- Consumer spending has been resilient

- Government shutdown effects should be reversed this quarter

- Activity in housing sector weak

- A good part of slowing in jobs market represents declining workforce, though hiring demand has clearly slowed as well

- Inflation has eased significantly but remains somewhat elevated

- Inflation should trend towards 2% once tariff inflation has passed through

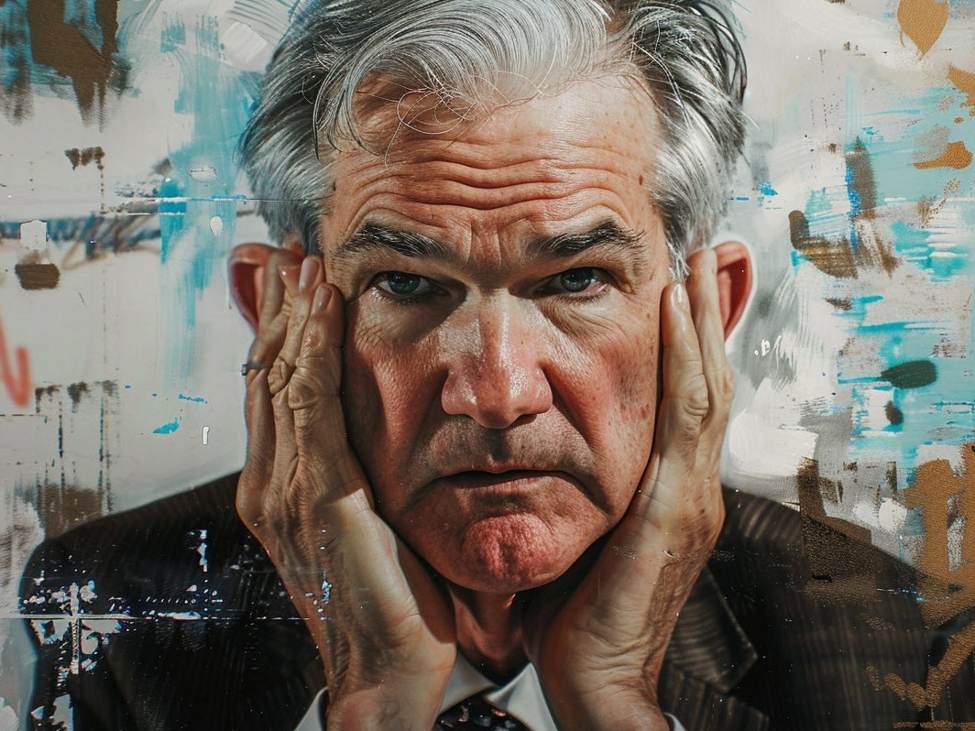

- Mon pol is not on a preset course

- We will continue to do our jobs with objectivity and integrity

In the Q&A:

- Cook case is perhaps the most-important in Fed history

- The outlook for economic activity has clearly improved since the last meeting

- Inflation performed about as expected

- Will make decisions meeting-by-meeting

- If you look at the December SEP, most people had additional rate cuts

- We think we’re well-positioned to let the data speak to us

- There was broad support for holding rates, including among non-voters

- A lot of tariff inflation has moved through the economy already

- Most of the overrun in goods inflation was from tariffs

- Upside risks to inflation and downside risks to employment have diminished

- Survey and market-based inflation numbers have come way down, that’s very comforting

- A rate hike isn’t anyone’s base case

- The consumer is filling out surveys that are really bad, and then spending

- Consumer spending is uneven across income levels but overall it’s good

- Economy has surprised us with its strength

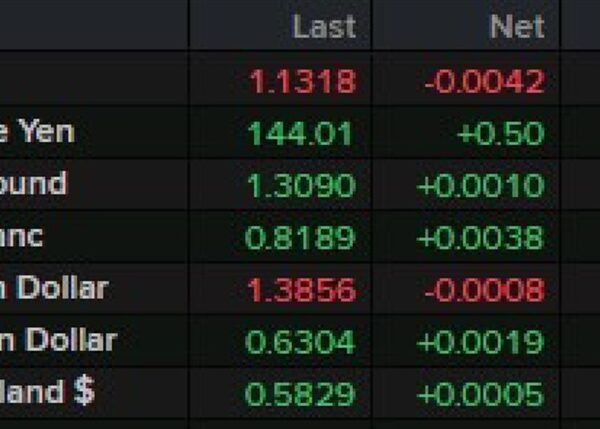

Powell has been less dovish without a doubt but the Fed funds futures market hasn’t moved much. Some of that might reflect that there will be a new Chairman for the June meeting. For that meeting, there are 19 bps of easing priced in. Through year-end, about 46 bps in easing is priced in, which is little changed from pre-meeting.

This article was written by Adam Button at investinglive.com.

![“[Colorado] is the place you turn into legendary”](https://whizbuddy.com/wp-content/uploads/2025/07/25973929-1751520430-600x600.jpeg)