gorodenkoff

Fixed-income markets are at fever pitch amid a changing debt capital market climate. Therefore, I decided to update our outlook on the PIMCO Corporate and Income Opportunity Fund (NYSE:PTY), a closed-ended fund that emphasizes the riskier part of the fixed-income market through a diversified strategy that spans corporate debt, mortgage-backed securities, and government-related issuances.

We last covered the vehicle a year ago, stating that economic tail risk wouldn’t upend the CEF due to its comprehensive portfolio diversification strategies. However, after delivering double-digit returns, I decided to revise our take on PTY CEF, especially as the lending environment is transitioning.

Pearl Gray’s Previous PTY Rating (Seeking Alpha)

Without further ado, here are my latest thoughts about PTY CEF.

PTY CEF: A Performance Review

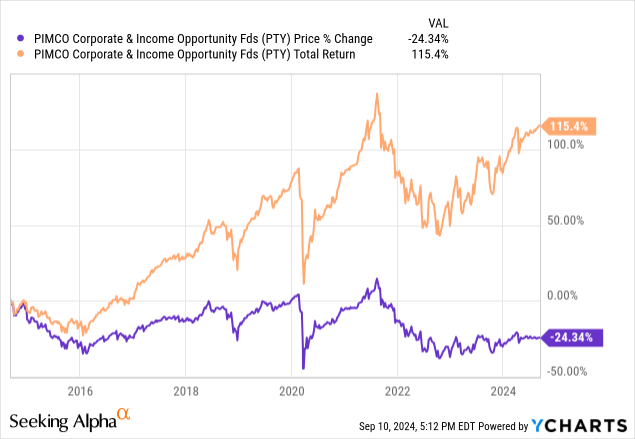

As mentioned in the introduction, PTY has produced double-digit returns since our latest coverage, mainly through carry, but capital gains have been realized.

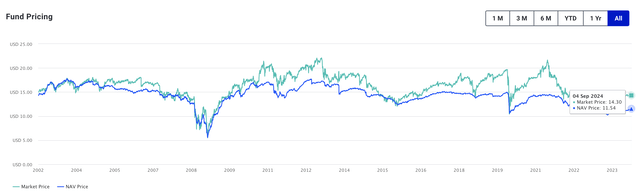

The fund’s distributions are relatively consistent. However, PTY CEF’s past return distribution conveys noteworthy price volatility.

Portfolio Changes

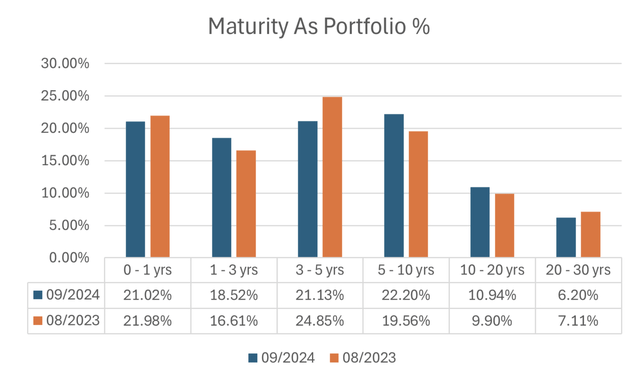

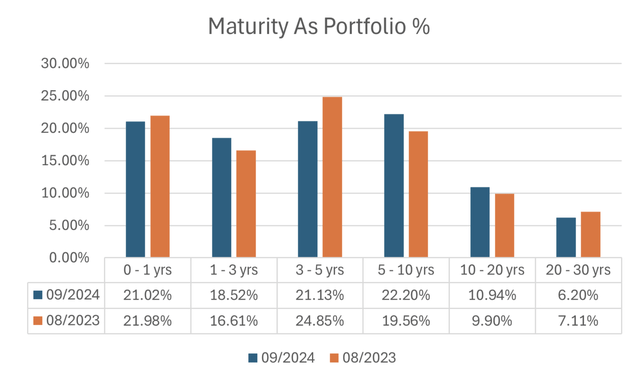

The natural movement of the market and strategic decisions by PIMCO’s team have altered PTY’s portfolio composition. Most notable is the vehicle’s pivot into five-to-tens and out of three-to-fives. Additionally, the CEF, which has an effective maturity of 6.8 years, has added to its one-to-three-year bucket while detracting weight from its long-term assets.

Overall, I’d say that the CEF’s latest movement shows that it is betting on key rates instead of changing its broad-based maturity outlook. However, its underlying assets’ optionality and interest rate sensitivity must be considered, as they can influence PTY’s duration.

