The Securities and Exchange Commission (SEC) is coming after crypto exchanges Binance and Coinbase with renewed vigor. As a part of its efforts to safe victory within the ongoing authorized battles towards these exchanges, the Fee has introduced the courtroom’s consideration to a recent landmark case to bolster its arguments.

SEC Cites Ruling In Terra Case In Its Case Towards Binance

The SEC recently filed a discover of supplemental authority in its case against Binance. The Fee drew the courtroom’s consideration to Judge Jed Rakoff’s ruling within the Terraform case. The regulator believes that quite a few points resolved in its favor in that case are just like those that Binance has raised.

On December 28, Choose Rakoff gave a abstract judgment within the SEC’s favor as he dominated that the LUNA and UST tokens have been certainly securities. Identical to the Terra case, the Fee’s case towards Binance revolves across the latter’s alleged violation of Securities legal guidelines.

Alluding to the choice within the Terra case, the SEC argued that Binance couldn’t ask the courtroom to put aside the Howey test in figuring out whether or not or to not dismiss the case. The Fee famous that Choose Rakoff had dominated that the take a look at stays a binding assertion of regulation and can’t be handled as a dicta.

Moreover, the SEC, nonetheless citing Choose Rakoff’s ruling, famous that the courtroom had pointed to programmatic sales of LUNA on exchanges like Binance and deemed them funding contracts additionally. As such, the Fee argues that the style wherein these “crypto asset securities” have been bought doesn’t matter when contemplating whether or not or not they’re securities.

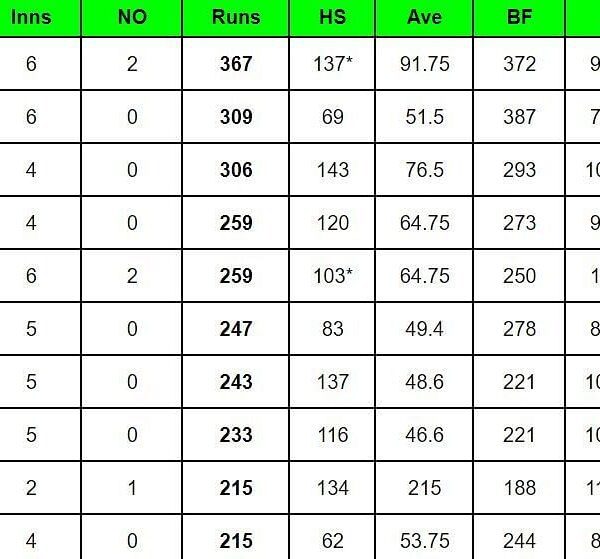

Complete market cap at $1.61 trillion | Supply: Crypto Total Market Cap on Tradingview.com

SEC Crypto Quest Contains Coinbase

The SEC additionally filed a discover of supplemental authority in its case against Coinbase. Within the letter addressed to Choose Failla, the Fee drew her consideration to the courtroom’s ruling in its case against Terraform Labs in help of its opposition to Coinbase’s motion.

The SEC is counting on this case because it believes some points resolved in its favor in that case are related when Choose Failla is contemplating the defendant’s movement. The crypto trade had filed a movement to dismiss the case, arguing that the SEC lacked jurisdiction.

Apparently, the Fee had sued Coinbase only a day after commencing the lawsuit towards Binance. The SEC alleges that Coinbase broke the regulation by providing and buying and selling unregistered securities. Among the notable tokens that the SEC is referring to as securities within the lawsuit embrace SOL, ADA, MATIC, FIL, and SAND.

Having introduced the Terra case to their discover, the courts in each instances might want to think about the explanation for Choose Rakoff’s choice and determine whether or not or not it applies to the problems in focus. They can even be guided by Judge Analisa Torres’ ruling within the SEC’s case towards Ripple.

Featured picture from Bitcoin Information, chart from Tradingview.com