Jorg Greuel

With Labor Day having passed on Monday, some say this marks the end of summer, while the official end date is September 22 this year. As the calendar speeds towards the end of the year though, investors can look back and see equity returns (the S&P 500 Index) have been strong to date in 2024, up 19.53%.

For the full trailing one-year period, the S&P 500 Index is up over 27%. Even bonds and cash are providing investors a reasonable return over the past year, with the Bloomberg U.S. Aggregate Bond Index up 7.3% and cash returning over 5%.

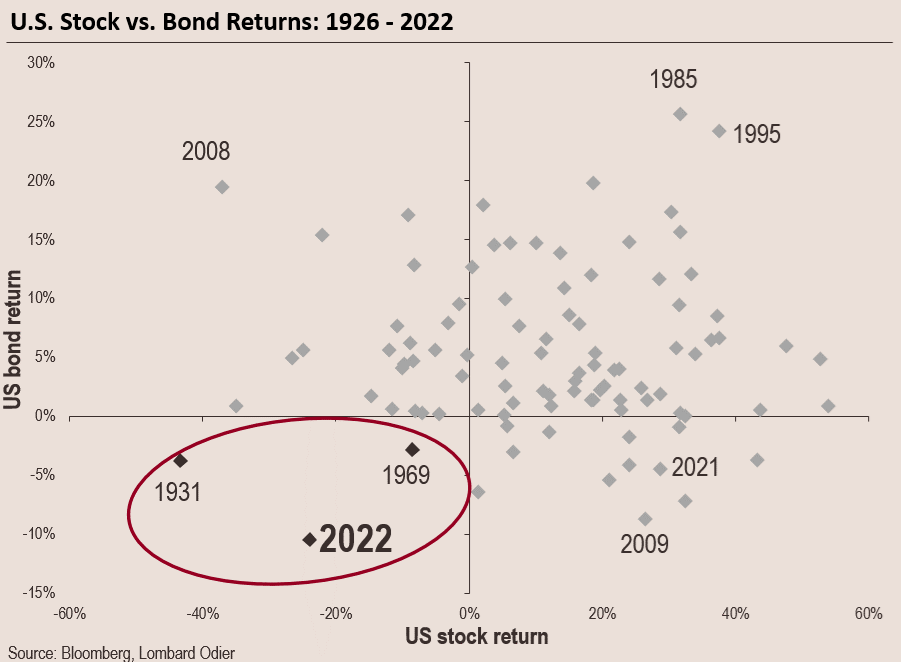

This is a far better outcome than investors experienced in 2022 when almost all asset classes were down, a rare occurrence simply to have both stocks and bonds deliver investors negative returns in the same year.

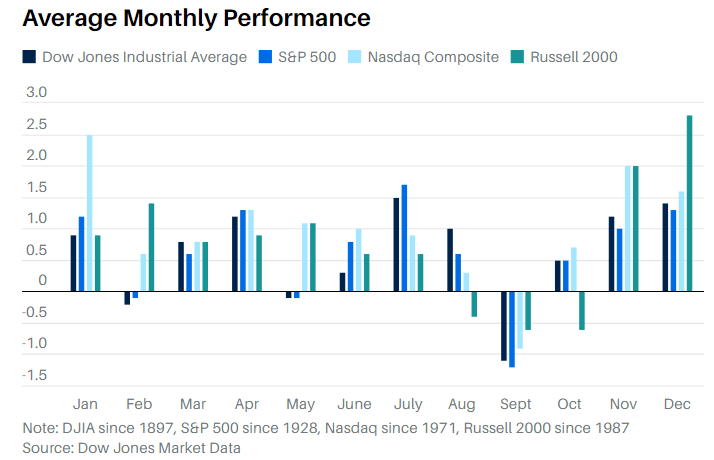

With the calendar now rolled into September, the topic of seasonality tends to be a common one. One reason for this is the fact that September is historically the weakest performing month of the year.

A recent Barron’s article highlighted monthly equity and bond returns since the inception of various indices, as seen below. As the article points out though, “the data doesn’t always look so bad in presidential election years.” Also, the magnitude of the average decline is not large either. On the other hand, large market selloffs have tended to occur in September.

GOVT)” loading=”lazy”>

This raises the question of whether an investor should raise cash at this point in time. What is important for an investor is to periodically review their asset allocation, the allocation of the investments between stocks, bonds and alternatives, along with other available asset classes.

This evaluation should incorporate one’s overall goals and objectives. Generalizing, one might have three to six months cash set aside for unforeseen emergencies, like the purchase of a new refrigerator, a new car, etc.

With respect to one’s investment portfolio, allocating funds to short term fixed income investments that can fund one’s lifestyle for one and a half to two years makes sense, as this reduces the likelihood of the need to sell stocks when they are down. A recent Morningstar article, What Role Should Cash Play in Your Portfolio?, provides good information for investors on the cash topic.

