- Inflation was not only a query of demand overheating, but additionally concerned a provide shock.

- Wanted to see an unwinding of the pandemic led distortions and the consequences of tighter financial coverage

- We predict financial coverage is tight

- There could also be extra supply-side good points available on inflation

- Labor market is rebounding

- Labor market has made substantial progress towards higher stability.

- Fed remains to be dedicated to getting inflation to 2% over time.

- Due to origins of inflation, there was a path to getting inflation again down with out the standard job losses. The reason being supply-side affect.

Market replace: US yields have dipped to the draw back. The ten 12 months yield is now adverse on the day at 4.361%. The two-year yield is down two foundation factors at 4.680%.

US shares are transferring larger with the S&P within the index now up 0.37%. The NASDAQ index is buying and selling up 0.49%.

The US greenback is transferring decrease. The EURUSD is testing it 200 day transferring out at 1.08323. Closing above that transferring common could be extra bullish. The GBPUSD is buying and selling to a brand new session excessive and the best stage since March 28. It’s approaching its 100-day transferring common at 1.2657. The USDJPY is buying and selling at 151.60 and approaches its 100-hour transferring common at 151.498, and 200-hour transferring common at 151.440.

- I do suppose financial coverage is working

- Financial system rebalancing in curiosity sensitivity sectors comparable to housing

- The availability-side restoration is creating new demand. It’s also stimulating new provide and is why development is growing whereas inflation is transferring decrease.

- Threat to chopping charges too quickly in addition to ready too lengthy

- If minimize too quickly, the progress on inflation may cease and reverse

- The opposite threat is that if we wait too lengthy and minimize too slowly through which case we could have a weakening of the labor market

- The chance of transferring too quickly could be actually fairly disruptive.

Shares are coming off a bit on the final feedback however nonetheless larger. S&P is up 10 factors or 0.18%. NASDAQ is up 50 factors or 0.31%

- Worth stability gives for lengthy durations of robust employment.

- Productiveness development in output per hour is tough to foretell. The query is can we maintain the productiveness development grown ahead

- AI ought to enhance productiveness, however too quickly to see productiveness from AI in the meanwhile.

- Coverage has gotten to place, impartial price query is just not a matter for immediately.

Powell Q&A ends at 12:56 PM ET

USD moved decrease:

- EURUSD moved briefly above its 200-day transferring common at 1.0832. It at the moment trades at 1.0829. The value additionally moved above the 38.2% retracement of the transfer down from the March excessive to the March low at 1.08219. That’s now a detailed threat stage for merchants within the brief time period. A transfer above the 200-day transferring common would goal the 50% of the March buying and selling vary at 1.08522

- USDJPY moved decrease however stays above its 100-hour transferring common at 151.498 and 200-hour transferring common at 151.44. The present value trades at 151.63.

- GBPUSD moved to a brand new excessive for the day and week and highest stage since final Thursday. The value stays beneath its 100-day transferring common at 1.26589. The present value trades at 1.26448, after reaching a excessive for the day at 1.26505.

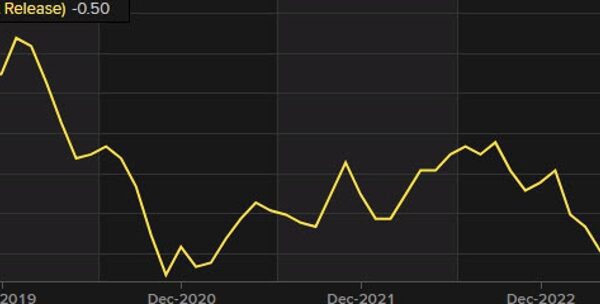

US yields moved decrease. The two 12 months is now adverse. The ten 12 months is close to unchanged:

- 2-year yield 4.682%, -1.8 foundation factors

- 5-year yield 4.3447, -0.8 foundation factors

- 10-year yield 4.363%, -0.2 foundation factors

- 30-year yield 4.5.6 %, +0.7 foundation factors

US shares are larger:

- S&P index is up 18.66 factors or 0.36%

- NASDAQ index is up 82.58 factors or 0.51%

- Dow industrial common is up 67 factors or 0.17%