Samson Mow, CEO at Jan3 and a staunch Bitcoin advocate, not too long ago sparked a dialogue among the many crypto group, suggesting that Bitcoin’s journey to reaching a valuation of $1 million continues to be believable.

Mow’s assertion comes from views and predictions on BTC inside the crypto group, together with Balaji Srinivasan, a former a16z accomplice and Coinbase CTO.

Balaji’s Preliminary $1 Million BTC Outlook

In March, amid a tumultuous monetary atmosphere marked by the chapter and subsequent rescue of a number of US banks, together with these with ties to the crypto world like Silvergate and Signature Financial institution, Balaji Srinivasan placed a $2 million bet on an analogous million-dollar trajectory for BTC.

The previous Coinbase CTO primarily guess that BTC would hit a million-dollar price ticket in 90 days. Balaji based mostly his forecast on the rampant cash printing by the US Treasury and Federal Reserve and the continued banking disaster.

Whereas agreeing with Balaji’s value goal, Mow famous that these occasions hadn’t sustained sufficient momentum to propel BTC to such heights. Although the previous Coinbase government ultimately exited the bet, Mow disclosed that Balaji was by no means incorrect in regards to the $1 million BTC value goal “but was wrong on the timing and the catalyst.”

Mow identified that the “normies,” or common folks but to embrace crypto totally, sought refuge in different banks as a substitute of turning to BTC.

Balaji wasn’t incorrect about #Bitcoin going to $1M, however he was incorrect on the timing and the catalyst.

My $1M name is predicated on an enormous fast inflow of institutional capital whereas Bitcoin out there on the market is at historic lows, compounded by the halving.

His $1M prediction was…

— Samson Mow (@Excellion) December 6, 2023

Path To A Million: Institutional Capital And Bitcoin Halving

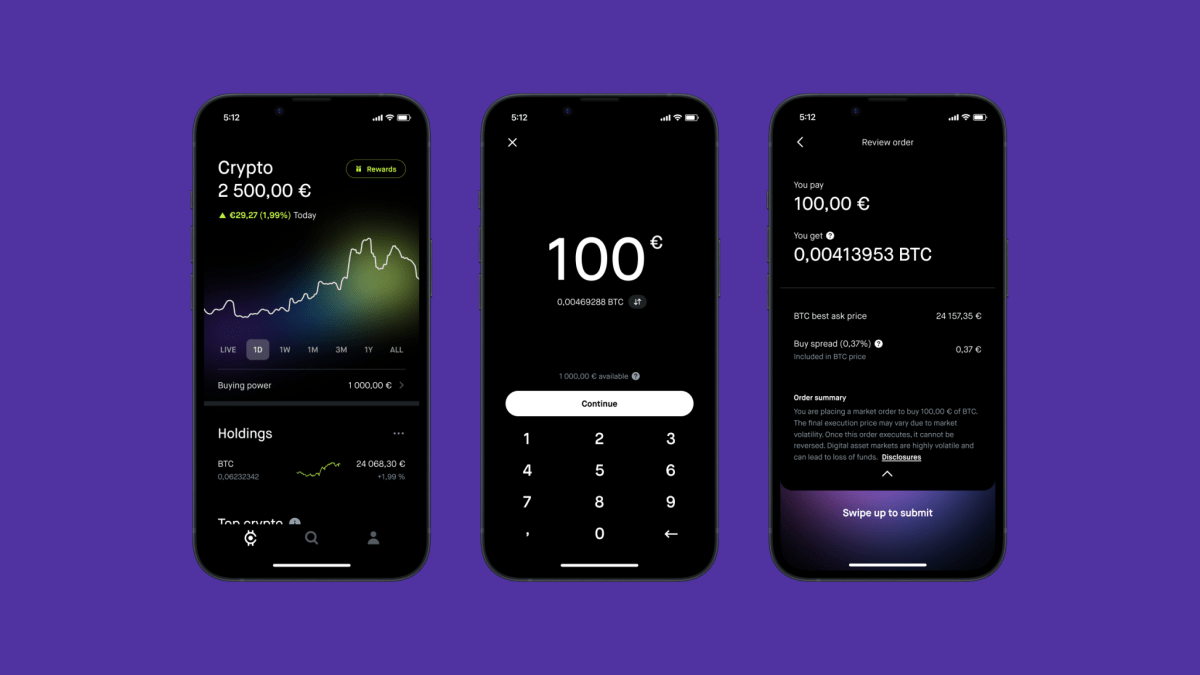

Delving deeper into the mechanics of BTC’s potential rise, Mow attributes the potential surge to a big inflow of institutional capital, coupled with the shortage induced by BTC halving occasions.

The Bitcoin advocate anticipates that as institutional investors pump capital into the market, the restricted availability of BTC will additional drive up its value. This view aligns with the BTC group’s long-standing anticipation of institutional funding as a key driver for substantial value will increase.

Mow’s perception is echoed by Bitcoin analyst Bit Paine, who provides a mathematical foundation for the million-dollar Bitcoin hypothesis. Paine’s evaluation begins with the essential ideas of provide and demand, calculating the brand new Bitcoin provide for upcoming cycles and estimating potential gross sales from long-term holders based mostly on HODL Waves information.

Folks appearing like @Excellion is insane for his $1M / #BTC name neglect how briskly #bitcoin can occur – which is the precise mindset wanted for such a factor to happen.

$1M/#BTC will not be my base case or expectation, however I can definitely think about a set of circumstances below which it… pic.twitter.com/Fc4acjShpy

— Bit Paine ⚡️ (@BitPaine) November 24, 2023

His projection entails an enormous capital inflow of round $4.5 trillion, figuring out U.S. retirement financial savings and company treasuries as potential main contributors.

Along with institutional investments, Paine additionally outlines different elements that might contribute to Bitcoin’s rise. These embody increasing adoption by nation-states and the influence of latest cash creation, particularly regarding the huge world bond market.

Featured picture from Unsplash, Chart from TradingView