Maturity Schedule – Measured by Market Value (Author’s Work – Data From PIMCO)

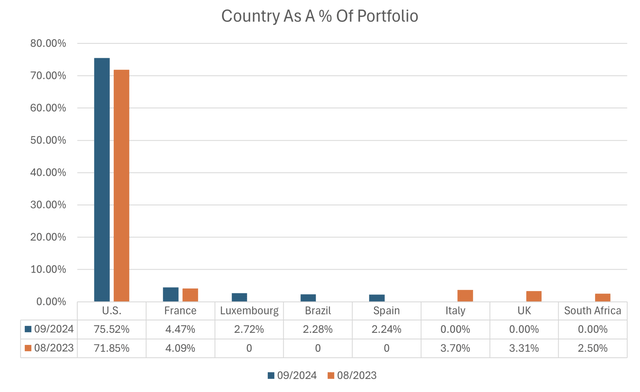

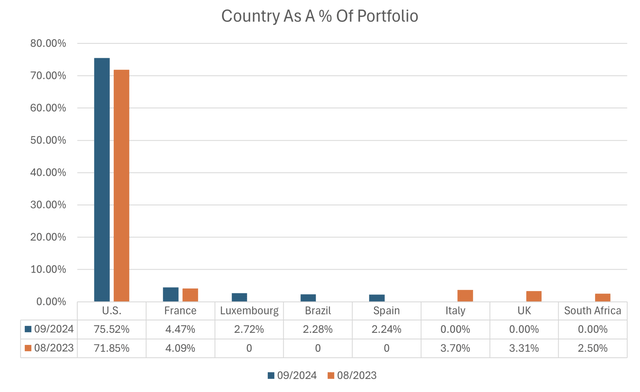

The PIMCO Corporate and Income Opportunity Fund’s U.S. exposure has increased by around 367 basis points since we last covered the CEF. Moreover, the vehicle added material exposure to Luxembourg, Brazil, and Spain while dropping exposure to Italy, Spain, and high-risk South Africa.

Despite its international exposure, over 75% of the portfolio’s market value is U.S.-centric. Therefore, its country risk is probably skewed.

Country Exposure – Market Value (Author’s Work – Data from PIMCO)

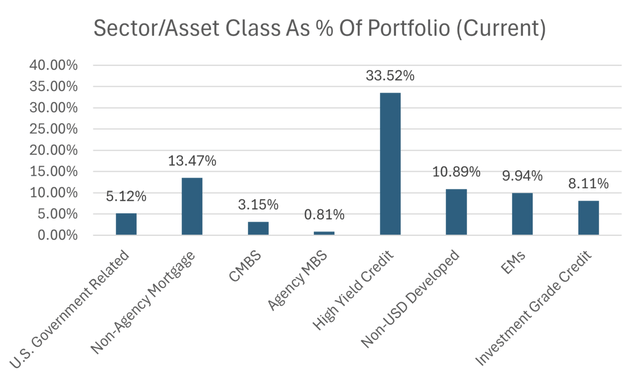

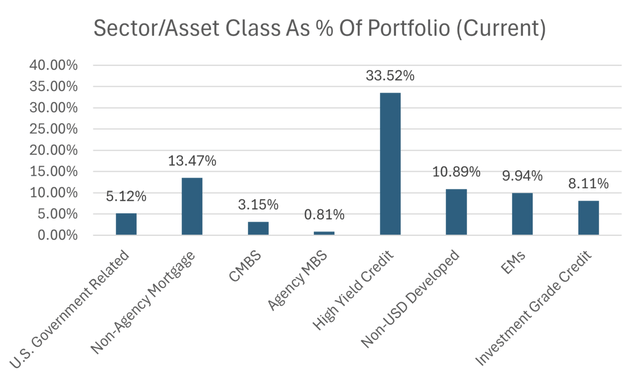

Our previous analysis did not show PTY’s sub-asset class exposure, so I’ll discuss the fund’s exposure in isolation.

The PIMCO Corporate and Income Opportunity Fund’s high-yield credit exposure is notable, with over 33% of its portfolio spanning non-investment grade credit. In addition, the PIMCO CEF has telling exposure to non-agency mortgage-backed securities, likely providing a negative duration effect.

Although PTY CEF holds higher-quality bonds, its U.S. government-related and investment-grade debt constitutes little over 13% of the vehicle’s exposure, meaning credit risk can be influential in the future.