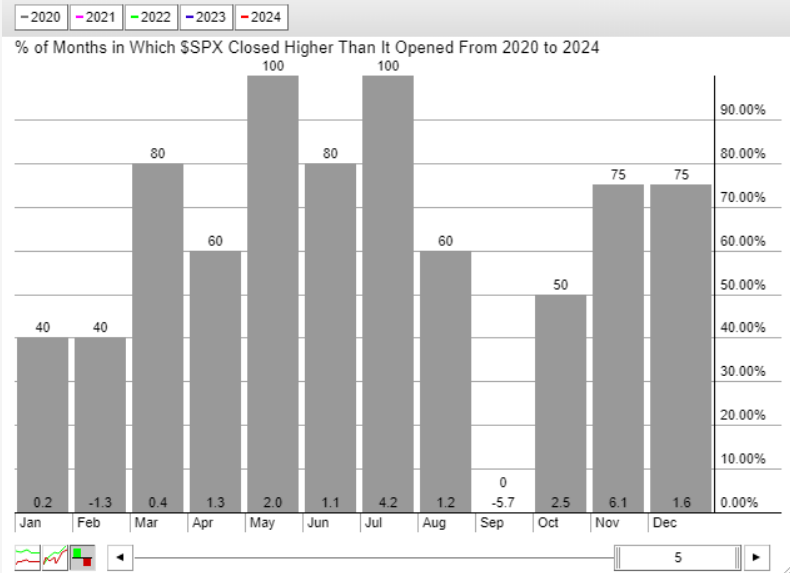

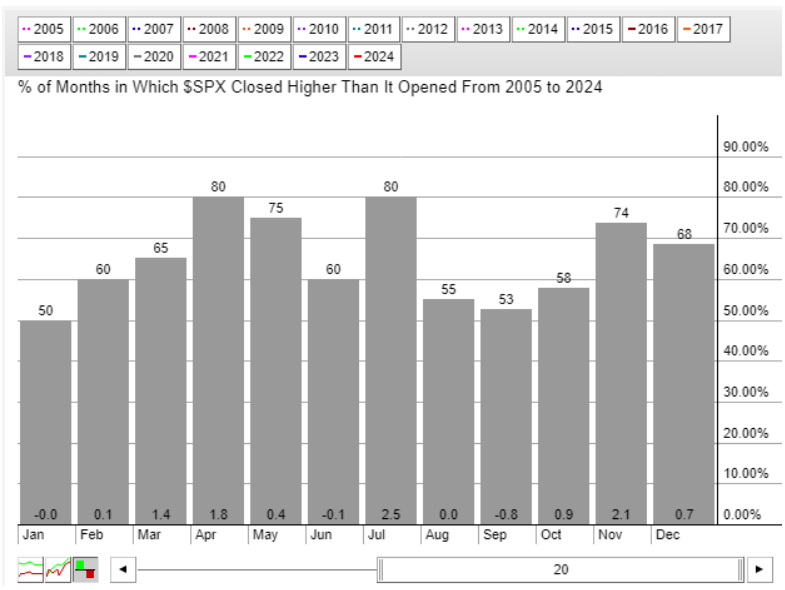

Finally, September can be a weak period for stocks depending on how far back one looks. As the first chart below shows, in the last five Septembers, the S&P 500 Index generated a negative return. The second chart goes back twenty years and just 47% of the Septembers were negative for the S&P 500 Index with an average decline of just -.8%.

This time of year tends to be a more volatile one versus other periods. Importantly, reviewing one’s asset allocation from time to time is a good practice and with the market up strongly this year, now is a good time to have that review.

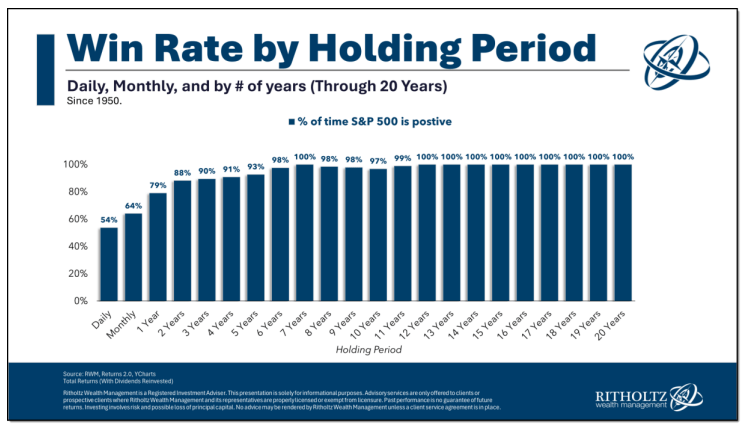

Keep in mind though, market timing is difficult to do, and it is time in the market that tends to be more important for most investors. The below graphic shows market returns by holding period and clearly stocks are more variable in the short run, but historically longer time frames provide favorable outcomes.

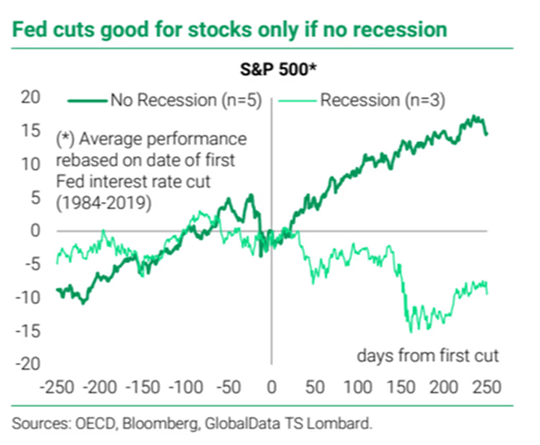

Additionally, the Federal Reserve is intimating they may lower short-term interest rates at the September FOMC meeting. Lower rates have been favorable for stocks so long as the economy is not in a recession.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.