phototechno

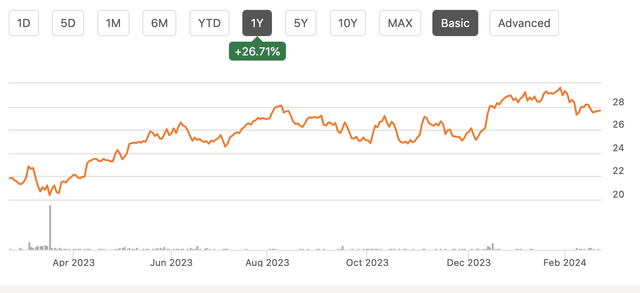

Shares of Radian Group (NYSE:RDN) have been a stable performer over the previous 12 months, rising by over 26%, as a buoyant housing market has tremendously decreased potential losses in its mortgage insurance coverage enterprise. Increased charges have additionally helped to gasoline elevated funding earnings. Since recommending shares in October, the inventory has returned a modest 4%. Whereas the inventory has fallen a bit since reporting earnings in early February, I view the outcomes as stable and proceed to view shares as a purchase.

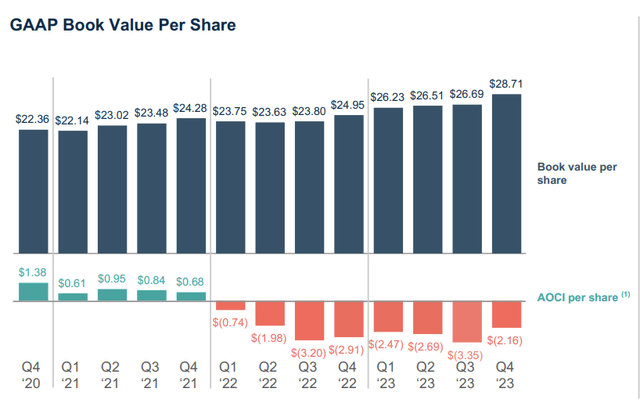

Within the firm’s fourth quarter, Radian earned $0.96, which beat consensus by $0.08, as income rose by practically 5% to $329 million. For the complete 12 months, it earned $3.88 and grew guide worth by 15% to $28.71. Due to sturdy working outcomes, Radian despatched $400 million of dividends to the holdco in 2023, on the excessive finish of steering. Administration expects this to be $400-$500 million in 2024, chatting with ongoing energy within the enterprise. Radian has $2.3 billion of extra belongings, up practically $600 million from final 12 months, enabling ongoing dividends.

It’s the holding firm that pays dividends and makes share repurchases, making these dividends from the insurance coverage working firm vital for capital returns. In 2023, it returned $279 million to shareholders, together with $133 million in buybacks. Subsequent to earnings, Radian increased its dividend by 9% to $0.245, giving the inventory a roughly 3.5% yield. I might count on at the least $300 million in capital returns in 2024, for a ~7% capital return yield. The holding firm additionally has $922 million of liquidity, and its debt to capital is right down to 24.4% from 26.5% final 12 months. There’s $450 million of debt due this October, and administration might search to cut back debt moderately than refinance your complete maturity. This is the reason I count on 2024 capital returns to rise extra modestly than intra-company dividends.

