PM Images

The Alpha Architect U.S. Quantitative Value ETF (NASDAQ:QVAL) has delivered returns that rival those of overall stock market indexes over time, thriving in an environment that has been challenging for value investing and smaller capitalization companies, two central characteristics of the fund.

QVAL’s rules-based methodology delivers on its attempt to offer a low-valuation investment. Its valuation metrics are significantly lower than a peer group of value ETFs. Meanwhile, its sector’s allocation toward areas such as energy and consumer cyclical provides diversification compared to market cap-weighted funds heavily allocated to the technology sector.

ETF Description & Highlights

QVAL is an actively managed exchange-traded fund that seeks capital appreciation by investing in a portfolio of 50 undervalued securities in the U.S. market from an initial universe of the largest 1500 stocks by market capitalization.

Using a proprietary methodology, the fund first filters out companies with negative characteristics, such as those under financial distress or showing signs of account data manipulation. The eligible stocks are then screened using a rules-based approach to select 100 undervalued stocks, primarily based on the companies’ enterprise multiple, calculated by their total enterprise value divided by EBIT. The method also adopts other metrics to support the identification of undervalued companies, such as book-to-market, cash-flow-to-price, and earnings-to-price.

As a final step, the fund applies additional quality screens, including profitability, stability, and operational improvement measures, to pick the top 50 stocks that will constitute the fund’s portfolio using equal-weight allocation criteria, with quarterly rebalances.

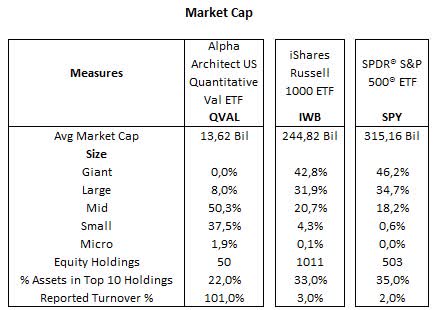

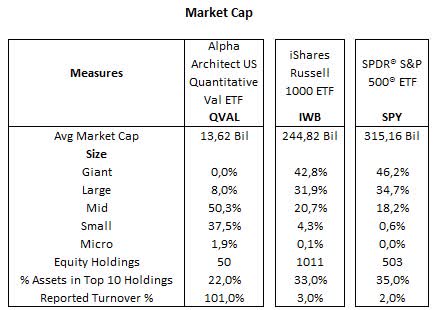

As of June 30, 2024, QVAL has allocations in 50 companies, with an average market cap of $13.6 billion, and is tilted toward smaller capitalization companies, as only 8.0% of total assets are classified as large caps, while 50.3% are mid caps, and 37.85% small caps. In contrast, the market cap-weighted Russell 1000 index, used here for comparison purposes and represented by the iShares Russell 1000 ETF (IWB), has nearly 74% allocated to large and mega caps, 20.7% to mid caps, and only 4.3% to small caps.

As an equal-weighted fund, QVAL does not have an overwhelming allocation in any particular stock as seen in other funds. Therefore, its top ten holdings [Taylor Morrison Home (TMHC), UFP Industries (UFPI), APA (APA), Allison Transmission (ALSN), Terex (TEX), ON Semiconductor (ON), PulteGroup (PHM), Toll Brothers (TOL), Lear Corp (LEA), and Fox Corp (FOXA)] are a result of short-term outperformance before the rebalance. The Russell 1000 index, on the other hand, is relatively more concentrated, with the top ten holdings representing 33% of the index due to its market cap-weighted allocation.

