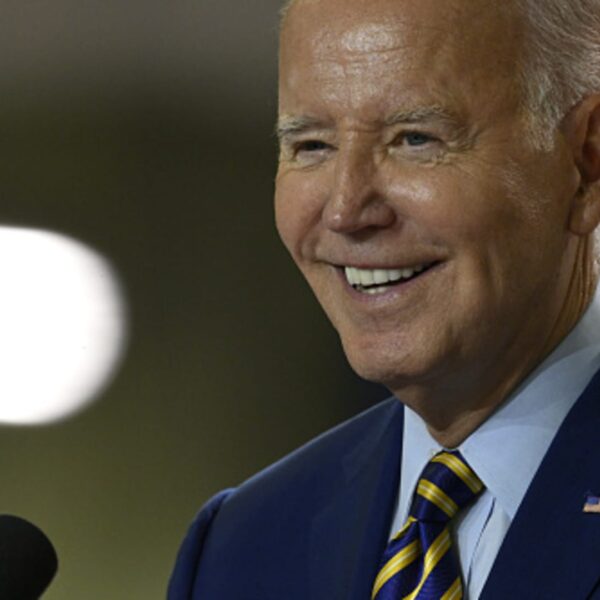

In a transfer that has ignited robust reactions throughout the crypto group, Senator Elizabeth Warren not too long ago launched the Digital Asset Anti-Money Laundering Act. This invoice goals to impose stricter rules on the crypto trade, triggering considerations in regards to the potential penalties for innovation and particular person freedoms.

Notably, the invoice has steadily gained assist within the Senate since its inception and subsequent reintroduction in July 2023.

Far-Reaching Penalties For Crypto

According to pro-XRP lawyer John Deaton, the invoice has garnered elevated backing within the Senate, with 20% of senators already expressing their assist for what he calls Warren’s “de facto ban” on cryptocurrencies, together with Bitcoin (BTC), in the USA.

Deaton additional asserts that Warren is leveraging her reelection campaign as a possibility to form and management the narrative surrounding cryptocurrencies.

Deaton’s robust criticism of the invoice extends to his perception that Senator Warren poses a major menace to private freedoms in the USA. If handed, Deaton argues that Warren’s proposed laws might have far-reaching implications for the crypto trade and its members.

Nevertheless, the pro-XRP lawyer additionally highlights that the invoice’s immediate passage is unlikely, emphasizing that its impression is extra more likely to be felt in the long run.

Responding to a follower on the social media platform X (previously Twitter), Deaton clarified that he doesn’t anticipate the invoice to cross the Home of Representatives within the present 12 months.

Nevertheless, Deaton cautions that if the Senate, Home, and Presidency all come below Democratic management in 2024, there’s a risk that components of the invoice may very well be handed in early 2025. In the end, Deaton emphasizes that the implications of this invoice ought to be considered with a long-term perspective, because it might form the way forward for the crypto trade.

KYC Provisions Might Criminalize Blockchain Know-how?

The proposed Digital Asset Anti-Cash Laundering Act has generated vital concern amongst proponents of cryptocurrencies, who argue that overly restrictive rules might stifle innovation and hinder the trade’s potential.

Critics of the invoice contend that it could hinder technological developments, restrict monetary inclusion, and impede the USA’ capacity to compete globally within the quickly evolving digital asset panorama.

On the identical be aware, Peter Van Valkenburgh, Director of Analysis at Coin Middle, not too long ago voiced his concerns relating to the invoice’s potential implications. Van Valkenburgh highlighted that the proposed laws primarily focuses on monetary surveillance and imposes Know Your Buyer (KYC) necessities on entities and people concerned in crypto-related actions.

Van Valkenburgh emphasised the absurdity of making use of KYC rules to actions similar to working a node, mining, or holding Bitcoin in a self-hosted pockets. The invoice’s provisions would require people to acquire private data, similar to names, addresses, and social safety numbers, for each transaction they interact in.

Van Valkenburgh highlights that failure to adjust to these necessities might result in prosecution, successfully outlawing blockchain expertise.

As the talk surrounding Elizabeth Warren’s Digital Asset Anti-Cash Laundering Act unfolds, the crypto group stays vigilant, looking for to make sure that regulatory measures strike a fragile stability between regulatory oversight and preserving innovation, financial development, and particular person liberties.

Featured picture from Shutterstock, chart from TradingView.com