bhofack2

Portillo’s (NASDAQ:PTLO) shares have fallen 40% year-to-date and are now off 55% over the past year. Investors have fled the stock following a disappointing first quarter earnings report, concern over consumer spending, and persistent selling by private equity firm Berkshire Partners (not affiliated with Berkshire Hathaway) since the IPO.

While 1Q numbers weren’t great, at today’s price, I see little fundamental downside in Portillo’s shares (discussed below) and think investors are overlooking some important positives, notably:

- Loyal core customer base in Chicagoland which provides some competitive insulation should price competition increase

- Operational improvements from kitchen reconfiguration & opportunities to reduce front of store costs through kiosks

- Continued restaurant expansion opportunity in sunbelt markets – new restaurant footprints have been optimized to improve returns on capital

- Approaching end of private equity overhang as Berkshire Partners is now down below 20% ownership (versus 60+% at IPO).

While I was negative on Portillo’s in late 2022 (with the stock at 20) and neutral earlier this year at 14, below $10 per share I am a buyer of the stock (and the delicious Italian beef sandwiches). I see the potential for 60% near-term upside and 130% upside (32% annualized) looking out to 2027.

Recent Results & Near-term Outlook

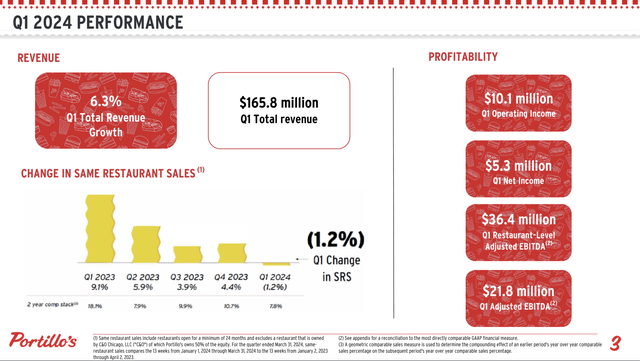

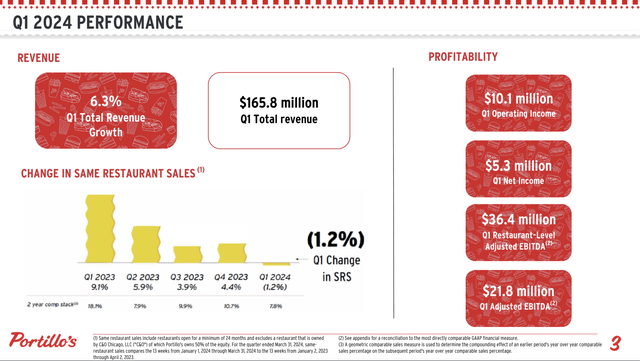

Portillo’s 1Q24 Same-Store Sales (Investor Presentation)

As shown above, same-restaurant sales in 1Q24 were slightly negative as positive pricing was more than offset by comparable transactions which declined 3.2% in the quarter. While results were disappointing it should be noted that Portillo’s is not alone as several restaurant chains reported soft results their most recent quarter, including Starbucks (SBUX) which saw -7% traffic and -3% same-store sales and Wall Street darling Cava (CAVA) which had -1.2% traffic decline contributing to a softer than expected 2.3% same store revenue growth. Similarly, Darden’s (DRI) largest chain Olive Garden also saw both negative comparable sales (-1.6%) and transactions (-2.6%). Nearly all restaurants are facing pressure as consumers tighten their belts due to years of inflationary pressure constraining household budgets and we are likely to see continued softness in near-term results.

For the foreseeable future, Portillo’s will be at a bit of a disadvantage versus restaurant peers when it comes to transaction/ same store comps because 55% of Portillo’s locations (and 70% of revenue) are based in Illinois which has a declining population. Overall, I expect -1 to 0% same-store transaction growth for the next couple of years (and 0-3% same-store revenue growth) until more sunbelt locations enter the comp base and bolster transactions.

Having said that, Portillo’s has done a reasonable job managing profitability in a tough environment with restaurant level EBITDA margins declining just 0.4% year-over-year and overall EBITDA margins increasing. Moreover, as described below, there are operational improvement opportunities which should help preserve margins even in a tough environment for comps.

