Well, that’s the answer we will be getting today. But whatever the case is, it won’t be anything too pretty. And whatever the numbers are, another 25 bps rate cut by the ECB in January is pretty much confirmed. The euro is sitting marginally higher today but is still pinned down by some key near-term levels against the dollar for now:

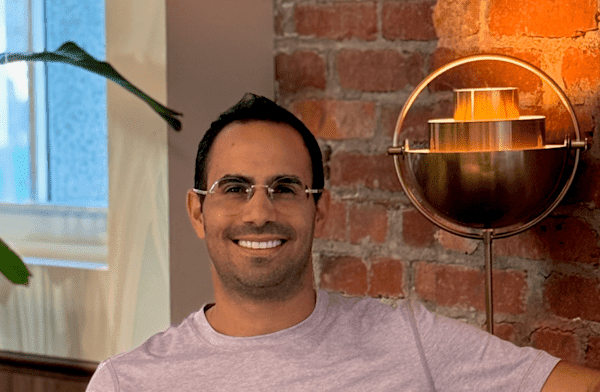

EUR/USD hourly chart

That alongside large option expiries should keep price action more limited, even with any kneejerk reactions to the PMI data. That considering traders have already priced in ~93% odds of an ECB rate cut for next month.

In any case, the releases will at least add some spice to European morning trade later. Otherwise, it’s a case of waiting on key central bank meetings to be over and done with in trading this week. It’s the final real trading week of the year! I want to say let’s make it count but I reckon the only meaningful trade is to catch the post-Fed reaction before wrapping up the year, unless you want to scalp some moves that is.

0730 GMT – Switzerland November producer and import prices

0815 GMT – France December flash manufacturing, services, composite PMI

0830 GMT – Germany December flash manufacturing, services, composite PMI

0900 GMT – Eurozone December flash manufacturing, services, composite PMI

0900 GMT – SNB total sight deposits w.e. 13 December

0930 GMT – UK December flash manufacturing, services, composite PMI

1000 GMT – Italy November final CPI figures

At 1000 GMT, we’ll also be getting euro area wage figures for Q3 but the one that really matters was already released last month here.

I wish you all the best of days to come and good luck with your trading! Stay safe out there.