Morningstar, consolidated by the author

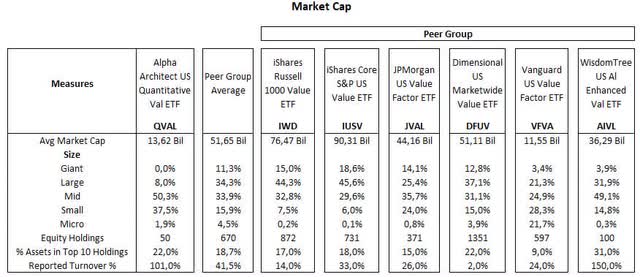

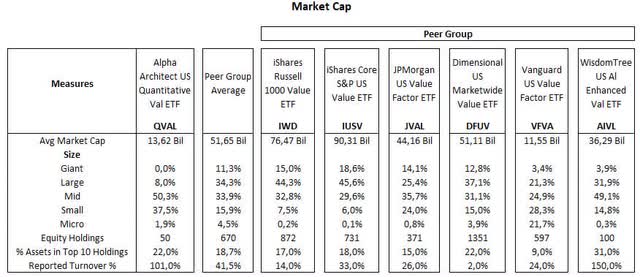

The table below compares QVAL and a peer group of value ETFs that show a more broad-based allocation profile rather than a focus on a specific market cap category, such as large or small caps. These ETFs are displayed in the table, with the first two, IWD and IUSV, having a higher allocation to mega and large caps. The following two, JVAL and VFVA, have relatively well-balanced allocations across market-cap sizes, while VFVA has a heavier allocation to small and micro caps. The last one, AIVL, uses an AI-driven model and is also more concentrated in smaller capitalization companies.

Morningstar, consolidated by the author

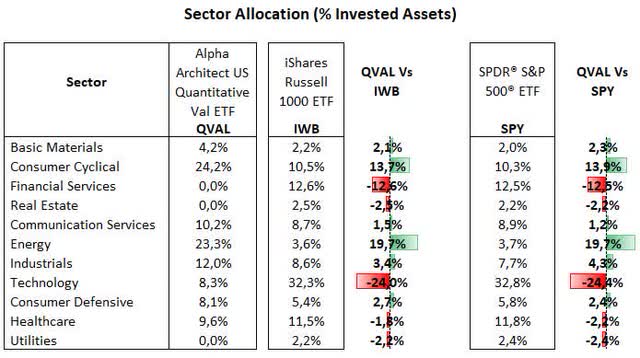

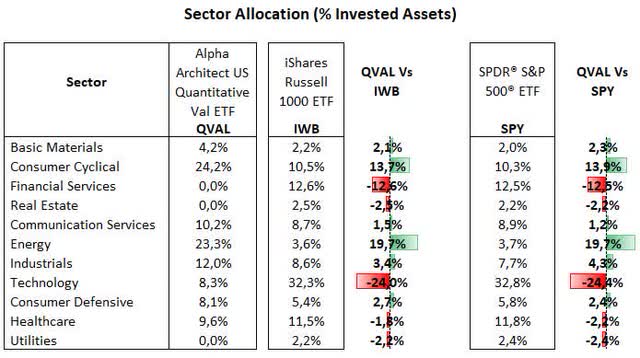

From a sector allocation perspective, QVAL‘s largest allocation is to the consumer cyclical sector, with 24.2% of total equities, followed by energy with 23.3%, industrials 12.0%, communication services 10.2%, healthcare 9.6%, technology 8.3%, consumer defensive 8.1%, and basic materials 4.2%. Relative to the Russell 1000 index, QVAL is overweight in energy (+19.7%) and consumer cyclical (+13.7%), but underweight in technology (-24.0%), financial services (-12.6%), and to a lesser extent, real estate (-2.5%) and utilities (-2.2%).

Morningstar, consolidated by the author

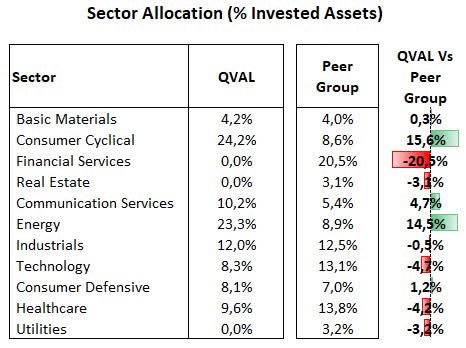

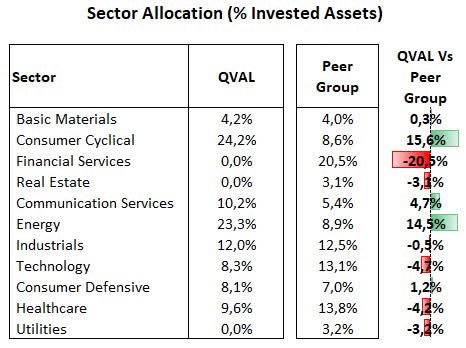

Compared to the peer group of value ETFs, QVAL is also overweight in consumer cyclical (+15.6%) and energy (+14.5%), with a heavy underweight allocation in financial services (-20.5%), as the fund avoids exposure to this sector.

