After I was a pupil within the U.Okay., I keep in mind that renting home equipment like washing machines and televisions was the norm for some folks, particularly college students dwelling in short-term lodging. Israeli startup Xyte (pronounced “excite”) has just raised $30 million, because it sees a return to this type of hardware-as-a-service mannequin to be the way in which ahead for producers whose margins are beneath fixed strain. If it really works so nicely for software-as-a-service, why not {hardware}?

Xyte let me check out its 27-slide deck to see the way it pulled it off. Was I excited by Xyte’s deck? Sadly, no. This 27-slide deck was quick on the knowledge that I would wish as an investor to make an knowledgeable determination on whether or not or to not spend money on it. Let’s break down what I noticed.

We’re in search of extra distinctive pitch decks to tear down, so if you wish to submit your personal, here’s how you can do that.

Slides on this deck

Xyte’s deck options 27 slides, some with redacted data. The redactions relate to its clients and buying and selling figures, which is each truthful sufficient and likewise makes it a bit trickier to get an image of the total firm.

- Cowl slide

- Firm overview, together with some group particulars

- Group slide

- Alternative slide

- Alternative 2 slide

- Market slide

- Downside slide

- Worth proposition slide

- Answer slide

- Answer 2 slide

- Answer 3 slide

- Devoted interfaces slide

- Traction slide

- “Any industry, any size” slide (buyer base)

- Worth proposition slide

- Enterprise transformation slide

- “Unique business and commerce platform” slide

- Buyer research slide

- “Pioneering a new product category” slide

- “A single, integrated platform” slide

- Group 2 slide

- Interstitial slide

- Enterprise mannequin slide

- Go-to-market slide

- “Forecast and drivers” slide

- Funding abstract slide

- Closing slide

Three Two issues to like

You would possibly suppose that with 27 slides, there can be lots to select from for the “three good things” part. Expensive reader, I’m not gonna lie: Attempt as I would, I actually struggled to search out three good issues about this deck.

So, let’s discuss concerning the two sparks of brilliance I may spot on this inky void of despair:

Opening abstract

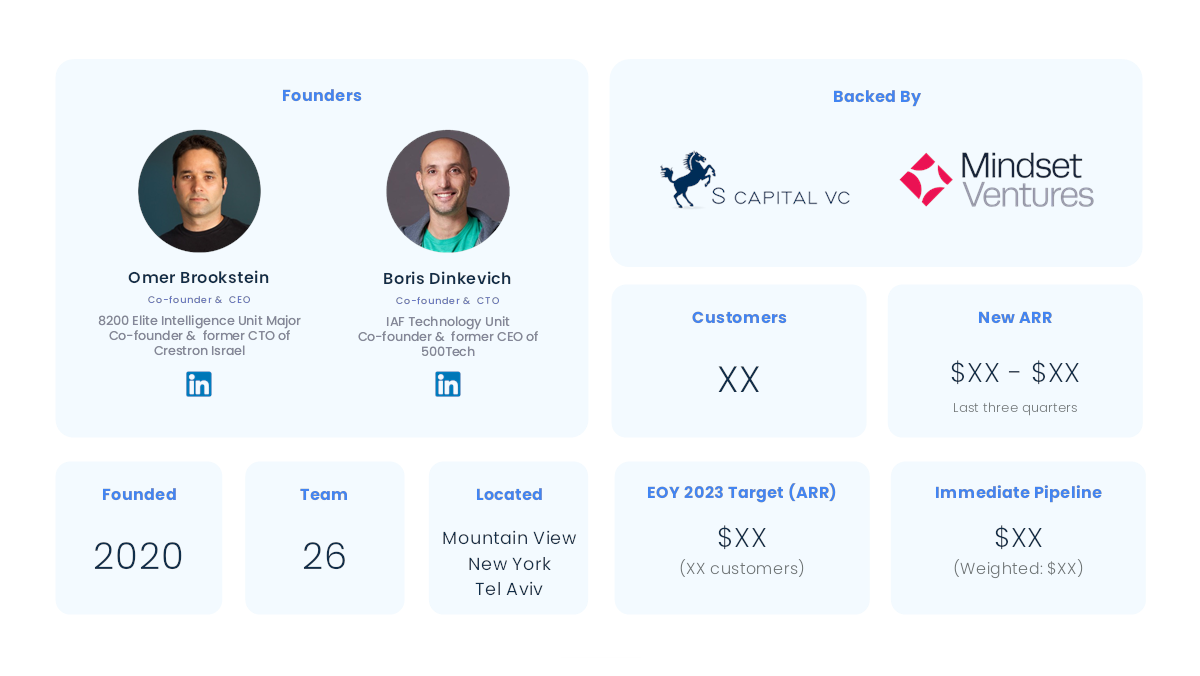

[Slide 2] A really well-done at-a-glance slide. Picture Credit: Xyte

Xyte’s slide deck, general, was a reasonably underwhelming cavalcade of mediocrity. Nonetheless, I did actually get pleasure from this one-slide abstract proper at first.

Even with among the core numbers redacted, it reveals off lots of vital data at a look that may seemingly get an investor to take observe. In reality, I feel this slide will change into my beneficial template for many startups elevating cash — it’s crisp, clear, and to the purpose, and it helps set the scene for what’s to return.

Pulling all of it collectively

I’ve lots of respect for summaries, and this deck pulled it off not as soon as, however twice. The primary one units the stage, and the second (under) summarizes the identical story as soon as extra, however by the lens of an investor.

[Slide 26] A strong abstract pulling all of it collectively. Picture Credit: Xyte

I actually like the way in which the group did this. Illustrating that the corporate has discovered an issue and go-to-market technique that is sensible is nice. So good, in actual fact, that I’m going to have a look at every of those factors individually:

- Monumental alternative: Sure! A startup has to succeed in “VC scale” with the intention to be investable in any respect. It may need been value it to remind the investor of the particular market measurement right here, however this barely extra summary abstract works nicely.

- Distinctive resolution: Sure! Together with a reminder of what you really do is nice.

- World-class product: I’d have liked to see this level backed by knowledge, to be trustworthy. Is it a world-class product? Perhaps, however deliver the receipts!

- Validated resolution: Certain, however bear in mind to incorporate the why. What validates this resolution? I think the purpose the corporate is really making an attempt to make right here is said to the subsequent level . . .

- Scalable GTM technique: With the ability to purchase clients at scale is what causes a startup to stop being a startup, and that’s a superb factor. For bonus factors, I’d have reminded the buyers of the CAC:LTV ratio right here, nevertheless it’s a rattling positive begin.

- Imaginative and prescient: Meh. This isn’t a reminder of the corporate’s imaginative and prescient, which is a missed alternative. Maybe, as an alternative, it may have swapped in a group abstract to remind the buyers why that is the correct group to construct this firm.

Minor tweaks apart, I feel this “investment summary” slide does lots of work, and I’m glad the group selected to incorporate it.

In the remainder of this teardown, we’ll have a look at three issues Xyte may have improved or finished otherwise, together with its full pitch deck!