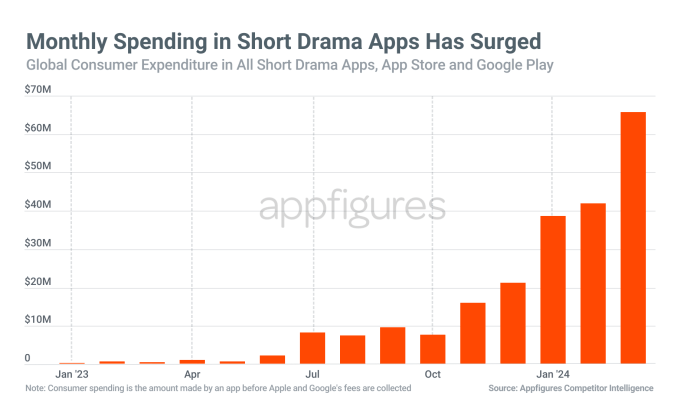

Was Quibi simply forward of its time? Quibi founder Jeffrey Katzenberg ultimately blamed the Covid-19 pandemic for the failure of his short-form video app, however perhaps it was simply too quickly. New app retailer information signifies that the thought Quibi popularized — unique reveals reduce into quick clips, providing fast leisure — is now making a comeback. Within the first quarter of 2024, 66 quick drama apps like ReelShort and DramaBox, pulled in document income of $146 million in international client spending.

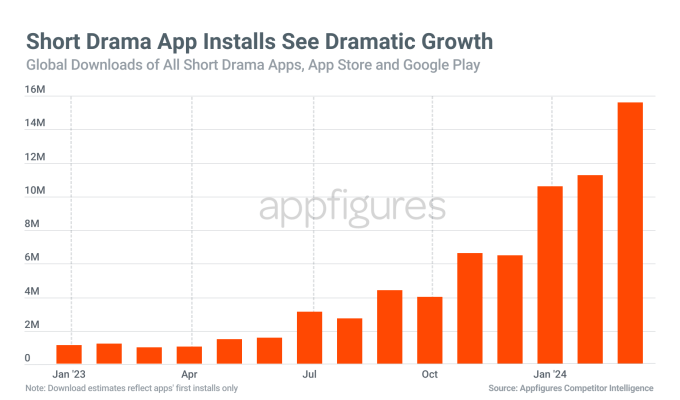

This represents an over 8,000% enhance from $1.8 million within the first quarter of 2023, when simply 21 apps have been accessible, based on information from app intelligence agency Appfigures. Since then, 45 extra apps have joined the market, incomes roughly $245 million in gross client spending and reaching some 121 million downloads.

In March 2024 alone, shoppers spent $65 million on quick drama apps, a ten,500% enhance from the $619,000 spent in March 2023.

It seems the income progress started to speed up in fall 2023, per Appfigures information, resulting in an enormous income bounce between February and March of this yr, when international income grew 56% to succeed in $65.7 million, up from $42 million. Partly, the income progress is tied to the bigger variety of apps accessible, in fact, however advertising and marketing, advert spend, and client curiosity additionally performed a job.

The highest apps by income, ReelShort (No. 1) and DramaBox (No. 2) generated $52 million and $35 million in Q1 2024, respectively. That’s round 37% and 24% of the income generated by the highest 10 apps, additionally respectively.

No. 3 app ShortTV grossed $17 million globally in Q1, or 12% of the full.

What’s attention-grabbing about these apps, in contrast with Quibi’s earlier try and carve out a distinct segment on this area, is the content material high quality. That’s, it’s a lot, a lot worse than Quibi’s — and Quibi’s was not always great. As TechCrunch wrote last year when describing ReelShort, the tales within the app are “like snippets from low-quality soaps — or as if those mobile storytelling games came to life.”

Whatever the horrible performing and writing, the apps have seemingly discovered a little bit of an viewers.

By each installs and income, the U.S. is by far the chief when it comes to prime markets for this cohort. However total, the charts differ when it comes to which nations are downloading versus paying for the content material.

By installs, the highest markets after the U.S. are Indonesia, India, the Philippines, and Brazil, whereas the U.Ok., Australia, Canada, and the Philippines make up the highest markets by income, past the U.S.

In Q1 2024, quick drama apps have been put in practically 37 million instances, up 992% from 3.4 million in Q1 2023. By downloads, ReelShort and ShortTV are the highest two apps, with the previous accounting for 37% of installs, or 13.3 million, and the latter with 10 million installs, or 27%. DramaBox, No. 2 by client spending, was No. 3 by installs with 7 million (19%) downloads.

Picture Credit: Appfigures

Mirroring wider app retailer traits, nearly all of the income (63%) is generated on iOS, whereas Android accounts for almost all (67%) of downloads.

Although there’s progress on this market, these apps see nowhere close to the attraction that their nearest rivals — short-form video and streaming video — do. Brief drama apps claimed a 6.7% share of the full throughout all three classes mixed, up from 0.15% a yr in the past. However the wider video app market makes much more cash.

As an example, the highest 10 apps throughout the mixed three classes, which embrace apps like TikTok and Disney+, made $1.8 billion in Q1.

Picture Credit: Appfigures