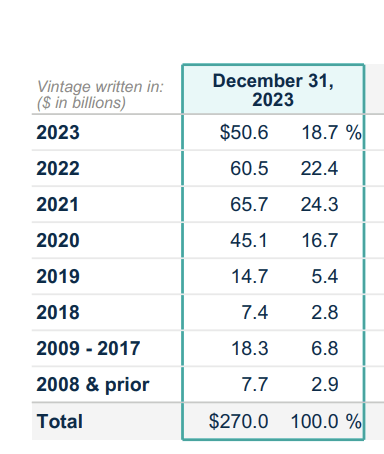

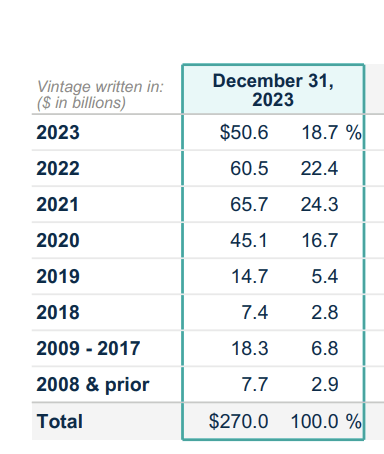

Wanting additional on the outcomes, Radian generated a powerful 14.2% return on fairness. The corporate has $270 billion in insurance coverage in power, up $9 billion from final 12 months. Whereas house gross sales exercise has been muted, excessive charges have additionally decreased refinancing exercise, which has meant insurance policies have been extra “persistent,” in different phrases, they’ve remained in power for longer. Nonetheless, given the slower market, it wrote $10.6 billion of insurance policies in This fall, down from $12.9 billion final 12 months.

Credit score high quality stays nearly “as good as it gets,” although as mentioned in my final write-up, we’re probably nearing the top of a multiyear discount in insurance coverage reserves, which boosted earnings. I consider this can be a motive for the inventory’s decline from its current excessive. RDN now has $370million in reserves, up $2 million sequentially and down $57 million from a 12 months in the past. In This fall, it took $5 million provision for losses, from $8 million of internet recoveries in Q3 and $44 million in internet recoveries a 12 months in the past. This provision was pushed by $49 million in favorable advantages and $54 million in provisions, because it continues to imagine an 8% default price on new loans. Flipping from internet recoveries to internet provisions has precipitated some weak spot in shares, however I don’t see a motive to be significantly involved.

Due to a number of quarters of insurance coverage reserve enhancements, recouping over $300 million, there may be much less room to proceed bringing down reserves, as this can be a finite pool of funds. We knew this supply of earnings could be transitory. It’s vital to notice that these reserves usually are not as a consequence of a extra unfavourable image of the long run, however the truth that the buoyant housing market is now largely captured by legacy reserves. Functionally, RDN continues to be working a virtually zero-loss enterprise, and I count on to see losses stay very low.

RDN sells personal mortgage insurance coverage. Whereas authorities businesses will insure as much as 80% on a standard mortgage (which is why folks put 20% down), RDN will insure past that for individuals who make smaller down-payments. Radian loses cash when 1) a borrower defaults on their mortgage and a couple of) the home is offered for lower than the remaining mortgage stability.

As a result of the labor market is powerful, delinquencies proceed to run low. Nonetheless, much more necessary than this, the sturdy housing market means most properties are price greater than their mortgages. Even when a home-owner can’t afford the mortgage, she or he can probably promote their house and repay the mortgage in full. Certainly, Radian estimates that 86% of its insurance coverage in power has at the least 10% of fairness. This gives a big cushion towards potential losses.

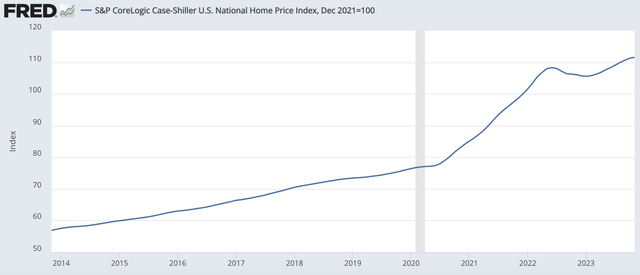

The sturdy housing market is a motive for this. As you may see under, house costs have risen greater than 10% from the top of 2021 and greater than 35% from 2020. If house costs keep at present ranges, people with Radian insurance coverage from 2021 and earlier probably have vital optimistic fairness of their properties, that means that even in a foreclosures, the house could be offered for greater than the remaining mortgage stability, insulating Radian from losses. This is the reason it has decreased reserves considerably and loved such sturdy earnings.

