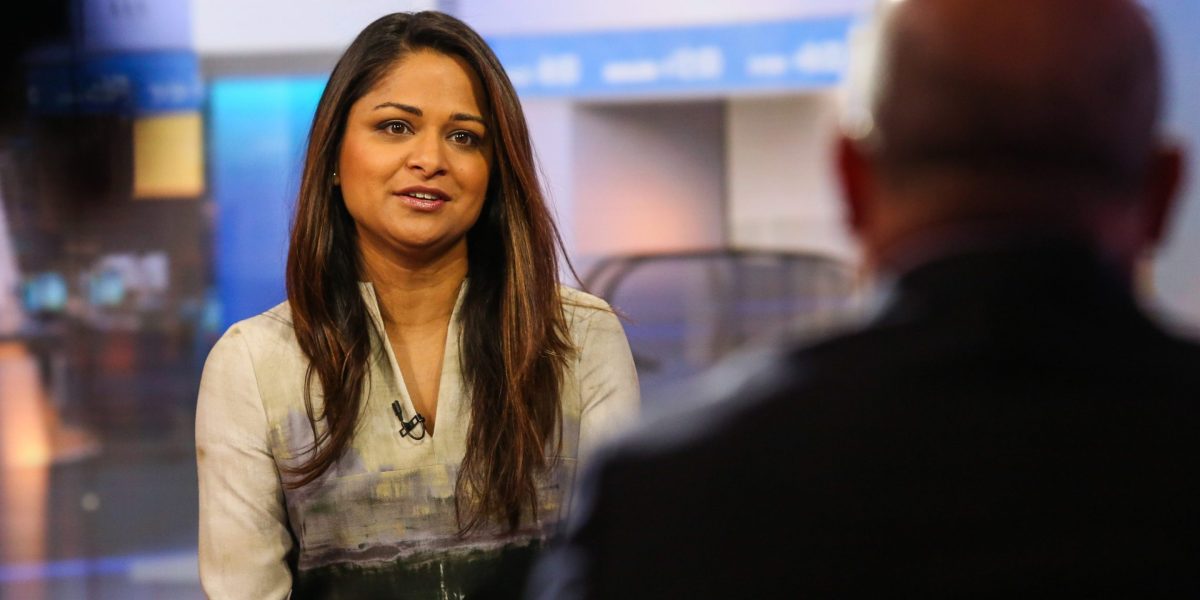

With unexpectedly sturdy financial knowledge and buyers’ AI enthusiasm driving the S&P 500 32% larger over the previous 12 months, some consultants are worried that the inventory market is in a bubble. Financial institution of America head of U.S. fairness and quantitative technique Savita Subramanian positively isn’t one in every of them, however after elevating her year-end worth goal for the S&P 500 from 5,000 to five,400 final week, she took the comparatively uncommon step of claiming she’d heard from fairly a couple of market bears.

Subramanian mentioned in a Monday notice that she had a “full week of feedback and pushback” since making her bullish name, together with a direct query on a name that went one thing like: “Savita, are you forecasting a bubble?” The reply to that query is not any, Subramanian insists—and she or he’s prepared to handle the priority.

In an FAQ issued by Bank of America Analysis, the veteran analyst defined that regardless of all of the fears over a doubtlessly irrationally exuberant market, prior market bubbles have usually featured a couple of key elements—primarily “a gap between price and intrinsic value” and “rampant speculation”—and the present market doesn’t match the invoice. “Housing in 2007, tech in 2000, tulips in 1637 are examples that tick these boxes. But the S&P 500 today does not,” she wrote.

Nonetheless, with AI fervor harkening again to the web period because it pushes some tech shares ever larger, a couple of Wall Road consultants have made comparisons to the dotcom bubble. Now, there’s an argument over whether or not we’re repeating 1995, and the tech bull run is simply getting began, or whether or not it’s extra like 1999, and a crash is correct across the nook.

Subramanian reassured readers that, in her view, it’s “more 1995.” From buyers’ comparatively subdued sentiment ranges to rising productiveness and the basic power of Huge Tech management, this isn’t a bubble simply but.

Shares are overvalued, proper?

The primary criticism of Subramanian’s bullish prediction for the S&P 500 has to do with market valuations. The S&P 500 at the moment trades at roughly 20.5 occasions ahead earnings, in contrast with a median of 15.8 since 1986, in keeping with BofA knowledge.

“The gap between price and intrinsic value is high, based on snapshot P/E multiples,” Subramanian admitted. “But the ex–Magnificent Seven trades closer to long-term average multiples, and, more importantly, today’s index lacks comparability to prior decades’, in our view.”