Sub Asset Class Exposure – Market Value (Author’s Work – Data From PIMCO)

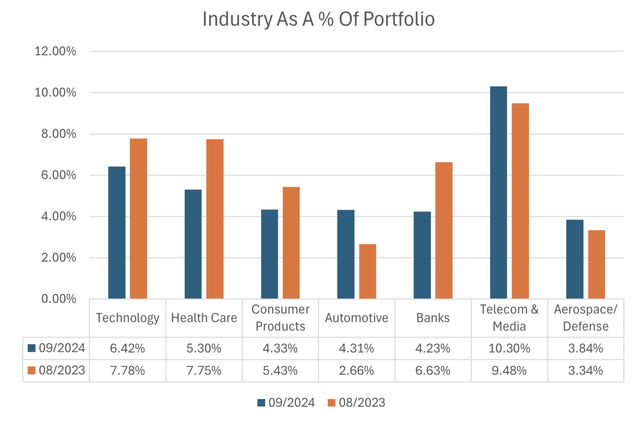

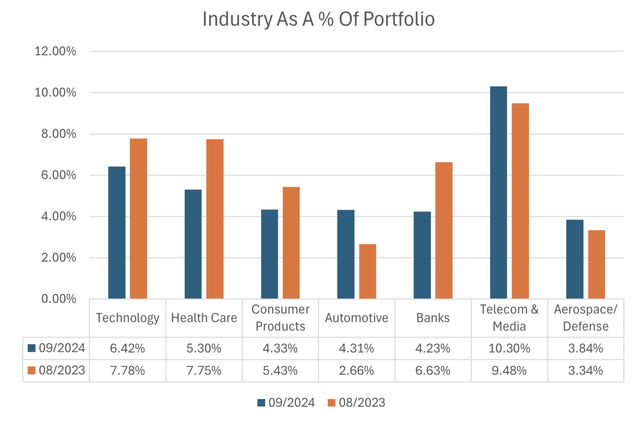

There hasn’t been much change to PTY CEF’s industry exposure. The fund has downsized its technology exposure by over 130 basis points while also downsizing on healthcare, consumer goods, and banks. On the other hand, PTY CEF’s automotive exposure has increased. However, it seems more sector-diversified than before.

Industry Exposure – Market Value (Author’s Work – Data From PIMCO)

Aside: Wireless, Cable, and Non-Cable Media Were All Combined Into Telecom & Media.

Commenting On Outlook

Asset Level

The PIMCO Corporate and Income Opportunity Fund has delivered compelling year-over-year returns. However, I think it is time to exit the CEF or at least downsize.

The primary reason for my bearish outlook on PTY CEF is the influence that high-yield bonds might exert.

Credit spreads have narrowed during the U.S.’s latest interest rate cycle, showing a natural inverse relationship between the interest rate and credit cycle. I believe a slowing economic environment and a negative correlation between interest rates and credit spreads will spike credit risk in late 2024 and early 2025 (assuming talks of an interest rate pivot are realized), leading to lower valuations on high-yield bonds. Moreover, lower inflation might result in lower value-based Loss Given Default numbers, exacerbating high-yield bond risk premiums.

High-Yield Option-Adjusted Spreads (St.Louis Fed)

Aside: Here are links to the U.S. and Global economic indicators to substantiate my macroeconomic claims.

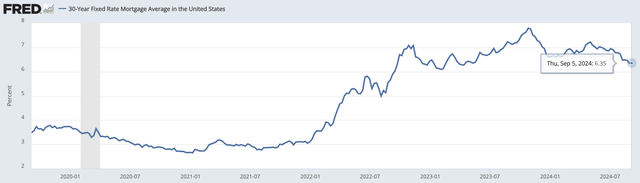

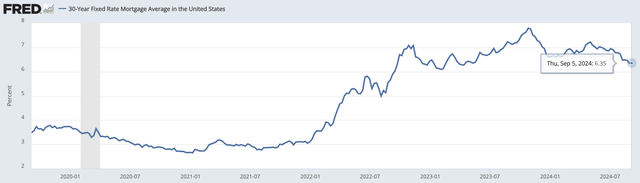

Furthermore, the U.S. yield curve has declined considerably in recent months, likely due to lower inflation and talks of an interest rate pivot. Mortgage rates have followed suit, with U.S. 30-year mortgage rates showcasing a telling decline. Therefore, considering lower mortgage rates and the concurrent possibility of prepayment risk, I believe PTY CEF’s MBS exposure is unfavorable.

