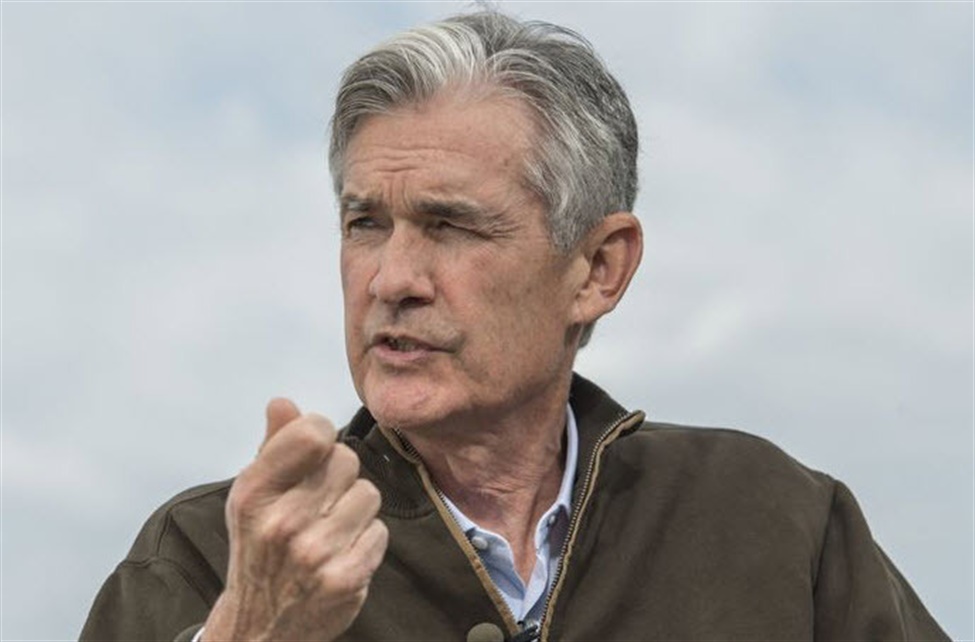

- We do not seek or welcome further cooling in labour market

- We will do everything we can to support strong labor market as we make further progress toward price stability

This is undoubtedly dovish

- My confidence has grown that inflation is on a sustainable path back to 2%

- Upside risks to inflation have diminished, downside risks to employment have increased

- Inflation now ‘much closer to goal’

- The cooling in labor market conditions is ‘unmistakable’

- Full text

Quotable:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

And this one is the clearest Fed put you will ever get from a Fed chair:

We will do everything we can to support a strong labor market as we make

further progress toward price stability. With an appropriate dialing

back of policy restraint, there is good reason to think that the economy

will get back to 2 percent inflation while maintaining a strong labor

market. The current level of our policy rate gives us ample room to

respond to any risks we may face, including the risk of unwelcome

further weakening in labor market conditions.

Ahead of the speech, the market was pricing in a 28% chance of 50 bps, 97 bps through December and 193 bps at this time next year. He certainly hasn’t slammed the door on 50 bps here and there was nothing in his comments about moving gradually.

Here is a live feed but there is no Q&A and the text was pre-released.