As you may see under, about 60% of its insurance coverage in power was issued in 2021 and earlier. This block of enterprise is unlikely to face losses until we had been to see a significant rise in unemployment and a significant drop in house costs. Plus, each month, debtors pay down some principal on their mortgage, additional decreasing potential losses and rising the fairness cushion. After all, more moderen mortgage insurance coverage insurance policies are written nearer to the present market stage, so it will not take as a lot of a downturn for there to be losses, which is why Radian continues to conservatively reserve on a go-forward foundation.

Radian

Importantly, I count on losses on current insurance policies to even be muted. The labor market stays fairly agency, and as long as employment is powerful, delinquencies ought to be pretty low. Given the structural undersupply of housing, as mentioned in my prior piece, I additionally count on house costs to remain agency. Certainly, they’ve risen again to an all-time excessive, and if the Federal Reserve cuts charges, decrease mortgage charges ought to assist house worth appreciation.

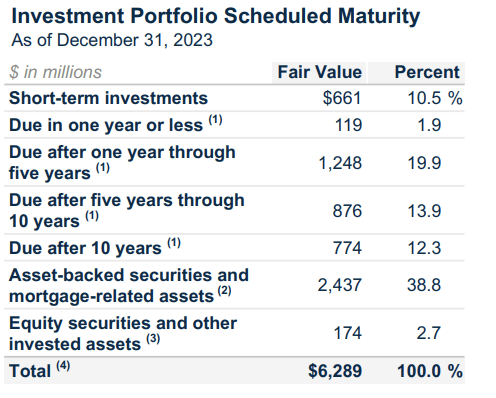

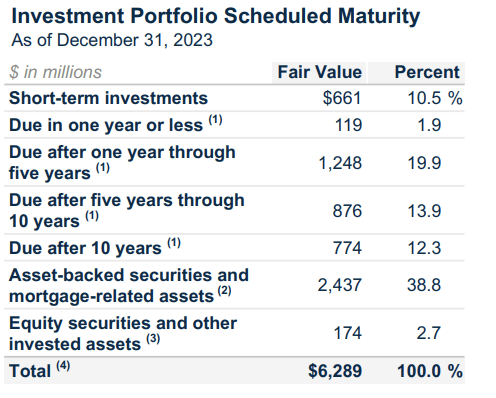

Radian has benefitted from greater charges, and its funding portfolio is comparatively effectively insulated from price cuts. It has a $6.1 billion funding portfolio. In This fall, it earned $69 million in funding earnings, from $59 million final 12 months, because the portfolio now yields 4.15%. This was flat sequentially and up from 3.69% final 12 months. As you may see under, 88% of the portfolio matures greater than 12 months from now. As such, we’re unlikely to see the portfolio yield rise very a lot. Nonetheless, this implies if the Fed does lower charges a number of instances, it should have restricted maturities whether it is investing at decrease charges. As such, I count on funding earnings to proceed to run round This fall’s tempo by way of 2024.

Radian

As a result of it has a portfolio of fastened earnings purchases when charges had been decrease, Radian does have unrealized losses that sit in gathered different complete earnings (AOCI). AOCI was a $2.16 drag on guide worth in This fall, which was down from $3.35 in Q3 as rates of interest retreated from their highs. As bonds progressively mature and pull to par, AOCI ought to steadily decline. Given its sturdy capital and liquidity place, RDN has no must promote bonds at losses.

Proper now, shares are buying and selling at a few 5% low cost to guide worth. Moreover, assuming modest reserve builds as its pre-2022 insurance coverage block continues to decrease, I count on RDN to earn about $3.50 this 12 months, aided by ongoing energy in funding earnings. I proceed to count on RDN to commerce between guide worth ($28.71) and guide worth ex-AOCI ($30.87), given the low chance of realizing losses. I view $30 as truthful worth, creating a few 12% complete return alternative, and nonetheless leaving shares under 9x earnings.

I might develop extra cautious on Radian if we noticed house costs fall by greater than 5%, and so I might proceed to intently monitor pricing developments. Nonetheless, given my constructive outlook for housing, I see additional upside in shares, aided by a rising dividend and accretive buyback. Buyers ought to keep lengthy RDN.