Opportunities for improvement

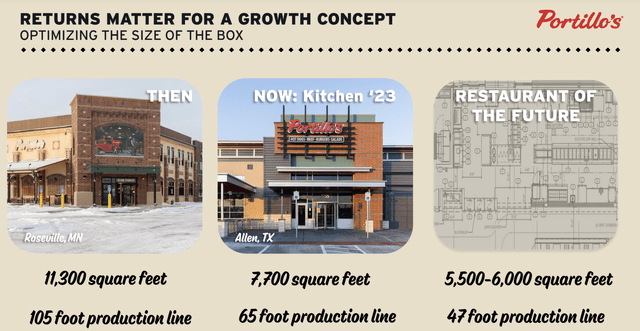

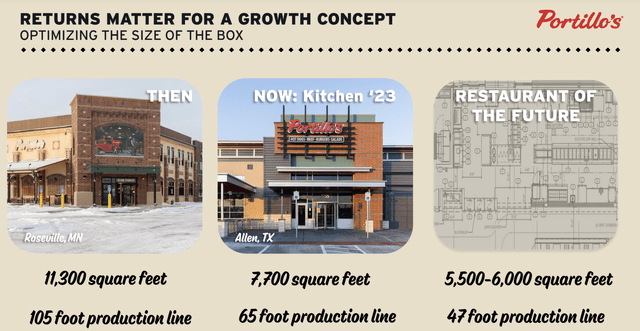

Production Line Efficiency (2023 Investor Day Presentation)

Portillo’s has large restaurants, a broad menu, and a fair amount of operational complexity. Historically it has had an unnecessarily long ‘production line’ (100+ feet in some locations) which both increased capital and operating costs (lower unit throughput per employee) and slowed service. The company is not only addressing this with smaller and more efficient new store builds (47-65 foot production lines and $1 million reduction in capital costs) but is retrofitting many existing restaurants to improve efficiency and throughput.

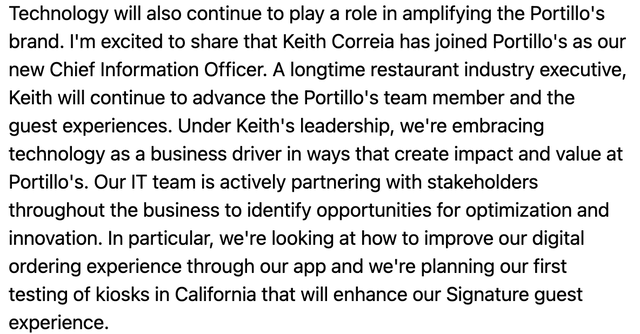

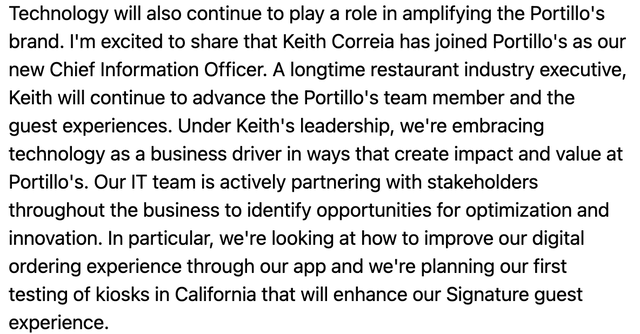

Trialing Ordering Kiosks (1Q24 earnings transcript from Seeking Alpha)

I see the introduction of ordering kiosks as a notable potential positive for Portillo’s. Benefits here are numerous and include: lower labor costs, improved order accuracy, and faster service time. The company is trialing kiosks in its California locations and I am hopeful that these will be rolled out to all locations over the next couple years.

It is also important to highlight that Portillo’s has made significant improvements to the process by which it opens new restaurants. The company went through growth pains from 2015-2021 as it didn’t have the infrastructure (dedicated new store opening teams) to properly open restaurants and had many hiccups along the way (incredibly long lines, poorly trained employees and in some cases 90 minute waits!). With scale Portillo’s has been able to invest in new restaurant opening teams which has greatly improved the opening process and improved both customer and employee satisfaction.

Valuation

At $9.72 per share, after factoring in its debt, Portillo’s has an enterprise value of just over $1 billion which is roughly the price at which Berkshire took it private in 2014 (when it had just 40 locations versus 86 today).

