niphon

By Kevin Flanagan

Following final week’s “hotter” than anticipated CPI launch, the only focus for the cash and bond markets was to, but once more, dial again their Fed charge minimize expectations. Nonetheless, there may be one other side of Fed coverage decision-making that has been flying underneath the radar, and that entails its stability sheet. With the Might 1 FOMC assembly solely two weeks away, I believed it might be a good suggestion to debate this a part of financial coverage as a result of, at this level, it seems as if this aspect might make headlines nicely earlier than precise charge cuts do.

So, what precisely am I referring to when speaking in regards to the Fed’s stability sheet? The easy reply is the Securities Held Outright line objects. For just a little Fed Stability Sheet 101, that is also called the System Open Market Account or SOMA. The reader most likely is extra accustomed to the phrases quantitative easing (QE) and quantitative tightening (QT) when addressing the Fed’s stability sheet.

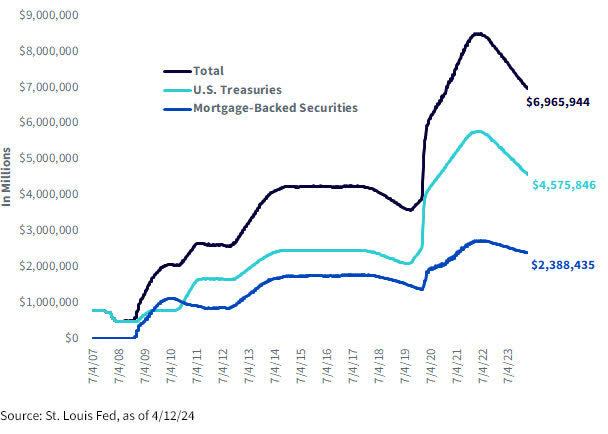

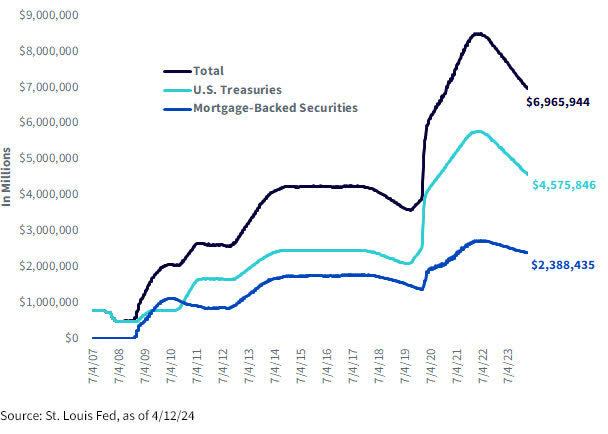

Securities Held Outright by the Fed

Recall that whereas the policymaker was busy implementing historic charge hikes from 2022 to 2023, it was additionally lowering its holdings of Treasuries and mortgage-backed securities (MBS), which had ballooned in dimension because of the COVID-19-related QE program. This latter portion of financial coverage tightening was QT. Quick-forward to the current, and it seems as if the FOMC is able to begin paring again the tempo of QT, even when it isn’t prepared to start out implementing charge cuts.

Let us take a look at the Fed’s securities holdings to get some perspective on how the present QT program has been working. At its peak, SOMA reached as excessive as $8.5 trillion in Might 2022, and since QT went into impact in June of that 12 months, whole holdings have dropped greater than $1.5 trillion to $6.97 trillion as of this writing. This discount is the results of the Fed’s current plan to let its Treasury and MBS positions roll-off by a mixed $95 billion per thirty days. Keep in mind, the Fed is just not outright promoting any securities; it’s simply not reinvesting the entire quantity of holdings which might be maturing or being redeemed.

Primarily based on final week’s launch of the March FOMC minutes, the Fed appears to be contemplating lowering the aforementioned roll-off quantity in half, which may quantity to roughly $50 billion per thirty days. As well as, the policymaker’s desire appears to be to pare again solely the tempo of QT that features the Treasuries portion of its general holdings, not MBS.

Apparently, a number of Fed officers have gone on file that the final word purpose can be to have solely Treasury securities on its stability sheet. Nonetheless, this might take fairly a while, because the Fed’s stability sheet is holding practically $2.4 trillion in MBS, and the present tempo of the roll-off right here is $35 billion per thirty days.

Conclusion

Whereas the cash and bond markets await steering on charge cuts, they could be getting one other announcement as quickly because the upcoming Might FOMC assembly {that a} “QT taper” is on the instant horizon as a substitute.

Kevin Flanagan, Head of Fastened Earnings Technique

As a part of WisdomTree’s Funding Technique group, Kevin serves as Head of Fastened Earnings Technique. On this position, he contributes to the asset allocation staff, writes mounted income-related content material and travels with the gross sales staff, conducting client-facing conferences and offering experience on WisdomTree’s present and future bond ETFs. As well as, Kevin works intently with the mounted revenue staff. Previous to becoming a member of WisdomTree, Kevin spent 30 years at Morgan Stanley, the place he was Managing Director and Chief Fastened Earnings Strategist for Wealth Administration. He was liable for tactical and strategic suggestions and created asset allocation fashions for mounted revenue securities. He was a contributor to the Morgan Stanley Wealth Administration World Funding Committee, main writer of Morgan Stanley Wealth Administration’s month-to-month and weekly mounted revenue publications, and collaborated with the agency’s Analysis and Consulting Group Divisions to construct ETF and fund supervisor asset allocation fashions. Kevin has an MBA from Tempo College’s Lubin Graduate College of Enterprise, and a B.S in Finance from Fairfield College.