Bitcoin put in one other optimistic worth efficiency over the previous week, with its worth rising by greater than 14% in simply seven days. Nonetheless, the value of the premier cryptocurrency and the potential of the starting bull run is likely to be underneath risk, as traders appear to be cashing in on their earnings.

In line with the newest on-chain information, vital quantities of Bitcoin have been on the transfer to cryptocurrency exchanges previously few days.

BTC Merchants Transfer Large Quantities To Crypto Exchanges

Crypto analyst Ali Martinez revealed – through a publish on X – that huge quantities of Bitcoin have been transferred to centralized exchanges previously few days. This revelation relies on the “Exchange Inflow” information from the blockchain analytics platform Glassnode.

In line with the post on X, round 20,000 BTC price over $880 million have been despatched to identified crypto trade wallets previously 5 days. When Bitcoin – and most cryptocurrencies – are transferred to exchanges, it sometimes signifies that some investors might be looking to sell their assets.

Round 20,000 $BTC have been despatched to identified #crypto trade wallets previously 5 days, price over $880 million! pic.twitter.com/rfeuBSaSv8

— Ali (@ali_charts) December 8, 2023

Large transfers to exchanges aren’t significantly promising for crypto belongings and their worth, as they improve the quantity of cryptocurrencies accessible within the open market. As extra Bitcoin will get transferred to exchanges, there’s a rise in supply accessible on the market, doubtlessly placing downward strain on the value.

Nonetheless, it’s price noting that there has not been any obvious affect on BTC’s worth to date. As of this writing, the Bitcoin price stands at $44,260, reflecting a 2.2% improve previously 24 hours.

How Is Bitcoin Traders’ Sentiment Shifting?

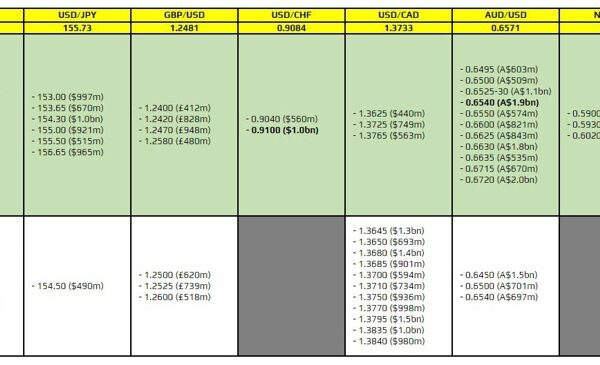

Curiously, one other latest information level from Glassnode dispels the notion that traders could also be dropping religion within the premier cryptocurrency. The analytics platform revealed that the sentiment of long-term Bitcoin traders has modified to a state of perception. The truth is, crypto pundit Ali Martinez famous that this marks “a significant shift in confidence” from traders.

Chart displaying BTC long-term investor sentiment shift to perception | Supply: Ali_charts/X

As proven within the graph above, this on-chain information revelation relies on the long-term holder Web Unrealized Revenue/Loss (NUPL) metric. This metric takes under consideration unspent transaction outputs (UTXOs) and serves as an indicator to evaluate the conduct of long-term traders.

It comes as no shock that the BTC optimism continues to develop stronger as traders await the greenlight of spot Bitcoin ETF (exchange-traded fund) in america. A number of spot BTC ETF functions are underneath the evaluation of the Securities and Trade Fee (SEC), with many anticipating approvals in early 2024.

Bitcoin worth approaches $45,000 on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Barron, chart from TradingView