The veteran strategist famous that extremely valued Huge Tech shares are obscuring the true valuation of the general market. To her level, the Magnificent Seven—a gaggle that features Microsoft, Google, Apple, Nvidia, Tesla, Meta, and Amazon—commerce at roughly 38 occasions their trailing 12-month earnings, in contrast with 23 occasions for the S&P 500 as a complete.

Subramanian additionally identified that the S&P 500’s constituents are fairly totally different from what they was once, which makes evaluating the index’s valuation with its historic common much less helpful.

“Valuation matters. But comparing a trailing P/E today to a trailing P/E of prior decades makes little sense given the index’s mix shiſt,” she wrote. “Today’s S&P 500 is half as levered, is higher quality, and has similar or lower earnings volatility than in prior decades.”

However are buyers too euphoric?

The second most typical function in any inventory market bubble is euphoria. And surging AI shares, led by the 278% rise in Nvidia over the previous 12 months, have some arguing that buyers are fairly enthusiastic, however Subramanian used a few of BofA’s knowledge to push again on that concept.

She famous that U.S. fairness buyers’ pleasure has been “ring-fenced” to themes like AI, however total sentiment is “nowhere near bullish levels of prior market peaks.” The truth is, investor sentiment is correct round the place it was in 1995, in keeping with BofA knowledge. “Sentiment is neutral despite pushback we hear that sentiment is ‘full bull,’” Subramanian wrote.

General, for Subramanian, regardless of the inventory market’s surge over the previous 12 months, the S&P 500 “lacks signs” of a bubble. “In our view, this bull market has legs,” she wrote, including “today is 1995, not 1999.”

The bears’ take

Whereas Subramanian has made the case for the inventory market to expertise one other banner 12 months in 2024, there are all the time bears meting out warnings. Simply this week, Michael Gayed, a portfolio supervisor at Tidal Monetary Group, told The Motley Fool that “we’re in a lot of trouble” and that “all bubbles end.”

Funding banks aren’t as apprehensive a few true bubble, however there are a couple of big-name bears on the market, together with Morgan Stanley’s chief funding officer and chief U.S. fairness strategist, Mike Wilson, who sees the S&P 500 dropping roughly 12% to 4,500 over the following 12 months. Wilson isn’t arguing we’re in a bubble, however he notes that 90% of the S&P 500’s “historic” 25% rally since October has been pushed by rising valuations as an alternative of bettering earnings.

The CIO defined in a Monday notice that he believes the market is being pushed by “ambiguity” and “liquidity” this 12 months, which suggests buyers ought to stay vigilant for a correction.

As for the paradox a part of the market equation, Wilson pointed to “conflicting data” within the economic system and inventory market that may very well be trigger for concern. Sturdy financial development with muted earnings; rising inventory market valuations with a extra hawkish Fed; these aren’t the everyday mixtures that you simply’d count on. Financial development normally drives company earnings, and the specter of larger charges is meant to lower inventory market valuations. So what’s accountable for the conflicting knowledge?

“We think the current policy mix explains many of the disconnects that have been hard to reconcile from an economic, earnings, and performance standpoint,” Wilson wrote.

Federal authorities spending through the Inflation Discount Act and CHIPS Act is driving spending and hiring by personal building and manufacturing corporations, protecting financial development alive, in keeping with the Morgan Stanley CIO. However there’s a problem with this spending that might clarify why earnings aren’t as sturdy as current financial knowledge: “While these programs are helping to keep the economy humming, they are also crowding out the private sector as they impact the cost of labor, materials, and capital,” Wilson mentioned.

So Wilson’s “ambiguity”—or conflicting knowledge factors within the economic system in contrast with the inventory market—can partly be defined by rising federal authorities spending. However the second a part of the equation is liquidity, which helps to clarify the distinction within the inventory market’s sturdy efficiency in contrast with its comparatively muted earnings development, in keeping with Wilson.

That is the place the reverse repo facility is available in. With a view to assist pay for the federal authorities’s giant finances deficit, the Federal Reserve permits personal sector corporations to earn somewhat extra cash, usually via an middleman, by basically lending cash to the Federal Reserve in a single day. These corporations purchase U.S. Treasuries after which conform to promote them again at the next worth at a later date, incomes yield however offering the Fed with money over a brief time period. That is used as a software by the Fed to place a ground beneath short-term rates of interest, nevertheless it additionally results in rising liquidity. “In our view, that liquidity has helped to elevate asset prices broadly, led by some of the more speculative areas of the equity market/asset classes,” Wilson defined.

Wilson’s ambiguity and liquidity argument is an extended, detailed manner of claiming “be careful” to buyers, as a result of the elements driving market good points is probably not sustainable. “With these dynamics now better understood by the market, the burden is now likely on earnings/fundamentals to show more material improvement,” Wilson concluded.