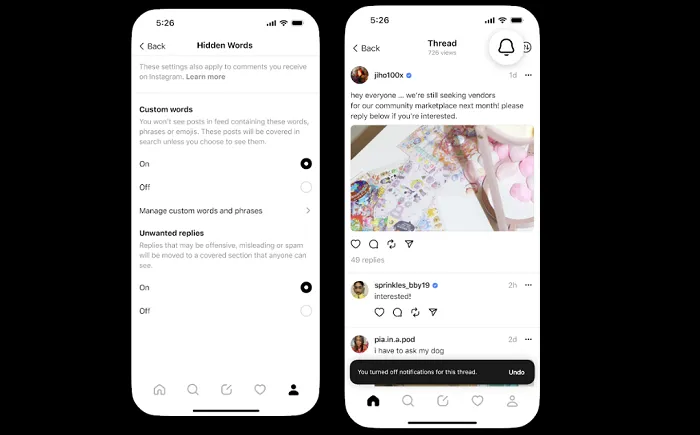

Latest knowledge from Santiment, a outstanding market intelligence agency, indicate that the altcoins could enter a “prime buying” part. In response to Santiment, greater than 85% of the altcoins they monitor are presently positioned in what’s traditionally thought of a “buying opportunity zone.”

Sentiment And Technical Indicators Favor Altcoins

This evaluation is predicated on the Market Value to Realized Worth (MVRV) ratio, which measures the profitability of held property over one-month, three-month, and six-month intervals. Such knowledge counsel that regardless of latest market volatility, the potential for a big bullish rally within the altcoin sector stays excessive.

👍 In response to our mannequin, the mid-term beneficial properties and losses by common wallets point out heavy realized losses throughout most #altcoins. Over 85% of property we monitor are in a historic alternative zone when calculating the market worth to realized worth (MVRV) of wallets’ collective… pic.twitter.com/NogkCSH5PG

— Santiment (@santimentfeed) April 25, 2024

The timing of this potential uptick is especially noteworthy. It aligns intently with the aftermath of Bitcoin’s newest Halving occasion, which is understood to positively affect the broader cryptocurrency market.

Santiment’s evaluation factors to heavy realized losses throughout most altcoins, which usually precede a restoration as markets stabilize and rebound. This downturn cycle, adopted by a robust restoration, affords strategic patrons an opportune funding second. Santiment significantly famous:

It could be justified to purchase whereas there’s rising worry seeping in from the group in any case of those market cap dips.

The sentiment surrounding altcoins is more and more optimistic, with varied cryptocurrency fanatics and analysts highlighting the potential for substantial beneficial properties.

On social platform X (previously Twitter), voices like person ‘Nagato’ advocate for endurance and strategic funding in altcoins. This means the present market consolidation part may quickly result in vital upward actions.

Crypto analyst Moustache shares this angle, noting parallels between present market circumstances and people previous the final main altcoin season almost 4 years in the past.

Throughout that interval, key technical indicators such because the Gaussian Channel and EMA 10 supplied robust purchase indicators, which had been validated by the following market conduct.

The final time Altcoins broke out of the Gaussian Channel and retested it was virtually 4 years in the past.

After that, we skilled a robust Altcoin-Season.

Again then we additionally noticed a purchase sign within the tremendous development in addition to the EMA 10, which withstood the complete run.👀🔥 pic.twitter.com/ddcikhSqwz

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) April 25, 2024

Market Watch: Altcoins Efficiency Amidst Bitcoin’s Dominance

In the meantime, the broader market metrics support this optimistic outlook. Regardless of Bitcoin’s dominance at round 54% of the entire market capitalization, the worldwide altcoin market cap has managed to stay strongly above $1 trillion, with a dominance of roughly 11.54%.

Latest efficiency knowledge for altcoins like XRP and Dogecoin, which have seen appreciations of 5.9% and three.1% over the previous week, additional validate the sentiment that the altcoin market could also be getting ready to a breakout.

Such actions underscore cryptocurrency markets’ dynamic and infrequently cyclical nature, the place sentiment and technical indicators can herald upcoming tendencies.

Featured picture from Unsplash, Chart from TradingView