U.S. 30y Fixed Mortgage Rate (St.Louis Fed)

Aside from developed market activity, emerging markets seem risky as election and commodity cycles have shown an impact. Additionally, global economic risk can enhance the systematic risk of emerging markets in excess, which is a factor I would consider amid PTY CEF’s exposure to Brazil and other emerging markets.

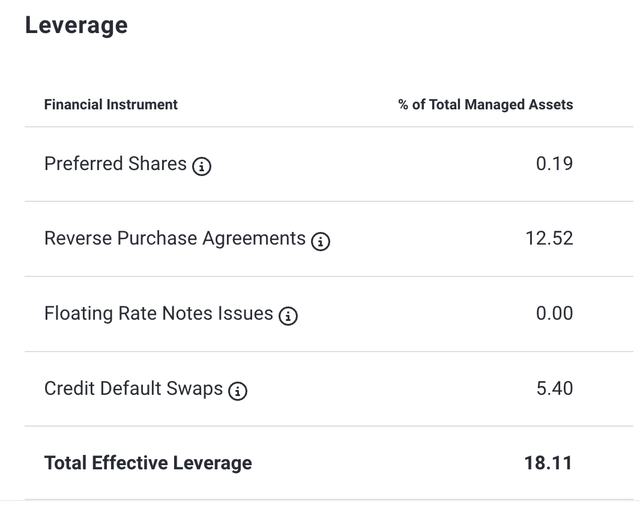

Liability Level

I don’t see PTY CEF as a highly leveraged fund. However, I would like to stress its reverse repurchase agreements as bond yields are declining rapidly, which might spark repurchase rates on existing short positions. Moreover, asset-liability management can be challenging whenever interest rate volatility enters the fray, which is a factor to consider as the U.S. interest rate has seemingly struck an inflection point.

PTY CEF’s Salient Portfolio Metrics

Dividends, ROC, Interest

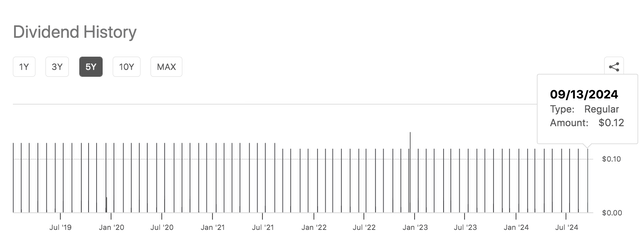

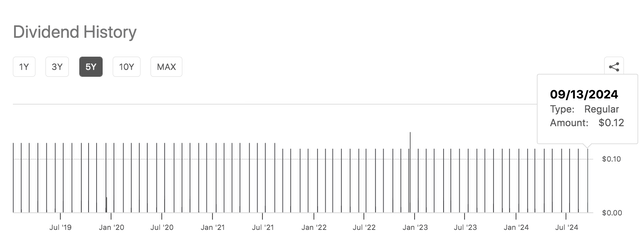

It was recently announced that the PIMCO Corporate and Income Opportunity Fund would pay a $0.1188 monthly dividend on October 1st with an ex-dividend date of September 13th.

The CEF has delivered consistent dividends in the past ten years, with the occasional return of capital and interest distributions occurring to provide excess returns. PTY CEF has a yield on cost of around 7.87%, which I find compelling. However, as mentioned before, I think the CEF has price risk, and its fundamental headwinds might attach additional risks to its dividend profile.

Dividend History (Seeking Alpha)

In addition to observing the CEF’s price return chart, the following diagram supports my price risk argument by showing that a ten-year historical regression of PTY CEF discovered a maximum drawdown of 36.51%.

PTY CEF Risk Metrics (Portfolio Visualizer)

Price-to-NAV

Fixed-income investors often emphasize a closed-ended fund’s price-to-net asset value to identify arbitrage opportunities. Although PTY CEF has frequently traded at a premium to its net asset value, its current P/NAV ratio is around 1.23x, which I deem outlying, especially given the challenging systematic environment.

Concluding Thoughts

It might be a good time to reduce exposure to the PIMCO Corporate and Income Opportunity Fund. Although it has experienced solid year-over-year returns, I believe PTY CEF is highly exposed to emerging risks within the high-yield credit and mortgage-backed security asset classes. Moreover, the fund trades at a telling price-to-net asset value premium, which I cannot substantiate in today’s market environment.

In essence, I think the CEF’s price risk exceeds its income-based benefits.