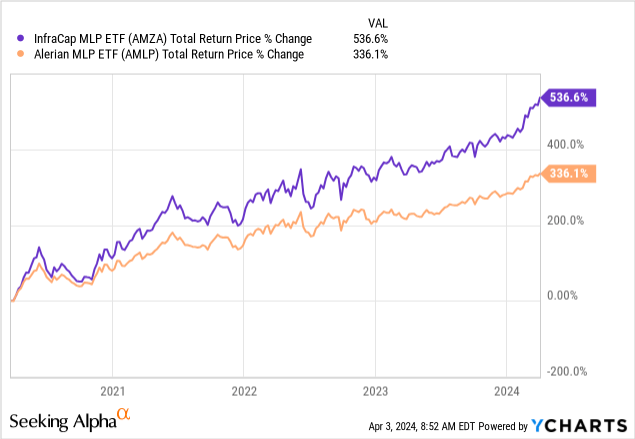

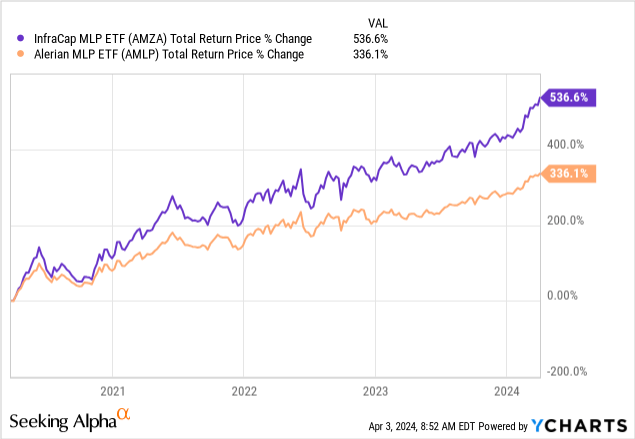

PFFA’s outperformance while impressive is a result primarily of leverage. That works both ways and investors may recall the other fund run by the same outfit, InfraCap MLP ETF (AMZA), where leverage did not pan out. We have thrown in the unlevered Alerian MLP ETF (AMLP) as a comparative.

We can use this same picture above to circle back to the earlier point about cycles. If you bought at the absolute bottom in 2020 (and based on comments on our articles, apparently nobody buys anything at any other point), AMZA demolished AMLP.

But you can see how poorly the overall returns stack over the full cycle. The same concept applies to the expense ratio. Investors may seem indifferent to paying it when things are going good.

PFFA

When the cycle turns, it will be a different matter altogether.

4) PFFA Is An (Common) Equity Proxy & That Increases Risks

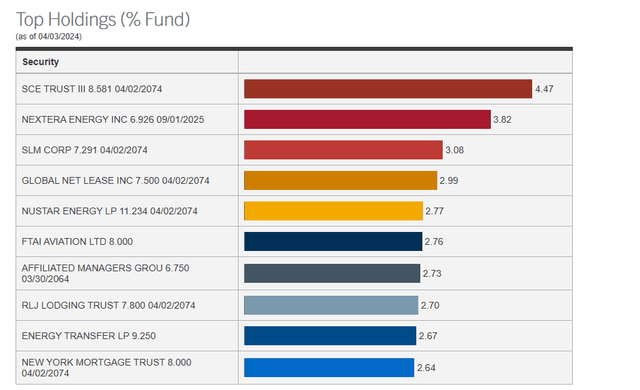

We are basing this on the instruments PFFA owns. We are familiar with most of these and we wrote about Global Net Lease, Inc. (GNL) preferreds only recently.

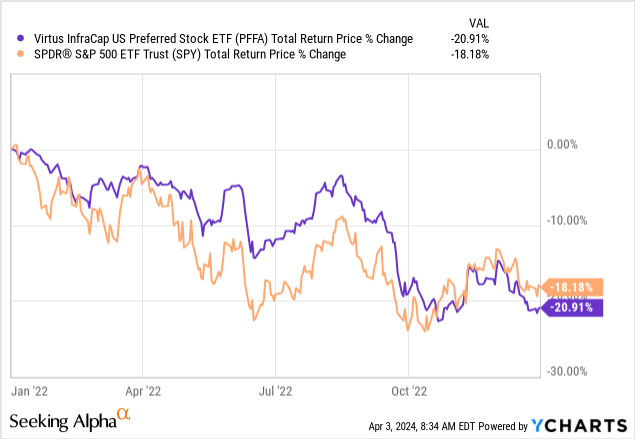

There is also a mandatory convertible in the mix above and those move like pure common shares. That was something investors have often found out the hard way. So with this mix, you will yo-yo in the downcycle, pretty much like common shares. Here is the 2022 performance of PFFA relative to the SPDR® S&P 500 ETF Trust (SPY) for a style.

So if we are right about a massive bubble top for the S&P 500, we think this will spell big problems for PFFA.

Verdict

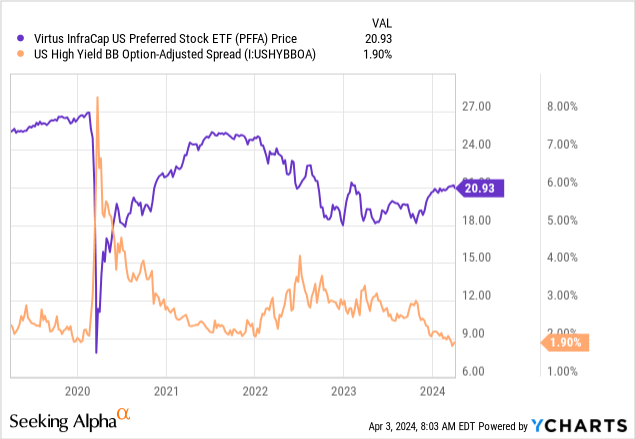

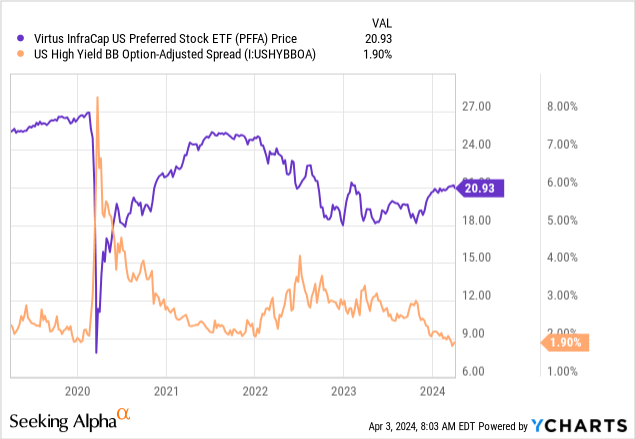

It’s inconceivable to motive with the “I’m completely happy amassing my revenue” crowd, so we don’t. We are writing for those that realize that income can be generated on net assets. If net assets drop a lot, the distribution will follow. Ares Commercial Real Estate Corporation (ACRE) is a great example of a stock where the NAV drop finally forced a big distribution cut. We are going with the logic that the NAV will drop and then eventually the distribution will follow. PFFA is bound to credit spreads and we think they are bottoming right now.

We’re transferring Virtus InfraCap U.S. Most popular Inventory ETF to a Promote and can take into account a extra constructive stance if credit score spreads mirror the true dangers of proudly owning this.