Portillo’s trades at just 10x 2024e EBITDA (and 9x 2025e EBITDA) which is a significant discount to other growing restaurant chains. While I consider the valuations of Cava (100x 2024e EBITDA and 80x 2025e EBITDA) and Kura Sushi (KRUS) at 60x 2024e EBITDA to be euphoric, Shake Shack (SHAK) which I consider to be the most comparable peer now trades for 21x 2024e EBITDA (and ~17.5x 2025e EBITDA).

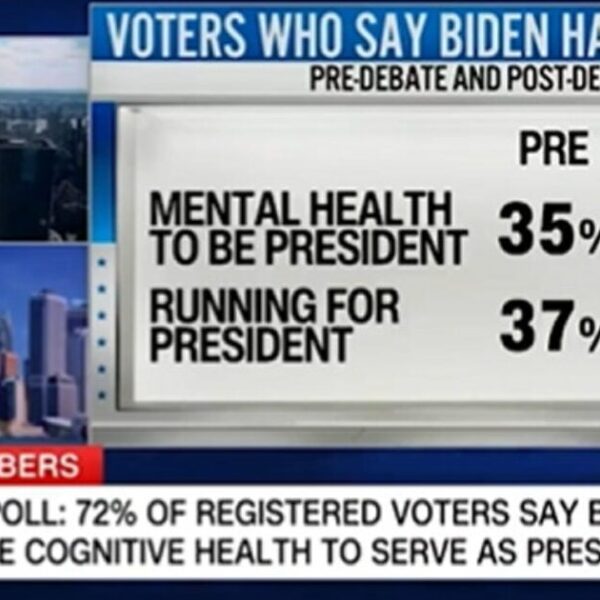

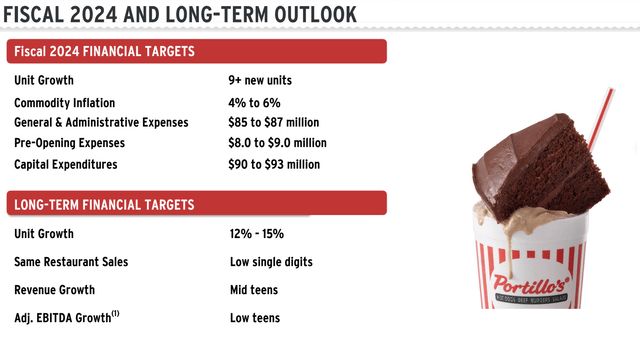

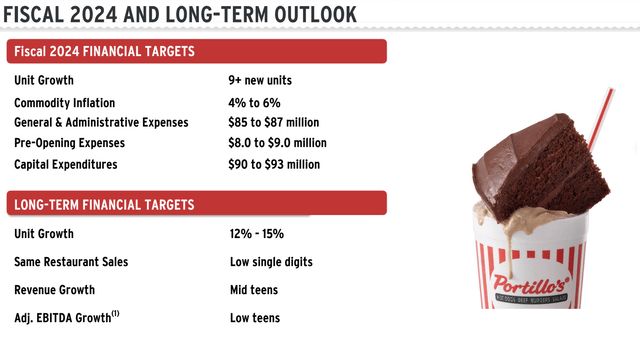

Financial Targets (1Q24 Investor Presentation)

Having optimized restaurant formats and greatly improved the restaurant opening process, Portillo’s has increased its unit growth targets. Moreover, as the company expands deeper into markets like Phoenix and Dallas, it well benefit from improved scale in advertising and logistics/distribution. While comps will be weighed down by its outsized Chicago footprint, I see management’s target of low to mid teens EBITDA growth as achievable. As such, I see an EBITDA multiple of 13x as reasonable which suggests a 2025 fair value of $16 per share or 60% upside. Moreover, as Portillo’s proves out its growth model, we could see the multiple expand to 15x (which would still be a large discount to the sector) which would imply a value of $23 (32% annualized) looking out to 2027.

Risks

- As mentioned above, consumers are tightening their belts when it comes to spending on restaurants and it is possible that this causes further deterioration in same store sales.

- Portillo’s has net debt to EBITDA of 3x. While I believe this level of leverage is manageable, the balance sheet could become stretched if operating results underperform expectations.

- Portillo’s is a small cap stock with a market capitalization below $800 million. Small cap stocks have significantly underperformed large caps over the past several years and it is possible that this trend may continue.

Conclusion

While sluggish consumer spending has dampened the near term outlook, I think the medium-term picture for Portillo’s is fairly bright. With shares trading at a large discount to my estimate of fair value, I’ve taken a position in the stock.