Morningstar, consolidated by the author

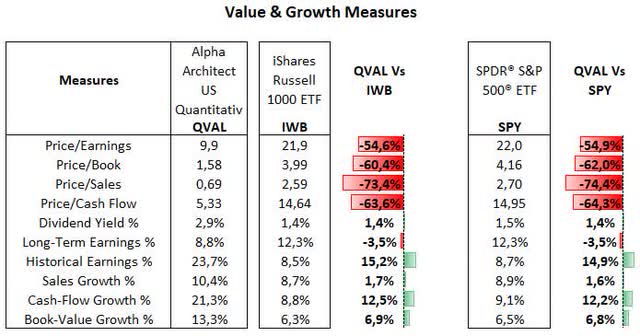

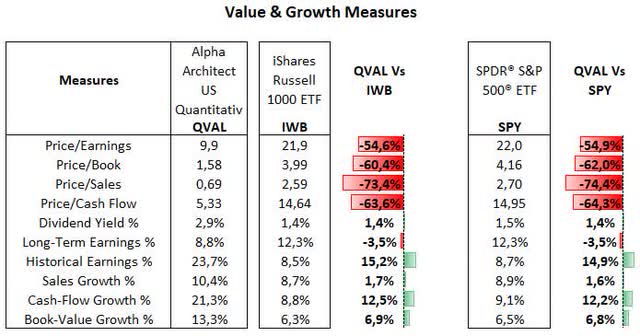

On the valuation side, QVAL’s multiples are way lower than those of the overall market. For instance, QVAL has a P/E ratio of 9.9x versus 21.9x for the Russell 1000 index, a gap of 54%. This substantial valuation gap is partially explained by QVAL’s heavy allocation to the energy sector and home building companies, which typically have P/E ratios around 10x.

Morningstar, consolidated by the author

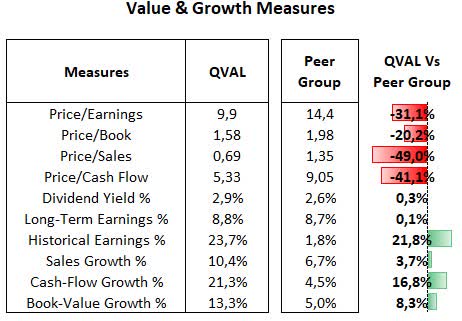

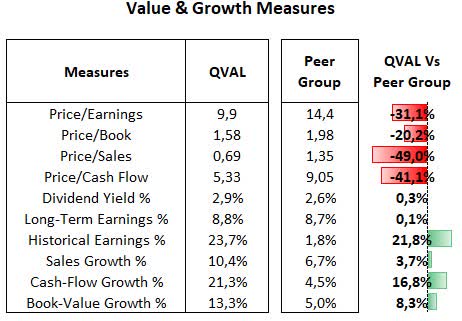

The peer group of value ETFs shows valuation multiples at levels slightly below those usually seen in the value fund (Price/Earnings at around 15x and Price/Sales below 1.8x). Nonetheless, even so, these are remarkably higher than those of QVAL, evidencing the strict valuation metrics employed by QVAL’s methodology in the stock screening process. Interestingly, while low valuations are often accompanied by lower growth measures, this has not been the case for QVAL, as its historical earnings and sales growth have been in line with the Russell 1000 benchmark.

