Anton Petrus/Second through Getty Photographs

Natural gas prices have fallen sharply since peaking at over $10 a gigajoule in September 2022, reaching simply over $1.60 a gigajoule at Henry Hub right now. Leveraged producers really feel the ache.

Key business gamers appear to be trying previous the present droop as they merge and purchase to broaden their footprint and look to liquified pure fuel (LNG) exports as an outlet for low-cost North American fuel in demand in gas-starved Europe and Asia. Chesapeake (CHK) acquired Southwestern to change into the most important pure fuel producer in January following Exxon’s (XOM) acquisition of Pioneer final October, solely to see

Diamondback (FANG) purchase Endeavour prior to now few days. The business consolidation targets not solely pure fuel but in addition the prolific shale-based oil manufacturing within the Permian Basin, however pure fuel is a key a part of the economics of every of those offers.

Chesapeake right now introduced a long-term LNG cope with Delfin and Guvnor concentrating on Asian markets to appreciate the Japan-Korea Marker Benchmark (JKM) pricing which is considerably larger than U.S. market costs. JKM prices are about $9 a gigajoule right now, however had been within the $15 a gigajoule space final yr. Netbacks from LNG exports are much more worthwhile than promoting pure fuel within the home market. The LNG alternative is a tailwind for U.S. producers which will encourage traders to look previous the droop in costs right now.

Canadian producers have restricted entry to LNG markets with the primary Canadian LNG terminal nonetheless below building in Kitimat, B.C., and anticipated to start delivery late this yr or early 2025. In consequence, it’s the Canadian producers who bear the brunt of the smooth pricing that the business faces right now.

Over time, development in LNG exports ought to present itself in tight home markets and all North American producers ought to profit. A chilly winter in 2024-2025 could be welcome, and appears seemingly as the present El Nino contributing to the nice and cozy winter we’re experiencing reverses to La Nina portending a colder winter starting in late 2024. However for now, it’s Canadian producers who will endure, notably these with an excessive amount of debt and few ahead gross sales.

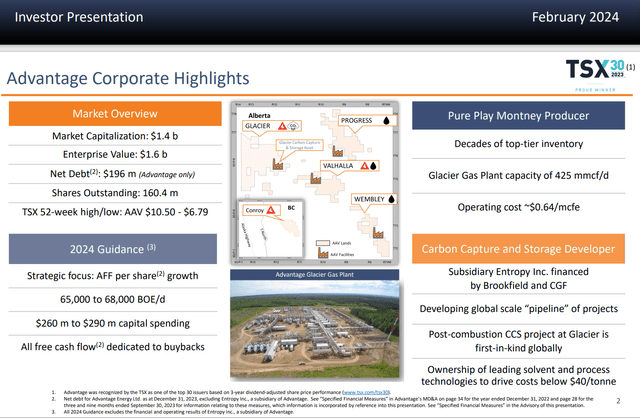

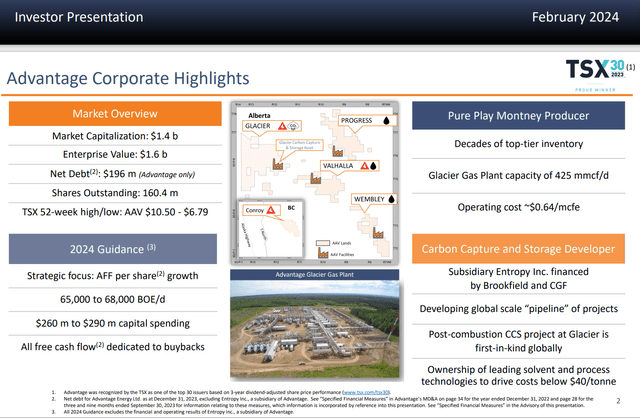

Benefit Power (AAV.TO) (OTCPK:AAVVF) is a favourite of Canadian power analysts combining glorious acreage within the Montney space with a singular subsidiary engaged in Carbon Seize named Entropy. The corporate affords low prices, quick payouts on new wells, and plans share buybacks. What may go unsuitable?

Benefit Power overview (Firm web site presentation)

Low pure fuel costs may go unsuitable for Benefit. Whereas Advantage has a small hedge book, it covers barely 10% of the projected output by my estimation.

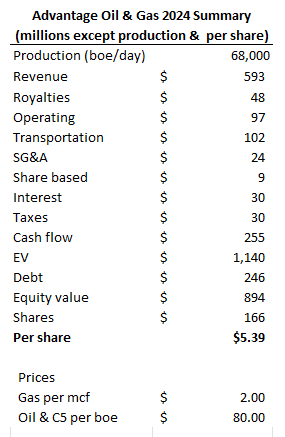

Regardless of its low working prices, Benefit has vital leverage to fuel costs. I’ve modeled the corporate’s operations based mostly on a realized common value of CDN$2.00 a gigajoule for fuel and CDN$80 a Boe for oil, and the corporate’s budgeted CDN$290 million capital program for 2024. If pure fuel manufacturing turns into congested at AECO or different fuel hubs (as has happened in the past summers) costs may go very low and even destructive for brief intervals.

I estimate the worth of AAV shares at CDN$5.39 per share based mostly on a realized common value of CDN$2.00 per mcf. Which may be optimistic if AECO turns into congested this summer season. I’ve used a a number of of 4 x EBITDA to calculate Enterprise Worth (EV).

Abstract Mannequin (Blair evaluation)

Benefit Power shares currently trade at CDN$9.01 a share.

There may be little Benefit Power administration can do to have an effect on pure fuel costs for the steadiness of this yr aside from so as to add hedges that lock in poor efficiency. Pure fuel in storage is about 15% larger than the five-year common, winter is ending in simply weeks, and the summer season months are hardly ever constructive for pure fuel costs.

If I’m appropriate that costs will common not more than CDN$2.00 per mcf for fuel, Benefit money flows of CDN$255 million is not going to cowl capital outlays of CDN$290 million and won’t fund deliberate buybacks with out including debt.

This text suggests Benefit Power is an efficient brief based mostly solely on the chance of decrease pure fuel costs persisting for the steadiness of this yr. Brief positions carry the chance of a brief squeeze, could be known as at any time if the seller one used can’t borrow the shares wanted to maintain the brief, and risky commodity markets may see larger costs for a plethora of unexpected causes together with manufacturing curtailment by producers, pipeline failures, and legislative actions that curb output.

I like the chance – reward and have a brief place of 30,000 shares.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.