Open banking — the place conventional banks can share information, and construct new providers, by means of APIs that deliver their ageing methods into the twenty first century — has seen its greatest traction to this point in mature economies, the place the overwhelming majority of shoppers and companies have already got financial institution accounts; are au fait with digital transactions; and are receptive to attempting out new approaches to on a regular basis issues if that may save them money and time.

However with even probably the most superior markets nonetheless seeing very gradual adoption — within the U.Okay., for instance, solely 11% of shoppers, and 18% of small companies, have ever used open banking — some are betting that the actual promise for these new providers lies in growing economies.

Prometeo, a startup out of Uruguay constructing channels to allow open banking throughout Latin America, is as we speak saying that it has picked up $13 million in funding to broaden its enterprise. Valuation will not be being disclosed however the firm says the spherical is at a “standard” dilution for Collection A, that means it’s now doubtless valued at just below $100 million.

Since its founding in 2018, Prometeo has grown to this point on comparatively lean funding. Previous to this spherical, it had raised solely round $6 million, says co-CEO and co-founder Ximena Aleman, who beforehand labored as a journalist overlaying the media and tech industries earlier than taking a flip to fintech.

Maybe consistent with the unlikely roots of its CEO, Prometeo can be taking an untraditional path to development.

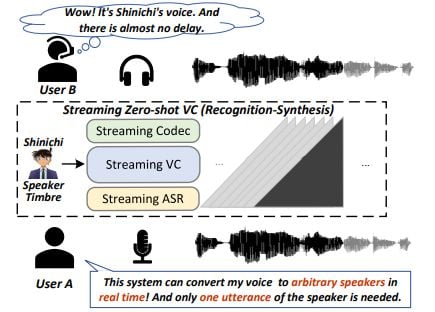

Plenty of open banking nowadays centered on nationwide rollouts — not least as a result of banking conventions and laws are sometimes very localized. Prometeo is taking a distinct course and tackling Latin America and its intensive fragmentation as a single market, and utilizing a single API to take action.

Beneath that one API, to this point, it has turned on some 350 channels throughout 283 monetary establishments in 10 international locations. Brazil and Mexico are its two greatest in the meanwhile, in addition to being the largest fintech markets within the area general. And its hottest providers to this point mirror those who have additionally discovered traction elsewhere: account-to-account funds and account validation, and (for companies) money administration, mentioned Aleman, who shares the CEO job with co-founder Rodrigo Tumaián.

The plan is to deliver on extra customers, add extra providers and broaden to additional geographies, she added, with revenues rising 10x within the final two years (the startup will not be disclosing precise income numbers).

All the identical, the challenges dealing with firms in open banking within the area are vital, beginning with the truth that Latin America, general, is effectively behind extra mature markets like Western Europe and the U.S. with regards to monetary providers.

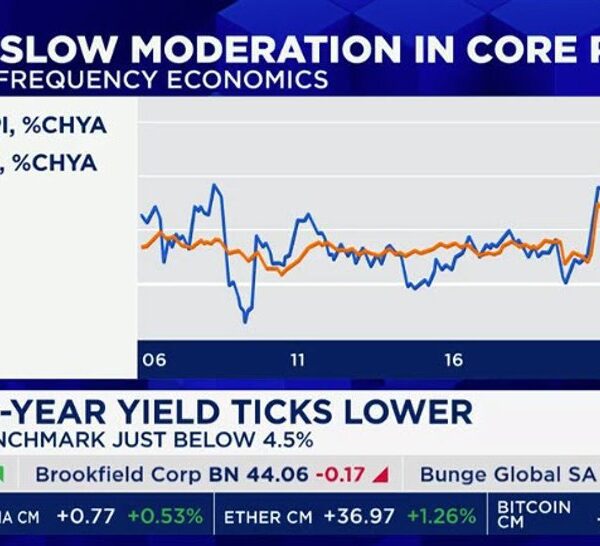

Checking account penetration is estimated to be around 70%, and whereas that’s exhibiting development, it’s nonetheless behind the excessive 90+ percentages of nations in different areas the place open banking has launched and brought off.

“There is a lot of improvements still to be made for financial inclusion,” admitted Aleman, who describes each day transactions amongst most companies and shoppers as “mostly cash-based.”

Checked out in a different way, although, this might additionally spell alternative. In additional established markets, one of many greatest aggressive roadblocks is the ubiquity of current cost rails — particularly these run by the likes of main credit score networks like Visa. That problem, not less than, is smaller in Latin America. (It’s not the one firm that believes that open banking has a giant position to play in monetary providers sooner or later: Final 12 months, the open banking startup Ivy raised funding particularly to broaden to Latin America; and Christine wrote right here extensively on Finerio, an formidable open banking startup out of Mexico.

The businesses backing Prometeo on this spherical underscore not simply who desires to develop their enterprise within the area, however who believes open banking may assist them get there. Antler Elevate, a agency with roots in Asia Pacific, is main the spherical, with PayPal Ventures, Samsung Subsequent, DN Capital, Cometa and Magma Companions collaborating.

PayPal and Samsung Subsequent, it must be famous, are usually not but working with Prometeo on providers, however backing the startup alerts their intentions and pursuits. PayPal has been placing down roots by way of investments into native startups for years within the area. One of many greatest was again in 2019, when it made a $750 million funding into market MercadoLibre. Extra lately, final 12 months it led a $14 million spherical into nocnoc, a Latin America cross-border commerce specialist. It additionally owns the point-of-sale funds firm Zettle, which has been making very huge inroads into Latin America for years now.

Samsung, in the meantime, is the area’s greatest cell phone vendor, with a market share of more than 40%.

In each of those circumstances, there’s a clear curiosity in having a key partnership, and an early seat on the desk, in an space that would doubtlessly grow to be huge, even when it isn’t proper now. Digital wallets, together with cellular wallets — which each firms are betting will play a giant half in how folks transact sooner or later — are nonetheless a really small a part of the commerce pie within the area, accounting for simply 10% of all transactions as of 2020.

However the progress the startup has made, and the curiosity it has generated among the many greatest gamers in banking within the area — with companions reminiscent of Citi, Santander, J.P. Morgan, Vtex and lots of native gamers — has led to traders taking discover.

“Prometeo, with its simple single API, provides banks and financial institutions access to payments and data throughout the entirety of Latin America,” mentioned Fady Abdel-Nour, a companion at Antler Elevate, in an announcement. “We are excited to partner with Ximena and Rodrigo to build a company that’s not just advancing technology, but also empowering businesses to reach new heights of success.”