Morningstar, consolidated by the author

Strong Returns For A Somewhat Volatile Fund

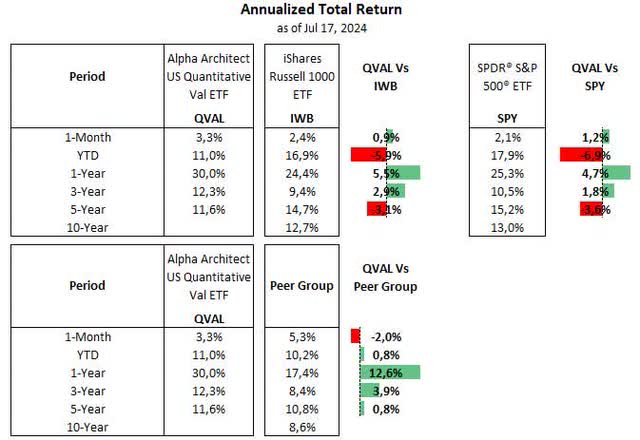

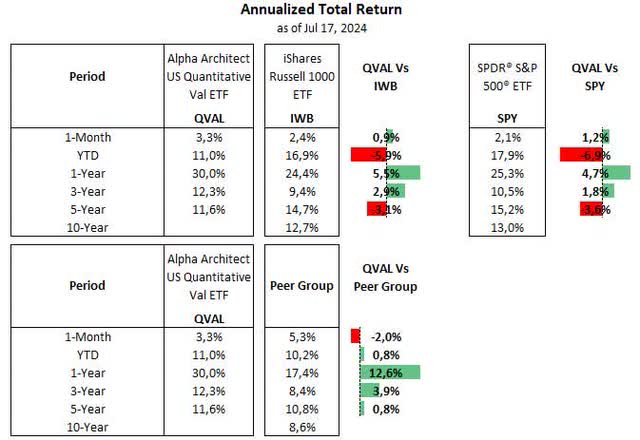

Despite trailing the Russell 1000 and S&P 500 indexes over the past five years, QVAL has performed relatively well, even outperforming the overall market in one and three-year timeframes. On the other hand, QVAL and the peer group have underperformed year-to-date, as most of the stock market gains have been concentrated in a few mega-cap stocks.

Morningstar, consolidated by the author

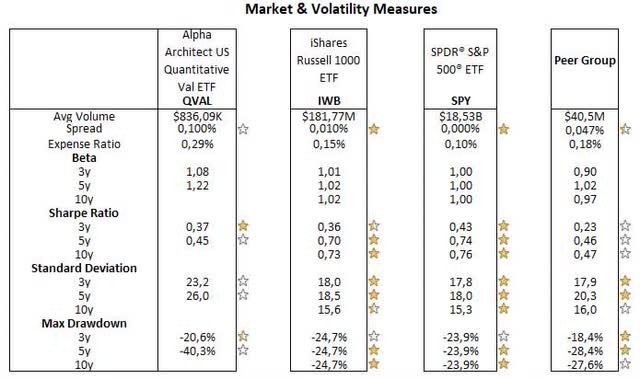

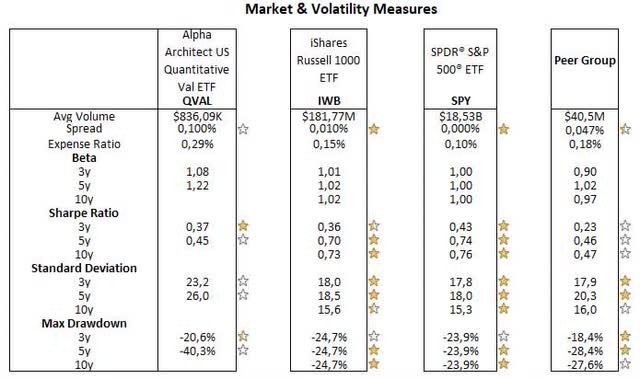

While this mixed but generally positive performance may attract potential investors, volatility measures show something that may be more troublesome. QVAL’s beta and standard deviation have been higher than benchmarks. This is not exactly what we should expect from a value-oriented investment, as evidenced by the peer group of value ETFs, which shows exactly the opposite, with beta below 1.0x and standard deviation readings below the benchmark.

Morningstar, consolidated by the author

Although this is likely driven by QVAL’s more concentrated portfolio, with only 50 holdings, or its overweight exposure to cyclical industries such as energy and home buildings, my point here is that investors interested in this ETF should be aware of this particularity, as volatility is something that not everyone can easily handle, especially value-oriented investors seeking more stable returns.

Despite this factor, a fund like QVAL can be a valuable addition to investors’ portfolios, as it has delivered solid returns over time without relying on mega caps or the technology sector. Instead, QVAL offers diversification by investing in smaller capitalization companies, and sectors such as energy and consumer cyclicals. Further, QVAL’s portfolio remains substantially cheap in a stock market that is currently trading at stretched valuations.